The very first step to buying a HDB flat can take a lot of work. But not anymore. From 9 May 2023, the HDB Loan Eligibility (HLE) letter will be replaced by the HDB Flat Eligibility (HFE) letter, which will consolidate all the eligibility assessments for homebuyers. With a single application, you will be able to know your eligibility to:

- Purchase a BTO or resale HDB flat

- Receive CPF housing grants and the grant amount

- Take up a HDB housing loan and the loan amount

With the new HFE letter, you no longer have to submit a thousand and one documents for eligibility assessment. Instead, your personal information will be retrieved from Myinfo via Singass, with your permission, streamlining the process for you.

If you are looking to buy your 2nd flat, you will also be able to know the resale levy/premium you need to pay, if applicable. Do take note that you will have to pay Additional Buyers’ Stamp Duty (ABSD) with the purchase of your 2nd residential property. You can read more about the new (and higher) ABSD rates here.

All you need to know about HFE

When should you apply for the HFE letter?

| If you’re buying a BTO flat | You must have a valid HFE letter when you apply for a BTO flat in sales launches starting from August 2023, or even during open booking. |

| If you’re buying a resale flat | You must have a valid HFE letter before you obtain an Option to Purchase (OTP) from the HDB seller, and when you submit your resale application. |

Here’s a sample of what the HFE letter looks like

How to apply for the HFE letter?

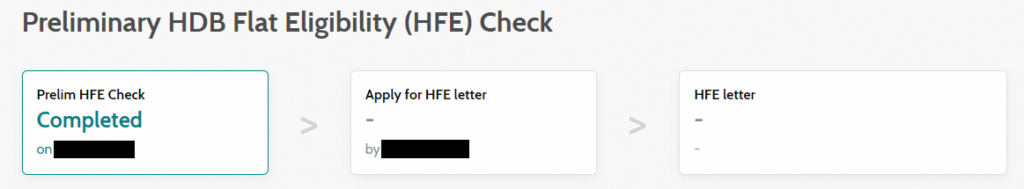

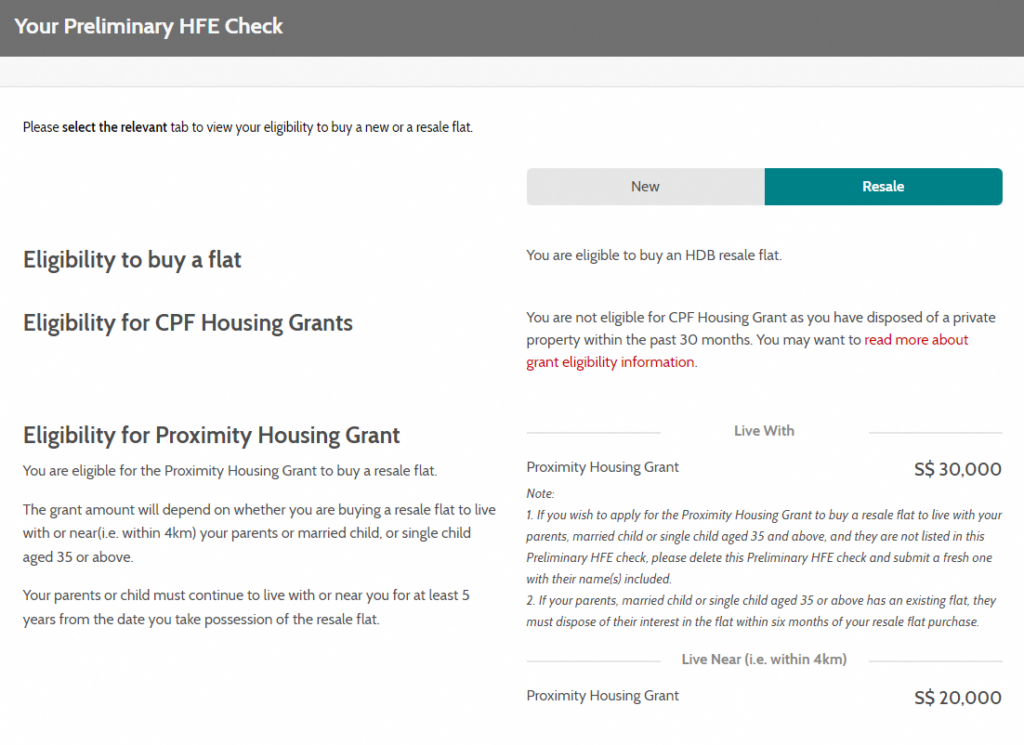

Step 1: Complete the preliminary HFE check

1. Log in to the HDB flat portal via Singpass

2. Provide your particulars, including other flat applicants and occupiers

3. Declare any interest in local and/or overseas private property

4. Indicate whether you intend to take up a housing loan

Based on all this information provided, you will receive a preliminary outcome, which will give you an overview of your eligibility to buy a BTO or resale HDB flat, which CPF grants you can receive, and if you can take up a HDB housing loan.

Take note to provide accurate information at this stage as you will have to start over from the beginning if there are any changes to the details you have provided. There is also no option to redo

Step 2: Apply for a HFE letter within 30 calendar days of starting Step 1

1. Select your housing loan option(s)

You will have access to HDB’s loan packages, as well as banks such as DBS, Hong Leong Finance, Maybank, OCBC, Sing Investments & Finance, and UOB.

When selecting your housing loan options, you’ll have to confirm your eligibility for a HDB housing loan, which you would have received upon completing Part 1 above.

If you will be taking a bank loan, you must obtain an In-Principle Approval (IPA) from your bank so you have an idea of the loan amount you can receive and put towards your HDB flat purchase.

2. Provide all required information before the due date

3. Review and confirm the application details

Step 3: Get your results

1. You can expect to receive your HFE letter within 21 working days upon HDB’s receipt of your completed application and full set of information — an SMS will be sent to you when the letter is ready for viewing on the HDB Flat Portal

2. The HFE letter is valid for 9 months, starting from the date of issue (Update: November 2023)

If you applied for a bank loan, you should receive the outcome of your housing loan at this stage.

After getting your HFE letter, what’s next?

Here’s an overview of the steps you have to take if you are looking to buy a BTO flat or resale HDB flat:

Step 1: Apply for a HFE letter

Step 2: Get an IPA from the bank of your choice if you intend to take a bank loan

Step 3: Start searching for flats

Step 4: Check your finances

| If you are buying a BTO flat | If you are buying a resale HDB flat | |

| Step 5 | Apply for a flat online during a sales launch | Obtain OTP from sellers |

| Step 6 | Receive ballot results | Submit Request for Value online |

| Step 7 | Book a flat | Request Letter of Offer to confirm bank loan (if applicable) |

| Step 8 | Sign Agreement for Lease | Exercise OTP and submit resale flat application online |

| Step 9 | Collect keys | Attend completion appointment at HDB hub |

Frequently asked questions about HFE

What is HFE application?

You must make an HFE application when buying a resale HDB flat or a BTO flat and to receive a CPF housing grant and/or HDB housing loan.

Do you need HFE to apply BTO?

Yes, you must have a valid HFE letter when applying for a BTO flat in sales launches starting from August 2023, or even during open booking.

What is the difference between HFE and HLE?

The HDB Loan Eligibility (HLE) letter was the old version of what is now known as the HDB Flat Eligibility (HFE) letter.

| HDB Loan Eligibility (HLE) Letter | HDB Flat Eligibility (HFE) Letter |

|---|---|

| Informs you of your eligible home loan amount, monthly instalments, repayment period, and the amount of cash proceeds from the sale of the existing or previous flat to be used to pay for the next flat (if applying for a second HDB loan) | Informs you of your eligibility to: – Purchase a BTO or resale HDB flat – Receive CPF housing grants and the grant amount – Take up a HDB housing loan and the loan amount |

Who needs to apply for HFE?

If you’re eligible to buy a BTO, you will need a valid HFE letter when applying. HDB resale flat buyers will need a valid HFE letter before obtaining an Option to Purchase (OTP) from the seller and when submitting the HDB resale application.

How long does the HFE application take?

It can take up to 21 working days to get your approved HFE letter from HDB, though the processing time may take longer during peak periods.

Where can I check my HFE application status?

You can check your HFE application staus on HDB’s My Flat Dashboard.

Ready to buy your dream HDB flat?

We’d love to help you find the right home that suits your needs and preferences, and our smart data-matching technology MATCH you with Ohmyhome’s available listings!

Submit your preferences to us and our algorithm will filter all our available listings based on those, and we’ll WhatsApp them to you once we find a match.

Let our property agents assist you with your home purchase

You can also directly reach out to us via WhatsApp or on our Live Chat at the bottom, right-hand corner of the screen if you have any questions or if you’d like to know more housing options, we’ll connect you with a Super Agent and an expert in your area.