Amidst growing global uncertainties and the likelihood of interest rates potentially increasing, more home buyers and property investors alike are looking into getting their next property.

But make no mistake. Choosing a mortgage loan is a major decision – one that is just as, if not more important, than choosing which home to purchase. After all, most homeowners will be stuck with their mortgage loans for at least a decade. Therefore, you’ll want to pick a sustainable home loan plan that you can realistically afford, even during times of emergency.

That said, don’t let the prospect of paying interest put you off from buying a house. Mortgage loans are classified as ‘good debt’, or debts that people take on to provide themselves with opportunities they wouldn’t otherwise have had. It’s pretty similar to a student loan, which unlocks the door to higher education for many who would find the cost prohibitive without it. Likewise, home loans help you get a foot in the door of homeownership, and possibly even the property investment market.

But before deciding which home loans are most appropriate, it is important to understand the fundamentals: Qualifying for bank loans, how long one should pay for them, and what risks are involved. This article will cover the most common types of home loans in Singapore, to help first-time home buyers take their first steps towards financing their home.

Determining the home loan for your property type

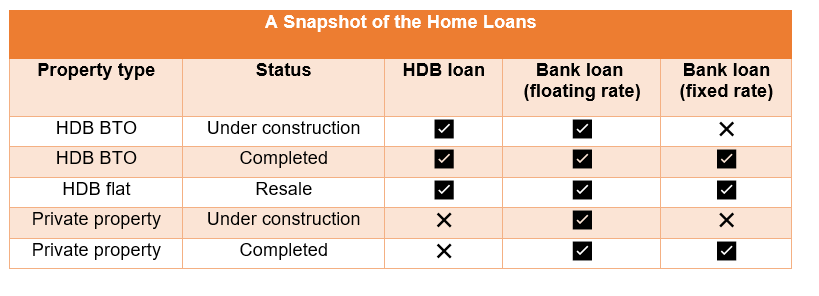

While there are a handful of loan options when it comes to financing your home, some loans may not be available to you, depending on the type of property you’ve purchased. It’s not just the property type that affects your eligibility either. Depending on whether your home has been completed, HDB and private banks might decide to withhold certain loan options from you.

Naturally, HDB will only offer HDB flat buyers with loans. Banks also do not provide fixed rate loans for properties that are under construction, as doing so would mean locking in an interest rate before the condition of the house – and its actual value – is known.

Qualifying for an HDB Housing Loan

It wouldn’t be a stretch to say that the HDB Housing Loan is probably the default option for HDB home buyers. The main feature of the HDB Housing Loan is that one can pay a significant portion of it with their CPF savings. This allows home buyers to finance their flat without touching much of their savings, especially when compared to bank loans.

The HDB Housing loan allows buyers to loan up to 85% of the flat’s purchase price and an additional 15% of the down payment. For resale flats, the 85% will be pegged at the resale price or value, whichever is lower.

HDB loan interest rates are pegged to 0.1% above the CPF OA interest rate. The CPF OA interest rate currently stands at 2.5%, making the HDB loan interest rate 2.6% per annum.

Not everyone can qualify for an HDB housing loan, either. It goes without saying that private property buyers do not qualify for this loan. But there are a ton of other criteria HDB considers before opening their wallets, and one has to pass ALL of the criteria to be considered:

- At least one buyer must be a Singapore Citizen

- Buyers must not have taken two or more housing loans from HDB previously

- Buyers’ last owned home cannot be private residential property, whether local or overseas

- Average gross income must not exceed:

- $14,000 for families

- $21,000 for extended families

- $7,000 for singles buying 5-room or smaller resale flat or 2-room new flat

This is by no means meant to be an exhaustive list. There are a bunch of other criteria that can disqualify you for a loan. For example, did you know that owning more than one hawker stall, or having additional sources of income when you possess one commercial property can make you ineligible for an HDB loan? So read the full details here and make sure to have all your bases covered before you apply for your HDB Loan Eligibility (HLE) letter.

Know how to pay off your HDB housing loan matters

While it might be tempting to service the majority of your HDB housing loan with CPF, keep in mind that by taking out a lump sum, you’re effectively denying yourself the opportunity to let your retirement funds appreciate within CPF’s healthy interest rate environment.

Until 30 June 2022, the interest rates of CPF OA and CPF SA are 2.5% and 4% per annum respectively.

That said, if you’re not confident of generating higher returns with other investments, allowing your savings to accumulate in CPF might be the wiser thing to do. Generally, risk averse individuals who favour saving over investing, will likely favour this route.

On the flipside, paying in cash might be advisable for individuals who are more liberal with their spending. Because if you are depleting your CPF funds for your home while simultaneously living a lavish lifestyle, you might not have much funds left when retirement finally comes knocking.

So whether you go with CPF or cash, always ensure that you have funds growing within at least one bucket to secure a peaceful retirement for yourself.

How do you Qualify for a Bank Loan

Those purchasing a private property will have to settle for bank loans as they do not qualify for HDB housing loans. That said, bank loans are also an option for HDB flat buyers.

And you might be in for a surprise if you thought that HDB’s requirements were stringent, because banks can be a lot more selective when it comes to who they lend their money to. Banks want to know that they will get their money back, and they determine this by assessing individuals according to two main metrics:

1. Credit Score

Your credit score is basically a number that indicates how likely you are to repay your debts (or go into default)! Basically, every loan that you have taken on and paid for in the past will play a part in deciding whether or not you secure a bank loan. Factors that affect your final credit score include:

- Utilisation pattern: Existing amount of credit that you currently owe. This can refer to any form of unpaid outstanding debt such as your credit card or tuition fees.

- Recent credit: Banks are weary of individuals who bite off more than they can chew. If you’ve recently borrowed other types of loans, it might give your bank reason to reject your application.

- Account delinquency: Any previous records of late payment will count against your final credit score.

- Credit account history: Having a history of prompt debt repayment, particularly in the last 12 months, will greatly boost your credit score.

- Available credit: The amount of liquid assets you currently possess within active bank accounts

- Enquiry activity: It’s not just the number of loans you have registered, but the number of times you have enquired for loans. To prevent this from counting against you, you should limit the number of credit cards and loan facilities you apply for.

2. Income

As one would expect, having a higher income qualifies you for higher loans. That is, banks won’t be lending out loans for multi-million dollar condos to the average fresh graduate (and neither is it advisable for you to do so)!

Apart from absolute income, your form of employment matters as well. Even if you have a steady stream of clients established, banks are likely to regard the self-employed and freelancers as less stable compared to traditional employment.

As a rule of thumb, your home loan should not be more than five times of your annual income. Also, the Monetary Authority of Singapore mandates that the monthly amount used to service your debt should not exceed 55% of your monthly income.

Fixed or Floating Bank Loan?

So if you’ve decided (or have no choice but to) go with a bank loan, the next question to ask would be whether to go with a fixed or floating rate. Keep in mind that properties under construction are not eligible for fixed bank rates.

In general, fixed interest rates are the more ‘secure’ option. It locks in existing interest rates for the next 2-3 years, which can prevent your debt from exploding in case markets become volatile. Fixed interest rates also tend to be more expensive than floating ones, because customers are paying more for guaranteed stability.

On the flipside, floating rates are cheaper, but subjected to more factors such as government policy and supply and demand. Floating rates are revised every one to three months.

The decision between fixed or floating really depends on your judgement of how the market will trend. If you believe that interest rates will go up, choose fixed interest rates to secure them while they are low. If you are confident that interest rates will go down, choose floating interest rates to avoid paying a premium on fixed rates unnecessarily.

If you’re still undecided, look into how much more you’ll be paying with fixed rate options, and decide if you’re willing to forgo the additional amount just for stability.

Keeping abreast of current affairs and financial news can help inform your decision. The latest updates on SIBOR rates are also updated regularly on the Association of Banks in Singapore (ABS).

More security in future floating bank loans

Floating rates vary because they are pegged to different indexes, which is an aggregate of the interest rates offered by all the banks within the market. While floating rates do carry more risk, recent changes in policy will hold some promise in terms of their future stability.

The major change to take note is that the Singapore Interbank Offered Rate (SIBOR) bank index will be gradually phased out starting from 31 March 2022 in favour of the Singapore Overnight Rate Average (SORA) index, which will completely take over floating rates by 31 December 2024.

SIBOR and SORA are basically the loan equivalent of stock market indexes, whereby SIBOR takes into account the rates of the top 20 banks sans the top and bottom quartiles, while SORA measures the aggregate of all banking rates, top and bottom percentiles included.

The switch from SIBOR to SORA can potentially stabilise interest rates because SORA takes into account past interbank transactions of the past 90 days, allowing home buyers to better plan their finances. Under SIBOR, loans were pegged to future interest rates, subjecting buyers to the whims of banks.

Looking to buy a HDB flat or a new condo?

Let Ohmyhome’s smart data-matching technology MATCH you with the right home, according to your specific needs. Submit your preferences to us and our algorithm will filter all our available listings based on those, and we’ll WhatsApp them to you once we find a match. We’ll also send you relevant content that you can use for your research and inform your home buying decision, so you no longer have to spend hours searching online for the information that you need.

Experience seamless, fast and exceptional service from our Super Agents. Chat with us at the bottom, right-hand corner of the screen. Or WhatsApp us at +65 9727 5270 to get in touch.

Header Image: Pixabay