If there’s one thing the pandemic has taught us, it’s to cherish what’s truly important: our health, safety, family, home.

As Covid-19 cases rose last year, the need to keep everyone socially distanced became more urgent, leading most of Singapore’s workforce back home. It re-introduced the importance of having a home or finding the right one with flexible spaces for rest, work, and play.

But buying a home has always been regarded as a meaningful and prudent financial investment; a safer option than the volatile stock market.

Still, our newfound familiarity with our homes invites several questions over the future of the real estate market.

Why should you invest in real estate despite the pandemic?

Despite the global economic turmoil, especially in the pandemic’s early days, Singapore’s real estate market remained resilient. Reports show that property prices rose in the last quarter of 2020, so much so that the government is now keeping a close watch on the market to implement cooling measures should property prices continue to rise.

Dive Deeper: Why invest in Philippine real estate now, despite the pandemic?

But why should you consider Clementi for real estate investing?

Clementi is now shaping up to claim prime real estate credentials as it cements its reputation as a million-dollar HDB hotspot. In 2020, more than 80 HDB resale flats were sold for over $1 million, compared with the 64 for 2019, proving that the HDB resale market is emerging from its slump after the government released a number of policy measures to improve housing affordability for Singaporeans and increase older flats’ attractiveness.

Many HDB resale flats in Clementi are sold for over $1 million.

60% of the $1 million HDB resale deals were flats located in Boon Tiong Road (Bukit Merah) and Dawson Road (Queenstown), both at the outskirts of Clementi. These sellers who are now in the market for a new home wouldn’t need to look further than Clementi as the town remains a popular choice for home buyers and property investors, mainly because of its good location.

Clementi is close to Singapore’s second CBD and tech hub

Located within District 5, Clementi’s relative proximity to the Core Central Region (CCR) might strongly appeal to those who prefer living in the Central Business District (CBD) fringe.

It is sandwiched between Jurong East and Lakeside, a commercial-business hub and recreational hub, respectively. URA has long since released its plans to make Jurong East the second CBD of Singapore, soon to be served by the new Jurong Region Line expected to launch in 2026, as well as the Cross Island Line. It could be an attractive factor for home buyers looking to live at the edge of gentrification.

Clementi is close to employment-generators Google and Shopee that could raise the level of lifestyle in District 5.

Clementi is also close to one-north, a tech-oriented, research and development precinct with prestigious tenants, such as Google, Grab, Shoppee, and Unilever. Even Chinese tech behemoths Tencent and ByteDance (the parent company of Tik Tok), including Paypal, Rakuten, Amazon, Twitter, Zoom, Kajima, Johnson Controls, and DB Schenker have announced their plans to set up regional offices and data centres in Singapore.

How can tech firms improve the potential of District 5 for real estate investment?

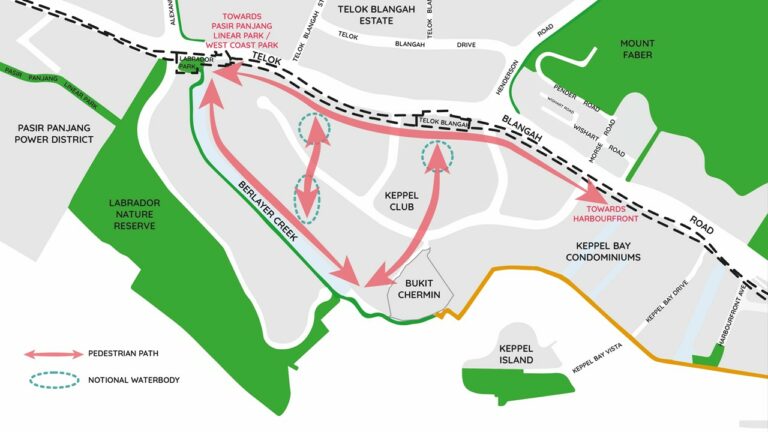

Software engineering talents are mobile and fluid. The best and brightest will move wherever they feel will provide job satisfaction and greater access to cutting-edge research or tech. And right now, quite a few of them can be found in District 5: Shoppee is located in 5 Science Park Drive at Kent Ridge, Google and Unilever in Mapletree Business City at Labrador Park, and Grab with an office at one-north.

These unicorns, a term coined by venture capitalist Aileen Lee to indicate a start-up is valued at more than US$1 billion, have the capital to expand and attract high-income employees who could raise the rental demand in the area. In fact, some 50,000 ICT jobs are expected to be created in Singapore; with the new work visa, Tech.Pass, which is aimed at attracting tech entrepreneurs and leaders, an influx of tech talent can be expected to flock to Singapore to perform frontier and disruptive innovations. As a result, they could raise the level of living in areas like District 5 as they move closer to their offices.

Moreover, the real estate market has always been a playground for the affluent. The wealth expansion of those in the technology sector-even healthcare, fintech, logistics and software-will bode well for the real estate market. They may continue to grow their investment portfolios in tandem with their income through real estate, primarily residential properties that could give more stable returns in the long run.

Clementi as an education hub can attract families and ensure longer leases

By now, it’s customary for buyers, especially those with families or couples intending to raise their own, to consider if there are schools nearby their house. Having educational institutions nearby elevates an area’s appeal as the closer a school is to a home, the higher the chances children have of getting into said school. When a family’s children attend a school nearby, they’re less likely to move, which means a longer lease: a definite upside for landlords.

Clementi is the only area you can call a ‘university town’ with the high amount of educational institutions surrounding it.

Fortunately, Clementi is well-known for being an education hub, home to many top-tier schools. It includes the following:

- National University of Singapore (NUS)

- Singapore Polytechnic (SP)

- Ngee Ann Polytechnic (NP)

- Anglo-Chinese Junior College (ACJC)

- Nan Hua High & Primary School

- Clementi Primary School

- Chatsworth Preschool

Dive Deeper:

Private home prices and sales are up

Apart from Clementi’s strategic location and proximity to employment generators, the private residential property market is doing well. URA flash estimates reveal private home prices rose 2.1% in Q4 2020, the sharpest increase since Q2 2018 when they jumped 3.4%, followed by a slew of property cooling measures in July that year.

The rising prices are despite Singapore’s economy appearing on track to shrink 6% for 2020 and unemployment rates hitting 3.6% in Q3, compared with 2.3% a year ago. It could be due to the strong sales of new launch projects, such as Clavon in Clementi and Ki Residences at Brookvale:

More than 10,000 private housing units were sold by developers last year, despite fewer launches amid the pandemic.

Clavon sold 473 units at a median price of $1,673 psf, while Ki Residences sold 172 units at a median price of $1,766 psf. Together, the two new developments accounted for 53% of new home sales in December 2020.

More than 10,000 private housing units were sold by developers last year, despite fewer launches amid the pandemic. It is 1.1% higher than the 9,912 units sold in 2019, based on URA flash estimates.

Private property market rental activity

According to other reports, the rental volume for private properties also increased 5.3% month on month. About 4,414 units were rented in December 2020, compared with the 4,193 units in November 2020. The year-on-year rental volumes are also 0.3% higher.

Volumes are 15.4% higher than the five-year average volume for December. 35.0% of rent came from the Rest of Central Region (RCR), which comprises District 5, where Clementi is bound.

As the government rolls out the vaccination programme, the housing demand could increase as the economy and job market improve.

That’s good news for property investors. Plus, as the government rolls out the vaccination programme, the housing demand could increase as the economy and job market improve.

To start, they can look at District 5’s new home launches, including Clavon, Normanton Park, and One-north Eden. The former two project’s success could be a sure sign of One-north Eden’s positive results when it previews early this year.

Dive Deeper: 3 Upcoming District 5 Condos in Singapore to Look Out For

Top 10 Condos in District 5 ranked by 5-year capital gain

Property investors should also identify a property’s capital growth potential. So here are the top 10 private properties in District 5 ranked by five-year capital gain:

| Project Name | Tenure | Completion | Capital Gain (%) | Historical Price ($PSF) | Current Price ($PSF) |

|---|---|---|---|---|---|

| Palm Mansions | Freehold | 1998 | 23.6 | 884 | 1,093 |

| The Parc Condominium | Freehold | 2010 | 21.9 | 1,098 | 1,339 |

| Waterfront @ Faber | 99 years | 2017 | 16.7 | 1,155 | 1,348 |

| Carabelle | 956 years | 2009 | 16.2 | 1,139 | 1,323 |

| Bijou | Freehold | 2018 | 14.8 | 1,749 | 2,008 |

| Gold Coast Condominium | Freehold | 1994 | 14.2 | 950 | 1,085

|

| Palm Green | Freehold | 1999 | 14.2 | 925 | 1,058 |

| Village @ Pasir Panjang | Freehold | 2016 | 13.7 | 1,123 | 1,277 |

| Botannia | 956 years | 2009 | 12.3 | 1,078 | 1,211 |

| Ventana | Freehold | 2003 | 11.3 | 1,098 | 1,222 |

Source: URA, https://www.squarefoot.com.sg

But determining the potential rental income you can receive when renting out a property is also essential. Here are the top 10 private properties with a gross rental yield of 3% and above.

Top 10 Condos with gross rental yield of 3% and above, and more than 50 rental units

| Project Name | Tenure | Gross Rental Yield (%) | Min. Price ($PSF) | Avg. Price ($PSF) | Max. Price ($PSF) | Min. Rent ($PSF PM) | Avg. Rent ($PSF PM) | Max. Rent ($PSF PM) | # Rental |

|---|---|---|---|---|---|---|---|---|---|

| Viva Vista | Freehold | 4.2 | 1,145 | 1,445 | 1,569 | 2.67 | 5.11 | 6.57 | 58 |

| West Bay Condominium | 956 years from 1991 | 3.7 | 794 | 838 | 907 | 1.86 | 2.60 | 3.29 | 66 |

| One-north Residences | 99 years from 2005 | 3.5 | 1,124 | 1,408 | 1,616 | 2.18 | 4.11 | 6.36 | 125 |

| Seahill | 99 years from 2011 | 3.4 | 1,187 | 1,350 | 1,430 | 3.13 | 3.87 | 5.11 | 77 |

| Dover Parkview | 99 years from 1993 | 3.4 | 823 | 1,406 | 1,208 | 1.96 | 2.95 | 3.68 | 120 |

| Blue Horizon | 99 years from 2000 | 3.4 | 955 | 1,039 | 1,131 | 2.43 | 2.93 | 3.68 | 106 |

| The Rochester Residences | 99 years from 2005 | 3.3 | 1,161 | 1,288 | 1,399 | 2.40 | 3.58 | 5.06 | 91 |

| Heritage View | 99 years from 1996 | 3.2 | 1,099 | 1,193 | 1,261 | 2.52 | 3.20 | 3.95 | 96 |

| The Trilinq | 99 years from 2012 | 3.2 | 1,042 | 1,427 | 1,643 | 2.52 | 3.77 | 4.73 | 90 |

| Parc Riviera | 99 years from 2012 | 3.2 | 1,060 | 1,389 | 1,588 | 2.31 | 3.65 | 5.33 | 138 |

Source: URA, https://www.squarefoot.com.sg

Plan a real estate investment strategy with a Super Agent and financial advisors

If you live in Clementi and your HDB flat is reaching its MOP this year or the next, now is the best time to craft a real estate investment strategy with a trusted real estate advisor and mortgage specialist. Singapore’s real estate market is still relatively unpredictable, which means there could be unforeseen opportunities popping up-having professionals in your corner to guide you in your investment journey.

Ohmyhome Super Agents are ready to visit countless private properties with you, go to showflats, provide you with detailed district analysis, and property price trend reports. Engage one now by calling +65 6886 9009.