Whether you’re considering buying an HDB flat or a private property, it’s essential to understand how much you can afford in the first place. Several factors come into play, ranging from your income and existing home loans to all your payable stamp duties and CPF usage. In this article, we’ll walk you through the key considerations that will help you determine the right budget for your next property purchase. (Or to make your life easier, let Homer AI help you.)

#1: Income

It is not advisable to overstretch your finances just for your housing expenses, which is why there are measures in place such as the Mortgage Servicing Ratio (MSR) and Total Debt Servicing Ratio (TDSR) to ensure you have sufficient income to cover your monthly loan repayments and other financial commitments, reducing the risk of financial strain or loan default.

Mortgage Servicing Ratio (MSR)

The MSR refers to your gross monthly income allocated towards repaying all your property loans, including the one you’re applying for. It is currently capped at 30% of your gross monthly income, ensuring that your monthly loan repayment does not exceed 30% of your gross monthly income. This rule applies to housing loans for the purchase of an HDB flat or an executive condominium where the minimum occupation period has not expired.

Total Debt Servicing Ratio (TDSR)

The TDSR represents the maximum proportion of your gross monthly income allocated to repaying all monthly debt obligations. The current TDSR threshold is set as a maximum of 55% of your monthly income, including property-related loans, car loans, student loans, renovation loans, credit card loans, and any other secured or unsecured loans.

Financial institutions use the MSR and TDSR to assess your ability to repay the loan, which plays a crucial role in their loan approval decision.

#2: Loan Tenure

Your loan tenure directly impacts the monthly repayment amount and the total interest you’ll pay over the loan’s life. For example, a 20-year loan tenure will result in higher monthly repayments but lower total interest paid compared to a 30-year loan tenure.

In Singapore, the maximum loan tenure for housing loans from the bank is capped at 30 years for HDB flats and 35 years for non-HDB properties. If you’re taking a HDB loan, the maximum loan tenure is 25 years. Joint borrowers’ income-weighted average age is used to calculate your ability to repay the loan. Therefore, carefully consider your loan tenure, balancing your monthly repayment ability with the total interest cost over the loan’s life.

READ MORE: HDB vs Bank Loan: Which is Better?

#3: Loan-to-Value (LTV) Limit

The LTV limit determines the percentage of the property’s value that you can borrow and is expressed as a percentage of the property’s value. LTV limits vary based on several factors, including the number of outstanding housing loans and the loan tenure.

For HDB flats, the LTV limit can be up to 80% of the flat price for new flats and up to 80% of the lower of the resale flat price and value for resale flats. However, if the remaining lease of the flat does not cover the youngest applicant to the age of 95 and above at the point of flat application, the LTV limit will be pro-rated from 80%.

#4: CPF Usage

For HDB flats, you must utilize your CPF savings to pay for the property and can retain up to $20,000 in your CPF Ordinary Account (OA) per buyer. For private properties, you can use your CPF savings subject to valuation and withdrawal limits.

#5: Downpayment

The downpayment requirement differs for HDB flats and private properties. For HDB flats, if you are taking a housing loan from HDB, the downpayment is 10% of the purchase price, which can be paid using your CPF Ordinary Account (OA) savings or cash. If you are taking a bank loan, the downpayment is 25% of the purchase price, with a minimum of 5% in cash and the remaining 20% can be paid using your CPF OA savings or cash.

For private properties, you are required to make a minimum cash downpayment of at least 5% of the lower of the purchase price or the valuation price of the property at the time of purchase. The remaining downpayment can be paid using your CPF OA savings, subject to the limits set by the Monetary Authority of Singapore (MAS).

#6: Buyer’s Stamp Duty (BSD)

The Buyer’s Stamp Duty (BSD) for both HDB and private properties in Singapore is calculated based on the purchase price or market value of the property, whichever is higher. The rates vary depending on the purchase price, starting at 1% for the first S$180,000 and progressively increasing to 6% for any remaining amount.

Please note that if you are a Singapore Citizen buying your second and subsequent residential property, a Singaporean Permanent Resident (PR) or foreigner, you are liable to pay Additional Buyer’s Stamp Duty (ABSD) on top of the existing BSD.

#7: Additional Buyer’s Stamp Duty (ABSD)

The ABSD rates for residential properties in Singapore vary depending on the buyer’s profile and the number of properties they already own.

Singapore Citizens (SC) buying their first residential property are exempt from ABSD. For the second residential property, the ABSD rate is 20%, and for the third and subsequent properties, it increases to 30%.

Singapore Permanent Residents (SPR) will face a 5% ABSD rate for their first residential property, 30% for the second property, and 35% for any subsequent properties.

Foreigners and entities, such as companies or trusts, face higher ABSD rates. Foreigners need to pay a substantial 60% ABSD for any residential property, while entities are subject to an even higher 65% ABSD.

It’s essential to note that these ABSD rates apply to both HDB flats and private properties. However, HDB requires buyers to dispose of all their private properties within 6 months from the completion date of the HDB resale flats. In this case, the ABSD remission will be given upfront, and you only need to pay ABSD at 5% instead of 30% when you buy the HDB flat.

Foreigners who are nationals or permanent residents of Iceland, Liechtenstein, Norway, Switzerland, or the United States of America are eligible for the same Stamp Duty treatment as Singapore citizens under the respective Free Trade Agreements (FTAs). This means they do not need to pay ABSD on their first property purchase in Singapore. However, if they proceed to buy a second and subsequent residential property, they will be subject to ABSD rates of 20% and 30%, respectively.

Remember, the ABSD is calculated based on the purchase price or market value of the property, whichever is higher.

#8: CPF Housing Grants

CPF Housing Grants are available to eligible buyers of both new and resale flats in Singapore. The type and amount of grant you can receive depends on your eligibility and the type of flat you are purchasing.

For new flats, eligible first-timer applicants can receive the Enhanced CPF Housing Grant (EHG) of up to $80,000. The amount you receive depends on your average monthly household income.

For resale flats, eligible families can receive a housing subsidy of up to $80,000 under the CPF Housing Grant Scheme. In addition, you may also apply for the Enhanced CPF Housing Grant (EHG) and Proximity Housing Grant (PHG) if you meet the respective eligibility conditions. The total amount of grants for resale flats can go up to $160,000, which includes the EHG (up to $80,000), CPF Housing Grant (up to $50,000) and PHG (up to $30,000).

For Executive Condominiums (EC), you may apply for the Family Grant or Half-Housing Grant when booking your EC unit with a property developer. The grant amount varies based on your household income and whether you and your co-applicant are first-timers or second-timers.

Please note that the CPF Housing Grant is fully credited into the CPF Ordinary Accounts of eligible Singapore Citizen applicants and can be used to offset the balance downpayment for the property and subsequent payments towards the purchase price, or to reduce the mortgage loan for the property.

When determining your property budget in Singapore, considering these factors and staying within your financial means is crucial to avoid financial strain.

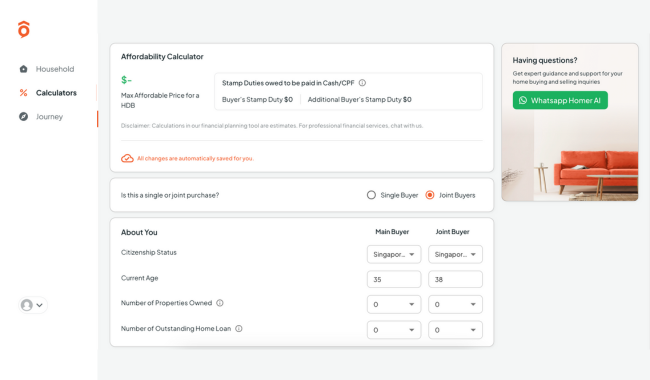

Know your budget and minimum cash needed for your next home

To make a more informed decision about your next HDB or condo, you can use Homer AI’s Affordability Calculator. We’ll let you know how much you can afford for your next home, including the downpayment required and your maximum home loan, in just a few minutes. Try it out for yourself here.

Don’t forget to seek professional advice from a property agent and create a solid financial plan that aligns with your goals and aspirations for your new home before committing to any property purchase. Drop us a message on WhatsApp at any time and we’ll connect you with one of our property agents who specialises in your area.