There were fewer BTO applications by first-time homeowners for February’s BTO sales exercise, and we believe it’s because more buyers are turning to the HDB resale market with the recent increase in the CPF Housing Grant, which allows eligible first-timer families buying a 4-room or smaller resale HDB to get up to $80,000 in subsidies. If you are considering getting a resale HDB flat too, this is for you.

Here are the 14 steps to buying a resale HDB flat in 2024

- 1. Check your eligibility

- 2. Calculate your affordability

- 3. Apply for a HDB Flat Eligibility(HFE) letter

- 4. Start your home search

- 5. Decide on a financing option

- 6. Make an offer

- 7. Discuss Temporary Extension of Stay with the seller

- 8. Request for flat valuation

- 9. Exercise the Option

- 10. Complete the Resale Application

- 11. Accept the Terms and Conditions

- 12. Make payment for resale fees and calculate stamp duty

- 13. Receive approval notification

- 14. Resale Completion Appointment

- Congratulations on your new home!

- Looking to buy a resale HDB flat? Let us speed up your home search!

1. Check your eligibility

Hopeful buyers must meet ALL of the following criteria to be eligible for resale HDB flat purchase:

| Age | Unmarried or divorced individuals: At least 35 years old Widowed or orphaned individuals: At least 21 years old |

| Citizenship | Only Singapore citizens or permanent residents are eligible. |

| Family Nucleus | Meet family nucleus requirements in accordance with the various eligibility schemes. This could mean registering with any of the following: – Spouse and children – Parents and siblings – Children under legal custody (for widowed and divorced parents) |

| Property Ownership | All individuals are required to relinquish ownership of any other HDB flat, private or overseas property within six months of the final transaction. |

In addition, you must also take the Ethnic Integration Policy and Singapore Permanent Resident quota (EIP and SPR quota) into account when selecting a flat for purchase.

While there are no income ceilings for HDB resale flat purchase, your annual income will determine whether or not you qualify for the HDB Housing Loan and CPF Housing Grants.

In most cases, an annual income exceeding $14,000 will put you out of range for most subsidies.

2. Calculate your affordability

Can you afford the home you’re considering? Ohmyhome’s free Affordability Calculator to find out the maximum loan amount and loan term you can get when financing your flat purchase.

Download the Ohmyhome app on App Store and Google Play to access our free Affordability Calculator. You’ll be able to find out the maximum loan amount and loan term you can get for your home purchase.

3. Apply for a HDB Flat Eligibility(HFE) letter

With a single application, you will be able to know your eligibility to:

- Purchase a BTO or resale HDB flat

- Receive CPF housing grants and the grant amount

- Take up a HDB housing loan and the loan amount

With the new HFE letter, you no longer have to submit a thousand and one documents for eligibility assessment. Instead, your personal information will be retrieved from Myinfo via Singass, with your permission, streamlining the process for you.

4. Start your home search

Now the fun begins! Find your perfect home on the Ohmyhome app where, once you log in, you’ll find all the available listings immediately — either from direct owners or those verified by our property agents.

There are no duplicate listings here as each address can only be used once.

Begin your search by inputting an address, MRT station, nearby school, budget or number of rooms.

To make appointments or enquiries with the sellers or our agents, simply click the ‘Chat’ button below each listing. But before you make an offer and agree on the resale price, you should first check the recent transactions in your area and the current market prices on Ohmyhome.

5. Decide on a financing option

Buying an HDB resale flat is a significant financial commitment. The property itself can cost anywhere between $350,000 for 3-room flats to $700,000 for upper-end 5-room flats. This can be spread out with mortgage payments, but you’ll be required to put down a downpayment of at least 10%.

| Payment Type | HDB Loan | Bank Loan |

| Downpayment | 10% of purchase price, which can be paid in full using CPF Ordinary Account (OA) savings | 25% of purchase price, of which at least 5% must be paid in cash |

| Interest rates | Pegged at 0.1% above OA interest rate | Generally lower but may fluctuate with market conditions |

| Lock-in period | No | Yes |

Some things to note if you’re considering taking an HDB or bank loan:

For HDB loan: You must get a valid HLE letter before making an offer.

For bank loan: You must have a bank’s LO before exercising the OTP. Do note that there may be limits on your use of CPF funds and HDB loans.

Also, note that you must use cash for the following payments:

- Deposit to seller (a maximum of $5,000, paid in 2 stages: Option Fee and Exercise Fee)

- Amount not covered by CPF savings and housing loan

- Cash proceeds from disposing of the last flat (if you’re taking a second HDB loan)

You can use the savings in your CPF Ordinary Account (OA) for the following:

- Initial payment in whole or in part, depending on whether you got an HDB or bank loan

- Partial or full payment for the flat purchase

- Monthly mortgage installments (up to valuation limit / Additional Housing Withdrawal Limit)

Additional costs:

- Resale application administrative fee ($40-$80)

- Valuation fee ($120)

- Insurance

- Legal fees (starts from $1,800 nett with Ohmyhome)

6. Make an offer

Once you’ve chosen your ideal home, you may make an offer on the flat. An agreed-upon Option fee ($1-$1,000) must be paid to the seller, who, upon accepting your offer, will grant the HDB-prescribed OTP. By doing so, the seller essentially promises not to offer their home to anyone else but you.

You will have 21 days to exercise the OTP; up to 4pm on the 21st day of receiving your OTP. But before you can exercise it, you must have a valid HLE letter or LO should you require financing for the flat purchase.

7. Discuss Temporary Extension of Stay with the seller

If the sellers are unable to move out from their flat by the completion date, they may request to temporarily extend their stay in the flat for up to 3 months. You can negotiate the fees for the Temporary Extension of Stay with the sellers. Other fees include:

- Property tax, charged to you at non-concessionary rates (higher than the concessionary rate)

- Admin fee of $20

The Temporary Extension of Stay, which will be terminated automatically on the 3rd month, must be submitted with the resale application. You must accompany the sellers in doing so at an HDB branch.

The computation of the Minimum Occupation Period for you, the new owner of the flat, will commence after the Temporary Extension of Stay is terminated.

8. Request for flat valuation

If you’re using your CPF monies and/or a housing loan to finance your flat purchase, you must submit a ‘Request for Value’ to HDB to determine the amount of loan and CPF you may use. This must be done by the next working day after you’ve received the OTP from the seller.

Information required for ‘Request for Value’:

- Page 1 of the OTP softcopy

- Property address

- OTP serial number, Option grant date, purchase price and Option fee

- Seller’s name, NRIC no. and contact details

- All buyers’ names and NRIC no.

- Contact details of 1 buyer

- Requestor’s contact details

Stay updated on the status of your Request by logging in to the HDB Resale Portal. The value of the flat will be available on the Portal within 5-7 working days; an email will be sent to notify you.

9. Exercise the Option

You must do the following on or before the Option expiry:

- Sign the ‘Acceptance’ in the Option

- Deliver the signed document (original copy) to the seller

- Pay the seller an exercise fee (capped to $5,000, minus the Option fee)

To cancel the purchase, you must inform the seller and allow the OTP to lapse and expire. Remember that the Option fee is non-refundable should you not proceed with the purchase.

10. Complete the Resale Application

You may complete the resale application on the HDB resale portal and you and the seller must submit the application, with the supporting documents, within 7 days of each other.

Do note that there’s an administrative fee of $40 for 1- and 2-room flats, or $80 for 3-room and bigger flats.

The fees are non-refundable and are inclusive of GST; payable by credit card (Visa or Mastercard).

You will be required to provide the following information when filling up the application form:

- Resale flat address

- OTP details (such as OTP serial no., Option fee, purchase price, Option grant/Exercise date)

- Soft copy of personal documents of all buyers and/or occupiers

- Soft copy of proof of income (if applying for CPF housing grant)

Also, take note that you will need to do the following:

- Complete the ‘Intent to Buy’ on the HDB Resale Portal

- Have a valid Intent and HLE letter or LO before the OTP can be granted or exercised

11. Accept the Terms and Conditions

You will receive an SMS from HDB within 10 working days informing you when you can accept the terms and conditions for all the documents prepared for you through the HDB resale portal.

This must be done within 6 days of receiving the SMS.

Once endorsed, you will receive an in-principle approval for resale.

12. Make payment for resale fees and calculate stamp duty

Apart from paying for resale fees such as the title search fee, there are also other miscellaneous fees you’ll have to pay for, including stamp duty fees and legal fees.

- Calculate your stamp duty

You can calculate your stamp duty fees on the Ohmyhome app. To do so, tap ‘Services’ and ‘Loan Calculator’, and select ‘Buyer Stamp Duty’.

13. Receive approval notification

You’ll receive an SMS or email to notify you when HDB’s approval letter has been posted on the resale portal.

- Final inspection of the flat

You’ll need to arrange a final inspection with the seller to check that the flat is vacant before the Resale Completion Appointment.

14. Resale Completion Appointment

Your HDB appointment is 8-10 weeks from the date of HDB’s acceptance of the resale application if the necessary documents are submitted accurately and on time.

The appointment is for HDB to witness:

- Signing of the transfer document for the resale flat

- Signing of the mortgage document/ agreement (applicable for HDB loans only)

- Handover of keys (if you opted for a bank loan, the bank’s lawyer can be authorised to collect the keys on your behalf)

Do note that you will have to reimburse the property tax to the seller for the portion of the year for which you own the property.

Service & Conservancy Charges are to be paid up to the date of completion by the seller (i.e. Completion Appointment date).

And you’re all set!

Congratulations on your new home!

You’ve reached the end of the road and found your dream home! May it be a place of safety, comfort and rest for you and your loved ones.

It’s a blessing to have a place you can call your own, so we hope you get to make as many happy memories with your loved ones in your new home.

Looking to buy a resale HDB flat? Let us speed up your home search!

You can browse our HDB listings for sale right here or sign up for our newsletter to be updated on all of our most recent listings.

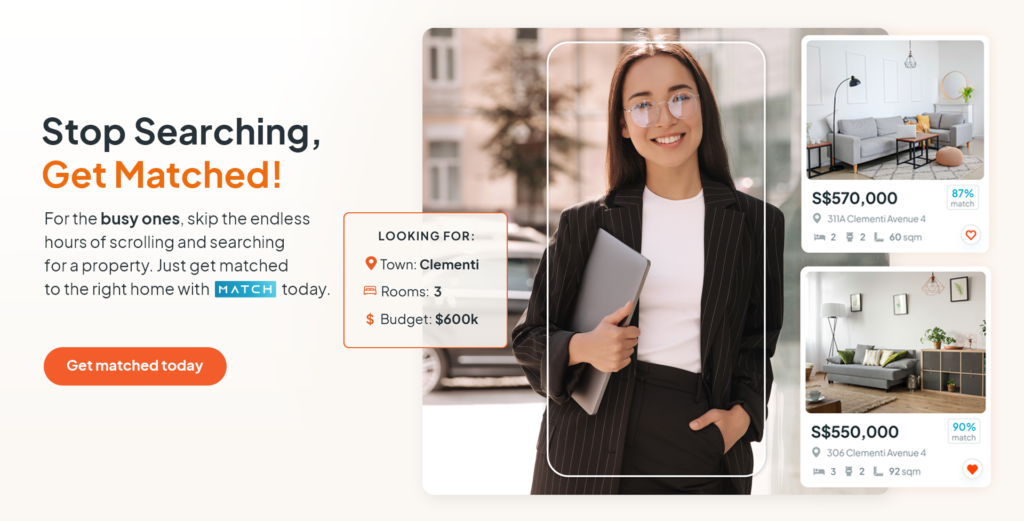

Let Ohmyhome’s smart data-matching technology MATCH you with the right home, according to your specific needs. Submit your preferences to us and our algorithm will filter all our available listings based on those, and we’ll WhatsApp them to you once we find a match. We’ll also send you relevant content that you can use for your research and inform your home buying decision, so you no longer have to spend hours searching online for the information that you need.

Call us at 6886 9009 to secure an appointment with any of our Super Agents or message us in the chat box at the bottom, right-hand corner of the screen. Or WhatsApp us at 9755 1009!