So you reach a point where you are at a crossroads and thinking of purchasing a property for the second time. This could be due to a variety of reasons. Some common reasons include such as needing a bigger home, staying closer to your family or getting home near a top school.

But not so fast! As a potential second-timer homebuyer, here are a few things to keep in mind as you dive back into the public housing pool.

Essential Tips for Second-Time HDB Buyers

1. The Minimum Occupation Period (MOP)

HDB owners should fulfill their current flat’s MOP in order to qualify for a second property. This means dedicating a whole five years to stay in the flat, before you can buy your next resale flat.

This brings up the question: are you willing to commit yourself to yet another 5-year MOP? In the event of any unforeseen circumstances, such as the inability to afford the monthly payments, or a breakdown in your family structure following a life event, this could all affect your eligibility to own your flat. Think carefully!

2. The amount of loans allowed for your second flat

The ownership of a second flat will impact your loan eligibility for your new purchase. Two factors will affect your loan eligibility for a second property, namely the total debt servicing ratio (TDSR) and the loan-to-value (LTV) ratio. Introduced to control the amount of loan allowed, as well as lessen the inability for borrowers to pay their monthly obligations.

It was initially 60%, but was revised to 55% on 16 December 2021 as a result of the latest round of the property cooling measures. The main aim of the TDSR framework is to instill prudence in buyers. And to ensure loans are only issued to borrowers who have the financial means to afford them. Most importantly it was implemented to deter property speculation in Singapore as well.

3. The amount you pay for the Additional Buyer’s Stamp Duty (ABSD)

Depending on the buyer profile and number of properties owned, the ABSD rates will differ. Singaporeans will need to pay a 17% ABSD on the purchase price or the market value (whichever is the higher amount) on the second residential property, aside from a lower LTV and higher cash down payment. This will increase to 25% for the third and subsequent residential property.

New laws from 9 May, 2022 with regards to residential properties transferred into a living trust:

Additional Buyer’s Stamp Duty (ABSD) of 35% will now apply on any transfer of residential property into a living trust. ABSD will be payable even if there is no identifiable beneficial owner at the time the residential property is transferred into a trust.

So this new change closes a loophole. This ABSD (Trust) is to be paid upfront when the transfer is made.

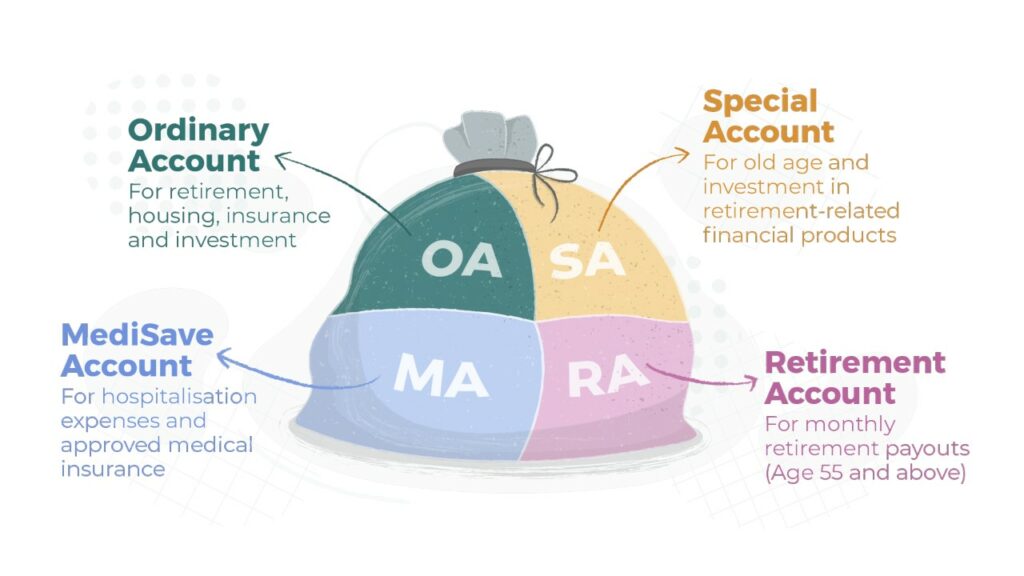

4. The eligibility of using your CPF

If you have already used your CPF for your first property, you could still use it for the second one under certain conditions. For instance, only after setting aside the current Basic Retirement Scheme (BRS), second-timers can then use the excess CPF Ordinary Account Savings for your second property.

5. The length of time it could take to sell off your flat

Granted if you have purchased a new flat before selling the existing one, you will generally have up to six months to sell off your current flat. As required under HDB rules, you are legally not allowed to own two HDB flats at once, and must sell the old flat within six months of getting your keys. Failing to do so may result in HDB enforcing their legal rights to pressure you to give up your brand new property.

You could appeal to HDB for a time extension of up to 12 months to sell the current flat, or delay the key-collection date. With such a huge investment at stake, opting for an extension should be a last resort, as this leaves you in a vulnerable position.

Though this may not be a exhaustive list, this will kickstart and set the wheels in motion when you are purchasing a HDB resale property for the second time. You can also check out the HDB website on some of the requirements needed for buying your next flat as well. If you are still unsure, our Super Agents will gladly guide you through the process with you.

Looking for an HDB or private property?

Let Ohmyhome’s smart data-matching technology MATCH you with the right home, according to your specific needs. Submit your preferences to us and our algorithm will filter all our available listings based on those, and we’ll WhatsApp them to you once we find a match. We’ll also send you relevant content that you can use for your research and inform your home-buying decision, so you no longer have to spend hours searching online for the information that you need. Because at Ohmyhome, we’re always by your side, always on your side.

You can also call us at 6886 9009 to secure an appointment with any of our Super Agents or message us in the chatbox at the bottom, right-hand corner of the screen. You can also WhatsApp us at 9755 1009!

Related posts:

- How to Pick The Best Mortgage Loan Type in Singapore

- Top 5 Benefits Of Selling HDB And Private Property With Property Agent

- What You Need to Know About the HDB Loan and HDB Loan Eligibility (HLE) Letter

- Why You Need Legal Conveyancing Service for Your HDB Flat

While the Information is considered to be true and correct at the date of publication, changes in circumstances after the time of publication may impact on the accuracy of the Information. The Information may change without notice and Ohmyhome is not in any way liable for the accuracy of any information printed and stored or in any way interpreted and used by a user.

Header Image: Freepik