If you want to buy a resale condo in 2023 and don’t know where to start, then this guide will help you navigate the complexities of making a significant life decision.

That private property you’ve been eyeing on a property portal recently? Get ready to make it yours with these easy-to-follow steps, which will take you through how to start your financial planning to collecting your keys upon completion of the sale.

Table of Contents:

- Start financial planning

- Begin your home search

- Contact a lawyer

- Make an offer

- Get Option To Purchase (OTP) and pay Option fee to the seller

- Exercise Option

- Make payment for stamp duty and legal fees

- Completion and key collection

Step 1: Start financial planning

Check the maximum home loan amount and property purchase price you can afford based on your income, age, and loan commitments.

Some financial costs to note:

- Buyer’s Stamp Duty (BSD): It’s computed based on the purchase price or valuation of the property, whichever is higher.

- Additional Buyers Stamp Duty (ABSD): If you’re a Singapore Citizen buying your first home, this does not apply to you. Permanent Residents and foreigners, however, are liable to pay 5% and 30% in ABSD, respectively.

- Total Debt Servicing Ratio (TDSR): This sets a limit on how much you can borrow from financial institutions (FI), who must ensure your monthly repayment for all debts (including mortgage, credit card bills, car loans and personal loans) does not exceed 55% of your gross monthly income.

- Loan-to-Value Ratio (LTV): Your LTV limit is up to 75% for your first housing loan. If you purchase a unit above valuation, you’d need to cover the difference out of your own pocket.

Discover the best home loan rates across all the banks in Singapore with Ohmyhome. We’ll draw comparisons of them all for you and advise you on which one you should go with according to your loan eligibility. We’ll also assist you with obtaining the in-principle approval (IPA) from the financial institution on the loan amount.

The IPA will be based on your financial capabilities and credit history and may take 7-30 days depending on the financial institution, the accuracy of the information you’ve provided and whether you’ve submitted all the necessary documents.

We suggest going for a higher IPA amount at this stage because you can always request to lower the loan after approval but not always vice versa once you place the deposit.

Doing this will ensure that you do not lose the Option fee, which is typically 1% of the property purchase price. Payment will need to be made once the seller has granted the Option to Purchase (OTP).

Step 2: Begin your home search

Do research on property platforms by shortlisting the units that match your preferences and needs, from location, budget and property size. Ohmyhome’s free listing platform offers detailed filters for you to find exactly what you’re looking for. Simply download the Ohmyhome app on the Play Store or App Store:

- Once you log in to our app as a buyer, you’ll find all the available listings immediately on the home page.

- To filter your search, inputt an address, MRT station, nearby school, budget or desired number of rooms on the search bar.

- You’ll be pleased to know that there are no duplicate listings on the Ohmyhome app as each address can only be used once.

- Post a ‘ShoutOut’ to publicly share the exact type of home you’re looking for. This can be seen by buyers, who may suggest their listing directly with you if it matches.

- Otherwise, you can also click ‘Chat’ to make an appointment or enquire with the sellers or our agents.

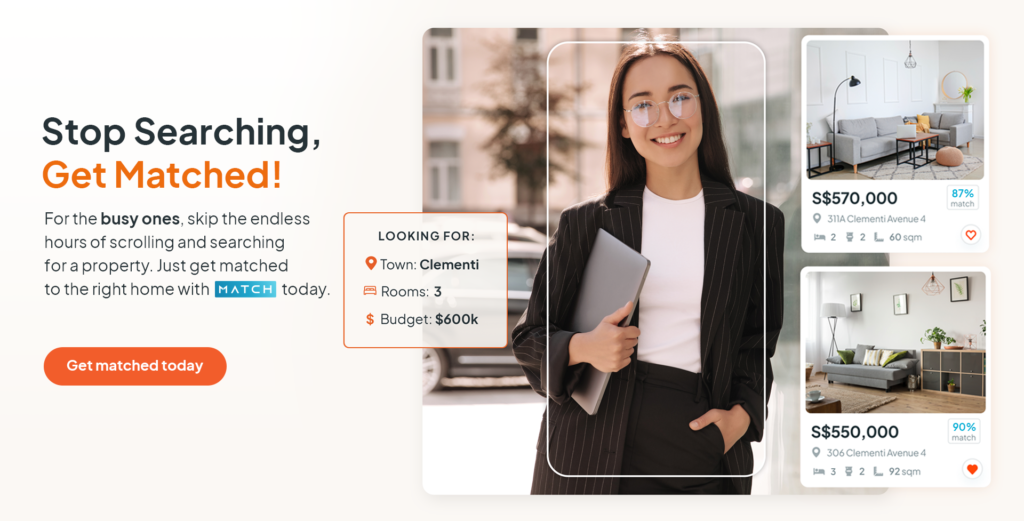

If browsing through thousands of listings is an issue due to time constraints, you can submit your preferences to Ohmyhome’s MATCH algorithm to get yourself a curated list of suitable units and homebuying content that will be sent directly to your phone.

Step 4: Contact a lawyer

At this stage, you’ll need to engage a lawyer to help you exercise the OTP on time, as well as with the rest of the conveyancing process. This involves the legal transfer of homeownership from the seller to you, the buyer.

If you will be using your CPF funds and/or getting a home loan to finance your home purchase, consider appointing a law firm from CPF’s panel and your FI’s panel. This will ensure that you won’t have to engage two lawyers for those two things, saving you hundreds of dollars in legal fees.

Pro-tip: Settle all your legal conveyancing needs with Ohmyhome’s legal partners. A great consideration if you’re looking for a seamless end-to-end engagement, where everything can be settled at a single touchpoint!

Step 5: Make an offer

Be sure to do your research by checking out the recent transactions and current market prices at Ohmyhome before making an offer through the in-app chat.

Once you’ve found the right home at the right price, you can make an offer!

After negotiating and agreeing on the property price, the seller will issue the Option to Purchase (OTP).

Step 6: Get the Option to Purchase (OTP) and pay Option fee

The OTP is a legal agreement between you, the buyer, and the seller to buy the private property.

Once the OTP has been granted by the seller, you will need to pay the Option Fee, which is usually 1% of the purchase price. After doing so, you’d have successfully expressed your interest in this private property, and the seller is not allowed to issue OTPs to other buyers.

Step 7: Exercise Option

You will have 14 days to exercise the OTP and prepare the remaining 4% downpayment in a cashier’s order. This process has to be done by your conveyance lawyer and sent to the seller’s lawyer.

We suggest handing the 4% cashier’s order to the lawyer when you exercise the OTP at least a day in advance to avoid delays.

To cancel the purchase of the resale condo, you must first inform the seller that you are not proceeding with buying the property. You may let the OTP lapse and forfeit the 1% option fee.

Step 8: Make payment for stamp duties and legal fees

The financial costs listed on Step 1, such as BSD and ABSD (if applicable), will be based on the property’s purchase price or market value, whichever is higher.

Your legal representative will advise you on when to make the payment. Usually, it is within 14 days from exercising the OTP. If payment is not made on time, you will incur penalties and face enforcement actions from the Inland Revenue Authority of Singapore.

Step 9: Completion and key collection

Once you’ve completed the final payment and your home loan has been disbursed, it’s time for the moment you’ve been waiting for – collecting the keys to your new home

The completion date will be approximately 8-12 weeks (depending on your agreement with the seller from the date you exercised the Option). Your lawyer will inform you to collect the keys on this date.

Looking for an HDB or private property? Here’s how you can speed up your home search!

Let Ohmyhome’s smart data-matching technology MATCH you with the right home, according to your specific needs. Submit your preferences to us and our algorithm will filter all our available listings based on those, and we’ll WhatsApp them to you once we find a match. We’ll also send you relevant content that you can use for your research and inform your home buying decision, so you no longer have to spend hours searching online for the information that you need.

You can also call us at 6886 9009 to secure an appointment with any of our Super Agents or message us in the chatbox at the bottom, right-hand corner of the screen. You can also WhatsApp us at 755 1009!

Frequently Asked Questions

1. When is a good time to buy a Condominium?

There is always an opportunity in every market condition, such as the low-interest rates in the current market.

2. What are the costs involved when buying a new condo in Singapore?

On top of the purchase price, be prepared to set aside money for the Buyer Stamp Duty (BSD), Additional Buyer Stamp Duty (ABSD) and other legal and mortgage fees.

3. Are foreigners allowed to acquire a condo in Singapore?

Yes, foreigners can purchase a condominium unit without approval under the Residential Property Act. It is also worth taking note that this approval does not exclude them from the ABSD.