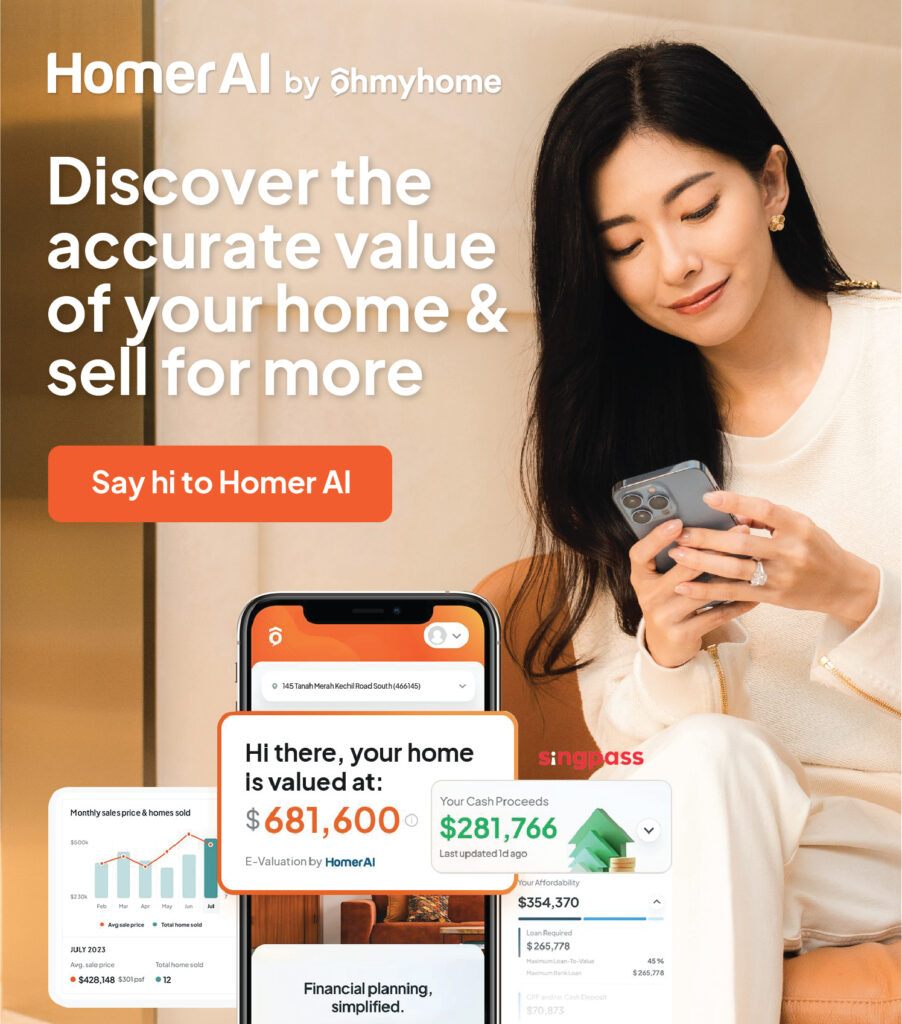

Ohmyhome helps you maximize your returns on your property with expert advice and negotiation. Plus, at a low 1% commission fee, you get to keep more profits in your pocket.

65% of HDBs and condos sold in a month.

That’s why we sold HDBs and condos above market price.

Get expert advice with 1% commission, more profit.

All services provided are complementary.

10 Best Property Agencies in Singapore

Introduction:

Considerations for Selecting a Real Estate Agency

- Expertise: Prioritize agencies specializing in your property type (residential, commercial, HDB).

- Market Knowledge: Seek agents with in-depth local market understanding and successful track records.

- Commission: Compare structures (fixed fee, percentage) and negotiate for competitive rates.

- Technology Integration: Leverage agencies utilizing virtual tours, 3D imaging, and AI-powered marketing for a seamless experience.

- Customer Service: Prioritize transparent communication, responsiveness, and client-centric approach.

Top Real Estate Agents in Singapore and Their Review

| Agency | Rating | Pros & Cons |

| OhMyHome | 4.9/5 | Pros:

|

| Propseller | 4.7/5 | Pros:

|

| ERA Singapore | 3.9/5 | Pros:

|

| C & H Properties Pte Ltd | 1.9/5 | Pros:

|

| OrangeTee & Tie | 4.0/5 | Pros:

|

| HUTTONS ASIA PTE LTD | 4.7 | Pros:

|

Compare Ohmyhome Vs Other Property Agents

| Unique Benefits | Ohmyhome | Other Property Agents |

| ✅ | ❌ |

| ✅ | ❓ |

| ✅ | ❌ |

| ✅ | ❓ |

| ✅ | ❌ |

Ohmyhome Spotlight:

- Transparent 1% commission for significant savings.

- Tech-driven approach with virtual tours, 3D imaging, and AI-powered marketing.

- Client-centric: Focused on transparency and responsiveness.

Consult an expert for free!

Send us your details and we’ll be in touch within 15 min (daily 9am to 9pm GMT +8).

SELLING A HOME

Frequently Asked Questions

Got a question? We’ve got the answers. If you don’t see your question here, drop us a message. We’re happy to assist.

An HDB flat owner may change the flat ownership to his/her immediate family members such as spouse, parents, children, or siblings if it is due to reasons acceptable by HDB.

Proof of ownership in HDB (Housing & Development Board) typically includes documents such as the Certificate of Title or the Deed of Lease, which shows the ownership details of the flat.

Regrettably, according to HDB regulations, married couples must jointly purchase an HDB flat as a family nucleus.

Each flat can have up to 4 owners. If there’s more than one proposed owner, they need to decide how they’ll share ownership when ownership changes: either joint tenancy or tenancy-in-common.

One spouse might agree to transfer their share of the flat to the other, so the other can keep the flat.