Heard or said the magical line “I do!” If yes, congratulations! You may be in the midst of planning the next chapter of your journey. It’s time to explore CPF housing grants for first time home buyers.

If you have ever wondered about the difference between Family Grant and Half-housing Grant, we have the answers:

These two grants are both for first-timer applicants buying resale flats. The family grant assists homebuyers who are married/ engaged couples composed of Singapore Citizen (SC) and at least one more Singapore Citizen or Singapore Permanent Resident (SPR).

What if your spouse/ spouse-to-be had previously received a housing subsidy? That is the reason why Half-housing Grant exists- this is for SC/SC applicants whose spouse/spouse-to-be had previously received a housing subsidy.

Unsurprisingly, Half-Housing Grant’s amount is half of the Family Grant that you and your spouse/ spouse-to-be would qualify for if both of you were first-timer applicants.

Family Grant vs Half-Housing Grant: What’s the Difference?

Summary of Family Grant and Half-Housing Grant

| Eligibility | Family Grant | Half-Housing Grant |

|---|---|---|

| Age | 21 years old and above | 21 years old and above |

| Flat type | 2-room or bigger | 2-room or bigger |

| Flat’s remaining lease | 20 years or more | 20 years or more |

| Income ceiling for a couple applicant | $14,000 | $14,000 |

| Income ceiling if purchasing with extended family | $21,000 | $21,000 |

| Previous housing subsidy | Both have not received any CPF Housing Grant for the purchase of an HDB resale flat | Either you or your spouse/ spouse-to-be previously received a housing subsidy before |

| Grant amount if buying 2- to 4-room Resale Flat | SC/ SC Household: $50,000

SC/SPR Household: $40,000 | SC/ SC Household: $25,000

SC/SPR Household: NA |

| Grant amount if buying 5-room or Bigger Resale Flat | SC/ SC Household: $40,000

SC/SPR Household: $30,000 | SC/ SC Household: $20,000

SC/SPR Household: NA |

If you noticed, the bigger the flat you are planning to purchase, the lower the grant amount. What are the other eligibility requirements? Except for the household status requirements, Half-Housing Grant’s must meet all of the other eligibility conditions for a Family Grant for Singapore Citizens.

Other eligibility criteria for Family Grant:

- You are not the owner of a flat bought from HDB, or an Executive Condominium (EC) or Design, Build and Sell Scheme (DBSS) flat bought from a developer

- You have not sold a flat bought from HDB or an EC/ DBSS flat bought from a developer

Requirements for Family Grant

- You and the other applicants and essential occupiers will need to get ready the following documents for verification:

- Payslips for 3 months preceding the month of application, if employed full-time (not on commission-basis)

- Income documents for 6 months preceding the month of application, for other types of employment

- Proof of unemployment, if not working

Other documents may be requested for verification if needed.

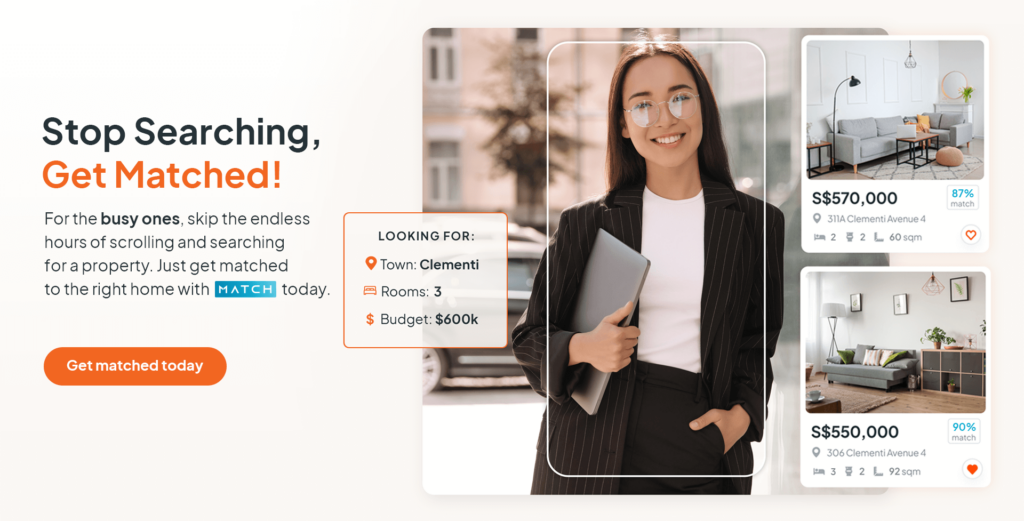

Looking for a HDB or private property? Speed up your home search!

Let Ohmyhome’s smart data-matching technology MATCH you with the right home, according to your specific needs. Submit your preferences to us and our algorithm will filter all our available listings based on those, and we’ll WhatsApp them to you once we find a match. We’ll also send you relevant content that you can use for your research and inform your home buying decision, so you no longer have to spend hours searching online for the information that you need.

Ready to speak to a property agent?

Drop us a message on WhatsApp or send us your questions via our Live Chat at the bottom, right-hand corner of the screen.

References: HDB First-Timer Applicants, HDB

Related posts:

- Mortgage 101: Is Fixed Rate Better than Floating Rate?

- Is Secured Loan For You?

- HDB vs Bank loan? Which is better?

- Available Grants for Resale Flats

- 4 Scientifically Proven Benefits of Proximity Housing Grant

While the Information is considered to be true and correct at the date of publication, changes in circumstances after the time of publication may impact on the accuracy of the Information. The Information may change without notice and Ohmyhome is not in any way liable for the accuracy of any information printed and stored or in any way interpreted and used by a user.