Every quarter, The Urban Redevelopment Authority (URA) releases a comprehensive database of price indices and sales volume for the private housing segment. Ohmyhome analyses this huge chunk of data and picks out the most relevant points and trends for readers.

The implications of the property cooling measures, geo-political tensions and rising interest rates reverberated across the private residential market in the first quarter of 2022.

New home sales declined sharply from 3,018 units transacted in 4Q2021 to 1,825 units sold in 1Q2022. This was a 39.5% (q-o-q) drop in the number of units sold. This was the sharpest drop since 2Q2020, when there were a total of 1,713 units sold.

While private resale transactions fell from 4,748 units in 4Q2021 to 3,377 units in 1Q2022. This translates to a 28.9% (q-o-q) decline in the number of units sold. Although the number of resale transactions have fallen, the resale market has remained consistent in attracting buyers.

The primary reason for this is due to the intermittent delays in the construction of newer developments. This has led to some buyers to shift their attention towards the steady supply of the resale market with completed properties that are readily available for immediate occupation. The private resale market is further boosted by buyers who are transitioning from HDB flats as well.

Past projects dominate new home sales performance in 1Q22

With the recent paucity of new launches, developments that were previously launched garnered more interest from buyers and investors in the first quarter of 2022.

Normanton Park topped sales in 1Q2022, as the best-selling project. The development sold a total of 260 units at an average price of $1,860 psf. The consistent interest in the project has boosted sales in the past few months, with the development nearing its sold-out status.

The increase in demand for the project has led to the average price of the development to rise from $1,789 psf in 2021 to $1,860 psf in the first quarter of 2022. This was a 4.0% increase in average prices.

Savy buyers and investors who are aware that there may not be many mega developments in the immediate future, lean towards such projects to reap the benefits. As mega developments tend to have a large offering of units, providing varying bed types with more facilities than regular condominiums. And the maintenance fees of such developments are lower as well. Hence, these projects tend to be popular with families of all sizes.

Belgravia Ace was the only new launch from the first quarter of 2022, that made it on to the top 10 best-selling project list. It was the first new landed development launch of the year, and had a praiseworthy performance, with 74 units sold at an average price of $1,080 psf. Newly launched freehold landed properties are a rarity. Hence, demand for these properties was robust.

Private property prices moderated in 1Q22

The URA private residential index moderated at a slower pace of 0.7% in the first quarter of 2022 as compared to the 5.0% growth in 4Q 2021.

A confluence of factors led to the slower growth in the overall property prices. This includes the cooling measures in place, absence of major new project launches, decreasing unsold units, subdued demand, lesser high value transactions and global uncertainties from the Russia-Ukraine conflict.

Private property prices across the different segments saw prices decline, except in the Outside Central Region (OCR). It is likely the rapidly depleting number of unsold units and lesser number of units launched in OCR, led to buyers and investors to compete for a limited pool of supply, resulting in a nudge in price growth by 2.2%.

While, interest in new landed homes such as Belgravia Ace attributed to prices keeping pace by 4.2% for the overall landed price growth.

Another contributing factor was that there were lesser big-ticket transactions were taking place in 1Q2022, which were above the $10 million mark as compared to 4Q2021. As the number of transactions reduced tremendously from 18 units sold in 4Q2021 to 6 units transacted in 1Q2022 for new sale properties. While, for resale properties, the number of units decreased from 68 units in 4Q2021 to 51 units in 1Q2022.

Significant impact to the purchasing behaviors of foreigners

The repercussions of the property cooling measures were noticeably reflected in the buying behaviors of the foreigners in both of the new sale and resale segments.

The number of new home units bought by foreigners dropped from 155 units in 4Q2021 to 81 units in 1Q2022. This accounted for a 47.7% (q-o-q) reduction in the number of new private home sales.

While the number of resale homes purchased by foreigners declined from 129 units in 4Q2021 to 68 units in 1Q2022. This reflected a 47.3% (q-o-q) reduction in the number of resale homes.

In addition, there were lesser high net worth foreigners entering the Singapore’s property market in 2021. Lesser purchases were made above the $10 million mark; the number of transactions declined from 25 units sold in 4Q2021 to 10 units sold in 1Q2022.

We can expect foreigner demand to remain subdued, with interest likely diverted towards the rental market.

Private Property Market Outlook

With a lack of major project launches or mega developments (projects with 1,000 units and above) released for sale, the number of uncompleted units launched for sale fell to an all-time low of 613 units in 1Q2022.

This was a steep decline of units launched since 1Q2018, when it was below the 1,000 unit mark. While, the number of uncompleted unsold units dropped to an all-time low of 14,087 units as well. With that in mind and some new launches such as North Gaia (EC), Piccadilly Grand, The Arden and Liv @ MB coming on stream, we are expecting a gradual pick up in momentum for new home sales.

However, the tight supply of new launches and uncertainties in the construction industry, might likely nudge buyers to move towards the resale market.

Looking to buy a private property?

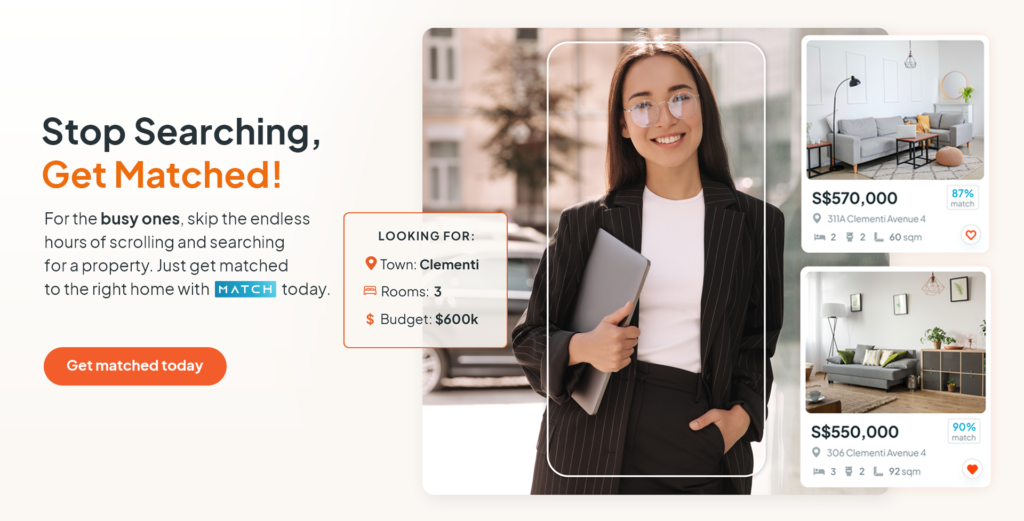

Let Ohmyhome’s smart data-matching technology MATCH you with the right home, according to your specific needs. Submit your preferences to us and our algorithm will filter all our available listings based on those, and we’ll WhatsApp them to you once we find a match. We’ll also send you relevant content that you can use for your research and inform your home buying decision, so you no longer have to spend hours searching online for the information that you need.

Experience seamless, fast and exceptional service from our Super Agents. Chat with us at the bottom, right-hand corner of the screen. Or WhatsApp us at 9755 1009 to get in touch.