Follow this guide to maximise your profit when you sell your HDB resale flat in 2024. Make sure it has reached its MOP of 5 or 10 years before you start Step 1.

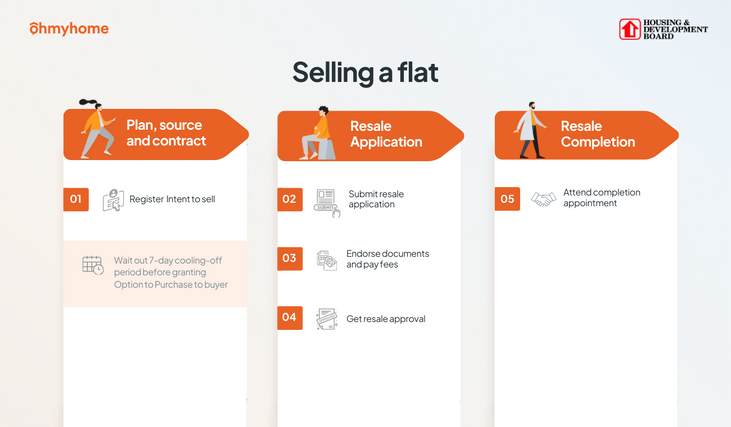

Here’s the full HDB selling procedure in 2024

Jump to each step.

- Step 1: Register Intent to Sell

- Step 2: Calculate HDB sale proceeds

- Step 3: Post your HDB resale flat for sale

- Step 4: Arrange viewings and conduct negotiations

- Step 5: Grant Option to Purchase (OTP) to HDB buyer

- Step 6: Discuss Temporary Extension of Stay with HDB buyer

- Step 7: Buyer will exercise the OTP and pay the Option fee

- Step 8: Submit HDB resale application

- Step 9: Contact a conveyancing lawyer

- Step 10: Endorse HDB resale documents

- Step 11: Pay legal fees and other HDB resale costs

- Step 12: Receive HDB approval letter

- Step 13: Prepare for the Resale Completion Appointment

- Step 14: Attend Resale Completion Appointment

- And you’re all done! Congratulations on selling your home!

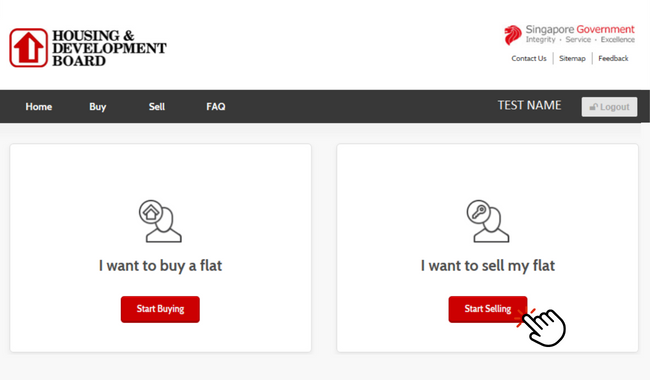

Step 1: Register Intent to Sell

To get the ball rolling, you have to register your Intent to Sell. To do that, you need to:

- Go to the HDB resale portal

- Click “I am a Buyer or Seller”

- Proceed to log in with your Singpass

Upon registration, you’ll receive:

- An instant assessment of your eligibility to sell

- The Ethnic Integration Policy/ Singapore Permanent Resident (EIP/ SPR) Quota for your block

- The status of upgrading and billing of upgrading costs

- Recent transacted prices of nearby HDB flats

IMPORTANT: Your HDB Intent to Sell is valid for only 12 months (1 year), so you need to submit the HDB resale application within that time. Otherwise, you’ll have to submit another application.

Step 2: Calculate HDB sale proceeds

While HDB resale prices have been rising, it does not guarantee you’ll sell at the same high prices. It’s best to be realistic about these things, and there’s no better way to do that than figuring out the math. You can follow the full, detailed calculation of your HDB sale proceeds here.

Or you could use our HDB Resale Cash Proceeds Calculator

Financial calculations can get quite technical, and we understand that not everyone has the time to do them as well. So we created a HDB Resale Cash Proceeds Calculator that automatically computes how much cash you can keep after you sell your home.

All you have to do is input your outstanding loan, CPF refund and accrued interest, and resale levy (if any) — we’ll factor in the agent fee, HDB admin fee, and legal fees — and you’ll get your estimated net cash proceeds.

Step 3: Post your HDB resale flat for sale

Now that you’ve registered your Intent to Sell with HDB, have gotten an estimation of your eligibility, and know pretty much how much to expect at the end of your sale, it’s time to put your HDB resale flat in the market.

When posting your listing, you’ll have to include photos of your flat, so make sure you’ve cleaned up, fluffed your pillows, removed any personal paraphernalia, or done any of these home-staging tips that can potentially drive a bidding war for your listing.

We’ve also created a handy guide that you can follow to take listing photos like a pro. The better your listing photo, the more buyers will click on your listing and enquire about it.

How to post your HDB resale flat for sale without a property agent

You can download the Ohmyhome app on Google Play or App Store, where you will find hundreds of ready buyers that you can chat with directly. You’ll find their requirements posted as a ‘ShoutOut’, which will include details such as their preferred home size, location and budget. If your home matches what they’ve posted, you can suggest your listing to them and start a chat immediately. So make sure you’ve got your notifications on for our app; you won’t want to miss a serious offer.

How to post your HDB resale flat for sale with a property agent

Well, you won’t have to because we’ll do it for you. When you engage an Ohmyhome property agent, the listing and advertising of your HDB resale flat will be done by us. We’ll post your listing on all the top property platforms in Singapore, and we’ll also handle all the offers on your behalf.

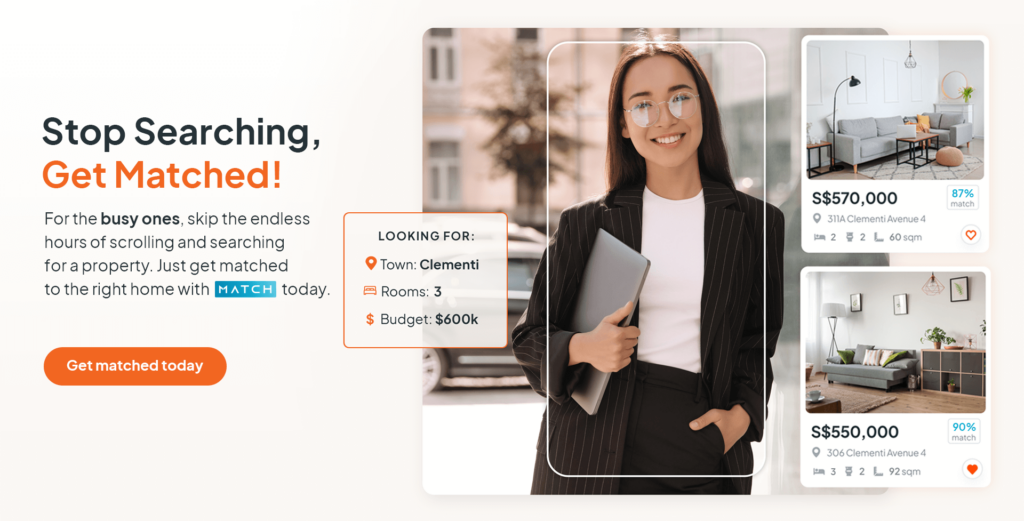

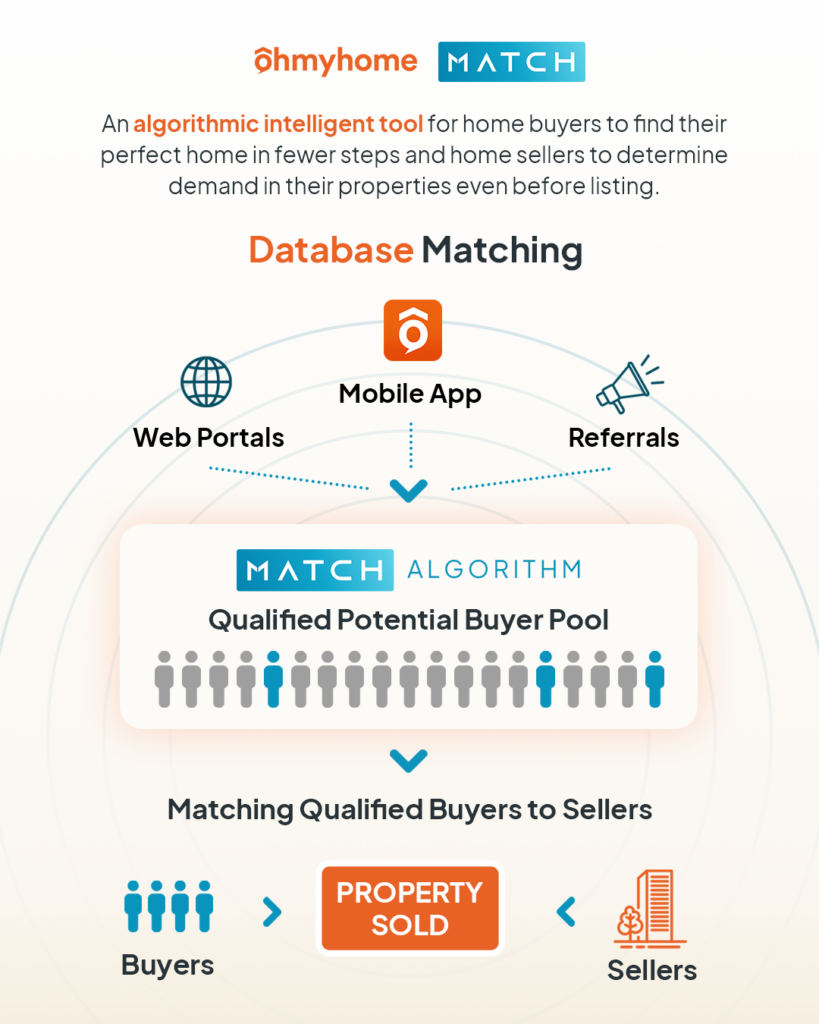

We’ll be matching you with buyers on our side as well. Our data-matching technology will automatically suggest your listing to our internal database of buyers on WhatsApp so they can make an offer.

Step 4: Arrange viewings and conduct negotiations

Remember what we said about keeping your Ohmyhome app notifications turned on? Well, that’s to make sure that you catch any offers from serious buyers or requests to view your property.

With an Ohmyhome property agent, once all the offers have come in, he/she will arrange all the viewings — after checking in with you on your schedule and availability. Here’s a secret tactic our agents use to generate hype and demand for your listing: Scheduling all your viewings in one day, instead of spreading it out over the week or multiple weekends.

Doing so creates a case of FOMO amongst buyers coming and going as they will see other potential bidders also viewing your property, giving the impression that they have to outbid the rest to secure your HDB flat. So at the end of the day, you may have a bubbling pot of demand just ready to explode with offers higher than the flat valuation.

With all those offers for your flat, you’ll once again need a professional to negotiate the price and drive it upwards so you can meet your goals — or exceed them. Our property agents will conduct the price negotiations on your behalf, so you don’t have to worry about that.

Before granting the Option to Purchase (OTP) to your buyer, remember these 3 things

- You need to complete the Intent to Sell at least 7 days before granting the Option to Purchase (OTP).

- The buyer will need to have a valid HDB Flat Eligibility (HFE) letter before you can grant the OTP.

- If the buyer intends to get a bank loan, he/she must have a Letter of Offer before he/she can exercise the OTP.

Step 5: Grant Option to Purchase (OTP) to HDB buyer

Upon registering your Intent to Sell, you will have a 7-day cooling period before you’re allowed to grant the OTP. You can download a copy of the HDB-prescribed OTP form on the HDB resale portal.

Remember: Once you have issued an OTP to a buyer, you will not be able to accept any other offers for about 21 days. (This is the same amount of time a buyer has to exercise the OTP. More on this below.)

Also, signing the OTP means that you have officially accepted the offer from the buyer to purchase your flat. So make sure you’re satisfied with the deal before signing anything.

After granting the OTP, you may collect an Option fee ranging from $1-$1,000 from the buyer. (The market norm these days is $1,000. The Option fee is non-refundable should the buyer not go through with buying your HDB resale flat.)

Step 6: Discuss Temporary Extension of Stay with HDB buyer

If you’re unable to move out of your home by the completion date, you can submit your request for a Temporary Extension of Stay along with your HDB resale application. (The buyer will have to state their consent when they submit their own resale application.)

Basically, this is a private agreement between you and the buyer that allows you to stay for up to 3 months in your flat after the resale completion.

Your Ohmyhome property agent will have a templated form ready for you and the buyers to sign. But if you’re transacting your HDB resale flat on your own, we can help you with just the documentation of your HDB resale transaction. So you can save on agent fees, and you won’t have to be stressed about the paperwork. More on Ohmyhome’s documentation services here.

Step 7: Buyer will exercise the OTP and pay the Option fee

When you’ve agreed on a price with the buyer, and have discussed the terms of the Temporary Extension of Stay (if necessary), the buyer can now exercise the OTP and send you the payment for the exercise fee. This, together with the Option fee, will form the deposit, which cannot exceed $5,000. For example, if the buyer paid $1,000 for the Option fee, the exercise fee should be less than $4,000.

Again, the OTP is only valid for 21 days and must be exercised within that period. Buyers have up to 4 p.m. on the 21st day (weekends and public holidays included) after the date of OTP issuance to exercise the OTP.

What if the OTP is cancelled?

However, should the buyer not wish to proceed with the purchase, the OTP will lapse and expire. You can then restart the viewing process with other prospects.

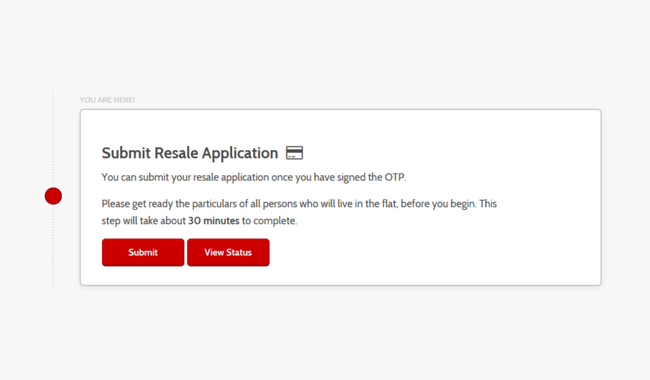

Step 8: Submit HDB resale application

Whew! You’re finally on the last leg of the HDB selling process. At this stage, you and the buyer may complete the resale application on the HDB resale portal. But here’s the thing: You and the buyer have to submit it separately and within 7 days of each other. So you’ll have to agree to a timeframe with the buyer in order to execute this.

Here’s a list of details you’ll need to provide when filling up the HDB resale application form:

- Resale flat address

- OTP details

- Soft copy of OTP

- Your personal particulars

To submit your HDB resale application, you’ll have to pay an administrative fee: It’s $40 for 1- and 2-room flats, and $80 for 3-room and bigger flats.

You can check the status of your application on the HDB resale portal.

Step 9: Contact a conveyancing lawyer

Conveyancing basically means transferring the title of your property to another person, and it usually involves:

- Checking if there are no outstanding mortgages or legal claims against the HDB resale flat to ensure that it’s eligible for transfer of ownership.

- Negotiating and finalising the terms of the sale, like the terms of the OTP.

- Arranging for the transfer of ownership to be registered with the relevant authority, which may involve paying for the stamp duty or other fees.

You will also need to engage a conveyancing lawyer if you have an existing bank loan, so you can refinance your existing loan.

Now, there are 2 ways you can get a conveyancing lawyer:

- Engage HDB’s legal services. You can go to the Legal Fees Enquiry Facility to get an estimate of the legal fees you’ll have to pay.

- Consider our legal services if you’re looking for your own conveyancing lawyer. Find out more about Ohmyhome’s legal conveyancing service here.

Step 10: Endorse HDB resale documents

You will receive an SMS from HDB within 10 working days informing you when you can accept the terms and conditions for all the documents prepared for you through the HDB resale portal. You’ll have to endorse all the HDB resale documents within 6 days of receiving the SMS. Once it’s been endorsed, you will receive an in-principle approval for your HDB resale flat.

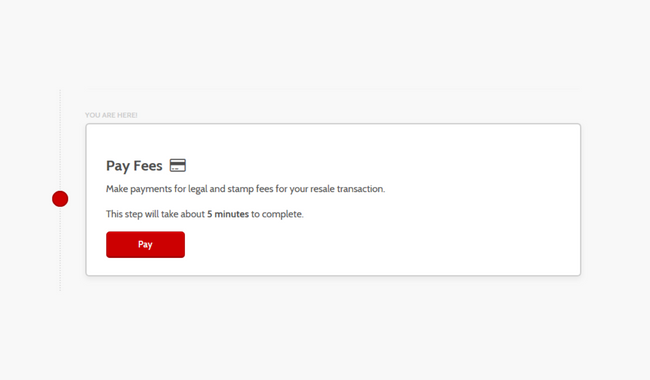

Step 11: Pay legal fees and other HDB resale costs

You’re getting close to the finish line!

With the paperwork out of the way, it’s time to make some payments. If you engaged HDB’s legal services, you can get an estimate of the cost on HDB’s Legal Fees Enquiry Facility. But if you engaged your own solicitor from a law firm, they will advise you on the payable fees.

If you engaged Ohmyhome for legal conveyancing, fees start at $1,800 nett for the following services:

- Sale & Purchase

- Mortgage & Real Estate Planning

- Retail & Corporate Real eSTATE

- Lasting Power of Attorney

- Letters of Administration

- Letter of Probate

- Notary Public

- Wills

Also, there’s a $40-80 administrative fee for the submission of your HDB resale transaction:

- $40 for 1- and 2-room flats

- $80 for 3-room and bigger flats.

The HDB flat inspection may also happen at this stage

Technical Executives from an HDB branch will come down to inspect your flat for any structural damages and unauthorised modifications. This is to ensure that your apartment does not compromise the integrity of the entire building or the safety of the new flat owners, which means if they spot anything, you won’t be able to complete the HDB resale transaction until the flat’s original state has been restored.

Should you be out of the country and unable to attend this inspection, you can have another person attend on your behalf for this, if you have a Power of Attorney.

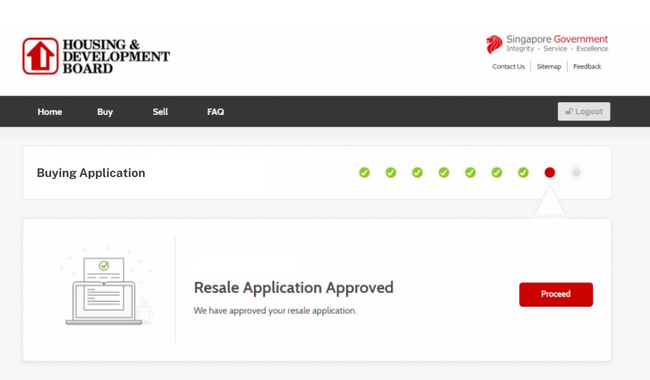

Step 12: Receive HDB approval letter

Hurrah! You’re 3 steps away from the finish line! After the inspection, you can expect to receive an SMS or email to notify you that HDB’s approval letter has been posted on the HDB resale portal. This is a good sign, and means that your transaction is well and truly underway.

Your HDB appointment will take place 8 weeks from the date of HDB’s acceptance of the resale application, if the necessary documents are submitted accurately and on time.

Step 13: Prepare for the Resale Completion Appointment

Ok, last few steps!

To prepare for your HDB resale completion appointment, you’ll need to:

- Fix any unauthorised renovation work.

- Terminate any automated GIRO payments and settle any outstanding payments such as property tax (payable up to the end of the year) or service and conservancy charges (payable up to the day of the resale completion).

- Prepare to vacate your flat before the date of completion so the buyer can move in on time. After vacating, ensure that you’re ready to handover the keys to the buyer during the completion appointment.

Step 14: Attend Resale Completion Appointment

This is the last thing you’ll have to do to complete your HDB selling process! You’ll have to attend the HDB resale Completion Appointment at HDB Hub to witness the following:

- Signing of the transfer document of the resale flat

- Signing of the mortgage document/agreement (only applicable for HDB loans)

- Handover of keys (if the buyer opted for a bank loan, the bank’s lawyer can be authorised to collect the keys on the buyer’s behalf).

You will receive your net sale proceeds at this point. HDB will refund any CPF monies to your CPF account within 10-14 working days from the date of the completion appointment.

But take note that the HDB resale application will be cancelled if any of these occur:

- You or the buyer do not go through the sale or purchase of the flat for any reason whatsoever.

- You or the buyer withdraw your application by giving notice in writing to HDB.

- You do not have sufficient CPF savings or cash to finance the purchase of the resale flat.

- The information given in the resale application by you or the buyer is incorrect or any information has been omitted by either party.

- You or the buyer are not eligible to retain the resale application under HDB’s policies.

And you’re all done! Congratulations on selling your home!

If you’ve made it this far, you deserve a medal. As you now know, the time it takes to sell an HDB depends on a huge variety of factors, some within the seller’s control, others not so much. But you can still maximise your chances of having a successful resale by having all your documents and preparations in order before each step. And of course, with an experienced property agent by your side, you can let go all of your worries and let them take care of everything.

Let us assist you to sell your HDB resale flat in 2024

That’s something Ohmyhome can guarantee for you. Our Super Agents are among the Top 1% in Singapore, helping more than 8,000 happy customers with their property transaction journey. This has resulted in 5-star ratings on both Facebook and Google, so you can check those out if you’re still not convinced yet.

Drop us a message on WhatsApp to book an appointment with our agents, or chat with us on our Live Chat at the bottom, right-hand corner of the screen.

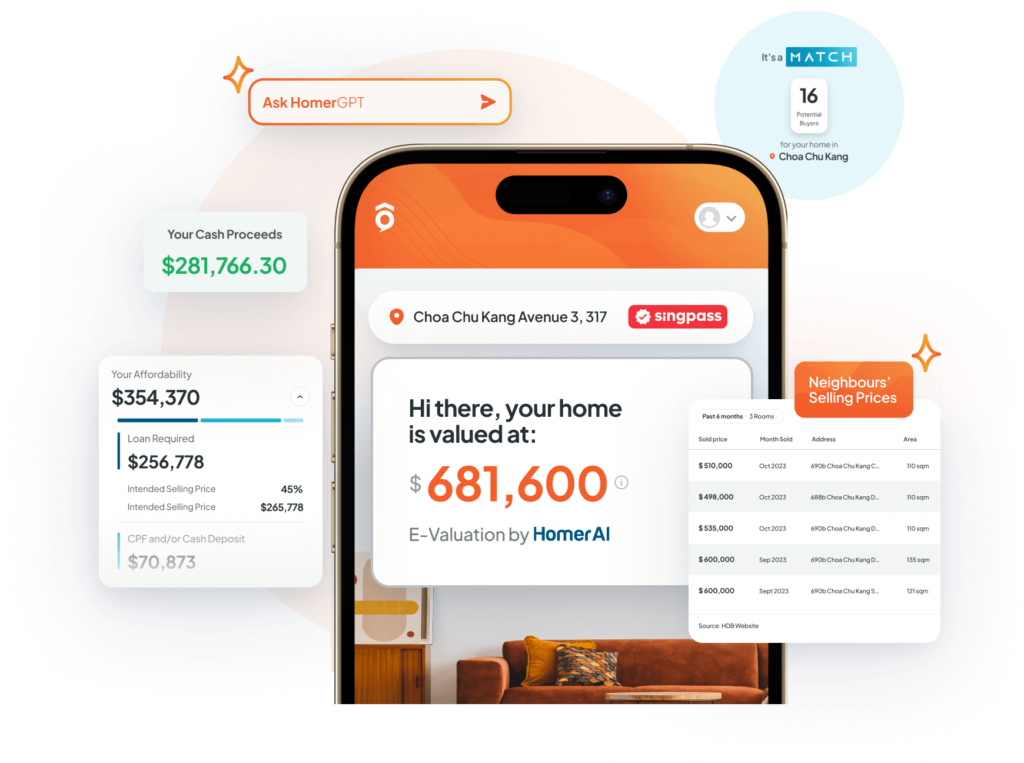

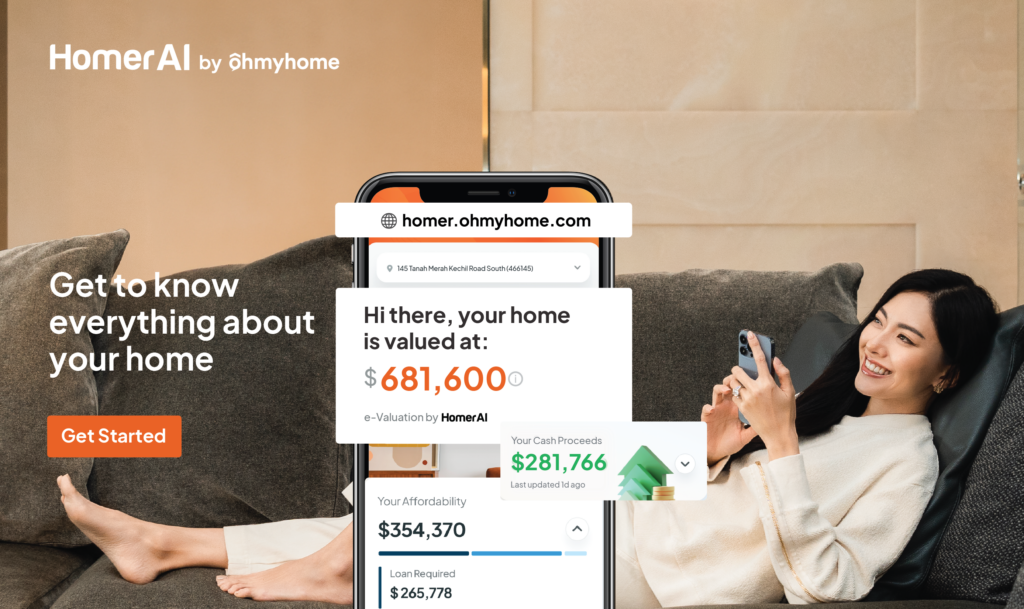

Not ready to speak to a property agent? Stay updated on your property valuation, latest transaction prices, and cash status with Homer AI!

Homer AI is our home ownership management & e-Valuation tool that will provide an accurate estimation of your home valuation that’s updated every month, so you can track if it increased, stayed the same, or decreased.

With Homer AI, you can also know:

- What your home is worth based on the recent transactions in your area

- How much cash you get to keep after selling

- If you have enough to buy your next home

While the Information is considered to be true and correct at the date of publication, changes in circumstances after the time of publication may impact on the accuracy of the Information. The Information may change without notice and Ohmyhome is not in any way liable for the accuracy of any information printed and stored or in any way interpreted and used by a user.