In a dense HDB estate such as Toa Payoh, you can find newer, skyscraper-like towers planted right next to 40-year-old vintage flats. The difference is striking and embodies the continuous change of Singapore’s landscape.

For a small country like Singapore, housing can be a complex and challenging issue due to the rising population and limited land available.

As a general policy, leasehold land will be returned to the State upon lease expiry, to allow it to be rejuvenated for the new social and economic needs of Singaporeans.

Thus, a 99-year lease means that the flat can be handed down one or two generations before it is returned for redevelopment.

99-year leases are not unique to Singapore, as cities like Hong Kong have residential properties sold on 50-year leases and Canberra in Australia has a 99-year leasehold system.

But what happens in Singapore when that lease is up? Do flats last that long or does HDB compensate the owners in any way? So far, no 99-year lease flats have ever reached the end of their lifespan, but there is another case study that we can learn from.

Contents:

What happened to these houses when their 60-year lease was up?

In 2017, The Singapore Land Authority (SLA) announced that the land occupied by 191 private terrace houses at Lorong 3 Geylang will be returned to the State once their 60-year leases expire on 31st December 2020. Eventually, most owners found alternative housing in time, while some experienced difficulties.

Any homeowner can understandably get concerned about outliving the 99-year lease of their properties. If you’re reading this and wondering what’s next, you’re not alone. Below are some of the options to help you unlock the value of your HDB flat.

3 ways to unlock the value of your HDB flat lease

So what if the lease to your flat is winding down, and you want to get the most value out of the dwindling years? Here are 3 avenues you can pursue, and if it all sounds daunting, Ohmyhome agents can help you get started.

Rent out your HDB flat

As the market value for older flats have been lagging behind newer ones, you might prefer to hold on to it rather than selling for a less than satisfactory price.

Renting out property has always been a good source of passive income for many homeowners, and there’s no reason why it can’t apply to older flats.

Only Singaporeans are eligible to rent out their HDB flats after fulfilling the 5-year minimum occupation period (MOP). However, if the flat was purchased without a Housing Grant before 30 August 2010, the MOP period is shortened to 3 years.

If you’re unsure how to find tenants, Ohmyhome’s agents can help to act as an intermediary and help any concerns that both parties may have.

Silver Housing Bonus

For seniors living in an old, large flat and find it too big for their needs, there’s a good way to settle both concerns. With the Silver Housing Bonus, owners can sell their old flat with dwindling lease, and also receive a cash bonus when they top up their Central Provident Fund (CPF).

There are several conditions that have to be met to qualify for the Silver Housing Bonus (SHB). The major ones are that at least one owner must be a Singapore citizen above 55 years-old, no concurrent ownership of another property, and the replacement HDB flat must be a 3-room or smaller unit. Here is the full list of requirements.

The SHB will require a top-up of $60,000 from the sales proceeds, into their CPF Retirement Account (RA) and join CPF LIFE. The top-up amount required depends on the proceeds, but is capped at $60,000.

You’ll receive the maximum cash bonus of $30,000 if you contribute $60,000 to your CPF RA. If the top-up is less than $60,000, a pro-rated cash bonus of $1 for every $2 you contribute will be given out as the cash bonus.

Example 1: Proceeds exceed $60k

Andy and Angela are selling their 5-room flat in Bedok (bought from HDB) and are buying a 2-room Flexi BTO flat in Tampines. Based on their proceeds, they are required to top up $60,000 to their CPF RA. They will receive SHB of $30,000.

| Selling price of existing property | $580,000 |

| LessOutstanding loan on existing property | $180,000 |

| Purchase price of next flat | $192,000 |

| Resale levy | $57,000 |

| Proceeds | $151,000 |

| Top-up required | $60,000 |

| Cash Bonus | $30,000 |

Example 2: Proceeds between $0 and $60,000

Benedict and Bernice are selling their 4-room resale flat in Bedok and buying a 3-room resale flat in Yishun. Based on their proceeds, they are required to top up $40,000 to their CPF RA. They will receive a prorated SHB of $20,000 since the cash bonus is a $1 payout for each $2 contributed.

| Selling price of existing property | $350,000 |

| LessOutstanding loan on existing property | $0 |

| Purchase price of next flat | $310,000 |

| Proceeds | $40,000 |

| Top-up required | $40,000 |

| Cash Bonus | $20,000 |

Example 3: Proceeds less or equal to $0

Charles and Charlene are selling their 3-room flat in Clementi and buying a new 2-room Flexi flat in Jurong. As they do not have any proceeds after settling loans, levies and the cost of their next flat, they are not eligible for SHB.

| Selling price of existing property | $250,000 |

| LessOutstanding loan on existing property | $80,000 |

| Purchase price of next flat | $140,000 |

| Resale Levy | $30,000 |

| Proceeds | $0 |

| Top-up required | $0 |

| Cash Bonus | Not eligible for SHB |

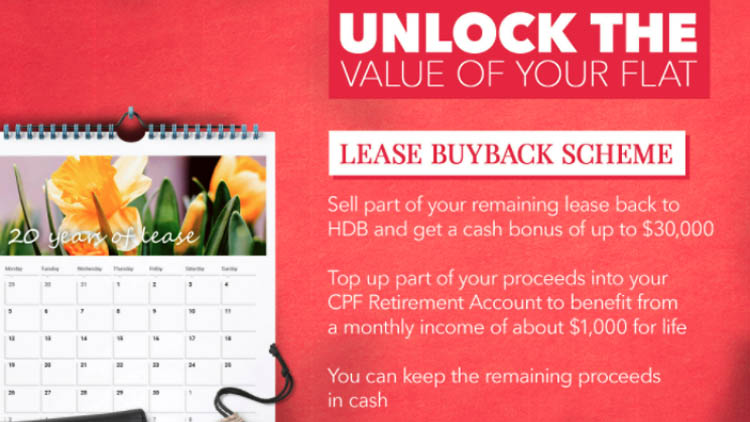

Lease Buyback Scheme

Using the Lease Buyback Scheme (LBS), an HDB flat owner can sell part of their lease to HDB and retain the length of lease based on the youngest owner’s age while continuing to live in their flat.

The proceeds from selling part of your flat’s lease will be used to top up your CPF RA. You can then use your CPF RA savings to join CPF LIFE, which will provide you with a monthly income in your retirement years.

Eligibility Conditions

| Criteria | Eligibility |

| Age | All owners must have reached the eligibility age (currently set at age 65) or older |

| Citizenship | At least one owner must be a Singapore Citizen |

| Income | Gross monthly household income of $14,000 or less |

| Flat type | All flat types* |

| Property Ownership | No concurrent ownership of second property |

| Minimum Occupation Period | All owners have been living in the flat for at least 5 years |

| Minimum Lease | At least 20 years of lease to sell to HDB |

*Excluding short-lease flats, HUDC, and Executive Condominium units

Once qualified, here’s what you can do under the LBS:

- Sell the tail-end of your lease for 3-room or smaller flat, or 4-room flat, or 5-room or bigger flat to HDB, and receive up to $30,000 or $15,000, or $7,500 of LBS bonus, respectively.

- Use the net proceeds to top up your CPF RA to the specified requirements based on your age.

Example: 2 Owners aged 65 sell 35 years of lease

Scenario:

- 5-room flat held under joint tenancy

- No outstanding loan

- Balance lease: 65 years

- Market value: $540,000

- Choose to keep a 30-year lease

- Sell the tail-end 35-year lease to HDB for $233,900

| Husband | Wife | |

| Citizenship | SC | SC |

| Age | 65 | 65 |

| Initial Retirement Account (RA) Balance | $15,000 | $7,000 |

| Shortfall to Current Age-Adjusted Basic Retirement Sum ($93k at age 65) | $68,000 | $86,000 |

Looking for an HDB or private property? Here’s how you can speed up your home search!

Let Ohmyhome’s smart data-matching technology MATCH you with the right home, according to your specific needs. Submit your preferences to us and our algorithm will filter all our available listings based on those, and we’ll WhatsApp them to you once we find a match. We’ll also send you relevant content that you can use for your research and inform your home buying decision, so you no longer have to spend hours searching online for the information that you need.

You can also secure an appointment with any of our Super Agents by dropping us a message on WhatsApp or via our Live Chat at the bottom, right-hand corner of the screen.

Frequently Asked Questions about what will happen to a HDB flat when the 99-year Lease is Up?

1. Why do HDB flats have 99-year leases?

Leasehold systems in land-scarce Singapore enable land to be recycled and re-developed, to ensure housing for future generations. If flats were sold freehold, there would not be enough land to build new homes.

2. Do I really own my HDB flat, or am I just renting it from HDB?

HDB flat buyers who purchase a new 99-year lease flat own the rights to their flats for 99 years and thus regard themselves as homeowners.

3. Where will my HDB flat go after the 99-year lease is up?

Even though there haven’t been any HDB flats that have reached the end of their 99-year lease, that doesn’t mean that it won’t happen in the future.HDB will surrender the land back to the State and it can be redeveloped into residential or other purposes.

4. Is getting a 99-year lease property worth it?

Although all HDB flats come with 99-year leases, for those who just want to live in them, a flat with a 99-year lease is usually sufficient for the long haul.

However, if you intend on making your next house a generational home and want to pass it on from generation to generation, you should seek out a private property with a 999-year lease or a freehold lease to maintain the property for decades.