When you finally decide to sell your HDB resale flat, you’re most likely wondering if you can make a profit, and the fastest way to tell is by checking the last transacted price in your block. As we wrote in this article, past transaction prices often set the benchmark for current and future home valuations within a particular block or area. It becomes part of the historical data that potential buyers, sellers, and valuers use to gauge the market value of similar properties, which influences the selling price of a property once it’s listed for sale. Now, the question is…

Where can you find the last transacted price in your block?

We’ve developed Homer AI, which provides all the information you need to know about your property — from your home valuation to the latest property transaction within your block, cluster, and 1km of your home. You can also zoom into the lowest and highest transacted prices, with details such as the transaction date and unit size.

Case study: Last transacted price in your block

For example, the last transacted price in Block 79E at Toa Payoh Central is $788,000 for a 4-room flat that’s about 818 sq ft.

As you can see in the graph, though there have not been any HDB transactions in 2024, the selling price of units in the block has risen from November to December. While the last transacted price was below $800k, the average sale price of a flat (from only 3 transactions!) is higher at $810k. With such information, you can stand firm on your ideal selling price when negotiating with potential buyers.

Case study: Last transacted price in your cluster

The last transacted price in this cluster of HDB blocks is $974,888 for a 4-room flat (980 sq ft) at the nearby Blk 79B.

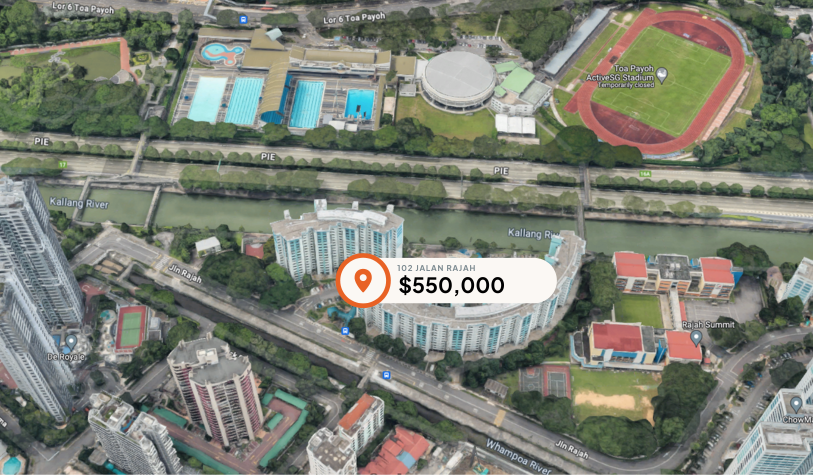

Case study: Last transacted price of properties within 1km of your home

The last transacted price within 1km of Blk 79E at Toa Payoh Central is $550,000 for a 1,012 sq ft 4-room flat at 102 Jalan Rajah.

Take the power of information into your hands, for free!

You don’t even need to talk to a property agent to learn more about your home and the property market. With Homer AI, you can get the most important property insights in just a few clicks.

Ready to sell your HDB resale flat?

Drop us a message on WhatsApp or chat with us via our Live Chat at the bottom, right-hand corner of the screen to reach any of our property agents. Set up a non-obligatory meeting and we’ll be there to help you execute your home sale.