Selling your current HDB resale flat is exciting; it means you’re about ready to move to your new home. But paying for the transaction fees and stamp duties? Not so much. However, it is integral to completing your HDB resale transaction. So we’ve come up with the ultimate HDB resale payment timeline that you can follow to keep you on track of your incoming and outgoing payments when selling or buying a HDB resale flat.

Contents

Sellers: When to pay for your HDB resale flat

| Timeline | Journey | Payment |

| Register Intent to Sell | ||

| Post listing on Ohmyhome and start marketing | ||

| Start home viewings & conduct negotiations | ||

| Grant OTP* to Buyer *OTP needs to be exercised within 21 days | Incoming: $1-1,000 (Option Fee) | |

| Within 21 days | Buyer exercise OTP | Incoming: $1-4,000 (Exercise Fee) |

| Within agreed number of days between seller and buyer | Submit Resale Application | Outgoing: $40-80* (Resale Application Fee) *1- and 2-room: $40 3-room and bigger: $80 |

| Approx. 4 weeks later | Receive Acceptance of resale application from HDB & Endorse HDB documents | Outgoing: – $300-$500 (HDB Legal conveyancing fees) – Refund of Deposit to CPF (in the case of negative CPF sale) |

| In 8 weeks | HDB Resale Completion Appointment | Incoming: – Cash Proceeds – CPF Refund (within 2 weeks from Completion date) Outgoing: – Outstanding Property Tax (if any) – Town Council Service and Conservancy Fee (balance payment up to Completion date) – Mortgage Discharge fee (where applicable) – From $1,800 (Conveyancing Fee with Ohmyhome Legal Conveyancing Services) – 1% of the sale price (Ohmyhome Agent Fee) – Refund of $20 HDB admin fee to Buyer if there is a request for Extension of Stay |

Buyers: When to pay for your HDB resale flat

| Timeline | Journey | Payment |

| Register Intent to Sell | ||

| Calculate affordability:Get HLE letter* from HDB or IPA** from a bank *Valid for 6 months from date of issue.**Valid for 2 months from date of issue. | ||

| Start home viewings & conduct negotiations | ||

| Receive OTP* from Seller *OTP needs to be exercised within 21 days | Outgoing: $1-1,000 (Option Fee) | |

| Request for Valuation of flat & Have valid HLE letter or Accept Letter of Offer from the bank | Outgoing: $120 (Request for Valuation Fee) | |

| Within 21 days | Exercise OTP | Outgoing: $1-4,000 (Exercise Fee) |

| Within agreed number of days between seller and buyer | Submit Resale Application | Outgoing: $40-80* (Resale Application Fee) *1- and 2-room: $40 3-room and bigger: $80 |

| Approx 4 weeks later | Receive Acceptance of resale application from HDBEndorse HDB documents | Outgoing: – Downpayment via CPF^ – $800-$1,000 (HDB Legal Conveyancing Fee, if applicable) – From $1,800 (Conveyancing Fee with Ohmyhome Legal Conveyancing Services, if applicable) – Stamp fees (where applicable) – $20 (HDB Admin Fee, in case Extension of Stay is granted to Seller) |

| Within 14 days of endorsing documents | Receive Approval of HDB Resale Application | Outgoing: – Buyer’s Stamp Duty – Cash Balance of Purchase Price (to cover any part of the purchase not covered by the home loan or CPF) |

| 8 Weeks upon receiving Acceptance notice | HDB Resale Completion Appointment | Outgoing: – ^Balance of Purchase Price to be paid by Cash (for amount not covered by the home loan or CPF) – Cash over Valuation (if any) – Apportioned Property Tax to be paid to Seller (pro-rated based on the portion of the year for which you own the property) – 1% of the sale price (Ohmyhome Agent Fee) Incoming: – $20 HDB admin fee for Extension of Stay (Seller to refund to Buyer) |

Need assistance with selling your HDB resale flat? Engage Ohmyhome

Drop us a message on WhatsApp to speak to any of our property agents, or simply chat with us via our Live Chat at the bottom, right-hand corner of the screen.

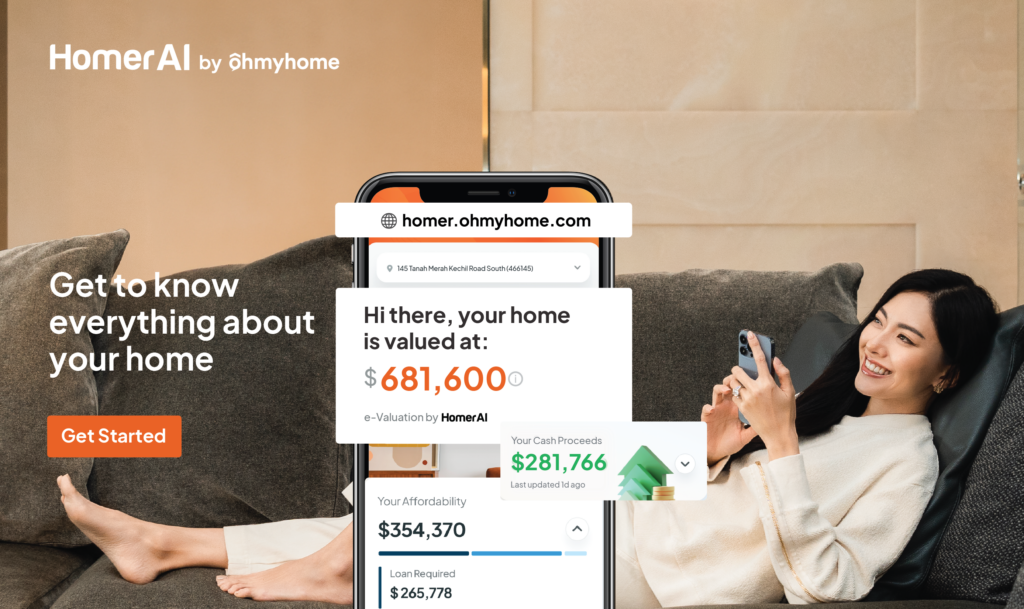

Not ready to speak to an agent? Get to know everything you need about your HDB resale flat from Homer AI

Homer AI is our home ownership management & e-valuation tool that will provide an accurate estimation of your home valuation that’s updated every month, so you can track if it increased, stayed the same, or decreased.

Homer AI can also help you:

- Estimate how high you can sell your home. With an accurate home valuation, you’ll know the exact market rate for your home and negotiate with confidence.

- Financially plan for your next dream home. How much do you actually get to keep? Do you have enough for your next home? Relax, leave the calculations to Homer AI.

- Stay updated on the property market. No more waking up to thousands of news articles about new cooling measures. Get it straight from one source.