Want to level up your financial planning? Then SGFinDex will be right up your alley. Say good-bye to your spreadsheets and embrace the digital way of tracking your finances.

Introducing SGFinDex

Singapore Financial Data Exchange (SGFinDex) is a new platform from the Monetary Authority of Singapore (MAS), and the Smart Nation and Digital Government Group (SNDGG), supported by the Ministry of Manpower (MOM).

What is SGFinDex and what does it do?

It’s an online platform that rides on SingPass, Singapore’s national digital identity system, that allows you to view all your funds and investments in one place and use digital tools like MyMoneySense to make better financial decisions.

You’ll need to log in to SingPass to access the platform, and give consent for it to retrieve your financial data. This means you have all the control, including choosing which participating entities your data will be shared with.

So far, these seven banks in Singapore are enrolled in the programme:

- Citi Singapore Ltd

- DBS Bank Ltd

- HSBC Bank (Singapore) Ltd

- Maybank Singapore Ltd

- Oversea-Chinese Banking Corporation Ltd (OCBC)

- Standard Chartered Bank Singapore Ltd

- United Overseas Bank Ltd

Can SGFinDex replace a financial advisor?

You may not need an advisor if your financial situation is relatively straightforward, such as having assets only in Singapore, and with just one property in your name, or none. In this case, you can consolidate your finances with an app (such as Planner Bee!) and proceed to review your plans.

The basics of financial planning involves:

- Knowing what you have

- Improving your cash flow

- Having an emergency fund (Calculate your emergency funds)

- Outsource your risks with insurance (Calculate your insurance)

- Figure out a goal and invest toward it

- Work toward Financial Independence, Retire Early, aka F.I.R.E (Calculate your retirement funds)

BUT. We often find that people have trouble sorting out steps 2, 3, 4, and 5 themselves. This is when it’s time to get a financial advisor to help.

For others, if you don’t want to deal with the research or stay updated with the changes in the industry, an advisor will recommend products that will suit you.

Financial planning is an ongoing process, not a one-time silver bullet, so an advisor can come in to keep you updated.

I know how much money I have, so why would I need SGFinDex?

Although you may think you know how much money you make and have in the bank, proper financial planning means getting a holistic view into your finances–across different bank accounts or cards–in order to identify any unknown leaks in spending or bills.

SGFinDex offers a view across seven participating banks. This will help your financial advisor get a clearer view into your existing finances before they can suggest improvements.

You’ll also be better equipped to discuss big purchases, such as a new home, because you’ll have the information ready to see how to plan your mortgage.

Who do I pick?

There are so many apps to choose from, including Planner Bee, DBS NAV Planner, Moneysense, SGFinDex, Seedly, OCBC’s Your Financial OneView.

SGFinDex touts a centrally managed system, which provides a single place for you to access your financial information across financial institutions.

Other existing platforms such as Seedly, Planner Bee and Spendee, also support cross-platform institutions. It even filters your spending automatically into different categories so you can identify your biggest spending areas.

But while SGFinDex allows you to see your overall ins and outs, it doesn’t allow you to view your transactions by categories.

Overview of what SGFinDex, Seedly, Planner Bee, and Spendee can do:

- Savings account balance

- Credit card statements

- Loans

- Fixed deposits

- Unit trusts

| SGFinDex | Seedly | Planner Bee | Spendee | |

|---|---|---|---|---|

Government data:

| YES | N/A | N/A | N/A |

| Syncs Singapore bank data: | YES | YES (Transactions are autocategorised) | ||

| Syncs bank data from foreign banks | N/A | YES (Transactions are autocategorised) | ||

| Syncs insurance policy data | N/A | N/A | YES (Transactions are autocategor | N/A |

| Syncs investment portfolio today | N/A | N/A | YES (Transactions are autocategorised) | N/A |

| Cost | Free | Free | Free | US$2.99/mth |

| Security | Users’ personal financial data is encrypted when it is retrieved through SGFinDex. Only the financial planning application/website that the user has authorised to receive the data is able to decrypt it. | All financial account information is retrieved in read-only mode and encrypted so only authorized users can access it. | ||

| Authentication | SingPass and iBanking login credentials Users are verified with SingPass before they can connect their bank accounts and retrieve data. User’s identity is verified each time their personal financial data is retrieved. | User input their ibanking login credentials through the app and this provide consent to the app to retrieve data on their behalf. User’s identity is verified each time their personal financial data is retrieved. |

How do I use SGFinDex?

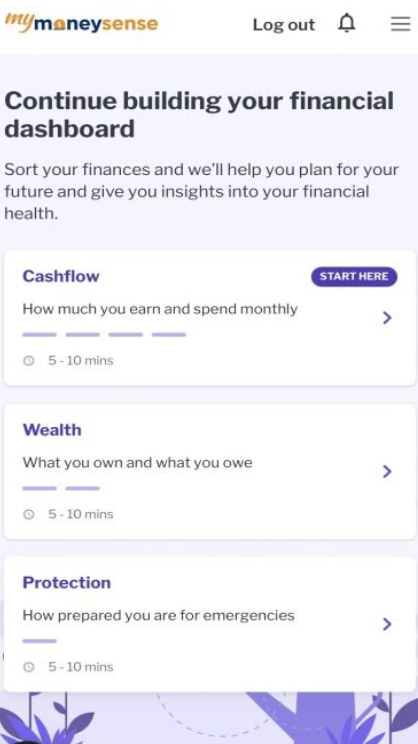

Head over to MyMoneySense, a platform by the Ministry of Manpower, to retrieve and view your personal financial data from government agencies via MyInfo.

Here’s a snapshot of the MyMoneySense portal:

Source: MyMoneySense

If you want to use a participating bank’s financial planning application or website, you’ll need an Internet banking account with it.

So once you’ve logged in to SingPass (to verify your identity on MyMoneySense and any of the seven participating banks), you will be redirected to SGFinDex where you can then connect your accounts and authorise the transfer of your financial data.

It will then be displayed on your chosen platform, be it MyMoneySense or a bank’s mobile app or website.

This article was originally published on Planner Bee, your handy financial planning app! Learn more about managing your money, investments and insurance on Planner Bee’s blog.