With HDB resale prices slowly inching towards Q2 2013 peak prices, some homeowners may have had thoughts about selling their homes pass through their minds lately.

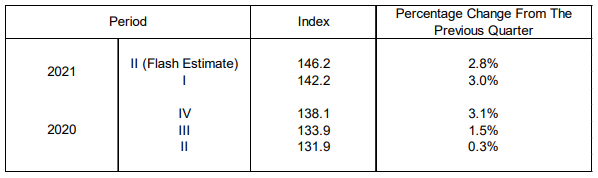

Afterall, resale prices in Q1 this year were just 5 per cent shy of top prices in 2013, according to Housing Development Board data.

Quarter on quarter, resale prices were up by 3 per cent in Q1.

Flash estimates released on July 1, meanwhile, showed Q2 resale prices moderating to a 2.8 per cent rise against the January-to-March quarter, thanks largely to continued robust demand and a supply shortage.

Compared to Q1 2020, the increase in the same period this year has been 8 per cent.

Rise in prices

The upswing in prices has certainly been good news to homeowners given that before the market recovered in the second half of 2019, HDB’s resale price index had logged consecutive years of decline from 2013.

These days, news of buyers willing to pay extra for choice HDB flats have also injected energy into the market.

In Q1 alone, 53 resale flats were sold for at least $1 million each, the highest quarterly number on record, while 825 flats transacted above $700,000. Of the latter, 393 units were sold above S$800,000.

To sell or not to sell

Ohmyhome Super Agent Louis Tay says on average, resale HDB prices have risen by 10 per cent over the year from June 2020.

“Rising prices do bode well for sellers, but as with any market, the benefits to be reaped from a climate of rising prices will vary for everyone,” he said.

For a family thinking about the sale of their home, Louis said that he would want, first of all, to understand the motivation for selling.

“Is it to upgrade to a bigger space to accommodate a growing family? To be nearer to a school, or office, or relatives? These reasons may compel a family to relocate, whatever the performance of the market, even if it means it may be an expensive move,” he said.

For those mulling over the likelihood of profiting from this upswing in prices, however, he cautions that the scenario is unlikely to happen as it will just be a case of “selling high, buying high” from the same market.

“Cash Over Valuation (COV) is also another factor to think about, with some sellers nowadays transacting at higher prices than the value of the flat. This means a buyer must be prepared to fork out even more for resale flats in this climate.”

COV can only be paid in cash, resulting in a higher cash outlay for buyers.

Louis’s verdict? “This sell-and-buy doesn’t benefit everybody, if you ask me.”

Higher resale prices and rising COV did drag on overall resale volume in the January-to-March period, with transactions slightly down by 0.8 per cent to 7,581 units compared to the previous quarter.

Compared to the same period a year ago, sales improved by 28.6 per cent.

Who may benefit from selling now?

“Two profiles of homeowners may benefit from this climate: (1) upgraders who are ready now to buy a private property and (2) those who are collecting their Build-To-Order keys soon and so must sell now.”

Those who have to sell their flats now on account of their BTO flat being ready soon have good fortune on their side given that the property market is doing well, he said.

“As their next flat was bought at a subsidised rate, this group does not have to contend with high open-market prices for their next home. That means whatever gains they may unlock from selling their current flat, they are free to keep, reinvest or use,” Louis said.

Upgraders to affordable private housing may find this an opportune time to move as well.

He said this group could benefit two-fold: they could sell their flat at a higher price and then buy a private property as prices have not risen as much as resale flats.

“Private property prices have gone up too but at a slower pace compared to resale HDB prices. So that means there is room for HDB homeowners who have been considering entering the private housing market to make a move now.

“They need only to do their calculations and see if they have sufficient funds for a private property,” he said.

Looking ahead

Given the Covid 19-related construction delays, Louis says the market expects more Singaporeans to turn to the HDB resale market this year for their housing needs

“Hopefully, some of the demand from those looking for a home will be met by the supply of housing reaching the Minimum Occupation Period (MOP) this year, “ he said.

Data from HDB showed 25,530 flats will reach their five-year MOP in 2021, up from the 24,163 units in 2020. In 2022, the number is poised to rise further to 31,325 units.

“With the number of flats reaching MOP this year, we may see a new record number of million-dollar flat sales,” he added.

Ohmyhome is here to help if you need assistance in your property journey. We also offer renovation services, mortgage solutions and legal conveyancing. Let us make it easy for you!

Call us at 6886 9009 to secure an appointment today.

Frequently asked questions about selling your HDB flat

What is Cash Over Valuation (COV)?

COV is the amount of money buyers have to pay in cash if the sale price exceeds HDB’s home valuation. For example, if the resale flat is valued at $600,000 and the HDB valuation is $550,000, the COV will be $50,000.

What is the Minimum Occupation Period (MOP) for HDB flats?

The MOP is the period of time that a homeowner is required to physically occupy the flat before it can be sold on the open market. It is calculated from the time the keys to the flat are collected and excludes the period when the owners did not occupy the space.

Do resale flats have an MOP too?

Only 1-room resale flats bought from the open market without the CPF Housing Grant have no MOP. Click here for more details.

What about private property?

There is no MOP for private property, but there is Seller Stamp Duty to be paid if the property is sold within the first 3 years of ownership. Click here for more details.