Having trouble deciding between BTO or a resale HDB flat? It’s the dilemma for most millennials. There’s a lot of information to soak in but we’ve crunched it down to the top 9 deciding factors. Find out what’s the best choice for you as you weigh the factors before owning your first home.

9 Factors to Consider When Buying a Flat:

1. Eligibility criteria

Citizenship

BTO: At least one person applying for a BTO flat needs to be a Singapore Citizen (SC), the other can be an SC or Singapore Permanent Resident (SPR).

Resale: There’s no need for at least one person applying to be an SC. However if you are buying a resale flat as joint singles or with a non-citizen spouse, then one or both might need to be a SC, depending on your household configuration. Find out which eligibility scheme is right for you.

Income ceiling

BTO: The current household income ceiling for a BTO flat is S$14,000 per month. If both you and your spouse earn more than this, you will not be allowed to buy a BTO flat.

Resale: There is no income ceiling for buying an HDB resale flat.

Age

BTO & Resale: For most HDB housing schemes, you must be at least 21 years old at the point of application.

Property ownership

BTO: You do not qualify for a BTO if you:

- Currently own other residential properties, either locally or overseas, or have sold them within the past 30 months.

- Applicants must also have only purchased up to one HDB, DBSS (Design, Build and Sell Scheme) or EC in the past. This is because SCs are only eligible for two subsidised flats from the government.

Resale: You still qualify even if you’ve recently sold your private properties and already bought two subsidised flats in the past.

2. Lease tenure

BTO: Comes with a 99-year leasehold.

Resale: The oldest HDB flats can have 50 to 60 years or less left on their lease. You can find out the completion date of any HDB block through HDB’s Map Services feature. Input the postal code of any block, and the lease start date will be provided for you.

If you’re planning to hand down the HDB flat to your children, a BTO flat would likely be a better choice.

3. Future market value

BTO: Once a BTO flat’s Minimum Occupancy Period (MOP) is over, they often command higher prices compared to resale flats.

Comparing a 5-year-old BTO flat in a mature estate like Tampines, and a resale flat which is 20 years older, which do you think is a better investment? Surely it’s the younger flat.

Resale: Buying a resale flat means competing in an open market against others who do not qualify for a BTO flat. They include 1) SPR, 2) Households with income exceeding $14,000 per month, 3) Those who recently sold their private properties and 4) Singaporeans who have already bought two subsidised flats in the past. Hence, this emboldens resale flat owners to boost their property’s value.

4. Location

BTO: You may not get your most desired location as prime spots in Singapore have already been occupied a long time ago by existing developments. However, if the BTO launch is at a good location, luck has to be on your side as the launch will be heavily oversubscribed.

In the recent BTO exercise in August 2021, certain flats in the Hougang estate were oversubscribed by as much as 17 times. When you ballot for popular projects in prime areas, the odds will be stacked against you unless you quality for a priority scheme.

Resale: As long as HDB flats exist and there are upcoming developments, the options in the resale market are limitless!

It’s all about your budget and preferences. Always evaluate the amenities and surroundings of your future home, and prioritise your family’s needs.

5. Renovation

BTO: Picture yourself being presented with a blank canvas. It comes in a default form, at its purest state, in other words, there are no faults or damages to rectify, only endless choices in personalising your home. BTO flats can come with flooring and certain fixtures if you pay a little extra, but ultimately some renovation work will need to be done before you can realistically live in the completed flat.

Resale: Every home needs maintenance. The older the property, the more “fixing” would be required. Thus, renovation works (extensive hacking to replace and rebuild existing features etc) may be needed and that translates to additional expenses.

If the property is in tip-top condition or extensive renovation had already been done, existing homeowners will likely set a premium price on it, but at least the flat is ready for immediate move-in.

6. Size

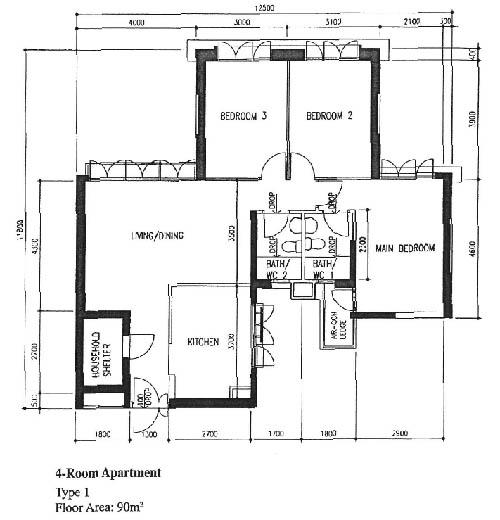

BTO: A 4-room flat is an average of 90sqm, and is often a comfortable fit for a family of 3 or 4. They may not be as big as 5-room flats but they’d be more budget friendly and still come with 3 bedrooms.

In recent years, HDB has been reducing the supply of 5-room flats, especially in mature estates. Hence for balloting purposes, going for a 4-room (or smaller) would yield the best chance of snagging a flat.

BTOs are suitable for couples and smaller families. However because they are physically smaller than older flats, they can can get quite claustrophobic if you have a big, multi-generational family.

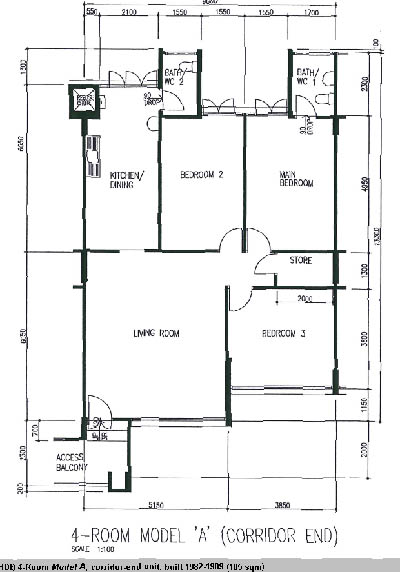

Resale: They are often bigger in floor area, even when compared within the same category. A 4-room corridor unit from an older flat (mid-to-late 1980s) could even go up to 105 sqm in size.

7. Waiting time

BTO: Home buyers often had to wait between 3-5 years for their BTO flats to be completed. However, the recent Covid-19 pandemic has led to delays in the construction supply chain, and HDB has announced that a more conservative 4-5 year waiting time is more likely.

Resale: You can easily move in after eight weeks from the date of HDB’s acceptance of the resale application, if the necessary documents are submitted accurately and promptly. This appointment is considered the Completion Date, and the seller is required to handover the key on the appointment date. Here’s an overview of the streamlined HDB resale process.

Depending on your timeline, you may be forced to choose one over the other.

8. Grants

BTO: For flat applications received from Sep 2019 sales launch onwards, you may be eligible for the Enhanced CPF Housing Grant (EHG). Your average gross monthly household income for the 12 months before your flat application must not exceed $9,000.

Resale: You can apply for the Family Grant and EHG. Those who are buying a resale flat to live near or together with their parents can also apply for the Proximity Housing Grant. Your average gross monthly household income for the 12 months before your flat application must not exceed $9,000.

Families with lower household incomes can receive a bigger EHG grant amount of up to S$80,000. Here’s a quick guide by HDB to find out if you’re eligible.

9. Current prices

BTO: Factors such as flat attributes (size, purpose of the flat, orientation, storey level), project location (proximity to city or town centre, accessibility, amenities) and timing (market conditions at the time of sale) determine the price of a BTO.

For example, the BTO list price of a 4-room flat at MacPherson Weave (launched May 2021) was from S$489,000 to S$626,000, while a 4-room at West Hill @ Bukit Batok was launched between S$260,000 to S$334,000.

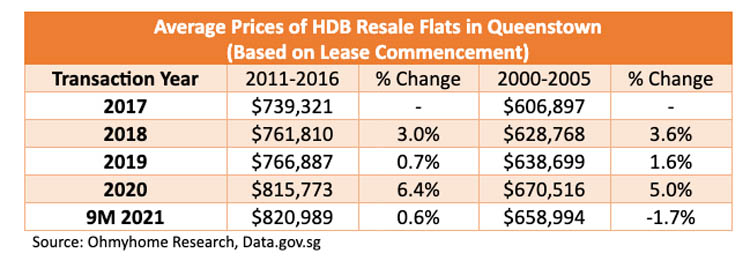

Resale: Older resale flats could cost more or even less, with age and location strong factors in the valuation. A 4-room resale flat in Tampines costs $468k and up. Buying resale could be cheaper if the flat is old, but prime locations will command a premium, with record number of flats being sold over S$1 million.

Pay attention to the price per square metre (psm), so you can consider how much space you’re getting for the price you’re paying, and use that as a gauge when comparing resale flats in different estates.

In conclusion, there are a handful of pros and cons for you to list out before making one of the biggest decisions in your life. Need professional advice from our in-house agents? We got your back!

Looking for an HDB or private property?

Here’s how you can speed up your home search

Let Ohmyhome’s smart data-matching technology MATCH you with the right home, according to your specific needs. Submit your preferences to us and our algorithm will filter all our available listings based on those, and we’ll WhatsApp them to you once we find a match. We’ll also send you relevant content that you can use for your research and inform your home buying decision, so you no longer have to spend hours searching online for the information that you need.

You can also call us at 6886 9009 to secure an appointment with any of our Super Agents or message us in the chatbox at the bottom, right-hand corner of the screen. You can also WhatsApp us at 9727 5270!