When selling a HDB flat, there are two main numbers that both sellers and buyers must consider: the selling price and home valuation. When your home valuation increases, chances are that you can set a higher selling price and potentially earn more from your home sale.

To give you a recap, the HDB valuation is an assessment of the worth of your resale flat — remember: you can only sell your home after 5 years — and is typically based on the past transactions of similar-sized units in the same block or within the surrounding area.

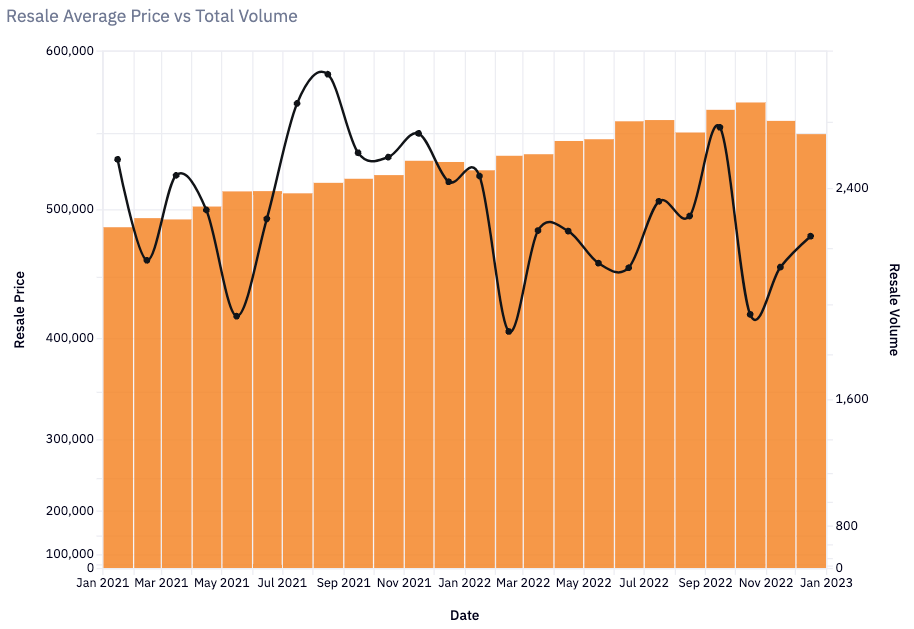

Now, with property prices rising all over the island, your HDB resale flat may also see an increase in its home valuation. Let’s give you some data to consider.

As you can see from the table below, the average price of HDB resale flats has gone up to $549,382 in 2022 from a previous $486,903 in 2022. That’s a 13% increase in one year, amid new cooling measures launched in December 2021 and rapidly rising interest rates.

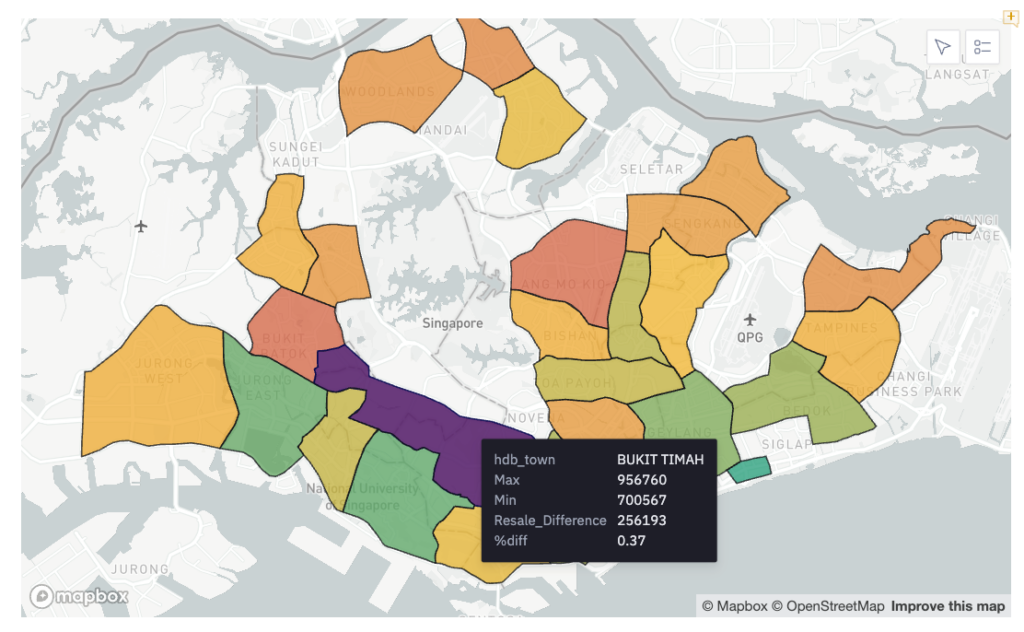

If you also look at the heatmap below, you’ll see towns such as Bukit Timah, Ang Mo Kio, and Bukit Batok (highlighted in red and orange) have shown the highest price growth from 2021 to 2022. In Bukit Timah, the average price of HDB resale flats grew by 37%, while Ang Mo Kio and Bukit Batok rose about 30%.

So with your home valuation potentially increasing in tandem with property prices in your area, you can sell your flat at a higher price.

But you may be wondering: “How can I track the exact value of my home?”

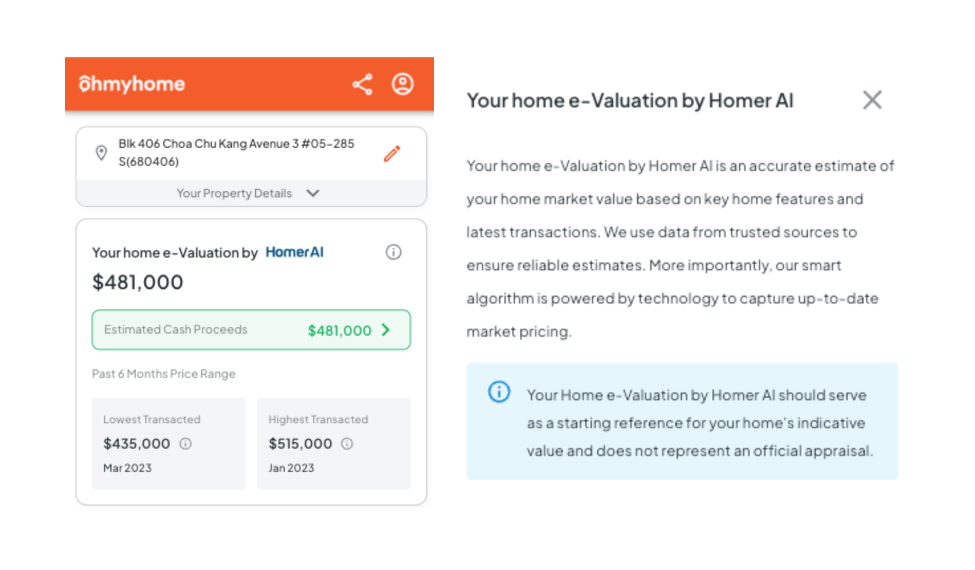

Say Hi to Homer AI

Homer is your next-generation Home Ownership & e-Valuation Report AI tool built by Ohmyhome, trained to provide you with only the most crucial insights on your home, including your home valuation!

But that’s not all. With Homer, you can also track your cash proceeds as your home valuation increases!

Finally, you won’t have to crunch the numbers yourself. Watch the step-by-step tutorial video below on what kind of numbers you need to input into the Cash Proceeds Calculator so you know the potential profits you can earn after your home sale.

Connect your home with Homer AI

If you own a HDB flat, met your 5-year MOP, and are thinking of selling your home, you can say hi to Homer AI right here. If you have any further questions, drop us a message on WhatsApp!