Ohmyhome helps you maximize your returns on your property with expert advice and negotiation. Plus, at a low 1% commission fee, you get to keep more profits in your pocket.

65% of HDBs and condos sold in a month.

That’s why we sold HDBs and condos above market price.

Get expert advice with 1% commission, more profit.

All services provided are complementary.

How to Appeal to Sell Your HDB Resale Flat Before MOP?

Anyone who owns a home already knows that you’re not allowed to sell your resale flat before you’ve reached your MOP HDB. But there are certain circumstances, like going through a divorce or avoiding bankruptcy, that necessitate selling your HDB flat before the typical 5-year MOP is up. Here’s how you can appeal to HDB for an early MOP sale.

When can I appeal to sell my HDB before MOP?

In the event of divorce, bankruptcy, or loss of citizenship, you may be able to appeal to HDB about selling your home before its MOP.

#1: Divorce and transference of ownership

Divorce is one of the most common reasons why homeowners have to sell their flat before reaching the MOP. While it may be realistic for one or both owners to hold onto flat ownership until it has been fulfilled, selling the resale flat is often preferred so both parties can have closure.

Lawyers will typically encourage one party to take over ownership of the flat if they are financially capable of doing so and eligible for ownership under the Single Singapore Citizen Scheme. However, should you ultimately decide to surrender the flat to HDB, you may submit an appeal to the board with the relevant documents via HDB’s e-Feedback form for approval. This includes:

- An Order of Court (if applicable)

- One of the following:

- Writ for Judicial Separation (previously known as the Deed of Separation)

- Divorce Certificate for Muslims

- Interim Judgement and Certificate of Making Interim Judgement Final (previously known as Decree Nisi and Decree Nisi Absolute respectively)

All documents are required to be accompanied by an official English translation if they are not written in one of Singapore’s four official languages (English, Mandarin Chinese, Malay and Tamil).

It is also advisable for both parties to reach an agreement on how to best divvy up the profits or losses before deciding to sell.

#2: Avoiding bankruptcy

Bankruptcy includes instances when a household’s sole breadwinner becomes incapable of work in the event of accident, death, and other related reasons.

However, this also depends on whether or not HDB deems the remaining members of the family capable of working to provide sufficient funds to keep the household afloat.

That said, if you can avoid declaring bankruptcy by selling your flat and right-sizing to a less expensive one, you may submit the relevant documents proving your current financial status to HDB’s appeal portal.

#3: Renouncement or loss of citizenship

Non-Singapore citizens are not eligible to purchase any HDB flat — be it BTO or resale — unless they apply under the non-resident spouse scheme.

Therefore, if all homeowners decide to renounce their Singapore Citizenship and/or SPR status to permanently move overseas, HDB may allow you to sell your house and return all your CPF monies to you.

How can I increase my chances of selling my HDB before MOP?

While MOP waivers are usually given out on a case-by-case basis at HDB’s own discretion, there’s no shortage of evidence out there to show that HDB has been flexible and understanding towards households that are undergoing exceptional circumstances.

Officially, HDB has approved the sale of 5,000 pre-MOP flats between the years 2015 to 2020 for reasons that include financial hardship, divorce, or demise of the owner.

So while there is no surefire way to guarantee that you will receive a MOP waiver, make sure that you have all your documents in order, conduct regular follow-ups, and be clear on the reasons why you need to sell your flat when writing your appeal.

How to submit my HDB appeal to sell my resale flat before MOP

That said, these HDB appeals are handled on a case-by-case basis. You may either:

- Visit the HDB branch office to submit your appeal

- Apply online by logging into the My HDBPage: Log in via SingPass > My Flat > Purchased Flat > Flat Details.

Once you’ve clicked on Flat Details, you should be able to find the contact details of the estate manager who is in charge of your block. You can draft a letter explaining why you intend to sell your flat before MOP and mail it to that address.

Additionally, you can speed up the process by reaching out to your MP. Ultimately, though, it is HDB’s call to make. So may the odds be ever in your favour.

You don’t have to handle this by yourself, Ohmyhome Super Agents are here to help you appeal to HDB

Ohmyhome Super Agents have decades of experience under their belt and have assisted numerous homeowners through difficult situations when selling their HDB resale flat. You can get the same assistance from us if you need to sell due to divorce, bankruptcy, or loss of citizenship.

Drop us a message on WhatsApp to speak with one of our agents, or chat with us at the bottom, right-hand corner of the screen.

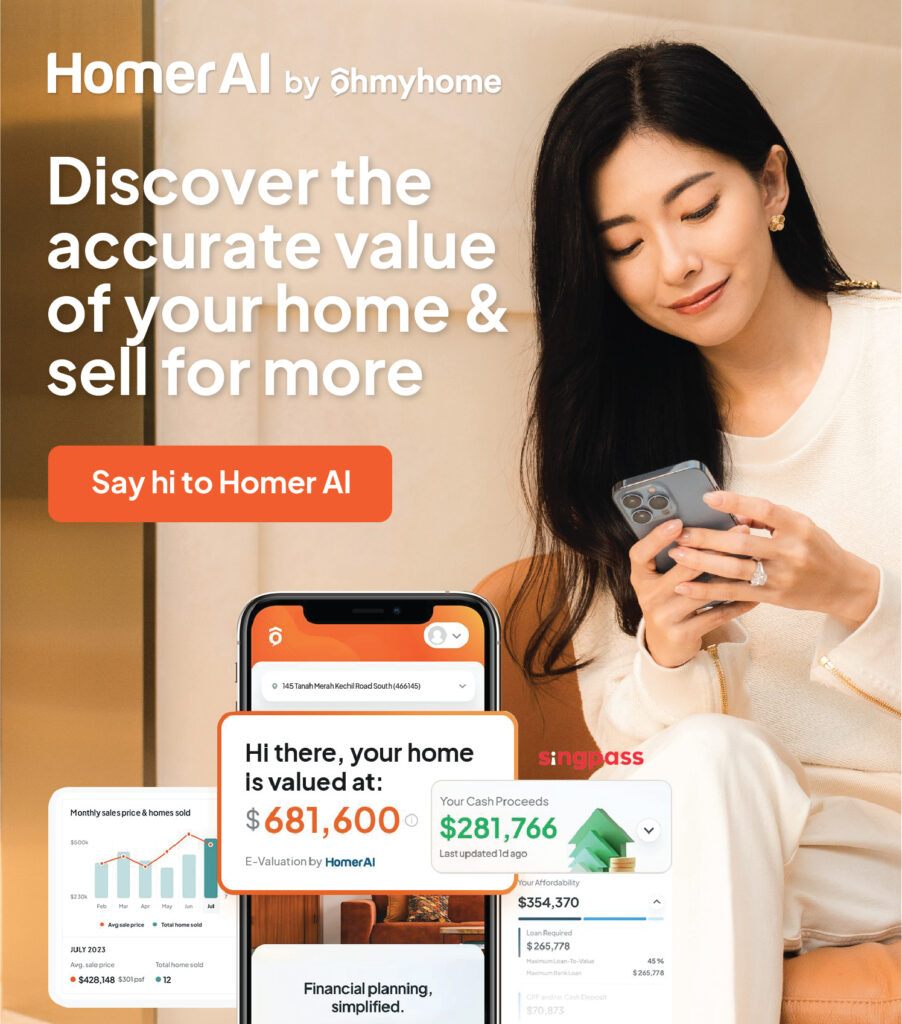

If you’re wondering how much you can sell your home for, check out Homer AI

Homer AI is our home ownership management & e-Valuation tool that will provide an accurate estimation of your home valuation that’s updated every month, so you can track if it increased, stayed the same, or decreased.

Homer AI can also help you:

- Estimate how high you can sell your home. With an accurate home valuation, you’ll know the exact market rate for your home and negotiate with confidence.

- Financially plan for your next dream home. How much do you actually get to keep? Do you have enough for your next home? Relax, leave the calculations to Homer AI.

- Stay updated on the property market. No more waking up to thousands of news articles about new cooling measures. Get it straight from one source.

Consult an expert for free!

Send us your details and we’ll be in touch within 15 min (daily 9am to 9pm GMT +8).

SELLING A HOME

Frequently Asked Questions

Got a question? We’ve got the answers. If you don’t see your question here, drop us a message. We’re happy to assist.

An HDB flat owner may change the flat ownership to his/her immediate family members such as spouse, parents, children, or siblings if it is due to reasons acceptable by HDB.

Proof of ownership in HDB (Housing & Development Board) typically includes documents such as the Certificate of Title or the Deed of Lease, which shows the ownership details of the flat.

Regrettably, according to HDB regulations, married couples must jointly purchase an HDB flat as a family nucleus.

Each flat can have up to 4 owners. If there’s more than one proposed owner, they need to decide how they’ll share ownership when ownership changes: either joint tenancy or tenancy-in-common.

One spouse might agree to transfer their share of the flat to the other, so the other can keep the flat.