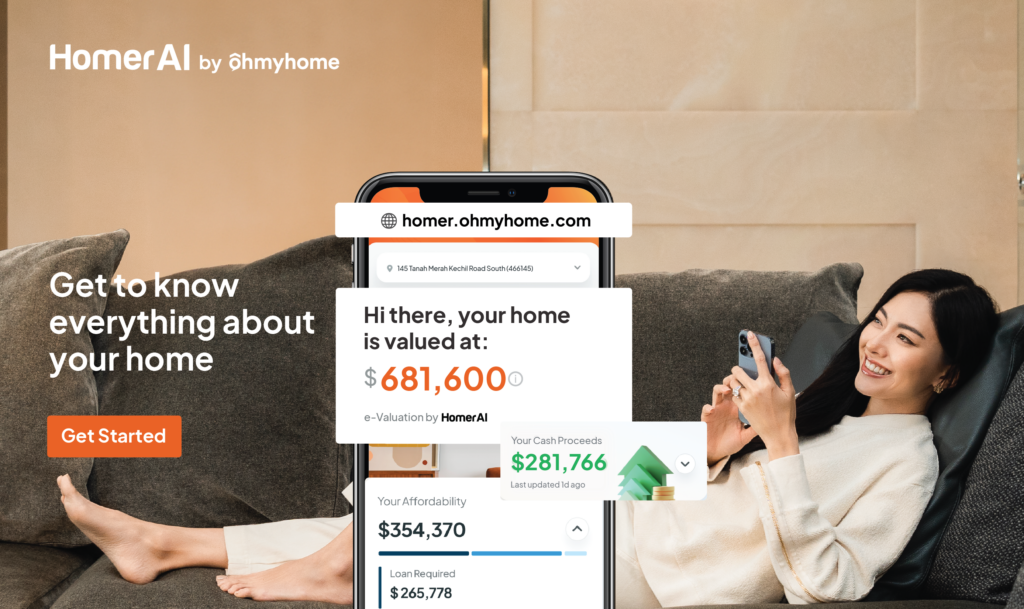

The resale HDB vs BTO battle never falls out of the general public discussion, simply because the affordability of owning a home is always in question. (Make use of our Affordability Calculator on Homer AI to take the guesswork out of your hands.) In this article, let’s discuss the pros and cons of buying a resale HDB or BTO flat.

Jump to each section:

- What is a resale HDB?

- What is a BTO flat?

- Resale HDB vs BTO: 6 factors to consider before buying a home

- Pros and cons of buying a resale HDB vs BTO flat

What is a resale HDB?

This refers to an HDB flat sold by an existing owner after it has reached its Minimum Occupation Period (MOP), in the open market.

Resale flats have shorter lease tenures than BTOs and usually command higher prices that rise and fall according to demand and supply.

What is a BTO flat?

A Build-to-Order (BTO) flat is a newly-built HDB flat launched prior to its construction. These houses have a fresh lease of 99 years. This public housing scheme was introduced in 2001 to offer potential homebuyers more flexibility in choosing the location of their new homes.

Interested buyers can ballot to book a BTO unit in any of the designated launch sites, which are typically announced once every three months, usually in February, May, August, and November.

Construction would only proceed if about 65% to 70% of the units have been booked. And for BTO flats located in mature or popular estates, balloting can be a disheartening process for homeowners who don’t get a favourable queue number.

Resale HDB vs BTO: 6 factors to consider before buying a home

1. Eligibility

To begin, you first have to assess your eligibility for either a BTO or resale flat. Here are the eligibility criteria:

| Resale HDB | BTO | |

| Citizenship | At least one applicant is a Singapore Citizen or PR. Households can be made up of only PRs. | At least one applicant is a Singapore Citizen. Households should have at least one Singapore Citizen and one Singapore PR. |

| Family Nucleus | Eligible family nucleus; married couple, or singles aged 35 and above | Eligible family nucleus; married couple, soon-to-be married couple |

| Income Ceiling | NA | $14,000 (prevailing) $21,000 if buying with extended/multi-gen family |

| Private Property Ownership | No restrictions on private property ownership. But resale flat buyers must dispose of their current property (if any) within 6 months from the date of their key collection. | Must not own or have interest in a private property and have not disposed of any in the last 30 months. |

Read these articles to understand the eligibility schemes for resale HDB and BTO flats, and the housing grants available for potential buyers.

2. Budget

BTO flats are subsidised public housing, hence the income ceilings. While they are typically cheaper when you look at the price tag, it may be a different case when you calculate the amount you are paying per square foot.

Older resale flats tend to be larger: A 4-room BTO these days is about 90sqm, while an older resale flat could measure up to over 110sqm. That is about 20 square metres of extra space spread over the same number of rooms. From this approach, resale flats may average out to be cheaper when viewed from a price per square foot angle.

3. Time and tenure

If you need to have your own space as soon as possible, BTOs are not ideal, given their infamously long completion times. Throw COVID into the mix and TOPs have seen repeated further delays in the past two years. These days, a BTO project can take up to five years or more to acquire TOP, while you can move into a resale unit within just months of transacting.

But while resale flats allow you to move in much quicker, they tend to have shorter remaining lease tenures, with some having even less than 40 years, which may make it tricky to get housing loans from banks. In contrast, BTO flats have a fresh, 99-year lease. And when resold right after it has reached MOP, it still carries a relatively longer remaining lease tenure of at least 94 years. Or if it’s an HDB flat under the Prime Location Public Housing (PLH) model, 89 years.

Read this to find out more about lease tenure and housing loans.

4. Renovation costs

When you own a home, you will want to tailor it according to your lifestyle needs. You may already have a rough idea of how you would like your home to look like, or maybe even have a detailed design scheme in mind. The question is: Which one would be easier to work with?

A BTO flat is akin to a blank canvas you can paint with your own style and colours. It’s also brand new and may require lesser work to be done. At the very least, it may not require as much hacking work compared to a resale flat that’s in poor condition.

Also, the resale HDB may have also been renovated in a style that doesn’t match yours, thus requiring a complete overhaul that may be more costly.

But it would still depend on your personal preference. Even if the older resale flat is not in the best condition or not designed in the way you like, you may still opt to not renovate the space for whatever reason.

On the other hand, you may also decide to change the whole layout of your HDB flat and proceed to hack your walls and floors to really bring your vision to life.

There are many circumstances that may or may not affect the renovation costs, so we highly recommend speaking to a skilled Interior Designer who can better advise you on what you should do next based on your needs and, more importantly, budget.

5. Location, location, location

There are three important things about property. The first is location.

The second… is also location.

And the third… Well, you should know what it is by now: Location.

If you are a foodie who needs to be surrounded by good eateries, hawker centres, or cafes. Or you desperately need to be near your parents for childcare purposes. Or if you need to shorten your commute to work…

You can find resale flats for sale on our website or on our free mobile app!

You can cast a wider net for your home search and likely find a resale flat that caters to the above requirements. As BTOs have fixed locations, you may find it harder to find one that’s in your favoured area if the latest launch doesn’t cover it. But it could also be possible that there are little to no resale listings in the area that you’re looking at.

With a resale HDB flat, you would also be able to avoid having to go through the frustration of the BTO balloting process that may or may not be in your favour.

While more and more new BTOs in non-mature estates like Punggol or Sengkang are now ringed by abundant amenities, they are still in less accessible locations and you may need to switch trains, buses, or even require a combination of both to get to your destinations. This may be a deal breaker for homeowners who aren’t natural early birds or who are averse to the idea of having to take multiple modes of transport just to get to work.

6. Exit strategy

Do you intend to raise your children in your flat? Or do you plan on cashing out to reap a profit when your flat reaches its MOP?

Perhaps you are planning to upgrade to a new launch private apartment or an executive condo?

Having a general plan in mind can help you make a prudent choice for your new home.

A BTO with a fresh 99-year lease is more ideal for raising a family, and can usually sell quite easily upon reaching its MOP, given that they have more years left on their lease than their resale counterparts. Unless you are holding on to a relatively new resale unit in a popular location, a BTO has greater potential for capital growth than a resale flat.

As with any property transaction, the decision is yours to make as to whether you should buy a resale HDB flat vs BTO flat. Our aim is to give you the information you need to make that decision, covering all the bases, so your home purchase fits your needs, preferences, and future goals. With that…

Here’s a summary of the pros and cons of buying a resale HDB vs BTO flat:

| Factors | Resale HDB | BTO |

| Price | Higher quantum, negotiable and may be more worth it per square foot | Lower quantum, non-negotiable |

| Renovation | Relatively higher cost, depending on the condition of the flat | Relative lower cost, but still dependent on your personal preference |

| Space | Larger | Smaller |

| Tenure | Very likely less than 99 years | 99 years |

| Location | Listings may not be available in the area | Can be chosen specifically |

| Wait Time | Within months | May take a few years |

Should you buy or sell a property now?

Everyone’s situation is different, so the answer to this varies. To find out whether it IS a good time for you to start a property journey, drop us a message on WhatsApp to reach any of our Super Agents. Empowered by proprietary technology and years of experience under their belt, they will be able to provide strategic advice on your next steps. You can also chat with us via our Live Chat at the bottom, right-hand corner of the screen.

Not ready to speak to an agent? Find out how much you can afford for your next home purchase with Homer AI

Click the image below to get started.