If you have exercised the Option to Purchase (OTP), submitted your resale application and received the HDB resale approval, congratulations on finding your dream home! After the eventful weeks or months of finding your home, you are now at the final lap of completing your purchase.

Contents:

- Let's have a brief recap of the 9 steps in buying your home:

- HDB resale completion appointment: 6 frequently asked questions

- 1. Who must attend the resale appointment?

- 2. When does the completion appointment happen?

- 3. What happens during the resale completion appointment?

- 4. Can you start occupying your new home on the completion appointment date?

- 5. What are the charges that must be paid by the sellers by the completion appointment date?

- 6. What are the charges that I need to pay on the resale completion date?

- Still looking for an HDB or private property?

Let’s have a brief recap of the 9 steps in buying your home:

- Register Intent to Buy– at this stage, home searching and negotiation with the Seller happen.

- Get the OTP from the Seller– after successful negotiations, you make an offer. Once the Seller accepts it, you pay the option fee and within the option period of 21 days, you exercise the OTP and pay the exercise fee.

- Choose your mode of financing your flat– whether it is through HDB Loan or Bank Loan.

- Submit a ‘Request for Value’– a buyer who is financing the purchase of the flat with CPF savings or a housing loan from HDB or bank/financial institution must submit a ‘Request for Value’ to HDB to determine the value of the flat which forms the basis for CPF usage and/or the reference for a housing loan from HDB or bank/financial institution.

- Submit the Resale Application– you need to agree with the seller on the resale application date, you and the seller will submit it separately, but the second party must submit it within 1 week from the first party’s submission.

- Endorse your Resale Documents– you will receive an SMS notification within 10 working days after your resale application. You need to accept the terms and conditions within 6 days of receiving the SMS.

- Pay the Resale Application Fees Online– both you and the seller are required to pay an administrative fee, which is non-refundable payable by credit card.

- Receive the Approval of Resale Application– you will receive an SMS and email notifying you of HDB’s approval of the resale transaction.

- Attend Resale Completion Appointment– this concludes your home buying journey.

You are about to complete these steps, but you may have a few questions in mind. Here are the answers to the common questions home buyers asked about HDB resale completion appointment.

HDB resale completion appointment: 6 frequently asked questions

1. Who must attend the resale appointment?

Both you and the sellers are required to attend the resale completion appointment at HDB. You will need to be present if you have engaged HDB’s solicitor to act for you.

But, what if you cannot attend the scheduled completion appointment? You need to contact your Customer Relations Manager (CRM), who will advise you accordingly which can be found on the HDB Resale Portal. If you have engaged your private solicitors to act for you, your solicitor representative can attend the resale completion appointment on your behalf.

2. When does the completion appointment happen?

The Completion Date is scheduled at about 8 weeks after the HDB’s acceptance of your resale application. You will be notified via SMS about the actual date and time of your resale completion appointment at HDB Hub, once it is scheduled. You can also check the appointment details from the HDB Resale Portal.

3. What happens during the resale completion appointment?

All Legal documents which require physical signatures will be signed by you and the sellers at the completion appointment.

The completion appointment is for the HDB to witness 3 things:

- The signing of the transfer document by the seller of the resale flat

- The signing of the mortgage document/ agreement by you (if you are taking an HDB housing loan)

- The handing over of the keys from the seller to you (or to your lawyer if you took a bank loan and engaged the bank’s lawyer to act for the purchase) after

4. Can you start occupying your new home on the completion appointment date?

Definitely! During the completion appointment, you confirm that the flat has been vacated and the conditions are acceptable.

Eight weeks from the resale flat application up to the completion appointment must be sufficient for the sellers to prepare the flat. That’s why it is important to agree with the seller on the date of resale application because after your purchase of the resale flat is legally completed, the seller is required to move out. During your completion appointment, you can immediately start making beautiful memories in your new home sweet home. The wait is over!

However, sellers can arrange with you for a temporary extension of stay of up to 3 months after the legal completion of the resale transaction, if they are unable to move out immediately.

5. What are the charges that must be paid by the sellers by the completion appointment date?

Service and Conservancy Charges

The sellers have to pay the service and conservancy charges up to this day of resale completion. This means that even if you the resale application has been approved a month ago, the sellers are still the ones who need to pay for the S & C charges. It is only during this completion appointment that the deal will be sealed, which means you are now the legal owner of the property.

Property Tax

As for property tax, the sellers are required to pay up to the end of the year

6. What are the charges that I need to pay on the resale completion date?

Balance of the Purchase Price

If you are taking an HDB housing loan, you must pay the balance of the purchase price of the flat on this day.

Outstanding Stamp Duty

You are required to pay Buyer’s Stamp Duty (BSD) for documents executed for the sale and purchase of the property. BSD will be computed on the purchase price as stated in the document to be stamped or market value of the property (whichever is the higher amount).

You can print a copy of the payment advice on the HDB Resale Portal, and bring it along for payment (by Cashier’s Order and/or NETS) at the Payment Office, Level 3, HDB Hub, before you meet the Customer Relations Manager for the Resale Completion.

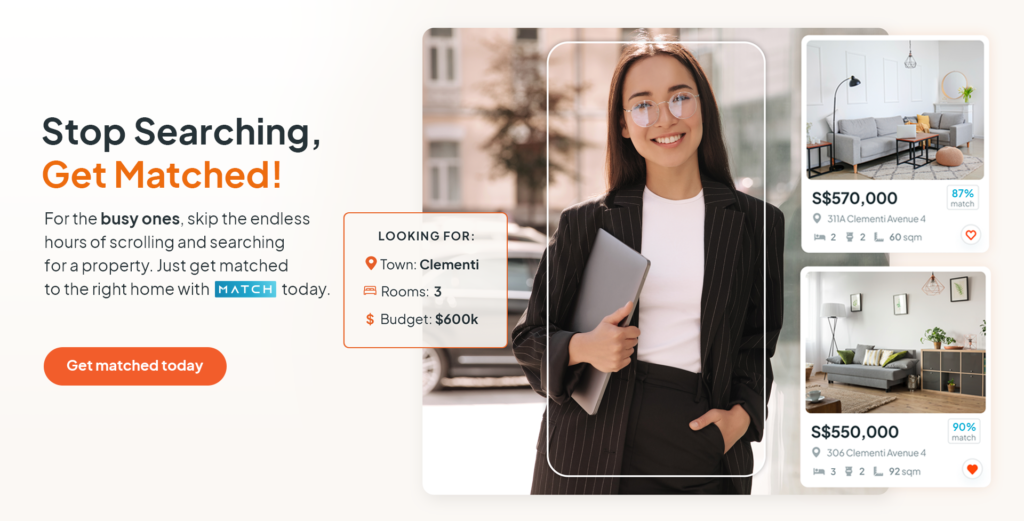

Still looking for an HDB or private property?

Here’s how you can speed up your home search

Let Ohmyhome’s smart data-matching technology MATCH you with the right home, according to your specific needs. Submit your preferences to us and our algorithm will filter all our available listings based on those, and we’ll WhatsApp them to you once we find a match. We’ll also send you relevant content that you can use for your research and inform your home-buying decision, so you no longer have to spend hours searching online for the information that you need. Because at Ohmyhome, we’re always by your side, always on your side.

You can also call us at 6886 9009 to secure an appointment with any of our Super Agents or message us in the chatbox at the bottom, right-hand corner of the screen. You can also WhatsApp us at 9755 1009!

Source: HDB