A property agent’s commission is not that cheap, though the market norm recently dropped from 2% to now 1%. But that’s still about a few thousand dollars. And if you’re buying a home, it’s on top of the property purchase price that should be a couple hundred dollars too, if not more.

While there are property agents who truly have your best interests at heart, there are still those who outrightly cheat their clients to get a higher commission or do some shady things that spoil the market.

Here are some real-life cases you can learn from and try to avoid when you embark on your own property transaction journey.

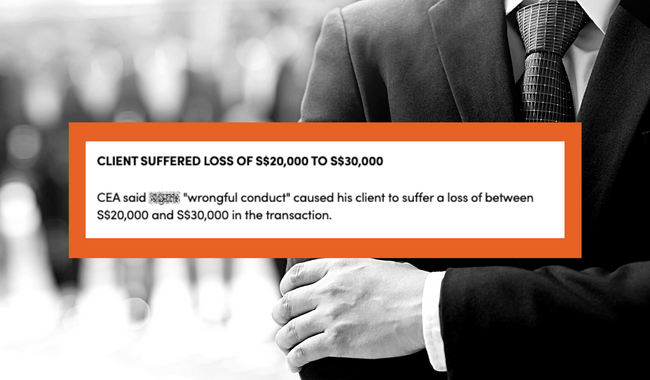

Case Scenario 1: Buyer suffered a $20,000-$30,000 loss due to property agent’s failed efforts at negotiating a higher commission for himself

Agent X acted behind his buyer-client’s back, making offers to the seller at a higher price than the client originally intended, higher even than the property’s estimated value, and negotiated with the seller and the seller’s agent for a higher co-broke commission, all without the client’s knowledge. And when he couldn’t get what he wanted, he told his client not to buy the property instead.

The condo that Agent X found and viewed with his client was on offer for $1.02 million by the seller, who was also willing to pay him 1% of the sale price, which is about $10,000.

He didn’t tell his client about any of this though. Instead, he told his client the condo was valued at $1.18 million and suggested they offer $1.06 million. But when the client checked with the bank, the estimated value turned out to be within $950,000-$1 million.

To appease his client, Agent X told his client he made an offer of $960,000 to the seller, which was rejected. He also said the seller made a counteroffer of $1.04 million, when no such thing happened. Without his client’s instructions, he made an offer for this price and asked for a 3% commission.

Agent X negotiated for a while, but the seller’s party ended up turning Agent X’s offers down and told him to collect his commission from his client instead.

Because he failed to get what he wanted, Agent X told his client NOT to buy the property anymore because the seller’s asking price was “too high”.

In the end, the buyer contacted the seller’s agent directly to ask about the condo and offered $1.04 mil for it, to which the seller agreed.

Agent X’s client ended up paying $20,000-$30,000 more than the seller’s original offer, which was $1.02 million.

There are a few ways you can avoid this:

#1: Recognise potential conflicts of interest with your property agent

Learn what the potential conflicts of interests are with property agents so you can recognise them when they arise, and find out what CEA requires property agents to do in those situations. We talk about this in more depth here.

#2: Give accurate and current financial and personal information

Always provide accurate and current information about your personal matters or finances to your agent so he/she can assess if there will be any potential conflicts of interest in the process.

#3: Look for any customer reviews online so you know what you’re getting into

Reviews can give you a better idea of how consumers have rated their agent’s service and what they really think about working with them.

#4: Always seek clarification from your property agents if you’re ever in doubt

No, you’re not being annoying. And no, you won’t look stupid. You’ll just be doing your diligence as a paying customer and seeking clarification from the professional you hired to help you with your property transaction. Besides, you’ll be better off constantly asking questions and getting clarity on things that may seem suspicious (even if they end up being nothing), because you’ll be safeguarding yourself and your finances.

Case Scenario 2: Buyer loses $93,000 to a property agent who used it to pay off his debts

In January 2016, Agent Y received $93,000 from a homebuyer who had engaged him for the purchase of a HDB flat in Yishun. He told his client that the money would be used for the legal conveyancing of his flat, but conveyancing fees never reach this amount.

Turns out that Agent Y used the money to settle his debts to loan sharks.

Agent Y’s client had no clue until, about a month later, the lawyers finally called him, asking to foot the conveyancing fees to complete his flat purchase. That was also when the lawyers also told him that they didn’t receive the $93,000 that he entrusted to Agent Y.

Fortunately, after the client lodged a complaint with Agent Y’s property agency, they advanced the money to him and had gotten a HDB extension for the flat purchase.

As for the agent, he had to repay the $93,000 to the agency — though he did lie first and said that the money had been stolen from his car before admitting how he really misused his client’s money.

Although the client ended up getting his money back, and getting an extension from HDB (which isn’t always the easiest), Agent Y nor his agency can’t pay for the stress that his agent had to experience.

To avoid this situation, you should…

Never hand over money to your property agents to handle any part of the home purchase (or sale) process.

Under the Estate Agents Act, it is against the law for property agents or agencies to handle transaction money meant for the sale and purchase of properties here or for the lease of HDB property on any party’s behalf.

But you shouldn’t let these two cases of errant property agents turn you off from them forever, because they can actually be a godsend when buying or selling a home.

Property agents are a wealth of knowledge about the property market, are expert negotiators, and they can help with scheduling and planning viewings and meetings, as well as handling the many many many documents you need to complete the process.

It will take time to find the best agent for you, though, so you should really start now if you’re planning to buy or sell a home anytime soon. You won’t regret planning early and locking down an agent who can help you out.

You can speak to any of our Super Agents and have a casual chat with them about your options via any of the contact options below.

We have more articles about finding the right property agent in Singapore for you, and you can read them right here: