If you’re choosing between an executive condo (EC) and a “regular” condo for your new home purchase, you should understand there are a lot more differences between these two properties than just their name.

EC vs Condo: What’s the difference?

| Executive Condo (EC) | Condo | |

| Price | $$ | $$$ |

| Lease | 99 years | 99 years or freehold |

| Public or Private | Considered private after 10 years | Private |

| Minimum Occupancy Period (MOP) | 5 years | None |

| Income Ceiling | $16,000 | None |

| CPF Housing Grants | Eligible (Only for first-timers) | Not eligible |

| Mortgage | Bank loan only MSR & TDSR apply | Bank loan only TDSR applies |

| Who Can Buy | Must be eligible for HDB’s EC schemes: Public Scheme, Fiancé/Fiancée Scheme, or Orphans Scheme At least 21 years old (widowed or orphaned) or 35 (unmarried or divorced) Does not own any other property locally or overseas and haven’t disposed of any within the last 30 months Have not previously bought a new HDB/DBSS flat OR received any CPF Housing Grants OR have only bought one of those properties and only received one CPF Housing Grant previously | Anyone |

As you can tell from the table above, there are a few hoops for you to jump through when buying an EC, just from the eligibility criteria alone. With a condo, there are fewer barriers to entry, but they are more costly. Which one should you buy?

Executive condo: Best for the “sandwich class”, eventually becomes private

Pros & cons when buying an EC

| Pros | Cons |

| 25%-35% cheaper than private condos | Income ceiling of $16,000 |

| Eligible for CPF housing grants | Must qualify under one of the HDB eligibility schemes |

| Has a similar design and facilities to a private condo | Not eligible for an HDB loan, so you must pay at least a 25% down payment in cash/CPF |

| Considered private after 10 years | 5-year MOP still applies |

ECs are more affordable, but less central

One key factor to note is that ECs are up to 35% cheaper than condos, but they’re usually in the more “ulu” parts of Singapore. So you need to decide on what you’re willing to compromise — price (which can affect your affordability) or location (which can affect your connectivity to your kids’ schools, your office, and/or other amenities). If you have a car, this shouldn’t be a problem.

Buying an EC is your best option to get a new home

If your combined household income ranges from $14,001 to $15,999, the only way you can get your hands on a newly built home is to get an EC. (New launch condos will be more expensive, and so will resale condos.)

The income ceiling for BTO flats is currently $14,000 and $16,000 for an EC.

Of course, you still have resale HDB flats as an option. But some 4- and 5-room HDB resale flats, especially those in prime areas, can get really pricey too.

Compared to condos, an EC is usually priced lower and it comes with the usual condo facilities you can expect, such as swimming pools and gyms.

You will be eligible for CPF housing grants too

Another key factor to note is that ECs are considered HDB flats in their first 10 years, which means all of the benefits of getting a flat come with it too. This means you will be eligible for CPF housing grants — assuming your income hits the eligibility criteria that allow you to afford an EC.

If you’re a Singapore citizen buying an EC for the first time with your spouse and your combined income falls below $12,000, you can get between $10,000 to $30,000 worth of CPF housing grants.

The reselling rules change when ECs become private after 10 years

From their 6th to 10th years, ECs are sold like regular resale flats, which means only Singaporeans and Permanent Residents (PRs) can buy them. That said, they will already not qualify for CPF housing grants as only “direct” buyers purchasing from HDB can get grants.

In the 11th year, ECs go “fully private”, so they can be sold to foreigners and companies, which greatly expands your range of prospective buyers.

But you’ll have to arrange for your own bank loan

Whether it’s better to take out an HDB loan or a bank loan is debatable, especially if you actually care about how much interest you’ll be paying. However, there is no such option with ECs.

The thing about bank loans is that while you might enjoy lower initial interest rates, you have to fork out more for the downpayment and/or cash/CPF portion, since you can only borrow a maximum of 75% as opposed to 90% for HDB loans.

So aside from an above-average income, you really do need to have quite a bit of cash/CPF savings to cough up the downpayment.

Note that 75% is the theoretical maximum, but if you already have other loans like car loans and whatnot, you might not even be allowed to borrow that much due to the Total Debt Servicing Ratio (TSDR).

Don’t forget about the 5-year MOP

Do note that ECs are subject to an MOP as well. Although you are allowed to rent out one or two rooms of your EC, you are not allowed to rent or sell the entire property for the first 5 years.

Condo: The “ideal” option, but only if you can realistically afford it

| Pros | Cons |

| No income ceiling | More expensive than an EC |

| No 5-year MOP, can rent and sell at any time | Not eligible for CPF housing grants |

| Anyone can buy, no restrictions on owning multiple properties | Not eligible for an HDB loan, so you must pay at least a 25% down payment in cash/CPF |

Out of both apartment types, condos are the most exclusive which is why it will suit those who care about status and identity. It comes with the downside of having to finance it almost all by yourself.

No MOP and no restrictions on owning multiple properties

To buy a condo, all you really need is money: Unlike ECs, condos are not subject to the 5-year MOP rule. You won’t have to sell your other existing properties to buy it either. More details on homeownership restrictions for ECs

You have more options for location and lease tenure

There are 2 main differences between ECs and condos.

Firstly, condos can have a 99-year or 999-year lease, or even freehold, while all ECs have a 99-year lease. With a longer lease, you can live in your condo long-term or pass it down to your children when they have their own family in the future.

Secondly, ECs are usually located at remote locations that are not near any MRT stations or bus stops. Condos, on the other hand, can be located anywhere. Naturally, the price will be higher if it is located in a more mature location like the central area. The more prime the location, the higher you’re going to have to pay.

However, you can only get a bank loan

As condos are not developed and sold by HDB, you will not be able to use a HDB loan to finance your property purchase.

The LTV is 25% cash/CPF and 75% loan, and you have to pay at least 5% in cold, hard cash. That’s a huge sum considering condos these days often cost above $1 million, so this isn’t to be taken lightly.

Banks are also known to be a lot less lenient than HDB, so don’t expect any mercy if you run into any unexpected financial issues and have problems with repayment.

There are no CPF housing grants available when you buy a condo

As expected, private housing purchases are not eligible for any housing subsidies. So, you really need to plan your finances carefully and know how much you can afford for your next home before you make a decision on which property to buy: an EC or a condo.

Should you even sell your home now?

Everyone’s situation is different, so the answer to this varies. To find out whether it IS a good time for you to start a property journey, drop us a message on WhatsApp to reach any of our Super Agents.

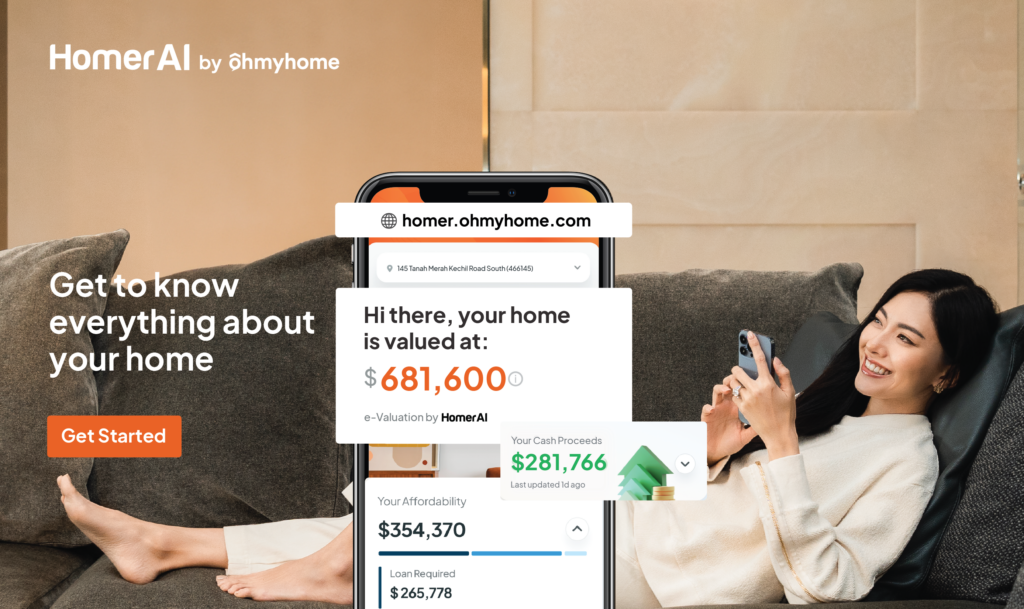

To get an idea of your potential selling price, you can also check how much your home is valued with Homer AI. You’ll also be able to find your estimated cash proceeds and affordability for your next home.

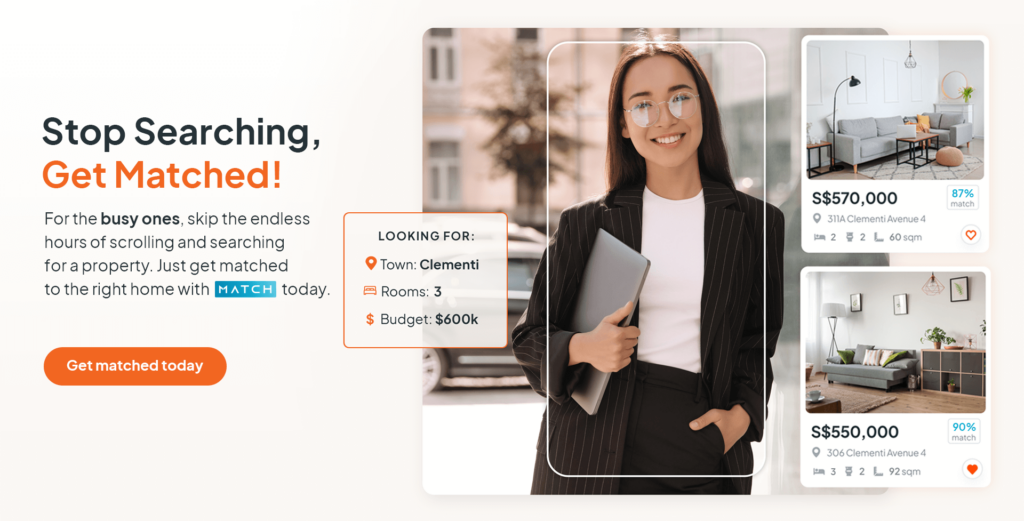

Find your dream home, without the hassle

Let Ohmyhome’s smart data-matching technology MATCH you with the right home, according to your specific needs. Submit your preferences to us and our algorithm will filter all our available listings based on those, and we’ll WhatsApp them to you once we find a match. We’ll also send you relevant content that you can use for your research and inform your home buying decision, so you no longer have to spend hours searching online for the information that you need.

This post was originally published on MoneySmart.