Why do people sell their homes? I have never owned an asset as valuable and expensive as property, but I can imagine selling it is not something you decide randomly.

There are many reasons why people sell their homes ranging from personal relationships to retirement. Which one might you relate to?

From our Top 4 Reasons Why People Sell Their Homes, you might find one that prompts you to consider selling your home. If that’s the case, you can book a meeting with our Ohmyhome Super Agents for a proper timeline and financial planning to outline your next steps and future housing options.

Top 4 reasons why people sell their homes in Singapore

- Upsizing/Upgrading

- Right-sizing/Retirement

- Divorce

- Relocation

#1: Upsizing/Upgrading

Is there a little bun in the oven that’s about to change your life forever, including your property needs? If your family is growing or you’re in the stages of family planning, it’s only natural to consider upsizing to a larger home for more space.

Before committing to your next home, have your desired family life in mind. For example, you’ll have to seriously consider moving closer to school districts instead of your workplace.

You’ll also need to straighten out your finances as buying a larger home can take you into a higher price bracket. You’ll have to assess how much of your mortgage you have paid off, what price you’re likely to get for your existing home, and whether you can afford the cash deposit required for your next property.

Even if you make a healthy profit from selling your existing home, you should continue to be price conscious when selecting your next property. Be it a larger resale flat or a private property, it should be affordable in the next few years; factoring in some reserve funds in case of job loss or unforeseen circumstances.

Speaking of private property, you may also be thinking of selling your HDB flat to buy private property. If so, you need to consider the factors mentioned above, as well as the capital appreciation of your next property and the developments in the estate.

Because nobody knows what the future holds, choosing your home with resale value in mind is important just in case you decide to sell again in the future. Hence finding a home in a location with high capital appreciation that can generate good returns is key.

A quality that can help boost capital appreciation is the development in the estate. A property located in an area with foreseeable development and upgrade plans, especially in the areas of transportation, infrastructure, and other neighbourhood upgrades.

We’re sure you know that proximity to vital amenities, like schools, supermarkets, malls, and the city, play a huge role in pushing up property prices. You can check the Urban Redevelopment Authority (URA) website for more updates on these.

#2: Right-sizing/Retirement

Let’s get this straight: Size matters.

Once you’ve gotten over the emotional hump of losing the prestige of owning a large (or even normal-sized) home, you may find that making it to the other side of right-sizing is worth the benefits.

Those who consider right-sizing are often people whose kids have fled the nest, about to retire, or those who may simply want a home that’s more manageable, one that requires less maintenance and fewer repairs.

Cutting down on space will do the trick: it reduces your housing costs (like your utility bills and so on) and makes your mortgage more manageable. Of course, even if you move into a smaller home, but that home is a condo, a newer flat, or it’s located in an attractive location, you might actually be paying more.

Throughout your life, especially as you transition into retirement, your cash flow and priorities will begin to shift. This can make it difficult for ageing couples, who are staying in a large family home into retirement, to age in place.

Fortunately, you can choose to right-size your flat and supplement your retirement income through the HDB Silver Housing Bonus (SHB) scheme. It is available to Singapore Citizens who are at least 55 years old with a gross monthly household income of $14,000 or less.

Dive Deeper: What you Need to Know About Right-sizing and Silver Housing Bonus (SHB) Scheme

The SHB scheme basically incentivises ageing Singaporeans to right-size their home and use their sale proceeds (from selling their house) to contribute to their CPF Retirement Account (RA). With that, they will earn up to $30,000 as a cash bonus, though the amount depends on the nett proceeds and how much the owners contribute to their CPF RA.

If you own a bigger HDB flat type, you can choose to right-size by selling your existing flat and buying either:

- Smaller and cheaper flat from the resale market, or

- Smaller flat from the HDB, such as a 2-room Flexi or 3-room flat

And to qualify for the SHB scheme, you must either:

- Book a new HDB flat or studio apartment or

- Apply to buy a resale flat before selling their existing property or within 6 months of completing the sale of their existing property.

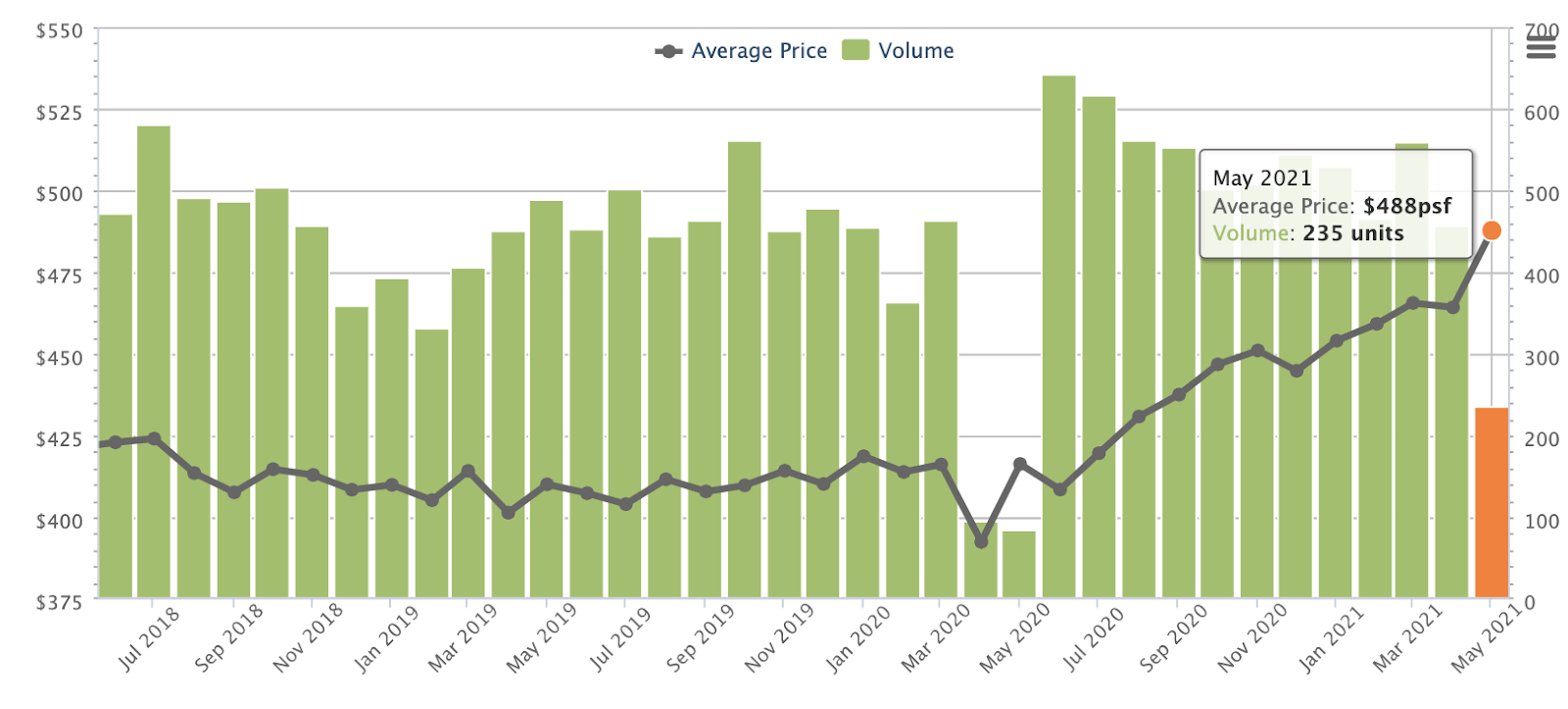

Here are the general prices of smaller homes in Singapore as of May 2021:

HDB resale 3-room flats across all HDB towns are averaging $488 per square foot (psf).

Source: Squarefoot Research

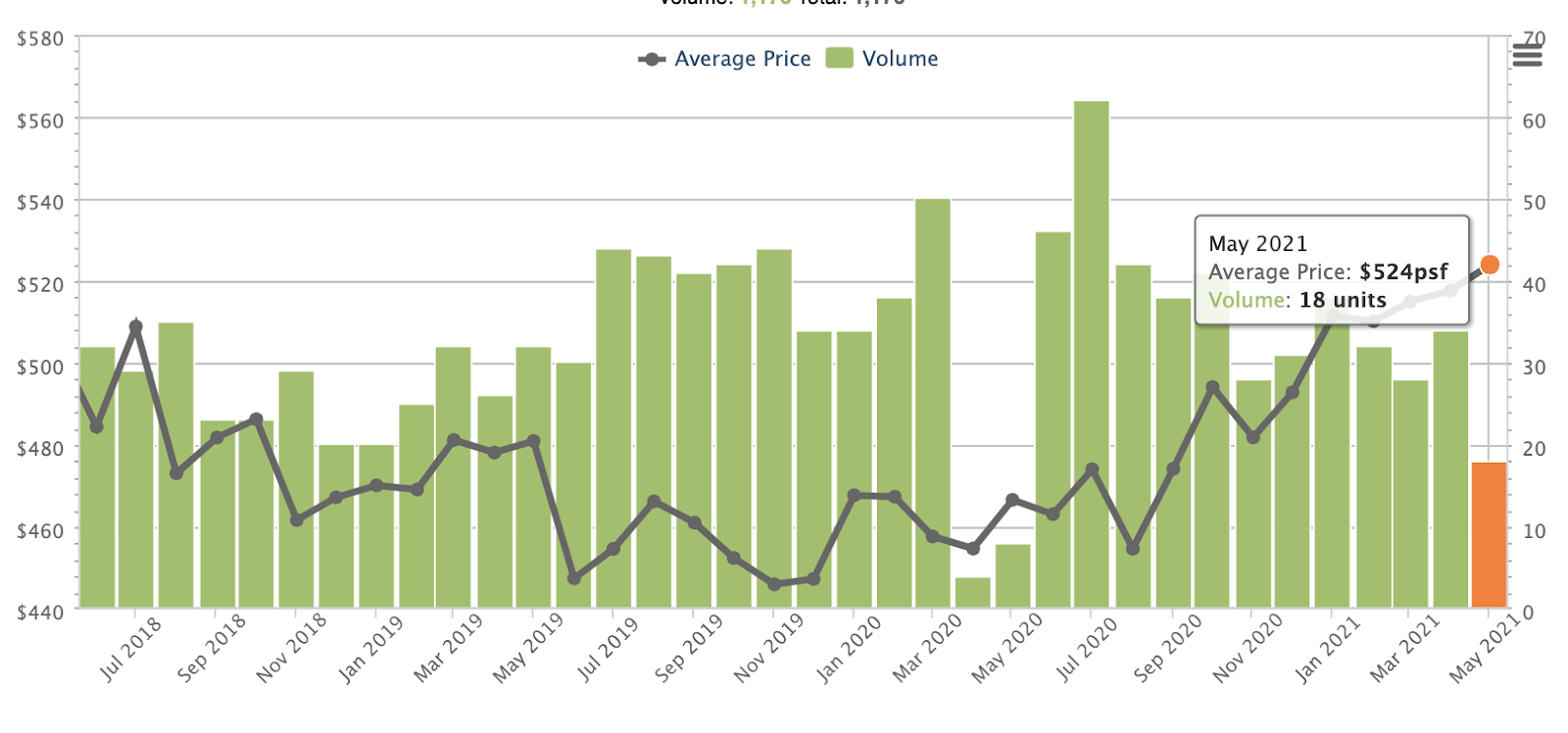

HDB resale 2-room flats across all HDB towns are averaging $524 psf.

Source: Squarefoot Research

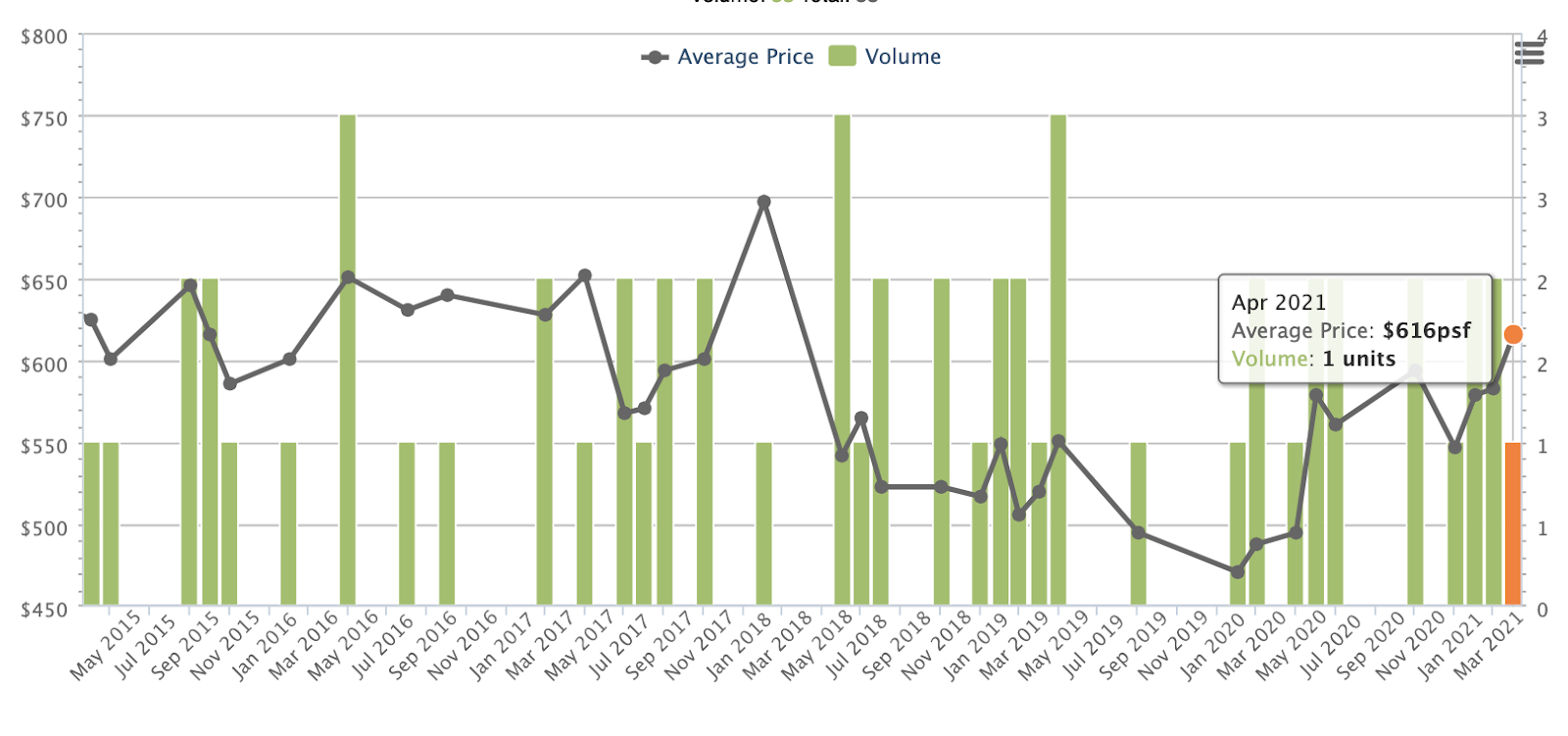

HDB resale 1-room flats across all HDB towns are averaging $616 psf.

Source: Squarefoot Research

For condos, here are the median transaction prices of 1-bedroom units across Singapore

| 1-bedroom | 1-bedroom | 1-bedroom | |

| 400 TO 500(SQ FT) | 500 TO 600(SQ FT) | 600 TO 700(SQ FT) | |

| City & Southwest (D1-D8) | $1,031,600 | $1,161,473 | $1,341,230 |

| Orchard & Tanglin (D9-D10) | $1,123,500 | $1,374,880 | $2,948,768 |

| Newton / Bukit Timah & Southwest (D1, D21) | $890,825 | $1,004,000 | $1,209,000 |

| Balestier / Macpherson / Geylang (D12-D14) | $728,296 | $821,444 | $1,159,333 |

| East Coast (D15-D16) | $772,500 | $980,250 | $750,000 |

| Changi / Pasir Ris (D17-D18) | $578,000 | $785,500 | $903,500 |

| Serangoon / Thomson / Northeast (D19-D20) | $739,500 | $909,056 | $1,050,000 |

| West (D22-D24) | $828,500 | $877,500 | $1,006,094 |

| North (D25-D28) | $558,333 | $727,500 | $824,350 |

Median transaction prices of 2-bedroom units

| 2 bedrooms | 2 bedrooms | 2 bedrooms | |

| 700 TO 800(SQ FT) | 800 TO 900(SQ FT) | 900 TO 1000(SQ FT) | |

| City & Southwest (D1-D8) | $1,532,678 | $1,450,463 | $1,673,800 |

| Orchard & Tanglin (D9-D10) | $3,439,294 | $3,337,141 | $3,583,200 |

| Newton / Bukit Timah & Southwest (D1, D21) | $1,246,000 | $1,550,000 | $1,425,250 |

| Balestier / Macpherson / Geylang (D12-D14) | $1,307,500 | $1,158,167 | $1,463,167 |

| East Coast (D15-D16) | $1,137,500 | $995,000 | $963,000 |

| Changi / Pasir Ris (D17-D18) | $847,000 | $895,000 | $1,025,319 |

| Serangoon / Thomson / Northeast (D19-D20) | $1,212,250 | $1,175,815 | $1,264,200 |

| West (D22-D24) | $1,174,000 | $1,193,750 | $1,100,000 |

| North (D25-D28) | $970,130 | $868,333 | $912,250 |

#3: Divorce

Dividing real estate in a divorce can add stress to an already stressful life event because the property, especially purchased together, can be a foundation of a relationship. As it’s challenging to figure out your available options while navigating a divorce, we’ve compiled the crucial factors you need to consider:

During a divorce, you can retain the flat if you have custody of the child (including care and control) granted all the eligibility conditions are met. However, the divorce must not be due to non-consummation of marriage or annulment. If it is due to those two things, or if there is a break-up of the fiance-fiancee relationship, neither party is allowed to retain the HDB flat.

If you have no children from your marriage, you can take over the flat under the Single Singapore Citizen (SSC) Scheme or include another person to retain the flat.

For matrimonial flats bought directly from HDB and resale flats bought with the CPF Housing Grant for Family, the 5-year Minimum Occupation Period (MOP) must be satisfied before you can retain the flat under the SSC Scheme.

Eligibility to retain the flat after divorce if you have no children under SSC Scheme:

- You are a Singapore citizen

- You are at least 35 years old

- Your matrimonial flat is a resale flat purchased from the open market without the CPF Housing Grant for Family

If you wish to sell your flat in the open market, it must be at the prevailing compensation price (subject to HDB’s approval) and the flat must have reached MOP by the divorce completion date.

Dive Deeper:

- Top 3 Questions About Selling an HDB During a Divorce

- Home Ownership: Difficult Questions Following a Loss, Death, Divorce, Separation

For Muslims, the Syariah Court will divide and apportion all the matrimonial assets post-divorce.

They will also decide if the property will be disposed of or divided between the husband and the wife and if the sale proceeds of the property will also be divided.

Typically, the matrimonial home will be ordered to be sold in the open market and the nett sale proceeds are divided between the two parties in proportion to what the Syariah Court deems just and equitable.

The Syariah Court may also order the sale or transfer of the home to either the husband or the wife, or to be surrendered to the HDB. (Read more about how the Syariah Court decides who gets how much for the home.)

#4: Relocation

While thinking about your relocation plans, remember to base your expectations on what your goal is. Are you relocating for work? For your children to be near their school? Or are you relocating so your kids can be closer to their grandparents (or vice versa)?

Read how Ohmyhome helped this couple relocate to a bigger home in just six weeks, after trying to sell (and failing) with an external agent for over a year.

There are several family-friendly condos near schools in the Core Central Region (CCR), in Districts 9 and 10, including Sophia Hills, Jervois Prive, and Leedon Residence.

HDB Towns Clementi, Bukit Batok, and Bukit Timah are great towns to live in for families, as well. Clementi and Bukit Timah, in particular, are relatively close to reputable schools and business parks.

Big tech giants like Google, Grab, Shoppee, ByteDance, and Tencent are either already present in the neighbourhood or have announced their plans to move in. Those working in tech and start-ups may find that living in Clementi and Bukit Timah can be as fruitful for them as their children. Hence homes in those towns have better property price appreciation, which may see growth once foreign talents flow in and investors cash in on the towns’ potential.

On the other hand, Bukit Batok would be great for elderly and young couples looking for a quiet neighbourhood to come home to. Backdropped by Little Guilin and surrounded by lush greenery, with easy access to numerous parks, the quaint town is one you should watch.

Homes in Bukit Batok are also some of the most affordable compared to the rest of the HDB towns: the median prices of 3-room HDB resale flats in the area about $300,000. You can even expect newer resale flats to hit the market soon as two BTO projects are reaching their MOP this year. They are Skyline I and Skyline II.

Whether it’s for retirement, divorce, or relocation, let Ohmyhome Super Agents assist you in selling your home.

Enjoy fees as low as $2,888 for a quick, professional, and stress-free home-selling experience!