Managing personal finances effectively is a crucial skill that impacts our lives in numerous ways. One key aspect often overlooked is understanding your money personality. By identifying your unique money habits, attitudes, and tendencies, you can gain valuable insights to improve your financial well-being.

What’s your money personality?

To determine your money personality, take a moment for self-reflection. Consider your spending habits, financial goals, and overall approach to money. Use these pointers to guide your assessment:

- Identify recurring patterns: Look for consistent behaviors and tendencies that define your relationship with money.

- Reflect on your financial goals: Assess whether you prioritize short-term pleasures or long-term financial security.

- Examine your decision-making process: Consider how you make financial choices and whether you lean towards caution or risk-taking.

Now, let’s find out which one you are.

Bargain Barbie

You have a passion for exploring new opportunities while also maintaining a strong desire for financial stability. Here are some tips for your journey:

- Strategic Risks: Embrace calculated risks to foster financial growth. Balancing safety nets with growth is essential for a secure future.

- Holistic Planning: Create a personalized budget that balances both present enjoyment and future stability.

- Informed Investments: Protect your hard-earned wealth from inflation by exploring investment opportunities that align with your present and future goals.

Big Spender

As a thrill-seeker, spender, and free spirit, you find joy in both retail therapy and exciting experiences. Consider these tips for a balanced approach:

- Diversified Investments: Minimize risk while ensuring good returns through a diverse investment portfolio.

- Automated Savings: Resist overspending by setting up automatic transfers to a savings or investment account.

- Balanced Budget: Craft a personal budget that caters to both your present joy and future aspirations.

The Daredevil

You fearlessly walk the investment tightrope, embracing market fluctuations as new opportunities. Consider these steps for your financial journey:

- Diversified Investments: Minimize risk while ensuring good returns through a diverse investment portfolio.

- Informed Investments: Protect your hard-earned wealth from inflation by exploring investment opportunities that align with your present and future goals.

- Balanced Budget: Craft a personal budget that caters to both your present joy and future aspirations.

Albert Einstein

Your careful planning and thorough research lay the foundation for your financial stability. To strike a balance between risk and wisdom, here are some steps to strengthen your wealth:

- Embrace Spontaneity: While planning is crucial, don’t forget to welcome the unforeseen and embrace moments of spontaneity.

- Diversified Investments: Minimize risk while ensuring good returns through a diverse investment portfolio.

- Intentional Budgeting: Balance present enjoyment with future security through mindful budgeting.

The Sage

Your instincts lead you to find the right mix of routine and spontaneity. Enhance your financial journey with these strategies:

- Strategic Risks: Embrace calculated risks to foster financial growth. Balancing safety nets with growth is essential for a secure future.

- Automated Savings: Resist overspending by setting up automatic transfers to a savings or investment account.

- Trust Your Intuition: Make decisions based on tangible benefits and adapt flexibly to changing circumstances.

Smooth Operator

You prioritize organizing your goals and priorities to ensure future stability. Consider these tips to further enhance your financial well-being:

- Strategic Risks: Embrace calculated risks to foster financial growth. Balancing safety nets with growth is essential for a secure future.

- Informed Investments: Protect your hard-earned wealth from inflation by exploring investment opportunities that align with your present and future goals.

- Embrace Spontaneity: While planning is crucial, don’t forget to welcome the unforeseen and embrace moments of spontaneity.

How to navigate financial discussions with different money personalities

Money can often be a sensitive topic within relationships, especially when partners have different money personalities. To ensure effective communication and decision-making, consider the following tips and techniques:

1. Foster open and honest communication

- Create a safe and non-judgmental space to discuss financial matters.

- Practice active listening and empathy to understand each other’s perspectives without criticism.

- Schedule regular money talks to address concerns, set goals, and make joint financial decisions.

2. Find common ground

- Identify shared financial goals and values to establish a foundation for compromise.

- Focus on common objectives, such as saving for a dream vacation or buying a house.

- Emphasize the importance of teamwork and finding solutions that benefit both partners.

3. Seek understanding

- Educate yourselves about each other’s money personalities to gain insight into your partner’s financial behavior.

- Discuss the strengths and weaknesses of each money personality type to foster empathy and understanding.

- Recognize that differences in money personalities can complement each other and contribute to a balanced approach.

4. Establish boundaries and compromise

- Set clear boundaries for individual spending and joint financial decisions.

- Create a system for managing finances that respects each partner’s money personality, such as allocating certain amounts for discretionary spending.

- Find compromises that align with both partners’ needs, values, and financial goals.

5. Collaborate on financial planning

- Involve both partners in financial planning discussions, including budgeting, savings, and investments.

- Consider seeking professional advice from a financial advisor or couples therapist to facilitate healthy discussions and decision-making.

- Explore financial management tools and apps that can help track expenses, set goals, and monitor progress together.

6. Celebrate milestones together

- Acknowledge and celebrate financial milestones achieved as a couple.

- Recognize the efforts made by both partners towards shared financial goals.

- Use positive reinforcement to encourage continued collaboration and growth.

In summary

Approach personal finance with continual self-reflection, adaptability, and a dedication to ongoing learning. With a solid understanding of your money personality and proactive financial management, build a strong foundation for a prosperous future. With a partner, recognising your tendencies, finding common ground, and setting clear boundaries can navigate financial decisions together. It’s an ongoing journey that requires open communication, compromise, and a commitment to shared goals.

Are you financially ready to buy or sell a home?

Everyone’s situation is different, so the answer to this varies. To find out whether it IS a good time for you to start a property journey, drop us a message on WhatsApp to reach any of our Super Agents. They’ll assist you with a financial calculation for you to figure out how much you can get when you sell your home and what you’ll need for your next home purchase.

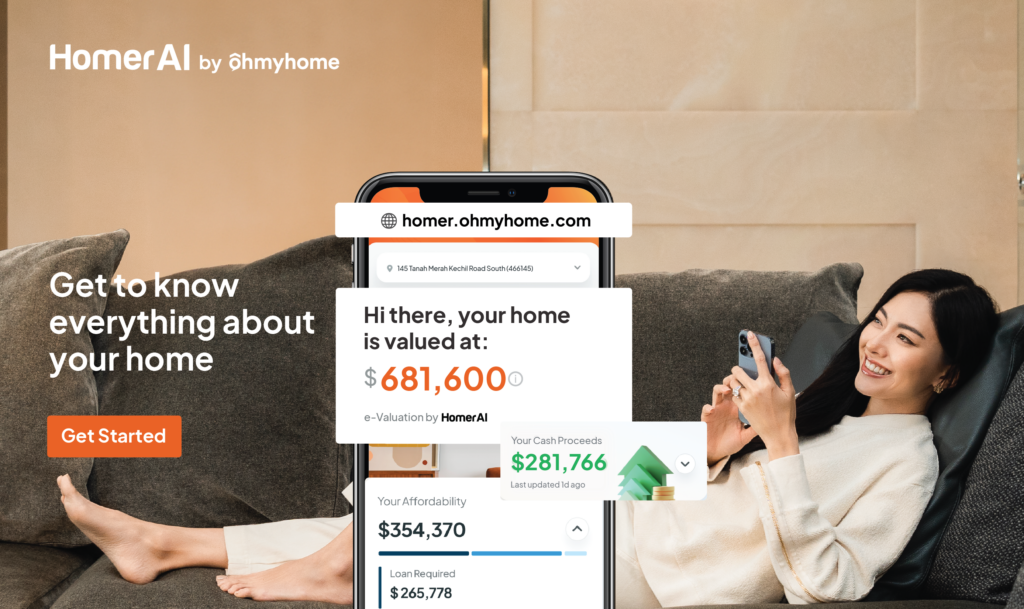

Or ask Homer AI!

Get answers to all your property questions in real time.

This post was originally published on PlannerBee.