Raising interest rates has been one of the primary mechanisms the US Federal Reserve uses to control inflation.

In simple terms, when interest rates are high, people tend to borrow less and spend less, reducing demand, allowing prices to fall, and thus, countering inflation.

Singapore doesn’t set its own interest rates and instead takes a queue from global interest rates, in particular the US.

So when they increase rates, we also experience a rate hike meant to lower rising inflation.

The interesting thing is that textbooks say that when interest rates rise, we should expect a downturn in the property market.

With it being strongly sensitive to changes in interest rates, when rates go up, it gets more expensive to service your mortgage.

Thus, you may be tempted to sell your investment property and perhaps even choose a smaller home for purchase.

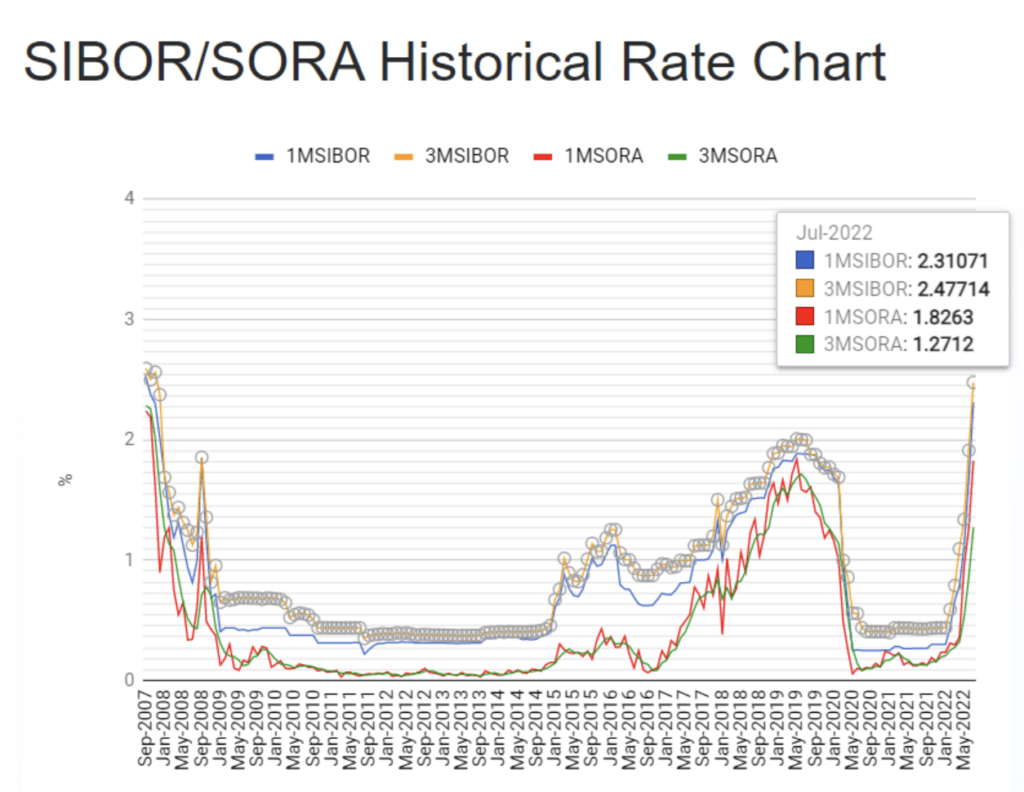

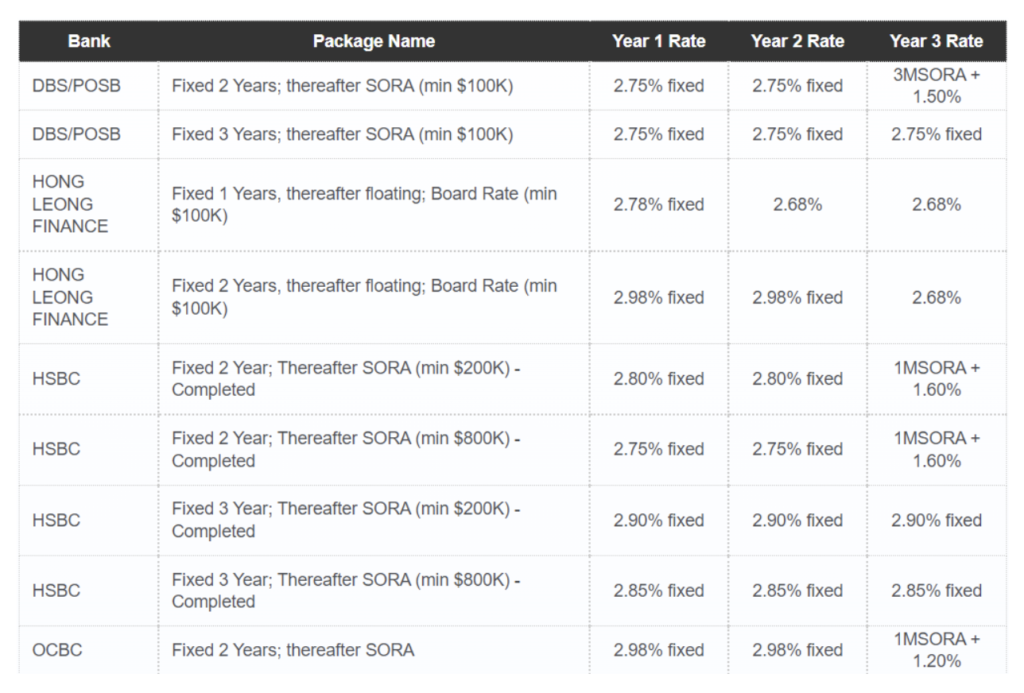

In fact, many bank loan rates are higher than HDB’s loan rate of 2.6% p.a which is a rare phenomenon since the global financial crisis in ‘08.

This then drives prices down as demand falls and supply increases.

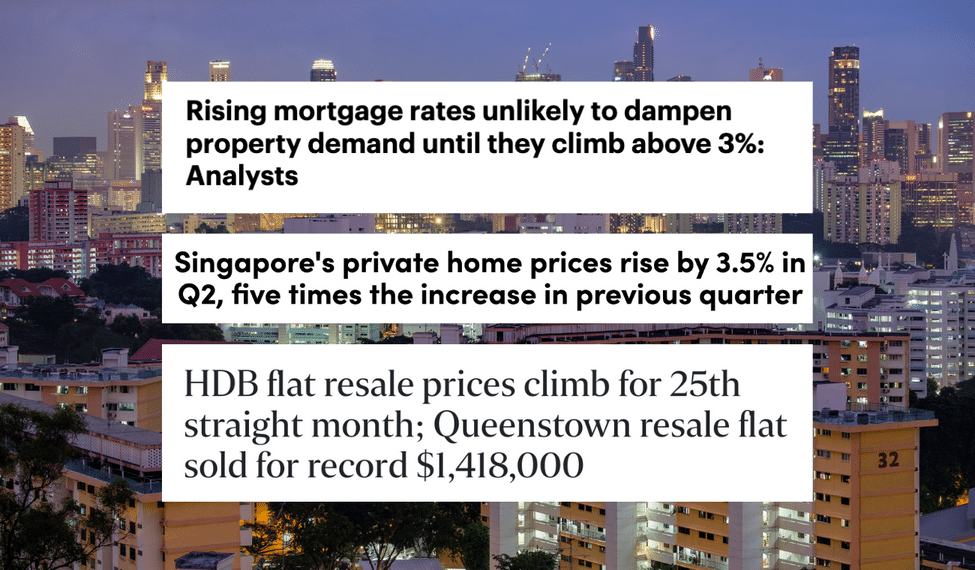

However, if you’ve been paying attention, this hasn’t translated to real world Singapore.

Surprisingly, prices are steadily climbing this whole year with record prices being set almost every other week.

So what gives?

Inflation — and the fact that there’s nothing else to buy.

We always hear that property is usually a great hedge against inflation. Property prices rise with inflation making it a steady growth asset with little chance of losing money.

Typically, if people aren’t buying property, they would be buying other investments.

There’s just no point in keeping cash, as inflation is still higher than the bank’s savings rate or fixed deposit is going to give you.

For instance, Stocks, Bonds, Gold, and now even Cryptocurrencies are alternative options to a property purchase.

But with the downtrend of these assets, everyone’s worried about making future losses on market uncertainty, especially with a looming recession.

The post-pandemic era is making many tread lightly on eggshells and no one wants to take big bets on the future.

Property seems to be the safest option.

As a matter of fact, higher interest rates may seem like just an inconvenience instead of a real detractor in the market.

What can we expect moving forward?

It’s important to realize, that just because property prices rise, it doesn’t mean there’s a sharp fall to come. On the contrary, what’s more likely to happen is a price plateau.

Similarly, for your wages, you get a promotion which bumps up your earnings by 10-25%. But then you’ll be on that new wage for a few more years before the next promotion.

It just happens to be promotion season right now for houses, but we expect things to eventually slow down slightly and eventually taper off at a new normal.

With this in mind, $2000+ psf for new launch properties outside the Central region may just be the new normal, and it might be here to stay.

All things considered, it may be prudent to contact a property agent who can provide a professional opinion on what would be the best property decision you can make.

There could be an opportunity to cash in on the potential market peak before a possible price plateau.

We’d recommend filling up a callback form on our website and booking a consultation with our professional and dedicated agents. We have a strong track record including being recognized as the top 1% of agents by the Council of Estate Agents by transactions and given over 8,000 5-star reviews across all platforms.

Consultation is free of charge and arranged at your convenience. Contact us today and let us help you make the best decision on your biggest and most personal asset, your home.