How did Singapore, the fifth most expensive country to buy property in, also manage to be one of the countries with the highest home ownership? Time and again, the Singapore real estate market has proven itself resilient, despite economic uncertainties and cooling measures implemented. It’s no wonder many continue to invest in properties here. But are property investments all that they’re cracked up to be? Before you decide to join the bandwagon, consider these pros and cons.

Pro: Capital gains, stable returns

Property prices going up are almost a given in space-scarce Singapore. Even as homes here are getting smaller, prices are steadily climbing. As an investor, as long as your chosen property is managed well and has at least some amenities in the vicinity, you are almost guaranteed capital gains. Real estate is also significantly less volatile than other forms of investment like stocks and rarely loses appreciation or value overnight.

Unless there is a major economic downturn, you have a great chance of turning a profit or at least breaking into our local real estate market. In fact, even though the global Covid-19 pandemic, Singapore’s property market has remained resilient throughout.

Pro: You could be a landlord

You could be a landlord in the very house you live in, even if it’s an HDB flat (conditions apply). As long as you own a property in Singapore, you have the option of unlocking your home’s potential rental yield. Don’t want to reduce profit by having to engage a rental agent? You can easily DIY your home rental on the Ohmyhome app. Find out more here.

Pro: Inflation-proof

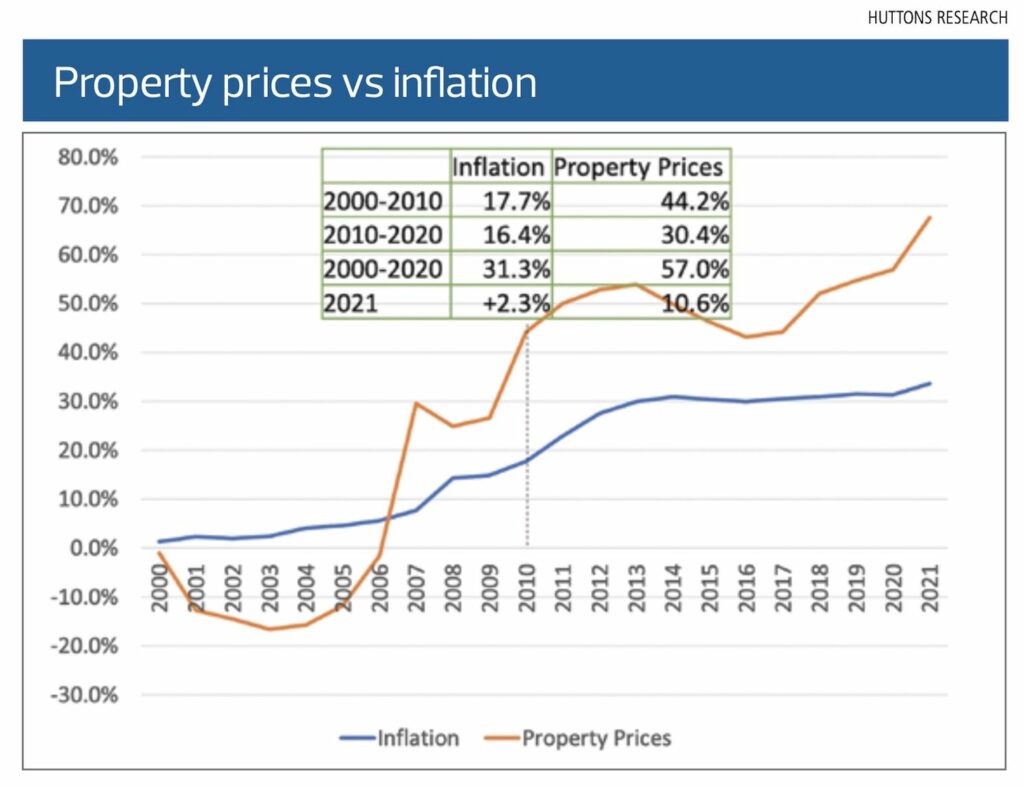

Real estate ownership is deemed one of the top ways to hedge against inflation. Your mortgage will cost less over time while rent prices will increase. As inflation rises, so will your property value, as well as the amount you can charge in rent. Earning a higher rental income over time can help you keep pace with the rise in inflation.

Rent increases with inflation, making it harder and harder to pay rent (but more and more lucrative to be a landlord). Therefore, investing in real estate is a smart way to hedge against inflation and a long-term retirement protection strategy.

Pro: Leverage

Leverage is when you use borrowed capital, a.k.a your mortgage, to increase the potential return on your investment. It is highly unlikely for someone to pay 100% for their property. It is common and usually necessary for a lot of people to buy their property on leverage.

Leverage allows you to own property you cannot usually afford and also increases the rate of return of your investment when you decide to sell.

For example, if you bought a home for $1m and sold it for $1.2m in a year (assume there’s no tax involved for this scenario), you make a 20% return.

But if you only paid $200k for that $1m property and borrowed the rest, after a year, a $200k profit would actually mean you made 100% return instead of 20%. A significant difference and one of the biggest reasons why property investing is profitable.

Leverage also helps you get your first “stepping stone” property that you can buy low and sell high and use the capital gains to move on to your next bigger, more expensive real estate investment.

Con: High capital, long journey

You need money to make money. Real estate rarely comes cheap, and you need to have a stable, relatively healthy income to finance your real estate purchases. While servicing your monthly mortgage may be manageable, it’s the hefty downpayment that usually throws aspiring investors off. What’s more, you need to set aside rainy day funds for potential repairs and upkeep to maximise your rental income. Owning a property also comes with hidden costs like taxes, insurance, and legal fees.

You should also know you’re in it for the long run with real estate. While you can attempt to ‘flip’ properties, you are technically still buying an asset that will require time to sell off, with transaction costs like the Seller’s Stamp Duty (SSD) that may eat into your profit if you try and sell it too quickly.

Con: (Potentially) High maintenance

Managing your property as an investor can get taxing real quick. First off, you need to have a discerning eye for income-generating properties. Scoring yourself a good investment is only the beginning. Then there’s the management of the properties per se. This can turn out to be a full-time job, especially if you are also a landlord.

Problematic tenants can cost you time, effort and money. A tenant who defaults on rental can cause you serious cash flow problems, while some others may damage your property or neglect to maintain it properly.

Con: Illiquid

Illiquidity refers to assets which can’t be exchanged for cash easily. Real estate is one of the most illiquid investments an investor can make; it takes much longer to sell a property and see your profits than if you were to invest in the stock market or short-term bonds.

As such, you need to have liquid funds parked aside for emergencies since you won’t be able to sell your property quickly for cash, unless it is at a substantial loss.

Con: Mortgage stress

Ever noticed how some of your craziest friends become all straight-laced after becoming parents? When you have a heavy responsibility to ensure something turns out well, it inevitably makes you risk-averse. You start planning, being careful with your cash flow, and making more prudent investments.

The downside to being risk-averse (although it sounds like a wise decision) is that you may second guess every decision that involves risk. This includes changing jobs, having another child, chasing your startup dreams, or diversifying into other investments.

As such, you may stick to a job that makes you miserable, miss out on the joy of parenting, sit on your dreams, or have all your money tied up in an illiquid asset. Many conservative investors are okay with this, but those who prefer quicker gains may feel the long-term “mortgage stress” very keenly.

On the prowl for an investment property?

Let Ohmyhome’s smart data-matching technology MATCH you with the right home, according to your specific needs. Submit your preferences to us and our algorithm will filter all our available listings based on those, and we’ll WhatsApp them to you once we find a match. We’ll also send you relevant content that you can use for your research and inform your home buying decision, so you no longer have to spend hours searching online for the information that you need. Because at Ohmyhome, we’re always by your side, always on your side.

Secure an appointment with any of our Super Agents by dropping us a message on WhatsApp or via our Live Chat at the bottom, right-hand corner of the screen

Contributed by Rachael Sia.