Ohmyhome helps you maximize your returns on your property with expert advice and negotiation. Plus, at a low 1% commission fee, you get to keep more profits in your pocket.

65% of HDBs and condos sold in a month.

That’s why we sold HDBs and condos above market price.

Get expert advice with 1% commission, more profit.

All services provided are complementary.

HDB Seller’s Guide to Seller Stamp Duty in Singapore

Every HDB seller has a financial obligation when selling or changing the ownership status of their flat due to a change in family circumstances, such as divorce or marriage.

Let us bring you through the costs and fees you, the seller, may be liable to pay during your resale transaction journey. They include:

- Resale application administrative fees

- Legal fees

- Property tax

- Service and conservancy charges

- Seller’s stamp duty

Resale application administrative fees

When submitting a resale application, buyers and sellers will each have to pay an administrative fee of $40 for 1-room and 2-room flats, and $80 for 3-room flats (or bigger). The fees include Goods and Services Tax and, once paid, are non-refundable.

Legal fees

Legal fees are incurred when selling an HDB flat because it involves the legal transfer of homeownership from you, the seller, to a buyer. This process is called conveyancing, which starts from the date the offer was accepted and ends on the date of key collection.

You may engage HDB’s legal services when selling your flat if your current outstanding loan is with HDB or you have no outstanding loan. The legal fees will be based on their Conveyancing Fees Rules 2002.

For resale transactions or transfer of flat ownership, there is a minimum fee of $20. Here’s a more detailed breakdown:

| Type of transactions for HDB flats | HDB’s scale of fees (computed to the next $) |

| Resale, transfer or assignment of flat by the owner | First $30,000 @ 13.5 c. per $100 or part thereof Next $30,000 @ 10.8 c. per $100 or part thereof Thereafter @ 9.0 c. per $100 or part thereof There shall be a minimum fee of $20 |

You may also engage a legal conveyancer through Ohmyhome, with fees starting from $1,800 nett. Services will include the following:

- Conveyancing for Sale & Purchase

- Mortgage & Real Estate Planning

- Retail & Corporate Real Estate

- Power of Attorney/Lasting Power of Attorney

- Letters of Administration

- Letter of Probate

- Notary Public

- Wills

Property tax

HDB sellers will also need to pay the flat’s property tax up to the end of the year. The official tax payment receipt needs to be produced during the HDB completion appointment.

You can log in to the Inland Revenue Authority of Singapore’s myTax portal to check how much you need to pay in property tax.

Service & conservancy charges (S&CC)

Depending on your flat type, the service and conservancy charges (S&CC) of HDB flats typically range from $20 and $90 for Singapore citizens, factoring in the reduced rates offered to them.

For non-citizens, the charges may range from a normal rate of between $50 and $90. If you own a private property and/or have left your HDB flat vacant, you may also be liable to pay the normal S&CC rate.

You may check with your town council on the S&CC rates for your flat.

As an example, here’s the S&CC payable to the Jurong-Clementi Town Council.

| Flat Type | Reduced Rates (per month)* | Normal Rate (per month) |

| 1-Room | $19.50 | $60.50 |

| 2-Room | $29.50 | $66.50 |

| 3-Room | $47.50 | $73.50 |

| 4-Room | $63.00 | $79.50 |

| 5-Room | $78.50 | $88.50 |

| Executive | N.A. | $101.00 |

The S&CC are due on the first day of each month without demand. An accumulative penalty fee, typically ranging from $0.50 for a 1-room flat and $7 for an executive flat, will apply from the following month until the payment has been made in full.

Seller’s stamp duty (SSD)

HDB flat owners are required to meet the 5-year Minimum Occupation Period(MOP) before they can sell the flat.

However, in cases where special approval has been granted by the HDB to sell the flat before the MOP, Seller’s stamp duty(SSD) may apply.

You are liable to pay the SSD if you sell your HDB flat within 3 years. This is called the holding period and starts from the date of HDB flat’s key collection or acquisition, and ends when the Option to Purchase is issued to sell the flat.

What are the SSD rates in 2022?

There are three factors that affect the total SSD payable:

- Date of purchase

- Holding period

- SSD percentage as per the holding period

For HDB flats purchased on and after 11 Mar 2017:

| Holding Period | SSD |

| A year or less | 12% |

| More than 1 year and up to 2 years | 8% |

| More than 2 years and up to 3 years | 4% |

| More than 3 years | 0% |

The total SSD payable is calculated by applying the applicable rate on the selling price of your flat or the current market value, whichever is higher.

In summary, the shorter the holding period, the higher the SSD that you need to pay.

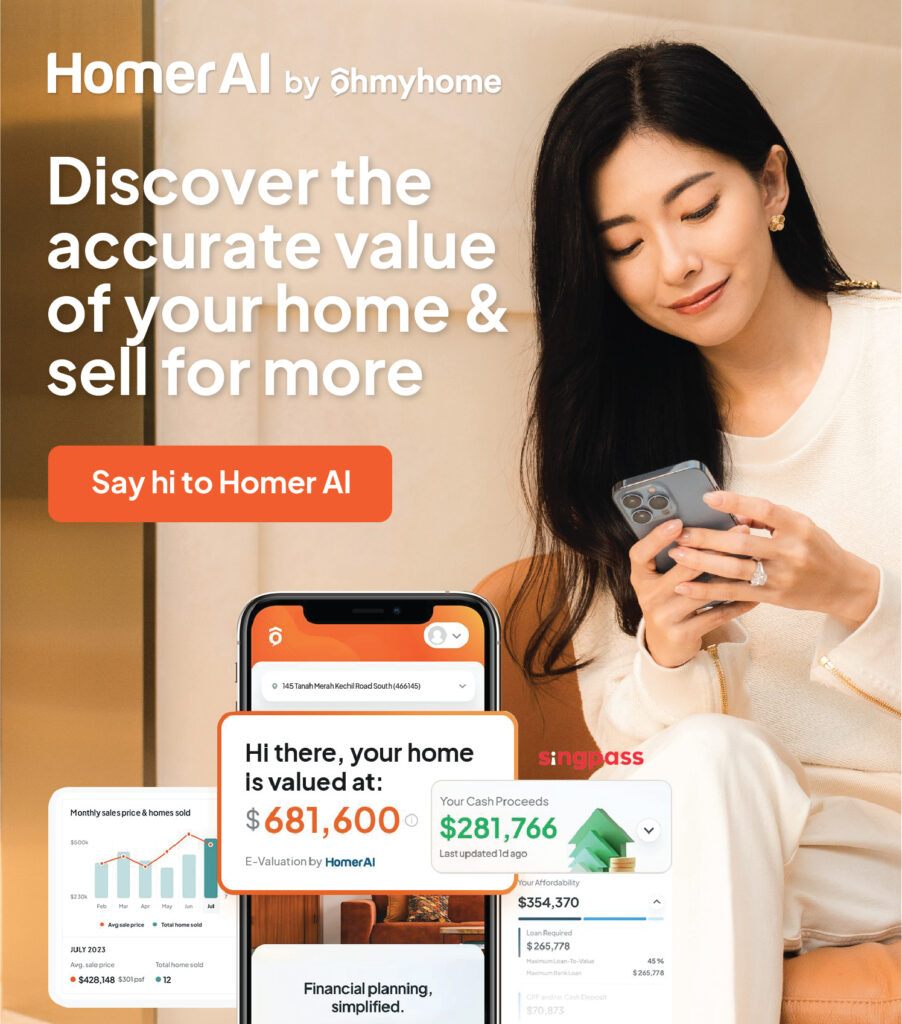

Sell your home fast and at the best price!

Sell your home for a high price in no time, hassle-free. Starting at 1% + GST of selling price. Our Super Agents are CEA-certified and among the Top 1% in Singapore. With more than 8,000 happy customers served, we’ve garnered 4-star ratings on both Facebook and Google! We go in-depth about what you can expect when you engage an Ohmyhome HDB Seller Agent.

Call us at 6886 9009 to secure an appointment with any of our Super Agents or message us in the chatbox at the bottom, right-hand corner of the screen. You can also WhatsApp us at 9727 5270!

Consult an expert for free!

Send us your details and we’ll be in touch within 15 min (daily 9am to 9pm GMT +8).

SELLING A HOME

Frequently Asked Questions

Got a question? We’ve got the answers. If you don’t see your question here, drop us a message. We’re happy to assist.

An HDB flat owner may change the flat ownership to his/her immediate family members such as spouse, parents, children, or siblings if it is due to reasons acceptable by HDB.

Proof of ownership in HDB (Housing & Development Board) typically includes documents such as the Certificate of Title or the Deed of Lease, which shows the ownership details of the flat.

Regrettably, according to HDB regulations, married couples must jointly purchase an HDB flat as a family nucleus.

Each flat can have up to 4 owners. If there’s more than one proposed owner, they need to decide how they’ll share ownership when ownership changes: either joint tenancy or tenancy-in-common.

One spouse might agree to transfer their share of the flat to the other, so the other can keep the flat.