You want to own a home someday, but you’re only just getting started in your career. There’s so much you need to learn, a home will cost you a fortune and there’s some hot competition in the market. How are you supposed to make that happen?

Don’t worry, I’ve got your back. There are things you can do right now that will push you toward your dream of homeownership in the future:

1. Learn about home buying in general

A good place to start is familiarising yourself with the home buying process. I’ve detailed all the steps you’ll need to take to buy a resale HDB flat or condo (be it a resale property or a new launch project) with the help of a property agent or through a Do-It-Yourself (DIY) platform, in these articles:

Buying a home is a monumental life decision and financial commitment, no matter how young or old you are, knowing what you’re getting into is extremely important. Especially because it can get complicated at times, with so many things to take note of, such as your level of affordability and eligibility for the type of property you’re purchasing.

“Wealth accumulation can come from maintaining a simple lifestyle.”

Ohmyhome co-founder and Chief Product Officer Race Wong

2. Track your spending

Ohmyhome co-founder and Chief Product Officer Race Wong has some practical financial advice for young people: “Know where your money goes, count up the costs and expenses. Choose savings when you can and stick to your financial goals.”

Tracking expenses is integral to identifying your monthly and yearly budget, which will eventually form your funds to finance your future home. The easiest way to do this is by creating a tracking sheet. You can find free templates on Google Sheets which only need to be filled up with your expenses, such as food, travel, entertainment and others that apply to you. Doing so will inform you of the black holes that vacuum your funds from your bank.

Need vs want

Knowing where and what you often spend on can then bring you closer to this nifty trick you may forget in the haze of a really good sale: deciding whether an expense is a need or a want. When you can differentiate a need from a want, you are fundamentally prioritising your future goals. If you truly want to own a home in the future, with the knowledge of the current property market and doing your due diligence to research what it could be like in five to ten years, you’ll be incentivised to cut the unnecessary expenses in your life and prioritise saving.

3. Prioritise saving

“Wealth accumulation,” Race says, “can come from maintaining a simple lifestyle. Think of simple swaps you can do in your everyday life that may save you maybe $10-$20 a day – swap a cab for the bus or MRT, bubble tea for water, an expensive holiday for a more reasonable one. These small changes can add up to a few thousand dollars a year.”

Let’s pause here for a second, because I can guess what you’re thinking. This is simple in theory but difficult in practice. And that’s alright — sustaining good habits is a gradual change you should commit to, no matter how long it takes to master it.

Cut unnecessary expenses in your life and prioritise saving.

4. Lease out your first property, rent a more affordable one

If you’re considering investing in property, then this strategy may work for you.

Race gives this example: Say you lease out your newly purchased condo for $5,000 and rent a smaller, more affordable HDB flat to live in for $2,000.

She says, “That’s $3,000 every month, or $36,000 annually. In three years, that’s more than $100,000. That’s a lot of money to help you pay off the mortgage.”

“If you buy a private property for your ownstay, you lose any earning potential from what may be your biggest asset at this point. Not only have you spent the bulk of your savings with this move, but you also now have a bigger mortgage to service and not much cash left over for other investments.”

Sit down with your partner and have that talk

If you’re planning to get married and have a family, have that talk with your partner; the important one concerning your finances. Here are some tips to navigate that conversation.

“Having a dual-income household is also important.” Race suggests in this article, “To supervise the household and help with your kids while both of you are at work, perhaps you could enlist the help of your parents or in-laws. If they are retired and willing, having them in your home could go a long way in easing your concerns.

“If properly managed,” she says, “combined incomes allow couples to increase the size of their monthly savings.”

5. Look for other property investment opportunities outside Singapore

Ohmyhome co-founder and Chief Executive Officer Rhonda Wong has had her fair share of this question thrown at her by young couples: How do we even go about owning an investment property when houses are so expensive?

She acknowledges that yes, it is expensive and difficult to save for one. “Knowing this,” she says in this article, “I’d say consider investing somewhere else. The world is big and there are other places that’s great for investments too.”

Rhonda also suggests looking at properties in the Philippines, which are more affordable in terms of price per square footage compared to Singapore. For example, a residential property in a prime location in the Lion City can easily cost more than S$1,800 per square foot (psf), while in Manila (the capital of the Philippines), it would only be S$500 psf.

You can also expect a gross rental income of about S$500 per month, which amounts to a rental yield of 6% per year. In comparison, with S$100,000 in Singapore, “most people leave it in their bank account with little interest returns or in a fixed deposit account with a 1% return. So a condo rental yield would hover between 1 to 3%.”

See where she’s going with this? That’s not all. For property investments, the potential for capital appreciation also needs to be carefully considered. And in fact, from March 2015 to March 2021, the annual average growth in prices of residential property in the Philippines was 3.4%. Increasing urbanisation, an expanding middle class, the growth of their Business Process Outsourcing industry and the increasing remittances of Filipinos working abroad are just some of the factors that are fuelling this growth.

“Consider investing somewhere else. The world is big and there are other places that’s great for investments too.”

Ohmyhome co-founder and Chief Executive Officer Rhonda Wong

And here’s the catch: Property prices are highly correlated with that growth. Rhonda says, “If you want to grow your wealth through property capital appreciation, you can look into the Philippine market while real estate is still affordable.”

The steps outlined above aren’t necessarily hard, but they will require your constant effort. The sooner you start taking your dream of homeownership seriously, the quicker you can make the necessary steps to attain it. And the more time you have to save, budget and plan your moves, the smoother your homebuying journey will be in the future.

We want to hear your stories on how young people can start saving for a home and/or get a leg up in the housing market. What strategies do you use to save money? Are there any major hurdles to home ownership or other concerns you wish we had covered? Comment your thoughts and opinions on our Facebook post!

Know someone who’s looking for an HDB or private property?

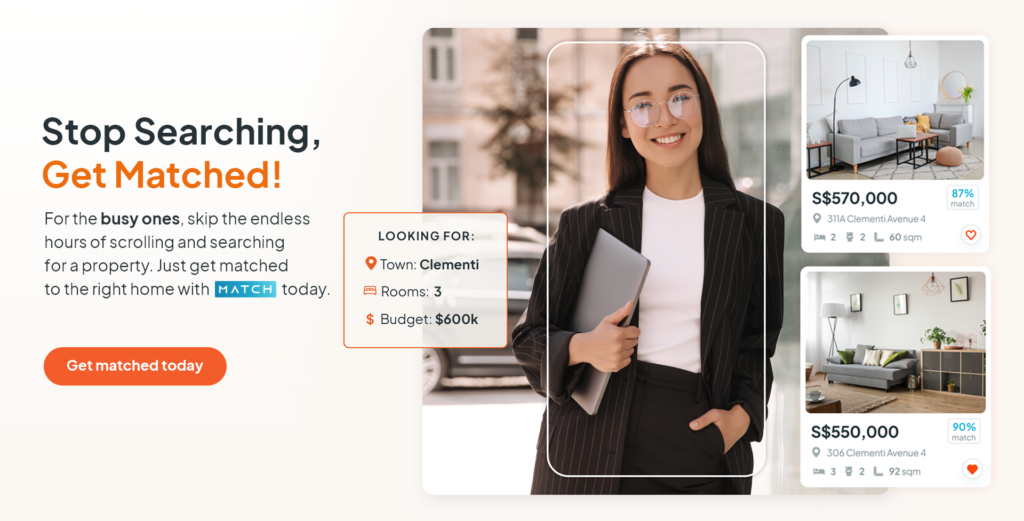

Refer them to us! We’ve got a smart data-matching technology that will MATCH them with the right home, according to their specific needs. All they’ll need to do is submit this form detailing their preferences (budget, size, location) and our algorithm will filter all our available listings based on those, we’ll WhatsApp them to you once we find a match. We’ll also send them relevant content that they can use for their research and inform their home buying decision, so they no longer have to spebnd hours searching online for the information that they need. Because at Ohmyhome, we’re always by your side, always on your side.

Simply reach out to us via our hotline at 6886 9009 or WhatsApp at 9755 1009, or secure an appointment with any of Super Agents on the chatbox at the bottom, right-hand corner of the screen.

Disclaimer: While every reasonable cause is taken to ensure the accuracy of information printed or presented here, no responsibility can be accepted for any loss of inconvenience caused by any error or omission. The ideas, suggestions, general principles, examples and other information presented here are for reference and educational purposes only. This blog article is not in any way intended to provide investment advice or recommendations to buy, sell or lease properties or any form of property investment.