Forecasts for the real estate industry in 2021 show that property as an investment remains a stable and safe option, especially as Singapore continues to be a desirable place for business growth; with more multibillion-dollar companies setting up shop in Singapore. The roll-out of the Covid-19 vaccine, proximity to important growth markets, government initiatives, and established regulations prove to be the driving factors of the current positive market sentiment.

But will it continue in the New Year?

Overview of the property market in 2020

Within the two-month Circuit Breaker period in April and May, when physical home-viewings weren’t allowed, private home sales plunged to historic lows. But according to historical data, Singapore’s private home market typically rebounds after each economic crisis-last year was no different.

Post-Circuit Breaker, the market saw an impressive turnaround as private home resale transactions hit more than 9,200 units by November 2020, surpassing the overall private home resale deals of 8,949 for the whole of 2019.

The private residential market in Q4 2020 at a glance:

According to the Urban Redevelopment Authority (URA), prices of private residential properties increased by 2.1% in Q4 2020, compared with the 0.8% increase in the previous quarter. For the full year, prices grew by 2.2%, marking the fourth straight year of the price increase.

| Key Indicators | Change | Q3 2020 | Q4 2020 |

|---|---|---|---|

| Price index | +2.2% | 153.8 | 157.0 |

| Rental index | +0.1% | 103.8 | 103.9 |

| Take-up | -26.0% | 3,516 | 2,603 |

| Pipeline supply | -2.1% | 50,369 | 49,307 |

| Vacancy rate | +0.8% point | 6.2% | 7.0% |

*Figures exclude Executive Condominiums (ECs) | Source: URA

Rentals of private residential properties also increased by 0.7% in Q4 2020, compared with the 0.5% decrease in the previous quarter.

But what’s next for 2021?

Data from further research show that property investments can still yield steady and lucrative returns, preserve wealth, and generate capital appreciation. With attractive mortgage rates, balanced market fundamentals, and resilient demand, Singapore’s private real estate market is poised for a steady recovery and further price growth, especially if the economy rebounds strongly this year.

Here’s Ohmyhome’s property outlook for the private residential real estate market in 2021:

Private residential real estate market

Investor attention shifting to the private residential sector

Singapore is at a comparatively sweet spot of affordability, compared to cities like Munich, Frankfurt, Toronto, and Hong Kong, which are at risk of housing bubbles, making it a likely target of an investment frenzy. (A housing bubble usually starts with an increase in demand, in the face of limited supply, which takes a relatively extended period to replenish and increase.)

It remains an attractive location for businesses to expand their operations, expecting foreign capital and businesses to flow into the city-state in 2021. This may result in investor attention shifting to the private residential sector; foreign buyers for luxury homes will provide developers with the bulk of demand for the condo units to be released this year.

As Singapore remains an attractive location for business to expand their operations, foreign capital and businesses are expected to flow into the country this year.

According to KPMG, Singapore is the top spot of leading tech innovation hubs outside of San Francisco, primarily due to the country’s strong fundamentals, business-friendly reputation, strategic location, and team innovation. In fact, around 80 of the world’s top 100 technology firms already have a sizable presence in Singapore, including Google, Shoppee, and Grab.

Those who arrived or expanded their investments in recent months are among the fastest-growing firms for their respective tech hubs in the U.S. or China, such as Zoom, Twitter, Paypal, Tencent, Alibaba, and ByteDance (TikTok).

With excellent potential for capital growth and business expansion in Singapore, the wealth of these companies’ founders and their high-income employees are most likely to follow suit. And as they move into the neighbourhoods where their offices are located, demand for private apartments will likely rise, and result in a peak in rental yield.

The south-western region-Alexandra Road and Clementi in particular-shows excellent promise. Property rental prices for one-to-two-bedroom apartments in these areas are expected to rise to over $3,000 per month for a two-bedder. (Ohmyhome Pro Tip: Google, Shoppee, Grab, and even Unilever are within proximity of these neighbourhoods.)

As such, in the private non-landed residential real estate market, you can anticipate:

- The market to remain buoyant

- Diminishing home supply to prop up prices

1. The market to remain buoyant

Private non-landed housing demand and prices did not dip as they usually do in a recession period as the employment rate was kept high, due to the government’s speedy implementation of supplementary budgets and economic stimulus packages. This helped homeowners to continue financing their home as they weren’t hit as badly this time round, compared to other crises.

Banks also went easy on foreclosing on homes where homeowners defaulted on their payments. There is also no significant batch of properties auctioned off at a lower price.

This makes it highly likely for the private residential market to stay afloat, despite the ongoing pandemic.

2. Diminishing home supply to prop up prices

Oversupply in Singapore’s residential market may be over soon. The number of new launches slated this year is expected to be lower, with fewer mega launches in the mass market and city-fringe areas. (The last megaproject launched was said to be Normanton Park.) Also, land sales have declined drastically over the years.

The number of new launches slated this year is expected to be lower, with fewer mega launches in the mass market and city-fringe areas.

For those who intend to buy new private properties for rental income, the leasing market has remained strong despite the pandemic, yielding positive capital appreciation over the past 30 years.

Collective sales activities almost came to a complete halt after the cooling measures were implemented in July 2018. The government calibrated the land supply from the GLS programme, and, over the past two years, a consecutive slate of land was released to maintain a moderate supply of units.

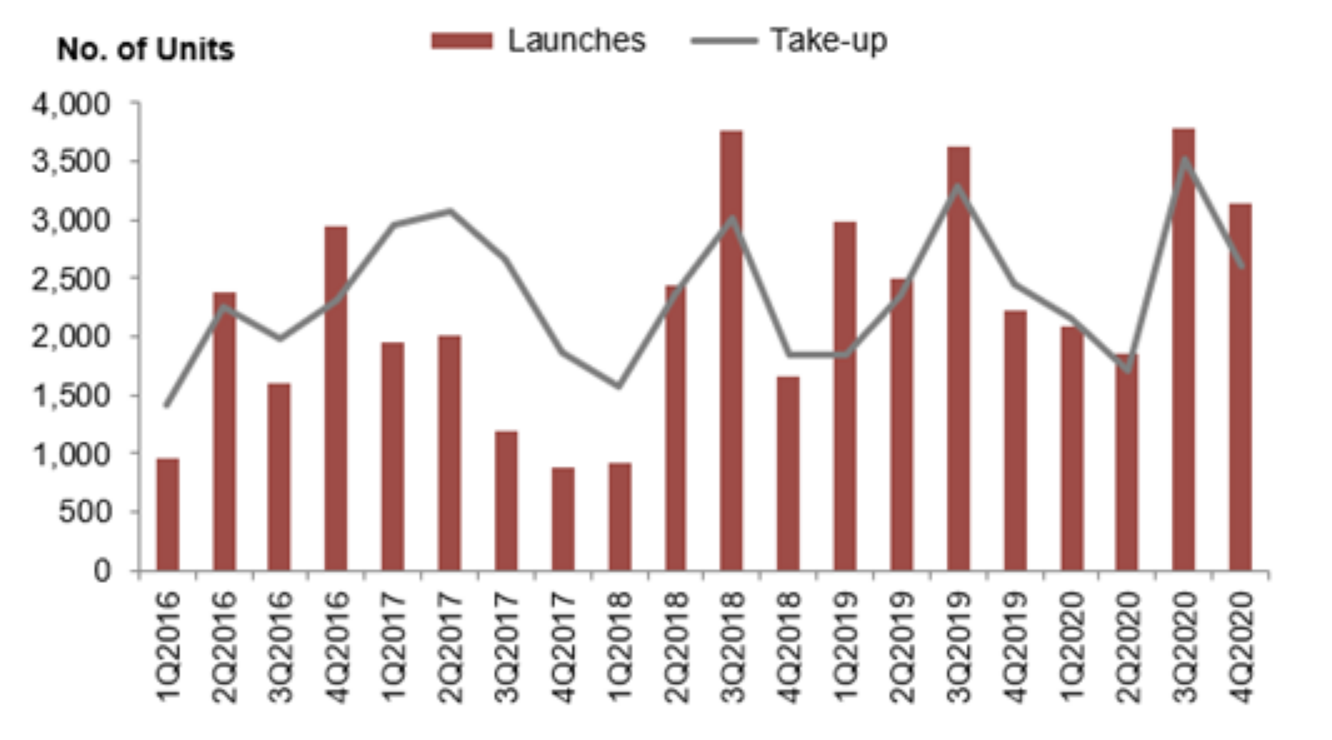

Source: URA

In Q4 2020, developers launched 3,147 new private residential units (excluding ECs) for sale, compared with the 3,791 units in the previous quarter. For the whole of 2020, 10,833 uncompleted private residential properties were launched for sale, compared with the 11,345 units in the previous year.

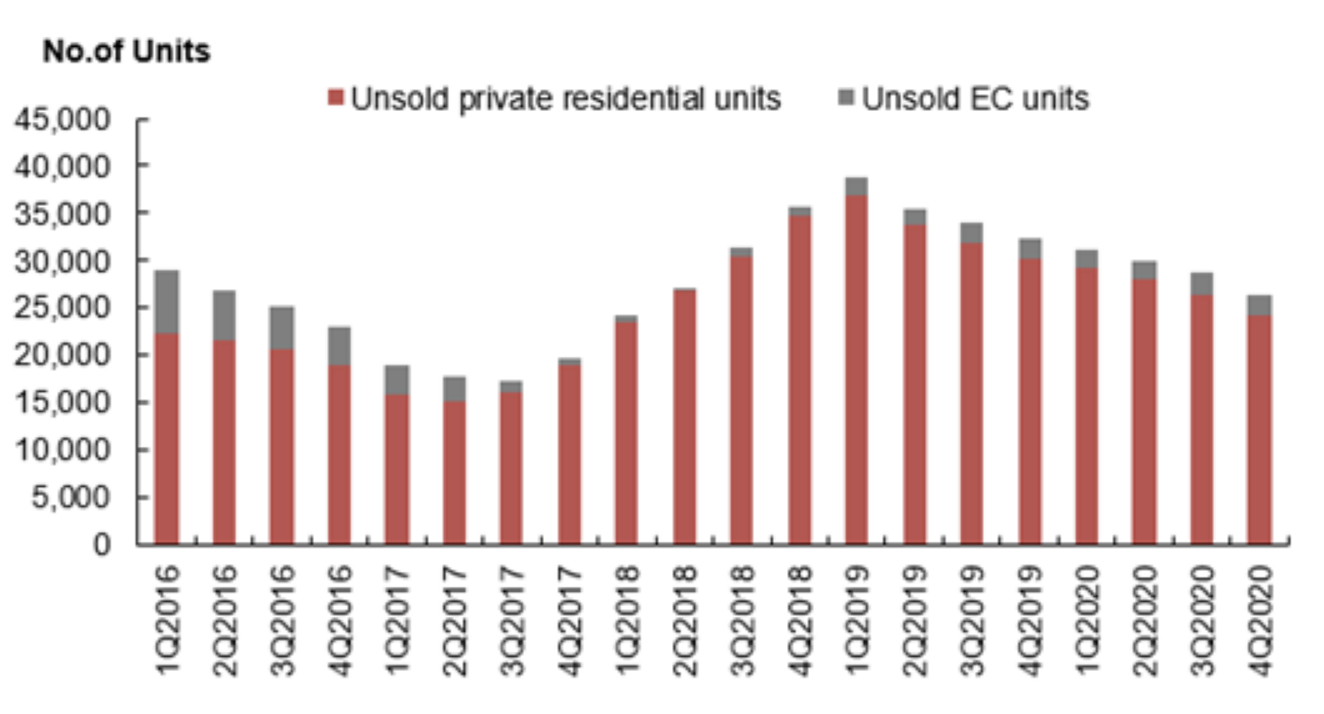

The cumulative number of unsold units may be nearing its peak and could start tapering this year, say reports.

Source: URA

Based on the expected completion dates reported by developers, 6,850 units (excluding ECs) will be completed in 2021. Another 11,049 units (including ECs) will be completed in the following year.

As of the end of Q4 2020, there was a total supply of 49,307 uncompleted private residential units (excluding ECs) in the pipeline with planning approvals, compared with the 50,369 units in the previous quarter. Of this number, 24,296 units remained unsold at the end of Q4 2020, compared with the 26,483 units in the previous quarter.

The supply of private homes in the pipeline is sufficient for Singapore’s housing needs when completed over the next few years. However, the Singapore government is keeping a close eye on the private property market and will “adjust policies if necessary” to maintain a stable and sustainable property market for Singaporeans.

New round of property cooling measures?

Deputy Prime Minister Heng Swee Keat said the government would “remain vigilant” as private property prices continue rising, mentioning that they “do not want to see the property market run ahead of the underlying economic fundamentals”.

They also want to ensure younger Singaporeans can “own their homes and fulfil their aspirations” as there will be mass grumbling and unease if entry-level apartments become too expensive for younger buyers, and has continuously advised buyers to exercise caution when shopping for homes.

The government will “adjust policies if necessary” to maintain a stable and sustainable property market for Singaporeans.

However, property analysts say that “it is still too early to assess if price growth is on an unsustainable trajectory”.

Wong Xian Yang, Cushman & Wakefield’s associate director of research for Singapore and South-east Asia, say: “The current market could be propped up due to government stimulus, and when that stimulus winds down, it is uncertain if current demand can be sustained.”

The recent Budget 2021, Emerging Stronger Together, includes a new $900 million Household Support Package to provide immediate relief to all Singaporean households, particularly lower- and middle- income households with children. It includes an extension of the service and conservancy charges rebate for those living in HDB flats. The rebate will offset between one-and-a-half and three-and-a-half months of the charges, depending on their HDB flat type.

Landed private residential market

The landed private residential market is also poised for a comeback as the momentum for bungalows in the waterfront housing district of Sentosa Cove is expected to strengthen further this year. Local and regional buyers can potentially drive up prices, supported by their confidence in the economy’s recovery and long-term capital returns of the real estate market.

The momentum for bungalows in the waterfront housing district of Sentosa Cove is expected to strengthen further this year.

According to Business Times, wealthy Chinese buyers snapped up six apartments worth a combined $20 million at Marina One Residences without any virtual tours at the height of the pandemic last year. With the political turmoil in regional competitors like Hong Kong and China, investors reconsider their options, ultimately turning to Singapore due to its stability. It also doesn’t hurt that the city-state is ranked as the fourth safest place to live in Southeast Asia during the pandemic.

According to URA, the total transaction volume is higher by 14% at $893 million last year, due to price appreciation. GCBs in prime locations such as Chatsworth, Cluny Hill, and Dalvey are hitting around $2,000 psf for land alone, as listed below.

Here are the reported GCB transactions in Q4 2020, in the following exclusive landed GCB enclaves:

| Street | Price ($) | PSF ($) | Area (sq ft) | Month-Year |

|---|---|---|---|---|

| Chatsworth Park | $44,000,000 | 2082 | 21133 | 2020-12 |

| Gallop Road | $42,000,000 | 1940 | 21647 | 2020-12 |

| Cluny Hill | $38,600,000 | 2315 | 16675 | 2020-12 |

| Lermit Road | $34,749,000 | 2000 | 17374 | 2020-12 |

| Mount Echo Park | $32,000,000 | 1712 | 18690 | 2020-12

|

| Maryland Drive | $25,680,000 | 1175 | 21862 | 2020-12 |

| Gallop Park Road | $24,150,000 | 1610 | 15004 | 2020-11 |

| Brizay Park | $21,000,000 | 1179 | 17808 | 2020-11 |

| Andrew Road | $20,488,000 | 744 | 27530 | 2020-11 |

| Dalvey Estate | $34,700,000 | 1740 | 19938 | 2020-10 |

Source: URA, teeco.sg

The market for landed homes is expected to do well this year as the trend of higher prices is projected to continue into the first quarter of this year. Investors may still be willing to buy older properties for its redevelopment potential, especially as brand-new GCBs in prime areas are running scarce.

Property investing for the future

Though there are still risks to consider, such as the new variant of the coronavirus and the slower economic revival in other countries, there is still confidence within the government that the spread of the virus will be contained. Plus, as the fundamentals of the country’s property market remain stable, private housing prices may continue to improve further in 2021.

Private housing prices may continue to improve further in 2021.

So for those who are looking to invest in this particular property asset, take this as your opportunity to make a move. Of course, with the right precautionary measures and guidance form professional real estate agents, navigating property investments in the New Normal is less daunting.

Start your property investment journey with Ohmyhome today!

Book a callback with our Relationship Managers for all things buying, selling, or leasing homes!