If you’re a homeowner, chances are that the question “Will my home go en bloc” has crossed your mind before. You might find that this question comes up more often as your condo gets older due to the fact that its chances of appreciating in value may start to diminish.

En bloc, which is defined by a collective sale of two or more property units to a single buyer, can be a way for homeowners to cash out on old properties and start afresh. But en bloc sales can only be carried out when a majority of homeowners within the same estate agree to sell their homes to make way for government authorities or private developers to build new developments. This is one of the ways in which the common good of space is recycled in land-scarce Singapore.

As with any collective decision, attaining absolute consensus is highly unlikely. Whether for sentimental or practical reasons, homeowners grow attached to their homes over the years. En bloc is thus not always welcomed by all, and can only be enacted when a majority consensus has been attained.

The Strata Titles Board determines the threshold of residential approval that must be attained before a block can be considered to have reached ‘majority consensus’. In developments less than 10 years old, 90% of shareholders must have agreed to the collective sale. The criteria for developments over 10 years old are slightly looser, requiring 80% of shareholders to approve of going en bloc.

A short history of en bloc sales in Singapore

En bloc sales are highly anticipated by certain homeowners due to the potential monetary rewards. Homeowners who were lucky enough to cash in on en bloc fevers in 2011 and subsequently between 2017 and 2018 have literally turned into overnight millionaires as they raked in sales of over seven figures in profit.

In fact, en bloc sales in 1Q2018 chalked up the most jaw-dropping sales figures in local property history, with 17 residential en bloc sales totaling at $5.83 billion in value. To understand just how unprecedented these figures were, sales proceeds acquired within two months surpassed 70% of the total en bloc sale deals in 2017.

Several years have passed since en bloc sales peaked in 2018. Since then, cooling measures such as the increased ABSD rates for foreigners announced on Dec 16 2021 have made it harder for homeowners to turn a profit on home sales. While it is unlikely that the local property market will reach the same heights as it did in the previous decade, there are still signs pointing towards a mini comeback for en bloc sales in 2022.

Golden Mile Complex garners 80% en bloc support

The most straightforward way of determining whether en bloc sales will still happen is to check out en bloc sales that have actually occurred. The spotlight recently fell on the iconic Golden Mile Complex on April 23 2022, when it was announced that over 80% of homeowners had consented to an en bloc sale in a mere matter of 15 days.

The consortium of Far East Organization, Perennial Holdings and Sino Land enticed homeowners to move out of their homes to a tune of $700 million. The site, which has a gross floor area of over 81,000 sq m, will provide the group with an option to build a new tower up to 30-storeys tall.

With the Urban Redevelopment Authority (URA) undertaking massive plans to transform Singapore’s architectural landscape in the next decades, older estates similar to Golden Mile Complex are being touted as prime candidates for en bloc sales.

Developers to replenish land banks as sales slump

In addition to renewing older estates, another factor pushing developers towards offering higher premiums for en bloc sales is the fact that many of them might have to replenish their land banks soon.

Presently, the local property market is in a bit of a rut. Both new home sales and private market sales are at all time lows since 2Q2020. Only 1,825 new home units were sold in the most recent quarter of 1Q2022, where sales declined by a sharp 39.5% from the 3,018 units transacted in 4Q2021. Although less drastic, the private resale property market still experienced a sales decline of 28.9% with only 3,377 units sold in 1Q2022 compared to 4,748 units in 4Q2021.

The decline in overall transactions may act as an impetus for developers to outbid one another to get their hands on new land that can be used to generate fresh sales. Developers might even be willing to offer higher-than-usual prices to secure land in time for future developments to be ready for sale alongside URA’s latest developments.

What gives a property en bloc potential?

But what happens if you don’t live in a residential estate like the Golden Mile Complex? How can you determine the likelihood of your neighbours agreeing to an en bloc, or whether developers are keen on buying over the land your home sits on in the first place?

Homeowners who are confident that their estate can go en bloc can gather ground consensus through collective sale bids. However, if they are unable to reach the required threshold of 80% or 90%, then the next collective sales bid can only be raised two years later.

Understanding the factors that maximise your en bloc chances can go a long way in helping you time when to submit a collective sale bid, thereby preventing the golden opportunity of en bloc from passing by your neighbourhood.

1. Age of a property

The older your property, the more likely it is for residents to be willing to part with it. While older estates have their own charm, people are only willing to put up with inconvenience to a certain extent. Once facilities and infrastructure can degrade to a point where it affects day-to-day living (lift malfunctions, rusty water pipes, generally unsanitary conditions), the patience of you and your neighbours can wear thin.

Under such circumstances, most homeowners will be more than willing to trade inconveniences for a major cash out. They can then use it to purchase a brand new home, where they won’t have to experience the same inconveniences they’ve been putting up with for a long time.

As you may expect, it is much easier to attain the required 80% consensus when a property is past 10 years of age. It is far less likely for 90% of residents living in apartments of less than 10 years old to have the desire to move out so quickly.

2. Accessibility to public transport, highways and schools

Location significantly affects property prices in Singapore, and things are no different when it comes to en bloc. Home buyers are willing to pay a premium to stay close to buses, MRTs and highways that will take them to where they need to be faster. Developers know this, which is why they’re often willing to bid slightly higher to secure land at good locations.

Therefore, having good access to transport puts the bargaining chips in your hand, increasing the chances of you and your neighbours attaining significant profit from en bloc sales.

Similarly, having a higher number of prestigious schools within a 1 to 2km radius of your home can greatly increase its en bloc potential, since it adds another selling point for future investors and developers to market.

Of course, there’s also a slight chance that this may work against you, since your neighbours might have grown accustomed to the convenience of living within close proximity of their school, office or places of interest.

3. Future developments

If your home lies within one of the regions slated for major redevelopment by URA, then you’re in luck. The land on which your house is built will probably be highly coveted by developers, who will be looking to put together homes that fall in line with URA’s vision. The plethora of upcoming new facilities that will accompany redevelopment will no doubt drive up sales prices.

Upcoming URA redevelopment projects include:

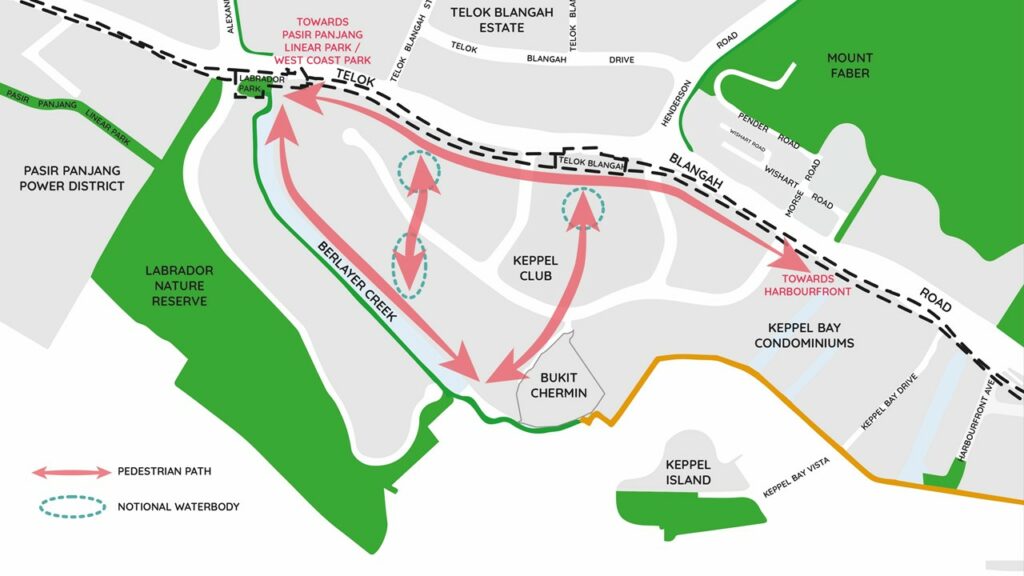

- Greater Southern Waterfront

- Changi Region

- Woodlands Regional Centre

- Punggol Digital District

- Jurong Lake District

4. Gross plot ratio and storey heights

Land is not always fully utilised in housing developments, especially in older condo estates that were built 20 to 30 years ago. Developers may wish to buy land from low density estates, which can fetch significantly lower prices since they house far fewer residents. Taller stacks with higher living density can then be built upon the same land for developers to make significant profit with the newer, excess units.

As a general rule of thumb, the lower your plot ratio and density, the greater your estate’s en bloc potential.

| Plot Ratio | Density | Storeys |

| 1.4 | Low | 5 |

| 1.6 | Medium | 12 |

| 2.1 | Medium High | 24 |

| 2.8 | High | 36 |

| >2.8 | Very High | >36 |

5. Land size

Larger land sizes help, to an extent. Even developers with their multi-million dollar budgets have a ceiling, after all. Homeowners living in the 1,017-unit condo at Mandarin Gardens hit the proverbial ceiling in 2019 when they tried to go en bloc for $2.9 billion, only to be left high and dry.

On the flipside, condos with smaller land sizes pose significantly less investment risk to developers, who will still have reserves left over even if sales do not hit their projected profits. According to a 2021 report by The Business Times, the 100 to 200 unit range tends to be the sweet spot for developers in terms of risk and potential profit.

6. Prices of past neighbouring en bloc sales

Finally, looking at en bloc sales in the immediate vicinity is a good way to determine en bloc potential, as well as the price that your estate may potentially fetch.

Apart from location, properties with similar attributes such as the aforementioned factors (land size, age, plot ratio) are also noteworthy, as they will give you an idea into what developers are willing to pay for.

In one relatively high profile case, homeowners from an estate on Mount Emily Road were able to peg their en bloc sale price to another estate that had gone en bloc 3 months earlier, Fairhaven and Sophia Ville of District 9.

Mount Emily Road had significantly less floor area of just 16,138 sq ft compared to Fairhaven and Sophia Ville’s 23,828 sq ft. However, since Mount Emily Road had the advantage of being a freehold property and Fairhaven and Sophia Ville had no takers for their initial bid, homeowners at Mount Emily Road were able to benchmark off the District 9 estate and ultimately went en bloc for $18 million.

What do you think about the recent en bloc sales and which are you looking forward to? Let us know in our Facebook post.

If you liked this article, we recommend 7 Property Factors That Increase En Bloc Potential Sales. Get market insights like this straight into your inbox! Join our editorial newsletter below. You can also get a free e-valutation for your unit with us!

If you’re looking to buy, sell, rent or lease a property, visit Ohmyhome, Singapore’s one-stop shop property portal. Or reach any of our Super Agents via our hotline, 6886 9009, or our WhatsApp, 9755 1009.