Location is often touted as the most important factor when it comes to buying a property. But it’s equally important to consider when you buy. Specifically, getting in early on a non-mature estate with bright plans for upcoming development can lead to some of your highest returns on investment.

These neighbourhoods aren’t typically understand as the “best” locations Singapore has to offer but many are primed for huge development opportunities, and equally profitable opportunities after such development occurs. Buying in such an area may seem like a risk, but the payoff can be substantial.

But how do you ensure you’re investing in the right non-mature/developing estate? And how much potential profit are we talking about?

What Counts as a Non-Mature Estate or Development?

Age used to be considered a factor in differentiating between mature and non-mature estates. According to a statement made by National Development Minister Desmond Lee on Nov 20, “…as non-mature estates age, the distinction between mature and non-mature estates becomes less relevant.”

To keep pace with the times, the classifications has since been reviewed by the Ministry of National Development (MND) who’ve responded to a question by a member of the parliament on the classifications of public housing as mature or non-mature:

“Non-mature towns and estates refer to those where there is more land available for public housing, whereas mature towns and estates are usually those with limited land for public housing development.”

Areas considered to be mature would be areas like Clementi, Bishan, Ang Mo Kio, Bukit Merah, Central and Toa Payoh. While non-mature area examples would be Bukit Batok, Punggol, Sembawang, Bukit Panjang, Hougang and Woodlands.

How to Identify the Right Non-Mature Estate

1) Research Upcoming Developments Nearby

In today’s times, the concept of a “mature” estate is losing its traditional value.

One such example is Jurong East. Despite being classified as a non-mature estate, it has undergone a dramatic transformation into a thriving retail hub and a secondary Central Business District.

Even once-perceived “ulu” estates such as Yishun are now seeing a rejuvenation with the opening of malls like Junction 9 and Northpoint City back in 2018.

And with the Land Transport Authority (LTA)’s plan to double the size and scope of the Mass Rapid Transit (MRT) network, high accessibility will very soon no longer be a privilege limited to mature estates.

Aside from malls and transport infrastructure, one can also look at other essential amenities such as schools. Take the recent example of Tengah, with the relocation of the ACS (Primary) to Tengah expected to drive significant growth in the region’s property prices.

Homes located near popular schools often command a higher price in Singapore with schools prioritising admission by students who live nearby.

Resale prices for condos within 1km of the school located in District 11 are priced at S$2,116 per square foot (psf), this is a price that’s 18% higher than the median resale price in the area, which hovers at S$1,791 (psf) in 2022.

Moreover, the government’s commitment to enhancing the liveability of non-mature estates is evident through the URA Master Plan 2019, which aims to develop local hubs and business districts.

As the line between mature and non-mature estates continues to blur, savvy first-time homeowners and investors can capitalize on the rising potential of non-mature estates as a possible option with far more potential for growth than mature estates.

2) Identifying Your Potential for Profit

After you’ve shortlisted your options to a select few areas with promising upcoming developments. Your next step will be to look at the financial side of things along with the current economic climate.

This is an essential step to take in order to ensure you’re actually maximising your potential for profit and a generous price appreciation. It is still very possible to make a loss even if you aren’t careful of the numbers surrounding your investment.

In this step, there are 3 things to consider:

a) Rarity of Units

b) Entry Prices

c) Market Trends

Rarity of Units

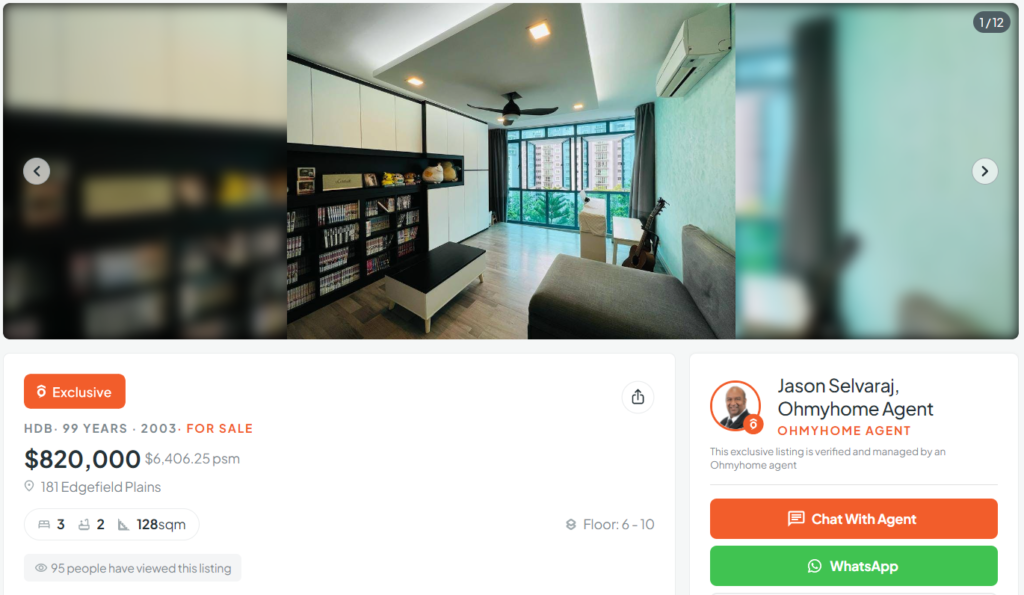

The type of unit that one chooses to invest in can have a significant impact on the potential return on investment. In Singapore’s real estate market, units like Executive Apartments, Executive Maisonettes, and lofts are a rare find, and their high demand makes them especially attractive in the resale market.

And since units in the non-mature estates generally have more space and are cheaper, a bigger unit can cost as much as a smaller unit in the mature estate. So if you have the budget for it, it may be a wise decision to add a layer of scarcity onto your purchase.

Another thing to consider would be choosing a unit on a higher floor. Firstly, they provide better views and natural light and are often more private and quieter, making them more appealing to tenants and potential buyers. These factors can translate into higher rental yields and resale values, making high-floor units a desirable option for investors seeking a profitable investment opportunity.

Entry Prices

When considering a property investment decision, the entry price is a critical factor that should not be overlooked. As property values increase over time, investors who enter at a lower price point will benefit from a larger percentage of the capital appreciation.

It also allows for a more resilient choice, as you have significantly more room to tide over a market downturn, ensuring you aren’t limited in your ability to sell the property or obtain financing.

Low COV (Cash Over Valuation)

COV refers to the amount paid above the valuation of the flat and is not covered by the home loan or payable by CPF.

While COV rates have not been published by HDB since 2013, they remain a significant factor in prime, mature areas, where buyers are expected to factor in COV amounts to be in the range of $20,000 – $40,000, as of 2022, and this figure can even exceed a hundred thousand dollars. This can be a significant deterrent for many buyers entering the market for the first time, particularly those on a tight budget or with limited cash reserves.

This is yet another factor that makes Non-Mature Estates a particularly attractive proposition considering the recent slowdown in economic growth and interest rate hikes, prices are bound to range in a considerably reasonable range for the near future. All of this presents an opportune time for buyers to obtain units at valuation with low or no COV.

Market Trends

Of the 29,106 units sold last year, homes in non-mature estates accounted for almost 60% of all sold. Interestingly, there has also been a surge in the number of flats resold close to the million-dollar mark. With a staggering 370 units surpassing 2022 figures by some distance. Non-Mature estates have also played a huge part with certain neighbourhoods hitting the million-dollar mark for the first time last year like Punggol.

Here are some of the HDB Resale Transactions in Non-Mature Estates of 2022:

| Town | Unit Type | Storey Range | Remaining Lease | Resale Price |

| Woodlands | Executive | 04 – 06 | 69 years 11 months | $1,080,000 |

| Woodlands | Executive | 10 – 12 | 70 years | $1,010,000 |

| Yishun | Executive | 07 – 09 | 68 years 05 months | $1,038,000 |

| Bukit Panjang | Executive | 16 – 18 | 79 years 03 months | $950,000 |

| Sengkang | 5 Room | 09 – 12 | 93 years 04 months | $928,000 |

| Hougang | 5 Room | 07 – 09 | 60 years 06 months | $868,000 |

This clearly shows the potential non-mature estates have as they have not been left out from featuring in the headlines that’s usually set by the flats found in the central regions of Singapore.

3. Live-in Potential

Lastly, it’s easy to forget that when you do find a good gem to not overlook the liveability factor, particularly for those intending to make this property their home.

While mature estates are well-established, they are often too popular, crowded, and costly. Non-mature estates are preferred by some residents as they are quieter and located in more peaceful environments.

Newer estates may also have greener co-living space in the vicinity with Punggol being the very first HDB Eco-Town. There’s also the upcoming Tengah “forest town” in the west promising to offer a green and sustainable living environment.

HDB recently announced its Green Towns Programme, a 10-year plan to make HDB towns more sustainable and liveable. This initiative further underscores the government’s commitment to developing and enhancing non-mature estates, making them an attractive option for property buyers who value a high quality of life.

Get Ahead of the Game With An Experienced Super Agent

Making the right investment decision is crucial when it comes to buying a home, which is why having an experienced Super Agent from Ohmyhome can make all the difference.

Don’t leave your investment decision to chance. From providing invaluable insights into local market conditions to identifying potential investment opportunities, an Ohmyhome Super Agent can offer you a level of expertise and guidance that’s unmatched in the industry.

Our Super Agents have served more than 8,000 happy customers, with over 70 families housed almost every single month. Secure an appointment with any of our Super Agents today by dropping us a message on WhatsApp or via our Live Chat at the bottom, right-hand corner of the screen.