Are you a single Singapore Citizen or Permanent Resident above the age of 35 looking to buy an HDB flat? As a single person, buying a home on your own can be daunting. However, with the right guidance and knowledge, purchasing an HDB flat can be a straightforward and rewarding experience. Here is a guide to help you navigate the process of buying an HDB flat as a single person above the age of 35.

Contents:

1. Check your eligibility

Before you embark on your quest of buying an HDB flat, it’s important to check your eligibility. You must be a Singapore citizen or Permanent Resident and at least 35 years old to buy an HDB flat on your own. If you are below 35, you can consider applying under the Joint Singles Scheme. Ensure that you meet the other eligibility criteria, such as income ceiling and property ownership, as outlined by HDB.

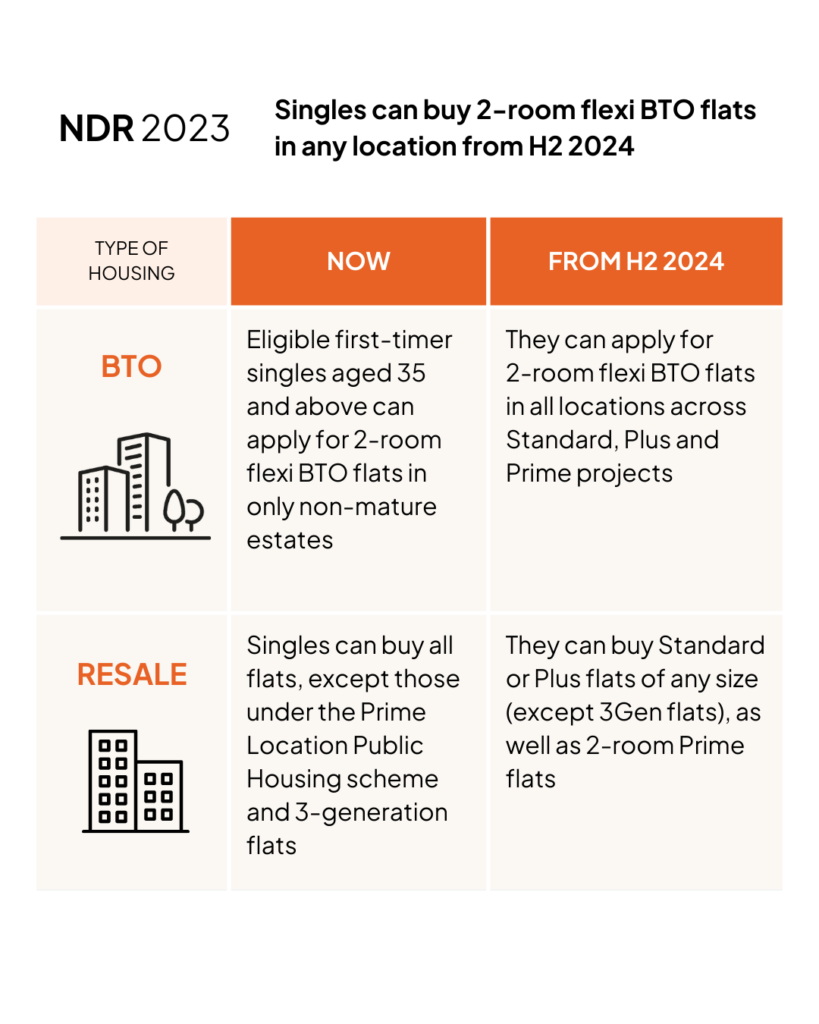

Singles Singapore Citizen Scheme 2023

By H2 2024, you’ll also be eligible to apply for 2-room flexi BTO flats in any location, in line with the new HDB classification of Standard, Plus, and Prime flats. Here are more details.

2. Determine your budget

Most importantly, you have to determine how much you can afford. Ideally, you should apply for the HDB Loan Eligibility (HLE) letter or get an In-Principle Approval from the bank, before you start your search for a flat. The HLE letter or IPA will provide you with an estimate of the loan amount you can borrow and the monthly instalments you will have to pay. Also, it’s a guarantee that the bank will give you the amount you need for your home loan. This will help you determine your budget and search for a flat within your financial means.

Additionally, having loan approval documents will demonstrate to sellers — if you are buying a resale flat — that you are a serious buyer and have the financial means to purchase the flat. This can give you an advantage over other buyers who haven’t done their homework.

HDB offers various loan options, and you can use their budget calculator to get an estimate of the maximum loan amount you can borrow. For bank loans, you can check out Ohmyhome’s home loan calculator or contact us for the best rates — we’re partnered with practically all the banks in Singapore and can recommend the best home loan for you. You should also consider additional costs, such as stamp duty, legal fees, renovation costs, and other expenses that come with owning a home.

3. Pick your property

Once you have determined your budget, choose the type of HDB flat that suits your needs and budget. HDB offers various types of flats, including 2-room Flexi, 3-room, 4-room, 5-room, and Executive flats. Consider the location, size, and other factors that are important to you, such as proximity to public transport, amenities, and schools. While you can cherry-pick from all flat types (save for 3Gen flats) in the open market, note that if you’re single, you can only buy new 2-room Flexi flats in the non-mature estates from HDB.

4. Know your grants

HDB offers various grants to assist first-time home buyers, including the Enhanced CPF Housing Grant (EHG) and the Special CPF Housing Grant (SHG). Check your eligibility for these grants and how much you can receive. You may also be eligible for other grants or schemes, such as the Proximity Housing Grant, Family Grant, or Singles Grant.

Read More: CPF Housing Grant Guide – How Much Can You Get For Your Resale HDB?

5. Secure a home loan

Please, do not sit on this. After you have found an HDB flat that meets your requirements and budget, you can submit an application through HDB’s website. Ensure that you have all the necessary documents, such as your income documents, bank statements, and identity documents.

Once your application is approved, you will need to secure a home loan. HDB housing loans can cover up to 90% of the flat’s purchase price, and the interest rate is fixed at 2.6% per annum. Meanwhile, you can also choose to take out a loan from a bank. Banks typically offer a range of loan packages with different interest rates, repayment periods, and fees. You may be able to borrow up to 75% of the flat’s purchase price, depending on the bank’s criteria and your eligibility.

Do not wait till you have put down an option fee for your flat before trying to get a home loan. In the event your loan is not approved, or if the process is delayed, you may be forced to forfeit your deposit.

Buying an HDB flat when you are single and over the age of 35 may seem scary at first, but with the right information and financial planning, it is possible to make it a reality. Whether you are looking to buy a new or resale flat, there are various loans available to help you finance your purchase, including the HDB Concessionary Loan, bank housing loans, and CPF Housing Grant. It is important to do your research, understand your financial situation, and seek advice from professionals before making any decisions. With careful planning and the right support, owning an HDB flat can be a valuable investment and a source of pride and stability for years to come.

Single, 35, and in need of property advice?

Let Ohmyhome’s smart data-matching technology MATCH you with the right home, according to your specific needs. Submit your preferences to us and our algorithm will filter all our available listings based on those, and we’ll WhatsApp them to you once we find a match. We’ll also send you relevant content that you can use for your research and inform your home buying decision, so you no longer have to spend hours searching online for the information that you need. Because at Ohmyhome, we’re always by your side, always on your side.

Secure an appointment with any of our Super Agents by dropping us a message on WhatsApp or via our Live Chat at the bottom, right-hand corner of the screen.