Selling your HDB resale flat can be daunting, regardless of whether it’s your first or second time. You may be worried about which documents to prepare and submit to HDB, or stressing about whether your cash proceeds will be enough to buy your next home or if you’ll be granted an extension of stay.

Don’t worry. We’ve compiled a list of everything you need to know and have when selling your home.

Jump to Full 2024 HDB Seller Checklist

2024 HDB Seller Checklist: Before Selling Your HDB

| No. | Checklist |

| 1 | HDB MOP Date |

| 2 | HDB Valuation |

| 3 | Intent to Sell |

#1: HDB MOP Date

The most important thing you need to check before selling your home is your Minimum Occupation Period (MOP). We explain this in depth here, but your HDB resale flat’s MOP is most likely 5 years. If you bought a BTO flat in 2019, you can start planning your home sale too because your flat will be reaching MOP in 2024.

#2: HDB Valuation

It’s simple: The value of your home will determine how much you can sell your home for. Typically, this is calculated based on the recent property transactions in your block and/or area.

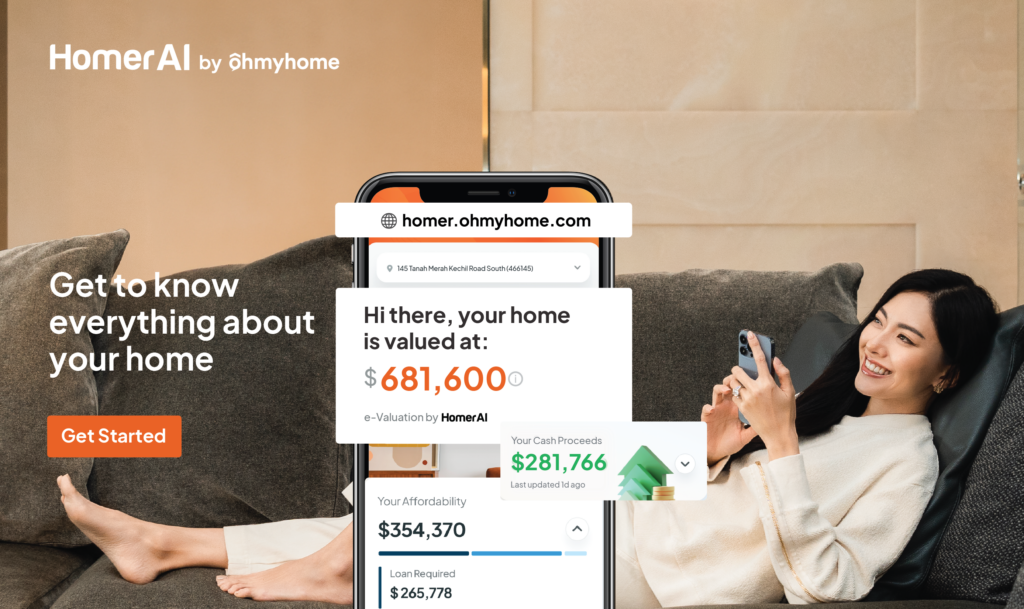

But we went a step further and developed Homer AI to also consider the current HDB resale prices listed on all the major platforms like PropertyGuru to give you a home valuation that’s closer to the true value of properties in the market right now.

Your home valuation by Homer AI will also be updated every month, so you can track how much it has increased or decreased.

With Homer AI, you’ll also be able to calculate how much cash proceeds you’ll get after selling your home — an important piece of information to have especially if you plan to use it to buy your next home.

#3: Register Intent to Sell

To register your Intent to Sell, all you have to do is:

- Go to the HDB resale portal

- Click “I am a Buyer or Seller”

- Proceed to log in with your Singpass

Upon registration, you’ll receive:

- An instant assessment of your eligibility to sell

- The Ethnic Integration Policy/ Singapore Permanent Resident (EIP/ SPR) Quota for your block

- The status of upgrading and billing of upgrading costs

- Recent transacted prices of nearby HDB resale flats

IMPORTANT: Your HDB Intent to Sell is valid for only 12 months (1 year), so you need to submit the HDB resale application within that time. Otherwise, you’ll have to submit another application.

At this stage, you can speak with a property agent to get the selling process started.

With Ohmyhome, your listing will be posted on all the major platforms in Singapore, and you’ll be assisted by a personal Relationship Manager. You can message them on WhatsApp for any and all questions you may have.

2024 HDB Seller Checklist: After Finding a Buyer

Now, when you’ve found a buyer, you’ll need to prepare to…

| No. | Checklist |

| 1 | Grant Option to Purchase to Buyer |

| 2 | Request for HDB Temporary Extension of Stay* |

| 3 | Buyer to Exercise OTP |

| 4 | Receive Option Fee from Buyer |

#1: Grant Option to Purchase

You won’t have to prepare the Option to Purchase (OTP) as it will be done by your buyer. However, before granting the OTP to your buyer, remember these 3 things:

- You’ll need to complete the Intent to Sell at least 7 days before granting the Option to Purchase (OTP).

- Your buyer will need to have a valid HDB Flat Eligibility (HFE) letter before you can grant the OTP.

- If your buyer intends to get a bank loan, he/she must have a Letter of Offer before he/she can exercise the OTP.

#2: Request for HDB Temporary Extension of Stay (if necessary)

If, for some reason, you can’t move out of your home by your HDB Resale Completion date, you can request for a Temporary Extension of Stay. All you and/or your property agent has to do is get the buyer to sign the Temporary Extension of Stay form and submit it along with your HDB resale application.

Basically, a HDB Temporary Extension of Stay is a private agreement between you and the buyer that allows you to stay for up to 3 months in your flat after the resale completion.

However, this will only be approved if your next home is already completed and ready for occupation. If it’s still under construction, your Temporary Extension of Stay will not be approved by HDB.

Terms and conditions for HDB Temporary Extension of Stay

#3: Buyer to exercise OTP

The OTP is only valid for 21 days and must be exercised within that period. If the buyer, for any reason, “backs out” of the purchase, the OTP will lapse and expire. So you’ll need to find another buyer — make sure they’re serious about buying your home this time.

Though you won’t have to exercise the OTP as the seller, you’ll have to provide all the OTP details when submitting your HDB resale application.

#4: Receive Option Fee from Buyer

When you’ve agreed on a price with your serious buyer, and have discussed the terms of the Temporary Extension of Stay (if necessary), he/she will send you the exercise fee. This, together with the Option fee, will form the deposit. It cannot exceed $5,000. For example, if the buyer paid $1,000 for the Option fee, which is typically the case, the exercise fee should be less than $4,000.

2024 HDB Seller Checklist: Submit HDB Resale Application

This is one of the last steps you’ll need to complete to sell your HDB resale flat. Now, your property agent can actually submit your HDB resale application on your behalf. Simply send him/her all your personal information and documents.

| No. | Checklist |

| 1 | OTP Details |

| 2 | You and Your Co-owners’ Personal Details |

| 3 | HDB Temporary Extension of Stay |

| 4 | Pay Admin Fee |

Here are all the documents you’ll need to prepare, according to the checklist above.

| What to Prepare | Checklist |

| OTP Details | – Your HDB resale flat address – Buyers’ particulars (such as name and NRIC) – OTP serial number – Option Date – Purchase Price – Option Fee – Option Exercise Fee – ‘Acceptance’ date – Soft copy of OTP |

| You and Your Co-owners’ Personal Details* | – Identity Card or Passport (for non-citizens) – Duplicate Lease, if it has been issued – Wife/Husband’s endorsement on the resale application form and Spouse Consent to Resale form if she/he is the occupant of the flat – Power of Attorney, if applicable – Lasting Power of Attorney (LPA), if applicable – Deed of Separation, Divorce Certificate, Decree Nisi/ Interim Judgement, Certificate Making Decree Absolute/ Certificate Making Interim Judgement Absolute, if applicable – A Letter of Consent from the Official Assignee, if applicable |

| If the HDB Owner Is Deceased** | – Death certificate of seller – Grant of Letter of Administration/ Probate, if applicable – Last will of the deceased, if applicable – Order of Court to sanction the sale, if applicable |

| If the HDB Owners Are Divorced or Separated** | – Deed of separation or Interim Judgment (previously known as Decree Nisi) – Certificate of Making Interim Judgment Final (previously known as Decree Nisi Absolute) – Order of Court, if any – Any other documents of the divorce |

| If You’re Planning to Use Your Cash Proceeds to Buy Another HDB Resale Flat | You’ll need to indicate that you’re applying for the Enhanced Contra Facility in the resale application. You’ll also need to indicate in your resale application whether you’ll be appointing your own private lawyer, or an HDB lawyer to act for you in the conveyancing of the resale transaction. |

| HDB Temporary Extension of Stay | Form signed by you, the seller, and your buyer(s) |

| Pay Admin Fee | $40 for 1- and 2-room flats$80 for 3-room and bigger flats |

*You may have to submit the documents of you and your co-owners’ personal details in soft copy.

**If the documents are in Chinese, Malay, or Tamil, you’ll need to submit an official English translation.

You can check the status of your application on the HDB Resale Portal.

2024 HDB Seller Checklist: After Submitting HDB Resale Application

| No. | Checklist |

| 1 | Acknowledge & Endorse Resale Documents |

| 2 | Pay Legal Conveyancing Fees |

| 3 | In-principle Approval Letter from HDB |

| 4 | HDB Resale Completion Appointment |

#1: Acknowledge & Endorse Resale Documents

After you’ve submitted your HDB resale application, HDB will send the necessary documents you’ll need to endorse via SMS. The endorsement will be done on the HDB Resale Portal, and must be completed in 6 days.

#2: Pay Legal Conveyancing Fees

Once the documents are endorsed, you’ll be directed to pay the conveyancing fees online using your credit card. If you can’t pay online, you can print the payment advice and make payment at HDB Hub.

#3: In-principle Approval Letter from HDB

Within 2 weeks after you’ve endorsed the resale documents and paid the legal conveyancing fees, you will receive an in-principle approval letter from HDB for resale via email and SMS. The letter will also be posted on the HDB Resale Portal.

#4: HDB Completion Appointment

Once HDB has approved your HDB resale application, you will receive a Resale Completion Appointment schedule via SMS to finalise the transaction. The completion letters will also be available on the portal.

At HDB hub, you will sign the legal documents to transfer ownership and hand over the keys to your buyer(s).

If you hired a HDB lawyer, you’ll need to be present at the appointment. If you hired a private lawyer, he or she can attend the appointment on your behalf.

The Full 2024 HDB Seller Checklist

| No. | Checklist – Before Selling Your HDB |

| 1 | HDB MOP Date |

| 2 | HDB Valuation |

| 3 | Intent to Sell |

| No. | Checklist – After Finding a Buyer |

| 1 | Grant Option to Purchase to Buyer |

| 2 | Request for HDB Temporary Extension of Stay* |

| 3 | Buyer to Exercise OTP |

| 4 | Receive Option Fee from Buyer |

| No. | Checklist – Submit HDB Resale Application |

| 1 | OTP Details |

| 2 | You and your Co-owners’ Personal details |

| 3 | HDB Temporary Extension of Stay |

| 4 | Admin Fee |

| No. | Checklist – After Submitting HDB Resale Application |

| 1 | Acknowledge & Endorse Resale Documents |

| 2 | Pay Legal Conveyancing Fees |

| 3 | In-principle Approval Letter from HDB |

| 4 | HDB Resale Completion Appointment |

Ready to sell your HDB resale flat?

Our Super Agents are among the Top 1% in Singapore, helping more than 8,000 happy customers with their property transaction journey. They’ve given us 5-star ratings on both Facebook and Google — check their reviews to understand how we serve HDB sellers.

Drop us a message on WhatsApp to get an immediate callback or talk to us via our Live Chat at the bottom, right-hand corner of the screen.