The BTO Proposal; not heavy on romance, but robust in its practicality.

While an actual proposal may be included so boyfriends (or really progressive girlfriends) don’t skimp on the romance factor, the BTO proposal is a great indicator of whether your partner is ready to settle down with you. How so? We weigh the pros and cons of a BTO proposal.

Pro #1: Easiest, most budget-friendly way to home ownership in Singapore

BTOs are the quickest, most pocket-friendly options a young Singaporean couple can find in Singapore to secure home ownership. Under the Fiancé/Fiancée Scheme, couples are eligible for various grants, and can get a flat as long as they are aged 21 and above.

However, if you are swinging single with no kids, you would have to wait till you are at least 35 years old before you can apply for a flat or get a resale unit.

As BTO flats are fresh units with clean layouts and new facilities, you can save on a ton of expensive renovation costs like hacking or even tiling, if your unit comes with completed flooring.

Pro #2: Step one to your asset progression

After homeowners fulfil their Minimum Occupation Period (MOP), they can sell the flat on the open resale market. Given Singapore’s land-scarce situation, most BTOs typically will appreciate in value. Sometimes, given the right market demands, if your flat is highly sought after, you could even make headlines selling your HDB unit for over $1 million.

Even if your HDB sells for a modest profit, the capital gains will help you move on to your second home — ideally a larger unit or even a private property. You may even make enough profit to cover the renovation for your next home, or have some spare cash for other forms of investments.

Additionally, as your BTO would have come with a spanking new 99-year lease, selling right after MOP gives you an advantage over other resale units in the market that have less remaining years left on their lease.

And if you’re sitting on a freshly MOP-ed home and want some advice on whether it is prime time to sell, you may want to contact us here.

Pro #3: Great way to tell if your partner is willing/ready to tie the knot

Okay, so not all Singaporeans are devoid of the romantic bone. We’ve seen some really creative take-her-breath-away proposal methods online and even in our own circles over the years.

But, casually dropping the “Will you BTO with me?” question on a random Tuesday afternoon could give you a pretty good gauge of whether your partner is:

a) ready to settle down,

b) ready to settle down with you,

c) has the financial ability and readiness to commit to joint home ownership with you.

This will then save you the awkwardness of receiving a hesitant answer, or worse, a resounding “NO” when you actually do get down on one knee.

If you are in the early stages of your relationship though, we would strongly recommend you wait at least a year before dropping the BTO bomb on them, lest they run screaming for the hills.

Con #1: Long wait time

The average waiting time of a BTO project is about 4 to 5 years. While HDB is working to reduce waiting time, even the projects with shorter wait times can take up to 3 years to be completed.

While most couples applying for BTOs have youth on their side, the notoriously long wait time, excluding the period for inspection and rectification of defects, plus your own renovations, could mean you will take even longer to finally move in.

If profit is your goal, you will have to add another 5 years for the MOP to up before you can sell off your unit.

Con #2: You sometimes need luck

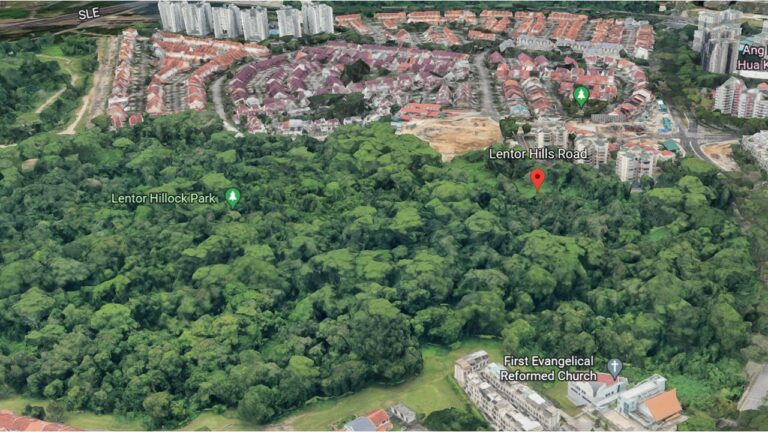

This is especially so for the BTO launches in “hot areas”; usually located in mature estates or the city fringe. The popularity of BTO launches means you will be facing stiff competition in the balloting process. With oversubscription being common, demand way exceeds supply, and you will need luck to smile upon you to get a favourable queue number so you can have a chance at selecting a choice unit — one that is on a higher level, with your preferred layout, or facing your preferred direction.

That being said, BTO launches may also not coincide with the time you are ready to settle down and apply for a unit, which means getting a preferred flat type in an area you like, with the layout you like, at a price you can accept and afford, really requires all elements to fall perfectly in place so you can score the BTO you desire.

Con #3: What if you break up?

Unfortunately, this is a completely possible scenario, given we have heard of at least one couple that broke up before the wedding took place and had to give up their BTO.

In the event of a breakup, you not only lose your BTO queue number, you also lose your $10 application fee, and may even forfeit your entire deposit. Here’s a quick summary below of what you stand to lose in the event of a BTO break up (depending on which stage you are at):

Stage 1: Breaking up after your BTO selection

You lose: $10 application fee and your option fee of $1,000-$2,000.

Obstacles: You cannot buy or ballot for another BTO for one year, additional chances for balloting will be set to zero.

Stage 2: Breaking up after signing Sale and Purchase Agreement but before key collection

You lose: Your option fee, your 5% down payment, Buyer’s Stamp Duty, legal fees, Housing Grants plus interest.

Obstacles: You cannot buy or ballot for another BTO for one year, additional chances for balloting will be set to zero.

Stage 3: Breaking up after key collection

You lose: Your option fee, down payment, Buyer’s Stamp Duty, legal fee, housing grants with interest, registration fees for mortgage, stamp duty on mortgage, survey fees, fire insurance, fees for Home Protection Scheme, repaying balance of bank loan (if money has been disbursed), and other miscellaneous fees

Obstacles: You cannot buy or ballot for another BTO for one year, and there will be no first-timer advantages for you when you try to get another BTO in the future.

Long story short, while we wish all lovebirds a lifetime of bliss and a happy marriage, things don’t always go as planned.

In this case, from the scenarios we have drawn up above, it is far better to cut your losses early before you allow it to escalate to Stage 3 where you will have to nurse a broken heart and a broke bank account at the same time.

Thinking of doing the BTO proposal to your partner this Valentine’s day? Pick out your ideal home first!

Let Ohmyhome’s smart data-matching technology MATCH you with the right home, according to your specific needs.

Submit your preferences to us and our algorithm will filter all our available listings based on those, and we’ll WhatsApp them to you once we find a match.

We’ll also send you relevant content that you can use for your research and inform your home buying decision, so you no longer have to spend hours searching online for the information that you need.

Because at Ohmyhome, we’re always by your side, always on your side. Secure an appointment with any of our Super Agents by dropping us a message on WhatsApp or via our Live Chat at the bottom, right-hand corner of the screen.