The Singapore Budget 2024 speech by Deputy Prime Minister Lawrence Wong on 16 Feb 2024 included a significant change to property taxes, ABSD remissions, and vouchers for BTO applicants.

Here’s all you need to know about Singapore Budget 2024 if you own a home:

#1: Potentially lower property tax in 2025

As DPM Lawrence Wong highlighted in his Budget 2024 speech last week, market rents have increased from 2022 onwards due to stronger demand and Covid-related supply-demand constraints. This has caused tax rates to rise even for lower-value homes.

Starting next year, there will be revisions to the tax rates for the AV bands of owner-occupied residential properties. This adjustment aims to maintain the equitable distribution of tax burden, with owners of high-end properties bearing the majority of the load, while the rest of Singaporeans pay the same or potentially reduced property tax rates.

Some homeowners will pay less property tax when the annual value (AV) bands for owner-occupied properties are raised next year

This is assuming there is no change in their AV and before any rebate.

| Marginal Property Tax Rate | Portion of AV from 1 Jan 2024 to 31 Dec 2024 | Portion of AV from 1 Jan 2025 |

| 0% | $0 – $8,000 | $0 – $12,000 |

| 4% | > $8,000 – $30,000 | > $12,000 – $40,000 |

| 6% | > $30,000 – $40,000 | > $40,000 – $50,000 |

| 10% | > $40,000 – $55,000 | > $50,000 – $75,000 |

| 14% | > $55,000 – $70,000 | > $75,000 – $85,000 |

| 20% | > $70,000 – $85,000 | > $85,000 – $100,000 |

| 26% | > $85,000 – $100,000 | > $100,000 – $140,000 |

| 32% | > $100,000 | > $140,000 |

From Jan 1, 2025, the lowest AV band threshold will be raised from $8,000 to $12,000. The highest threshold will increase from over $100,000 to over $140,000. Corresponding adjustments will be made to bands in between.

This means homeowners can expect to pay the same or lower property taxes at each band, assuming there is no change in their AVs and before any rebate.

Get an exclusive copy of our 2023 Singapore Property Market Review!

Simply click the image below to download the review for an in-depth analysis of the trends, challenges, and opportunities that defined the past year.

#2: 24-month interest-free instalment plan for retirees

To better support retirees living in high-end homes who may have inherited the property from their parents or grandparents, which could have seen significant appreciation in the past few years, IRAS will be offering a 24-month interest-free instalment plan for which they can apply, as long as the following criteria are met:

- All owners of the property are 65 years old and above

- The applicant must be an owner-occupier of the property (e.g. living in the property they own)

- The applicant’s Assessable Income must not exceed $34,000, based on the latest tax assessment available

Eligible retirees can apply for the EGS Residential Property (Retirees) via myTax Portal from 19 Feb 2024 onwards.

#3: ABSD remissions for single Singaporeans

Married couples have been eligible for an Additional Buyers’ Stamp Duty (ABSD) remission; if one spouse is Singaporean and they sell their previous property within 6 months of buying a new one. This concession will now extend to single Singaporeans aged 55 and above as long as the following conditions are met:

- ABSD has been paid on the replacement property.

- Each first property is solely owned by a single Singapore citizen (SC) aged 55 and above, or with single SCs aged 55 and above who are immediate family members*.

- The owners of each first property need to be the owners of the replacement property. Any additional owners purchasing the replacement property with the owners of each first property must also be single SCs aged 55 and above who are immediate family members. There should be no change of ownership in the replacement RP at the time of the sale of each first property.

- The buyer(s) do not own more than one property each at the point of purchasing the replacement property, and have not purchased or acquired any other property since the purchase of the replacement property.

- The value of the replacement property is less than the value of each of the first property sold.**

- The buyer(s) dispose of the first property (whether co-owned or separately owned) within six months after the date of purchase of a completed property, or the issue date of the TOP or CSC of an uncompleted property, whichever is earlier.

- The application for the refund of ABSD is made within six months after the date of sale of the first property.

* Immediate family members refer to one’s parent, child, or sibling.

** The value refers to the higher of the purchase price or market value of the property purchased/sold. The value of the replacement RP is that as at the date of purchase of the replacement property, while the value of the first RP is that as at the date of sale of the first RP.

#4: One-off rental vouchers for families waiting for their BTO flat to be completed

Families under the Parenthood Provisional Housing Scheme (PPHS) will get a one-time rental voucher to offset their rental, for any HDB flat in the open market, while waiting for their BTO flat. The amount has not been revealed yet.

Recap on Singapore Budget 2023 for homeowners:

- First-timer families applying for a BTO get an additional ballot

- First-timer families buying resale flats get increased CPF Housing Grant

- $30,000 for 4-room flats and smaller

- $10,000 – 5-room flats and bigger

- Together with the Enhanced CPF Housing Grant and the Proximity Housing Grant, eligible families can receive up to $190,000 in grants when buying a resale flat.

Should you sell and buy a property in 2024?

Everyone’s situation is different, so the answer to this varies. To find out whether it IS a good time for you to start a property journey, drop us a message on WhatsApp to reach any of our Super Agents. Empowered by proprietary technology and years of experience under their belt, they will be able to provide strategic advice on your next steps. You can also chat with us via our Live Chat at the bottom, right-hand corner of the screen.

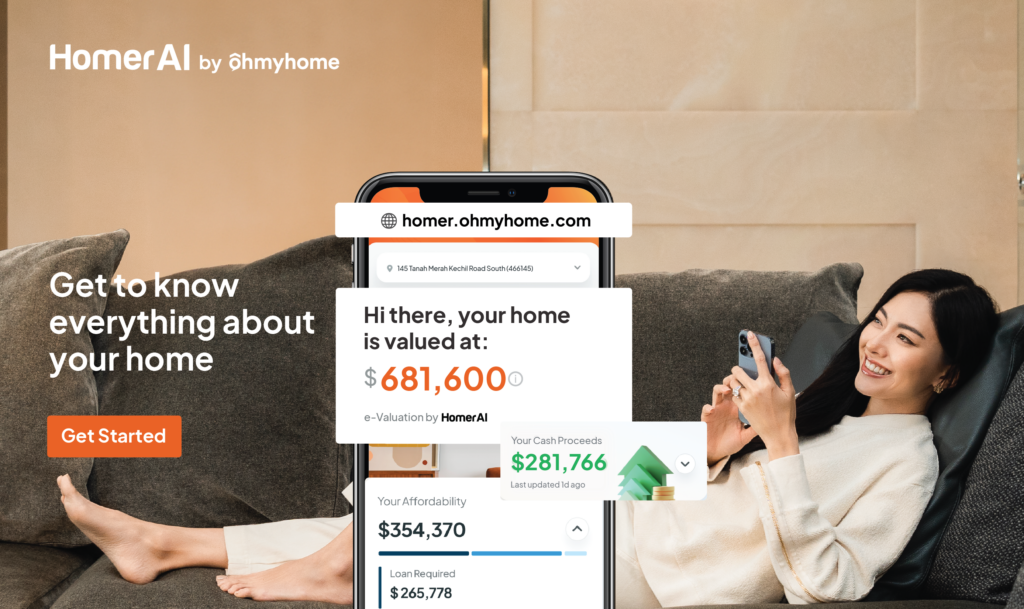

Not ready to talk to an agent? Stay updated on your property valuation and recent transactions near you with Homer AI

Homer AI is our home ownership management & e-Valuation tool that will provide an accurate estimation of your home valuation that’s updated every month, so you can track if it increased, stayed the same, or decreased.

Homer AI can also help you:

- Estimate how high you can sell your home. With an accurate home valuation, you’ll know the exact market rate for your home and negotiate with confidence.

- Financially plan for your next dream home. How much do you actually get to keep? Do you have enough for your next home? Relax, leave the calculations to Homer AI.

- Stay updated on the property market. No more waking up to thousands of news articles about new cooling measures. Get it straight from one source.