On a bright and early Saturday morning, we successfully held our third housing literacy seminar!

We may be familiar with the steps of buying but how about the stages that require more thoughtful planning i.e. the financial calculations, contra and picking out a home loan to finance your purchase? Staying true to our commitment to making housing transactions simple, fast and affordable, we conduct free seminars every third Saturday of the month that aims to share invaluable property knowledge in a fun and accessible way.

Helmed by our two senior property agents, Douglas Quah and Zen Lim (or D & Z for short), and held in our cosy public seminar chamber, the jam-packed two-hour seminar treated our participants to an exciting day of hands-on learning through live demonstrations on our app, detailed breakdown of tricky financial calculations and finished off with expert home loan advice from our resident mortgage specialist.

Here are some of the key takeaways from our third seminar.

Affordability Calculations

Ever wanted to calculate your finances and see how the property price you can comfortably afford, the estimated bank loan you can get, your maximum loan tenure and the best bank rates – all in one shot? Our Affordability Calculator gives you the answers you need in seconds!

Our mortgage specialist, Mitchell Ling, guided attendees through the simple process of using the calculator on our app. Before long, everyone was ready for the next segment. Affordability calculation is such a breeze with the right tools to help!

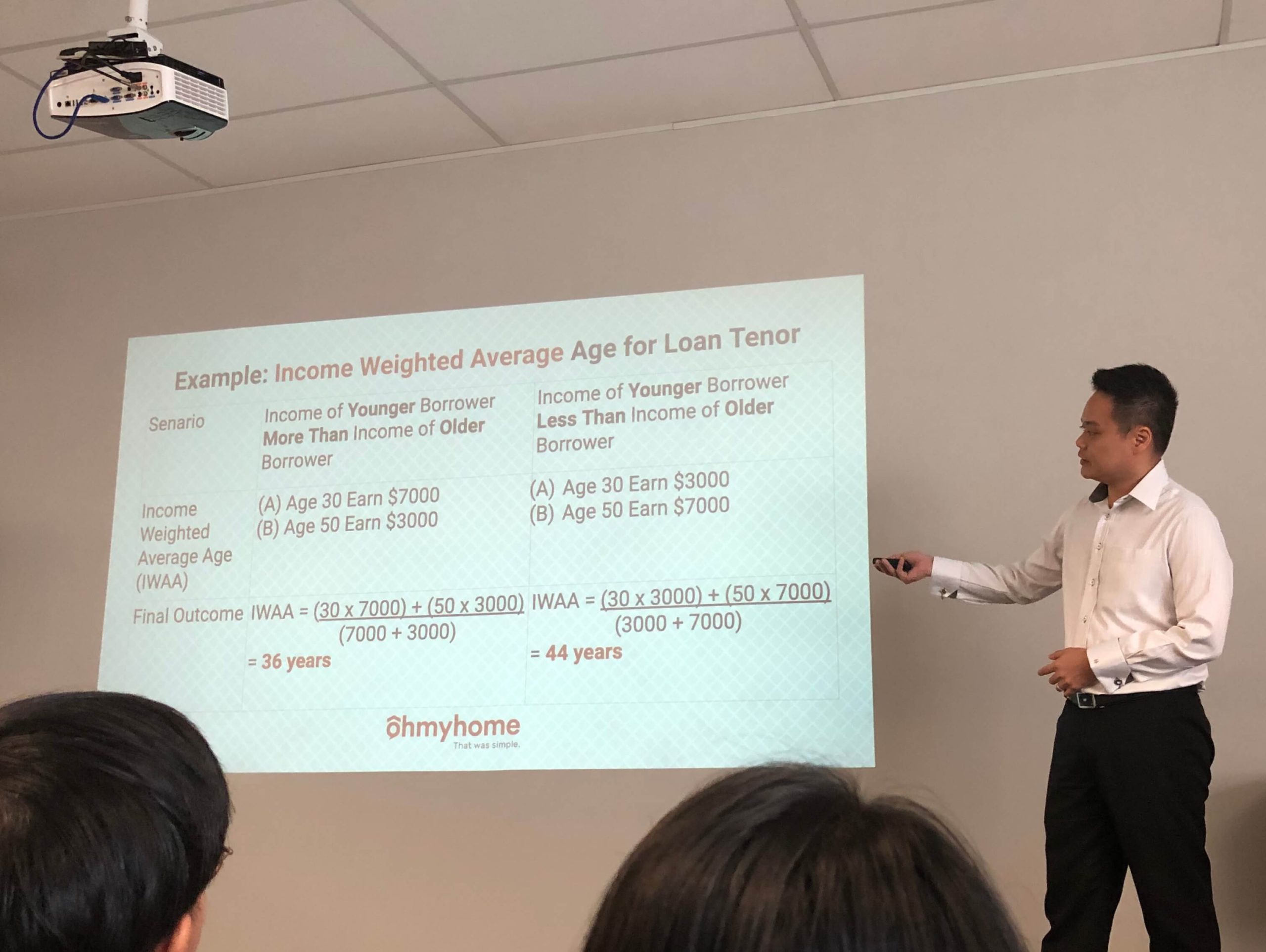

Following that, Mitchell dived deep into mortgage calculation by explaining how banks calculate the loan applicant’s income recognised by banks.

How banks calculate recognised income:

Mr Tan is a salesman earns a fixed pay of $3000 per month. He also earns commissions of $2000 per month on average. He currently rented out his common room for $500 per month.

$3000 (100%) + ($2000 x 70%) + ($500 x 70%) = $4,750 per month

Top 3 Home Loan Mistakes

Avoid these common home loan mistakes! Our mortgage specialist dug into his vast industry experience to educate about which mistakes to steer clear from and provided his professional advice.

- Comparing home loan packages

Instead, it is best to access home loans based on your risk appetite, the prevailing market conditions as well as your own personal needs.

- Using huge CPF lump sum repayments

Paying with CPF is only worthwhile if the interest rates are higher than 2.5%.

- Incurring high mortgage payments

It is best to reevaluate your home loan package when it nears the end of your contract with our mortgage specialist to avoid forking out high mortgage payments in the long run.

Fixed vs. Floating Rate

When deciding on a home loan package, the question you’ll most likely ask is whether to apply for a fixed-rate or floating-rate loan. Our mortgage specialist suggests checking the current interest rate environment.

For fixed-rate: best for rising interest rate environment

For floating rate: best for falling interest rate environment

Best Home Loan Package

Last but not least, Mitchell informed attendees of the best home loan packages as of 17 August 2019. Fixed rates safeguard you from rising interest rates, allowing you to finance your monthly loan repayments, worry-free. Rates are subject to change.

| DBS | UOB | OCBC | |

|---|---|---|---|

| Lock-in Period | 3-year Fixed Rate | 3-year Fixed Rate | 2-year Fixed Rate |

| 1st Year | 1.89% | 1.89% | 1.98% |

| 2nd Year | 2.18% | 2.18% | 2.08% |

| 3rd Year | 2.18% | 2.18% | 2.35% |

| Thereafter | 2.18% | 2.18% | 2.35% |

All in all, the seminar was chockful of helpful lessons for homebuyers who wish to embark on their property journey! Like our Facebook page and be updated with our upcoming seminars. Download Ohmyhome app now and try out our affordability calculator.

Need more assistance in deciding on a home loan package that best suits your needs? Get the best mortgage loan rate in town at 1.89% fixed rate! Don’t hesitate to contact our mortgage specialist by calling 9755 9103 or visit our mortgage advisory page to schedule a callback.