If you’re reading this, you may be interested to know what’s in store during our Live Seminar held on the 29th of November 2022 at our office in Toa Payoh. If you’ve been sitting on the fence, here’s the direct link to get tickets. (P.s. They’re selling fast!)

It’s been a while since we had the chance to meet you and our other valued readers. And with so much happening in the property industry recently, we felt it was necessary to clear any doubts and worries homeowners may have when it comes to their buying/selling journey and the future of the property prices.

As you may already know, just less than 2 months ago, the Housing & Development Board, in conjunction with The Ministry Of National Development, posted a joint press statement on new cooling measures meant to tackle the rise in HDB prices and promote prudent borrowing in a time of high (and still rising) interest rates.

Since then, there’s been a market reaction, and plenty of never-ending questions and appeals, especially from Private Property Owners whom we feel are affected the most. We cover the winners and losers here the day after the news was released.

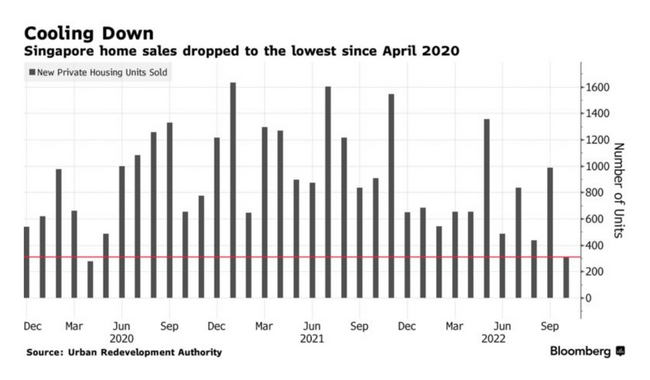

The market reaction has been swift with an immediate drop in volume transactions, with a 12% decline in private property resales and 24% in HDB resales in the month of October. A knee-jerk reaction? Perhaps, perhaps not.

In addition, flash estimates have also predicted a drop in property prices across the board as well – highly due to the drop in demand.

Are homeowners sitting still and waiting to react only when things are clearer? Or are they still tempted to cash out early while markets are still at an all-time high?

Similarly, are buyers waiting for a decline or are they instead looking to buy smaller units or move to less central areas?

On the 29th, this is exactly what we will be covering.

1) The Facts, The Figures, & The Fall?

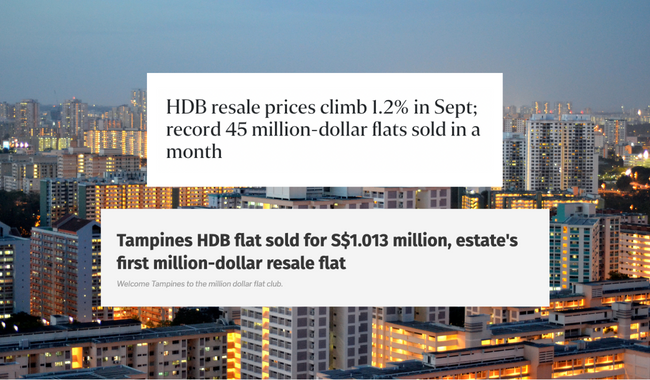

As covered above, the cooling measures felt necessary. We were seeing consecutive months when prices were rising for both HDBs and Private Properties. Everyone was getting in on the action.

Nothing else showed how clear the rising prices were than the news of multiple million-dollar HDBs exchanging hands — there were 45 in just September alone. Even Punggol, a non-mature estate, earned its first million-dollar sale.

So, what happened?

There were 3 main cooling measures:

1) 15-month wait-out period for private property sellers planning to move to a HDB as long as they are below the age of 55.

2) Increased computational rate for HDB Loans from 2.9% to 3%. (Note: Rates are still at 2.6%, but the calculation on how much to give you has reduced.)

3) Reduction in Loan-To-Value limits for HDBs from 85 to 80%. (You’ll have to pay more in Cash or CPF as a down payment.)

At a glance, we can see that the biggest factor at play is the amount of cash in the hands of buyers.

Private Property owners are set to have a bigger windfall from their investments paying off. They are also seen as more willing to outbid and pay a higher Cash Over Valuation to get the biggest units available, forcing them to rent for 15 months or longer, which would drain the new cash they received. This would result in a lower purchasing power when they can finally purchase.

The 15-month period also acts to “rest” the market and hopefully stabilise prices, or return to more normal figures during the time.

If you’re a first- or second-time buyer, points 2 and 3 both reduce the amount of loan disbursed to you to help finance your property. Requiring more resources on hand would make sure you are more certain in your property purchase.

So, what is expected?

While many predict a fall, and even though we’ve seen some early signs, it’s still early to tell. We expect prices to stop climbing and stabilise instead of heading off a cliff — we’ll provide even more figures to back this up during our seminar.

This section will be hosted by none other than the face of our Ohmyhome video content:

Whether it’s a 57-second reel on Instagram, a voice-over of a new launch condo, or whether she’s covering the most interesting nooks in your apartment, Audrey Siek will be reporting the news as she did all those years ago when she was with Channel News Asia.

2) One Thing Is Still Bound To Rise: Interest Rates And Your Mortgage Payments

We aren’t experts when it comes to the hows and whys of the interest rate markets. Therefore, we onboarded experts that can make head and tail of the biggest financial instrument meant to help you afford a home: your home loan.

If you’re holding on to a bank loan, you know how much of a pain it has been recently. Such high interest rates have turned profitable investments into negative cash flow assets, and some have even burst the Total Debt Servicing Ratio limits of 55% because of the recent increase.

To put things into perspective, earlier this year, a 1.2% rate on a $1,000,000 mortgage over 25 years equalled a monthly payment of $3860. Today, at 4.2%, that same loan now requires a monthly payment of $5390 instead. That’s a 40% increase in just a matter of months.

This is why we’ve seen landlords raise rental prices of their investment properties to match the rise of interest rates. Rent has also increased by about 30-40% during the same period.

To help explain it all, we have Desmond Chua, Vice President, Home Loans Specialist from UOB who will be covering everything you need to know about where the interest rate market is headed, and the different offers the banks are having today for those planning to purchase a new home or refinance existing loans to prevent even further pain if interest rates cross the 5% mark.

Find out what Desmond has to say here.

And if you’re feeling the “mortgage stress”, this may put you at ease at least a little bit: Banks such as DBS have said that they “have measures in place to help customers manage their home loan repayments in the event of unexpected financial difficulties”.

3) Tell Me What To Do!

Of course, we won’t leave you empty-handed. This isn’t just an informational event, meant to overload your brains with data and stats, we’re here to help. As we say we’re always by your side, and on your side.

Our final speaker would be none other than our Sales Director and the gentle giant of the North East. Trusted from Serangoon to Punggol, Jason has completed over 135 deals in the last 2 years. If you want to know the best spots along the purple line, he’s your guy.

Jason will be covering specific case studies of Singaporeans like yourself on what they’re planning to do and the options they have when planning their next property journey.

Here is where you learn that you’re not alone and many others face similar conundrums and need the same quality of advice when it comes to their home sale or purchase.

Jason will be going through 3 case studies:

1) An existing private property owner that is currently contemplating the 15-month wait but desperately requiring more space due to a growing family.

2) A HDB owner who feels it is time to cash out and right-size their property as their kids have grown, but wondering who their ideal buyer could potentially be.

3) First-time buyers who cannot wait 4-6 years for a BTO and need the space to help with the low birth rates.

If I’ve described your situation perfectly above, you should already have your tickets on hand right now. And even if you’re facing a different scenario, there will be 15-30 minutes at the end of the seminar to run through your unique issues with Jason and our other agents to get the necessary help you need.

So, what are you waiting for?

Tickets have been selling fast and are still priced at $5 until the 29th itself.

You’ll be getting access to rich, useful, and highly relevant content that will likely give you a leg up when compared to your peers when deciding what to do next for your home journey.

Blogs like these can only cover so much and it’s only during these times when we’re physically together that we can provide nuance in our analysis.

Do yourself a favour and end the year by learning something new before you jet off for your end-of-year holidays.

Open your google calendar right now and check if you’re available on the 29th of November at 7.30pm. If there’s an empty uncoloured slot on your calendar, you know what to fill it up with.

Come down for our Live Seminar: The Market Impact Of Cooling Measures & Rising Interest Rates.

Tickets are on sale here. Just one more thing to add to your Black Friday cart. It’s also likely cheaper than anything else you’re buying. See you there, friend!