Here’s an analysis of the HDB resale price movement in the past 10 years, as well as the number of transactions, so you can gauge when is the best time to sell your HDB resale flat in 2024.

To begin, you must first pinpoint your goals and future plans. For example, you may be looking to:

Cash out to buy a bigger HDB or condo / Retire and buy a smaller HDB or condo

If you’re looking to buy a bigger property, you may be waiting for your HDB valuation to reach a certain value so you can use your sale proceeds to finance your next home purchase.

You may also be waiting to sell high so you can buy a smaller home and use your extra funds to invest in a property and earn passive income.

Either way, you should not wait too long. If you’re looking to buy a condo, it won’t do you any good to sell high but at the wrong time as you may end up having to buy high. To figure out the best way to move forward, you should speak with a property agent.

Here’s what the HDB resale market has shown us in the past 10 years

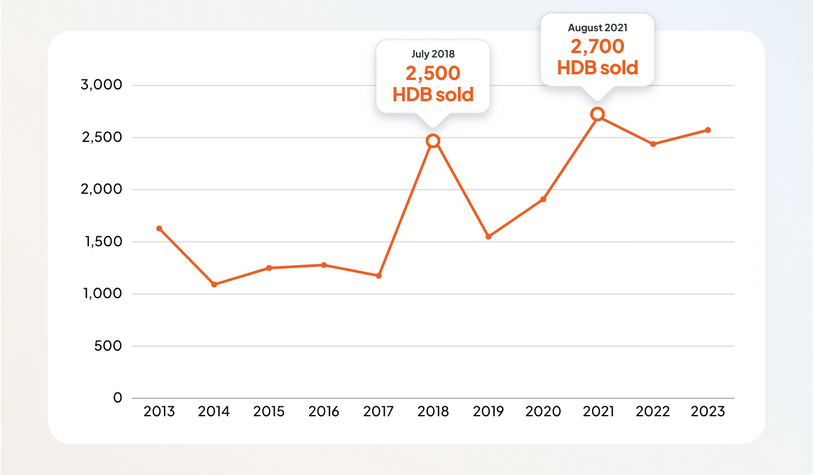

When the number of HDB resale transactions reached a peak

The last peak 10 years ago was in July 2018, when the HDB resale market saw over 2,500 HDB flats sold at a median HDB resale price of $445,041. Mind you, this was the same month the Additional Buyers’ Stamp Duty (ABSD) rates were raised:

- For Singaporeans purchasing 2nd property, the ABSD changed from 7% to 12%

- For Singaporeans purchasing 3rd property onwards, it increased from 10% to 15%

- For PRs purchasing 2nd property onwards, the ABSD was raised from 10% to 15%

- The ABSD for foreigners purchasing any residential property climbed to 20% from 15%

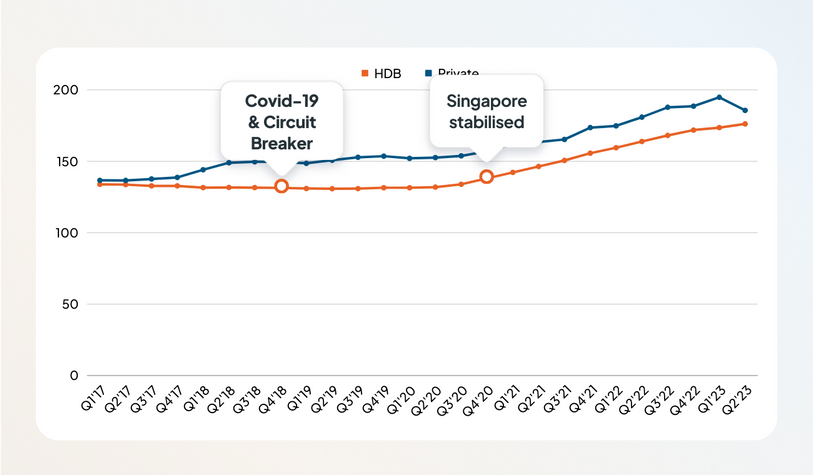

HDB & Private Price Index From 2017 to 2023

Following that, HDB resale prices remained moderate due to the Covid-19 pandemic and the Circuit Breaker lockdown in Singapore in mid-2020, which led to a hard stop on physical viewings and significantly affected both HDB and condo transactions.

HDB resale prices didn’t start climbing until the 4th quarter of 2020, as Singapore began to stabilise and the market has had time to adjust to the new cooling measures.

The next HDB resale price peak came in August 2021, where over 2,700 flats were sold at a median HDB resale price of $517,640.

That’s roughly 200 more transactions and about a 16% increase in the median HDB resale price.

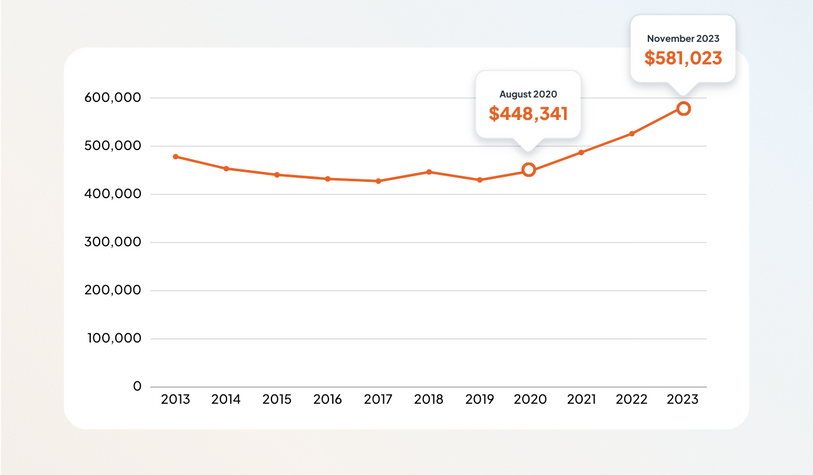

When median HDB resale prices reached a peak

The median HDB resale prices started rising post-Covid. From 2020 to 2023, prices rose from $448,341 in August 2020 to $557, 712 in November 2022, and in November last year it reached a peak at $581,023. That’s about a 30% increase in just 3 years.

Median HDB Resale Price From 2013 to 2023

Note that a month before median HDB resale prices hit a new high in November 2022, a new round of cooling measures were introduced.

In September 2022, a 15-month waiting period were implemented to keep private property owners out of the HDB resale market and from pricing out regular buyers. These private property owners typically have a higher cash windfall as private properties are sold at higher prices than HDB flats, which means they’re more likely able to pay a higher Cash Over Valuation (COV) for bigger and central HDB resale flats.

Despite this, median HDB resale prices continued rising over time.

Then came the latest round of property cooling measures where ABSD rates were raised again in April 2023.

The ABSD rates as of 2023

| Citizen | Buying 1st Residential Property | Buying 2nd Residential Property | Buying 3rd and Subsequent Residential Property |

| Singapore Citizen (SC) | 0% (no change) | 20% (up from 17%) | 30% (up from 25%) |

| Singapore Permanent Resident (SPR) | 5% (no change) | 30% (up from 25%) | 35% (up from 30%) |

| Foreigners buying any residential properties | 60% (up from 30%) | 60% (up from 30%) | 60% (up from 30%) |

| Entities buying any residential properties | 65% (up from 35%) | 65% (up from 35%) | 65% (up from 35%) |

What can you learn from these?

#1: Property prices tend to rise over time

Time and time again, the Singapore property market has proven to be the exception to the rule. Despite uncertain macroeconomic conditions, the housing market here has remained resilient. Historically, property prices tend to trend upwards after a period of stability.

And even though property prices dip slightly after a round of cooling measures are introduced, they pick up again after some time. In fact, median HDB resale prices post-April 2023 ABSD hike surpassed the last peak.

That said, you’ll never know when the next set of cooling measures will be implemented. So waiting too long may backfire on you; don’t forget that you may need to pay COV as well, which means a higher cash outlay for you.

#2: Private property prices appreciate faster than HDB flats

If you’re looking to buy a condo after selling your HDB resale flat, you should know that private property prices tend to appreciate faster than HDB flats.

However, there tends to be a downturn in prices after new cooling measures are introduced. Following the April 2023 cooling measures, the average condo PSF price per unit fell to about $1,800 PSF in October 2023 from around $2,000 PSF in February of the same year.

With less ultra rich foreigners in the market due to the 60% ABSD they now face, double from the 30% previously, you may think this points to the possibility that you can buy low now. The reality is, most condo buyers are locals and the prices haven’t dropped that much.

The “sell-and-buy” method doesn’t benefit everyone

The general consensus amongst property agents is that the “sell-and-buy” method does not benefit everybody.

It would be wiser for you to sell your HDB resale flat when you’re certain you have enough sale proceeds after paying off your outstanding loan and refunding your CPF monies, as well as sufficient cash to settle the downpayment and payable stamp duties.

Don’t wait for the “best time” to sell your HDB resale flat. Plan your home sale now with Singapore’s top 1% property agents

Drop us a message on WhatsApp to speak with us and we’ll connect you with the right property agent who will help you sell your home at the best price and within your preferred timeline.

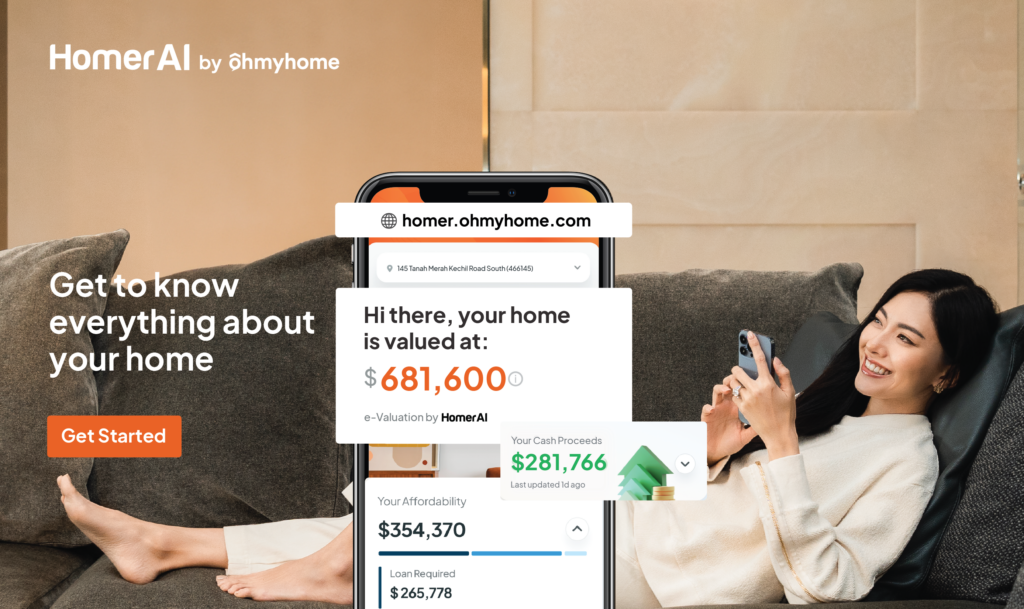

Not ready to speak to an agent? Get to know everything you need about your HDB resale flat from Homer AI

Homer AI is our home ownership management & e-Valuation tool that will provide an accurate estimation of your home valuation that’s updated every month, so you can track if it increased, stayed the same, or decreased.

Homer AI can also help you:

- Estimate how high you can sell your home. With an accurate home valuation, you’ll know the exact market rate for your home and negotiate with confidence.

- Financially plan for your next dream home. How much do you actually get to keep? Do you have enough for your next home? Relax, leave the calculations to Homer AI.

- Stay updated on the property market. No more waking up to thousands of news articles about new cooling measures. Get it straight from one source.