Nothing says ‘adulting’ faster than getting engaged and planning to move in together as a couple — or, shall we say, fiancé/fiancée? Lucky for you, in Singapore, it’s possible to apply for a matrimonial home with HDB before tying the knot. And isn’t a home the perfect cherry on top of a sweet ‘I do’?

Jump to each section:

- A quick overview of the HDB fiancé/fiancée scheme

- HDB fiancé/fiancée scheme eligibility criteria for resale HDB and BTO flats

- Financing your HDB: Can you afford to buy an HDB flat?

- Looking for your matrimonial home? Speed up your home search

- Want to talk to a property agent instead? Let us help you find your dream home

- Frequently asked questions on HDB Fiancé/Fiancée Scheme Eligibility and Grants

A quick overview of the HDB fiancé/fiancée scheme

| What is the Fiance/Fiancee Scheme? | HDB allows you to purchase an HDB flat with your partner as a family nucleus before marriage. |

| Who is this for? | Those in committed relationships and have plans to tie the knot soon. |

| Eligibility Conditions: | At least 21 years and above Singapore CitizenshipProof of marriage after key collection |

| Available Grants: | Enhanced CPF Housing Grant (EHG) Family GrantProximity Housing Grant (PHG) Half-Housing Grant |

If you’re newly engaged or are thinking about proposing to your partner, this one is for you: HDB’s Fiancé/Fiancée Scheme allows you to apply for your first matrimonial home before getting married.

HDB fiancé/fiancée scheme eligibility criteria for resale HDB and BTO flats

| Eligibility Criteria | HDB BTO | HDB Resale |

| Age | 21 years old and above | 21 years old and above If below the age of 18, a Special Marriage Licence from the Ministry of Social and Family Development is required for verification. |

| Citizenship | At least one owner must be a Singapore Citizen (SC). Your partner may be another SC or a Singapore Permanent Residents (SPR). | SC or SPR only. For SPR couples, the scheme also applies if you’re buying a resale flat; the only stipulation is that you must have held your SPR status for at least 3 years to be eligible. |

| EIP & SPR Quota | Couples must declare their racial group upon application. HDB will reflect the flats available for selection according to the available ethnic quota. SPR quota is not applicable for BTO application. | Couples must also meet the Ethnic Integration Policy (EIP) and SPR quota for the block or neighbourhood when submitting the HDB resale flat application. |

| Income Ceiling(Average Gross Monthly Household Income) | – 3-room flat: $7,000 or $14,000 (dependent on project) – 4- and 5-room flats: $14,000 – Extended & multi-generation (3Gen): $21,000 | No income ceiling to apply for a resale flat. |

| Family Nucleus | Your fiancé or fiancée must be listed in the application as either a co-applicant (if 21 years old or above) or an occupant. | |

| Property Ownership | – Must not own other property overseas or private properties locally – Have not sold any private properties (local or overseas) within the last 30 months – Cannot invest in or purchase any other property from the date of the flat application until after the 5-year Minimum Occupation Period (MOP) – Must not have bought an HDB/DBSS flat or EC, or bought only one of those properties before | If you own other HDB or private properties (local or overseas), you must sell them within six months of the key collection of the resale flat purchase. |

Other special conditions

Condition #1: HDB needs your parents’ consent to purchase a flat

If you or your fiancé/fiancée are between the ages of 18 and 21, his or her parents must agree to the purchase of the HDB flat.

Also, if you or your fiancé/fiancée are below the age of 18, a Special Marriage Licence is required for verification.

Condition #2: You and your fiancé/fiancée must solemnise your marriage within 3 months from the resale completion date

The solemnisation can be with the Registry of Civil Marriages or Registry of Muslim Marriages.

But if your marriage is registered overseas, you need to submit a photocopy of your marriage certificate to HDB within 3 months from the resale completion date.

Condition #3: Divorcees are required to produce three types of documents

If you or your fiancé/fiancée are divorcees, you must submit these three documents to HDB for verification: Final Judgment (otherwise referred to as Decree Nisi Absolute), Interim Judgment (or Decree Nisi), and Order of Court.

Financing your HDB: Can you afford to buy an HDB flat?

Planning for a marriage is all well and good until you realise you can’t afford the home you’ve been dreaming of sharing with your soon-to-be spouse. While that sucks, it doesn’t have to be a reality.

You can get a CPF housing grant to financially cushion your home purchase.

4 CPF housing grants under the HDB fiancé/fiancée scheme:

1. Enhanced CPF Housing Grant (EHG)

One of the CPF Housing Grants under the HDB Fiancé/Fiancée Scheme is the EHG, which is applicable for first-time homebuyers with an average gross monthly household income of up to $9,000.

You can get up to $80,000 in grants, depending on you and your fiancé/fiancée’s combined income.

To be eligible for the EHG, either you or your spouse/ fiancé(e) must have worked continuously for the past 12 months prior to the resale application and must still be working at the time you submitted the resale application.

2. Proximity Housing Grant (PHG)

Speaking of which, the PHG encourages Singaporean families to live near or with their parents.

You can get up to $20,000 in grants if your purchased flat is within 4 km of your parents’ home.

3. Family Grant

The Family Grant assists homebuyers who are married or engaged couples with a combined income ceiling of $14,000 (and not any higher).

You can get $50,000 in housing grants if you qualify, or up to $160,000 if you also qualify for the EHG and PHG.

4. Half-housing Grant

The Half-housing Grant is applicable for eligible first-timer applicants whose fiancé/fiancée had previously received a housing subsidy. This means they have either previously taken a Singles Grant; bought a 2-room BTO flat as a single; or received a family grant under another family nucleus to purchase a flat before.

You can get $25,000 in grants for a 2- to -4-room flat or $20,000 for a 5-room (or bigger) flat.

However, the CPF housing grants depend on a range of factors. So be sure to double-check with HDB if you truly qualify. Better yet, engage Ohmyhome Super Agents to do the research for you.

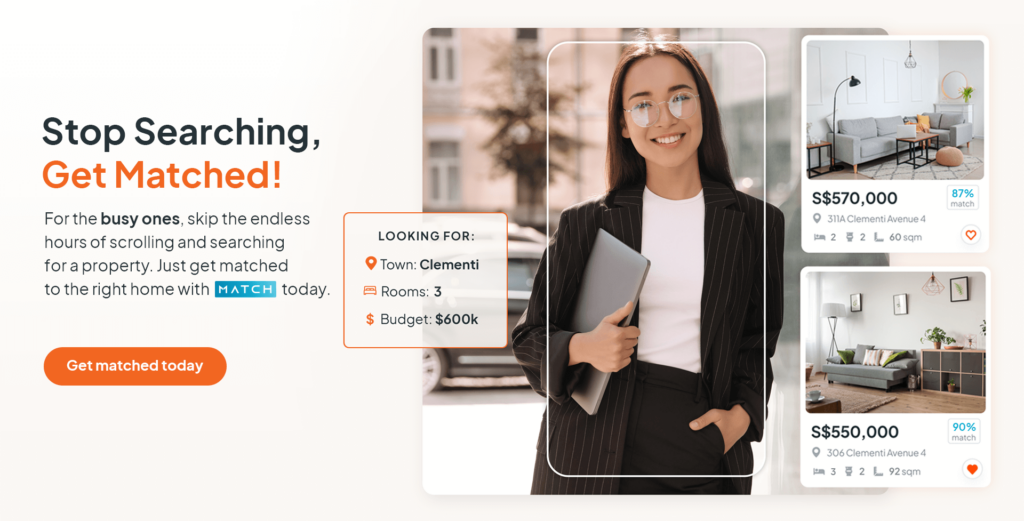

Looking for your matrimonial home? Speed up your home search

Finding the right person to spend the rest of your life with can be just as difficult as finding the right home. Let Ohmyhome’s smart data-matching technology MATCH you with the right home, according to your specific needs. Submit your preferences to us and our algorithm will filter all our available listings based on those, and we’ll WhatsApp them to you once we find a match. We’ll also send you relevant content that you can use for your research and inform your home buying decision, so you no longer have to spend hours searching online for the information that you need.

Want to talk to a property agent instead? Let us help you find your dream home

Speak to any of our property agents for free! Simply drop us a message on WhatsApp or our Live Chat at the bottom, right-hand of the screen.

Frequently asked questions on HDB Fiancé/Fiancée Scheme Eligibility and Grants

What is the Financé/Fiancée scheme?

HDB’s Fiancé/Fiancée Scheme allows you to apply for your first matrimonial home before getting married. But you must solemnise your marriage within 3 months from the date of key collection.

Who is eligible for the HDB grant?

Singapore Citizens (SC) and Singapore Permanent Residents (SPR) with at least another Singapore Citizen can apply for four types of CPF grants under HDB’s Fiancé/Fiancée Scheme. They include the Enhanced CPF Housing Grant (EHG), Proximity Housing Grant (PHG), Family Grant, and Half-housing Grant.

Can a married couple own 2 HDB flats?

A married couple cannot own two flats at the same time. HDB will consider you to be one entity and thus, you can jointly own only one flat as a family nucleus. If either of you owned an HDB flat before you were married, you need to relinquish ownership of that flat upon marriage.

Can a married Singaporean buy an HDB flat alone?

A married person cannot buy an HDB flat under his or her name alone. The spouse must either be a co-owner or an occupant of the flat.