In 2023, the overall residential property market in Singapore has shown a slowdown in demand, and high property prices remain prevalent. HDB sellers intending to buy a private property are still struggling to afford them in the face of prevailing interest rates. This, along with multiple other uncertainties, impacted the property market in Singapore in 2023.

#1: Geopolitical tensions

The geopolitical tensions in 2023, particularly the strained relations between the US and China, the Russia-Ukraine war, and the Israel-Hamas conflict, have had a significant influence on Singapore’s residential property market. The global economic slowdown triggered by these conflicts led to a more cautious approach among both local and foreign property investors as concerns about the stability of the global economy prompted them to reassess their investment strategies and adopt a wait-and-see attitude.

#2: Economic headwinds

Despite a tempering of interest rates, property acquisition and borrowing costs remained elevated. The aftermath of the global geopolitical events, coupled with a worldwide economic slowdown, compelled a cautious approach from both property buyers and sellers. The surge in inflation and the increment in the Goods and Services Tax (GST) added to the financial burden, contributing to a decrease in urgency among individuals looking to finalise property transactions.

#3: Property cooling measures

In April 2023, the Singapore government introduced property cooling measures to address the evolving property market dynamics. Notably, the Additional Buyers’ Stamp Duty (ABSD) for foreigners purchasing residential properties in Singapore was increased to a substantial 60%, doubling the previous rate of 30%. Singapore Citizens and Permanent Residents were not exempt, facing higher ABSD rates for their second, third, and subsequent property acquisitions.

| Citizen | Buying 1st Residential Property | Buying 2nd Residential Property | Buying 3rd and Subsequent Residential Property |

|---|---|---|---|

| Singapore Citizen (SC) | 0% (no change) | 20% (up from 17%) | 30% (up from 25%) |

| Singapore Permanent Resident (SPR) | 5% (no change) | 30% (up from 25%) | 35% (up from 30%) |

| Foreigners buying any residential properties | 60% (up from 30%) | 60% (up from 30%) | 60% (up from 30%) |

| Entities buying any residential properties | 65% (up from 35%) | 65% (up from 35%) | 65% (up from 35%) |

These measures led to a moderate property market and a slower pace of price growth in both the HDB resale and private property market segments.

How did the Singapore property market respond in 2023?

The impact of these measures was palpable as potential homebuyers and investors approached transactions with heightened caution. This cautious sentiment manifested in a more measured pace in property dealings across all market segments. The higher ABSD rates, especially for foreign buyers, contributed to a slowdown in international interest in luxury private properties in the central area. Overall, there was a downward trend in transaction numbers for freehold and leasehold condos in the Core Central Region (CCR), with average prices hovering around $1,750 per square foot (PSF).

These challenges extended to the HDB and private property rental markets. As new private projects reached completion, domestic demand tapered off, and asking rents experienced a decline throughout the year. The increased supply and subdued demand created a tenant-favorable market, forcing landlords to adjust rental expectations.

What to expect in 2024

While demand has softened in 2023, property prices continue to rise across all market segments, though at a slower pace. The post-pandemic supply crunch may also be at an end, with more BTO and new launch project completions seen in the tail-end of last year.

Buy a home you can realistically afford

Despite the moderation in property prices and more housing options in the market, if you’re genuinely looking to buy a new home in 2024, you should remain level-headed when it comes to your property transaction. It may be dangerous to gamble on whether we’re at an inflection point. Rather than timing the market, you should seek the advice of a property agent to make your purchasing decision based on your real financial situation. Contact us here to speak to an agent.

Sell your home at the right price

As for HDB and private property sellers, it may be time to adjust your expectations. Property prices have lost their upward momentum, and fewer buyers are willing to pay Cash Over Valuation (COV). Only 15% of buyers forked out COV when buying a HDB resale flat in the last three months of 2023, down from almost 30% in the same period in 2022. Drop us a message on WhatsApp to speak to an agent about selling your home.

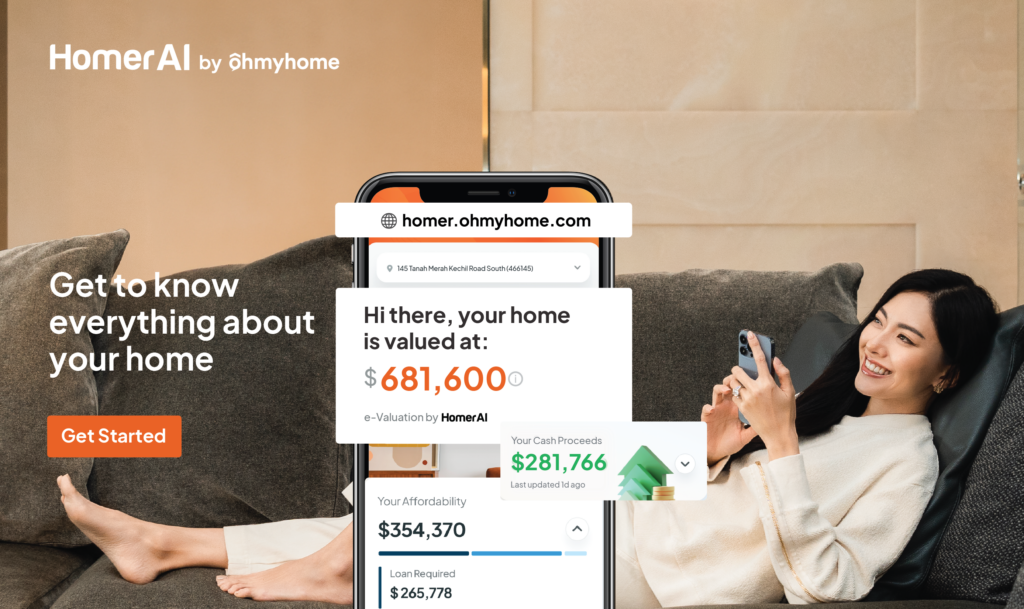

To find out your property’s market value, check out Homer AI

Homer AI is our home ownership management & e-Valuation tool that will provide an accurate estimation of your home valuation that’s updated every month, so you can track if it increased, stayed the same, or decreased.

With Homer AI, you can also know:

- What your home is worth based on the recent transactions in your area

- How much cash you get to keep after selling

- If you have enough to buy your next home