This article is provided by eToro, a leader in the global Fintech revolution since it was founded in 2007. It is the world’s leading social trading platform, with millions of registered users and an array of innovative trading and investment tools. Visit eToro to learn more.

Singapore’s global real estate investment rises as China’s influence in housing markets abroad weakens. In recent years, Singapore’s real estate industry has relied on strong and effective government policies to achieve rapid and sustainable development. This has attracted a large number of relevant investors, many of whom are international. Yet, there is a threshold for investing in real estate: as first time home buyers hold back once they ask themselves, “Can I afford the price of a property?”

You’re not alone. Having the right amount of money to purchase a property for investment is not easy for many, and risky for some. However, there is another great investment opportunity in the realm of housing: real estate stocks.

Real estate stocks provide the best of both worlds as they can be a more affordable option for those who lack the capital to buy a piece of property and could be a lower-risk alternative to owning your own property. But, how does one buy real estate stocks? If you are looking for an easy, user-friendly platform to lead you inside the door of trading and investing, eToro is the answer. Their user-friendly interface makes trading as simple and as interesting as using Facebook and is just as welcoming to all types of users, from beginners to experts. Trading and investing don’t necessarily need to be intimidating or overly complicated. On eToro, you can easily find comprehensive stats, easy-to-follow charts, and in-depth financial analysis.

eToro’s Global Community

The best part about eToro? You’ll never trade alone, but rather, leverage the wisdom of millions of traders and investors worldwide. Their cutting-edge online platform offers you the ability to talk directly with hundreds of “rock star” traders or Popular Investors, and gives eToro community members the ability to copy their trading portfolios with just a few simple steps. Find your favourite Popular Investor, click on the “Copy” button, choose your “Stop Loss” setting, and start copying!

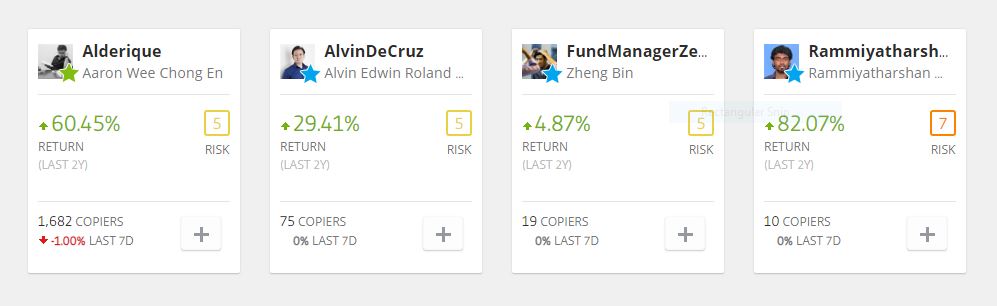

Worried about being misled? Fret not! To have the honourable title of a trusted Popular Investor on eToro, all traders and investors need to meet certain stringent standards on their equity, copier numbers, and AUM. After joining the program, each Popular Investor on eToro has their specs presented on their profile with full transparency, including their Risk Score, earnings, transaction records, portfolio, and much more. This is incredibly helpful for other clients to understand the trading and investing history of each investor, and also gain a better sense of each Popular Investor’s personal money managing philosophy. Now on eToro, you can find over 539 Popular Investors from all over the world, and you can choose to copy as many as you like in order to diversify your portfolio as much as you want. Below are four responsible Popular Investors from Singapore.

Data as of 15/02/ 2019. Past performance is not an indicator of future results. This is not an investment advice.

Singapore’s Investment Influence

It’s an exciting time to start investing. As regulators take drastic measures against capital outflows, the number of Chinese investors’ participation in real estate investment has plummeted, according to major US news outlets. With this in mind, Singapore is single-handedly replacing China as the largest Asian investor of commercial real estate in the United States, and that means more opportunity for you to invest.

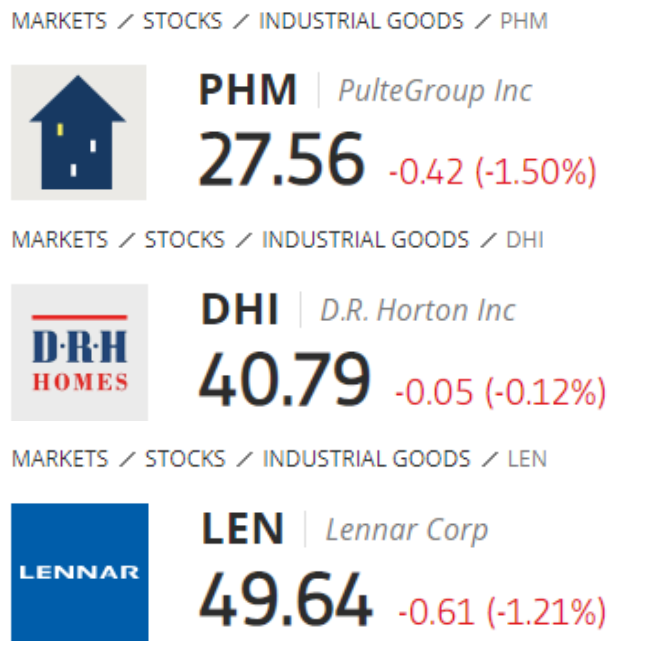

If you’re not yet ready to purchase a property in the US, how about checking on the stock market performance of those real estate giants that are doing so? On eToro, you can find renowned US home construction companies, including PulteGroup, D.R.Horton and Lennar Corporation.

Data as of 15/02/ 2019. Past performance is not an indicator of future results. This is not an investment advice.

eToro: More than Just Real Estate

Due to the influence of supply and demand, international policies, and interest rates, housing prices are constantly fluctuating, influenced by market signals. If you foresee a sell-off market for the real estate industry, you can not only sell your home assets, but you can also go short on real estate stocks to gain profits. Win-win!

Aside from US housing giants in the stock market, Country Garden, listed on the Hong Kong Stock Exchange, is also available for traders and investors on eToro, as well as reigning tech giants such as Apple, Amazon, Spotify, and more! In fact, in addition to more than 1,000 stocks, you can also trade and invest in currencies, ETFs, commodities, global indices, and even cryptocurrencies to diversify your personal portfolio and control risk. Even if you’re a beginner, with eToro, you can learn how to trade and invest like a seasoned professional with the help of their global community and Popular Investors.

Visit eToro to learn more!

This content is provided for information and educational purposes only and should not be considered to be investment advice or recommendation. Past performance is not an indication of future results. All trading involves risk. Cryptocurrencies are a highly volatile investment product. Your capital is at risk.