Every quarter, The Housing and Development Board releases flash estimates of resale prices for public housing flats. Ohmyhome analyses the data released and picks out the most relevant points and trends for readers.

Flash estimates from HDB indicated that prices in the HDB resale market rose at a slower pace by 2.3%. This is a lower price change as compared to the 3.4% price change in the preceding quarter.

The slower growth in the HDB resale prices in the first quarter of 2022, can be attributed to a blend of factors. This included a drop in demand, viewing restrictions that were in place and the strong interest for February’s Build-To-Order (BTO) exercise.

Drop in demand in 1Q22

Preliminary transaction volume for 1Q2022 reflected a 18.2% drop in flats sold as compared to 4Q2021.It is likely some home owners might be on the sidelines and may have postponed their decision to put their flat for sale on the market, to evaluate the impact of the property cooling measures.

Hence, restricting the provision of flats that become available for sale. While prudent buyers might be selective in their home purchasing decisions and anticipate an opportune time to enter the market as well.

More applications for BTO flats

The February BTO exercise witnessed a total of 26,870 applications for the 3,953 flats that were launched for sale. This accounted for a 6.8 application rate as compared to the application rate of 4.4 in November 2021. Hence, this could have contributed to the drop in demand for resale flats as buyers were more attractive to the BTO flats in this round.

The strong interest was due to a fair mix of flats with exceptional locational attributes in estates such as Geylang and Kallang/Whampoa estate. As well as shorter waiting time for the BTO flats in Tengah and Yishun have likely fuelled interest as well.

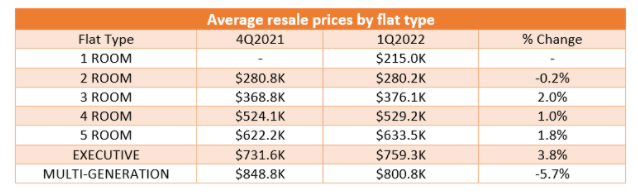

Growth in average resale prices for bigger flats

However, the reason for HDB resale prices to still reflect a positive price growth in the first quarter of 2022, was due to average resale prices rising across most flat types. With the highest price increase seen for bigger flats such as executive flats and 5 room flats.

A 3.8% increase for executive flats and a 1.8% rise for 5 room flats respectively. And at least 18 out of the 26 HDB towns saw price increases across the varying flat types in 1Q22 as compared to the price increase of 20 HDB towns in 4Q 2021.

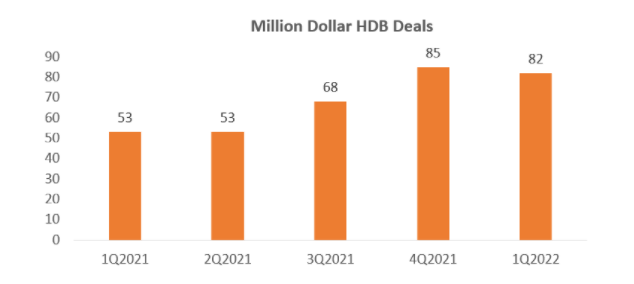

Highest ever million dollar deal recorded in 1Q22

Based on the estimates so far, there have already been 82 million dollar deals in the first quarter of 2022. It was a minor dip of 3.5%, as compared to the 85 deals in the fourth quarter of 2022. However, it has outpaced the 53 deals in 1Q2021.

Buyers of such flats are generally unfazed by exorbitant prices and have ample liquidity, as they place heavy emphasis on locational attributes and having a spacious home.

The priciest flat ever to be transacted, occurred in the first quarter of 2022 as well. A five-room flat at the popular Pinnacle @ Duxton, for a price of $1.39 million. Surpassing last year’s high of the five-room HDB DBSS flat in Bishan, which was sold for S$1.36 million.

These transactions may have contributed to the overall resale prices to keep pace with the rate of positive price change.

Outlook

Although it is unlikely that the phenomenal sales performance will be repeated this year, we are expecting demand to remain positive for the resale market. First-timers and buyers with urgent housing needs will continue to be demand drivers. As observations on the ground have reflected that, some resale flats have been transacted after just one home viewing.

With Singapore moving towards a pivotal direction in living with Covid-19 and with the relaxation of measures, this will further improve market sentiments as well. Keeping that in mind and with the rise in interest rates, we are expecting prices to hover around 3% as compared to the 6% increase in the first half of 2021.

The Housing & Development Board will release the updated and full set of statistics on Apr 22 for the first quarter of 2022.

Looking to buy a HDB resale flat?

Here’s how you can speed up your home search

Let Ohmyhome’s smart data-matching technology MATCH you with the right home, according to your specific needs. Submit your preferences to us and our algorithm will filter all our available listings based on those, and we’ll WhatsApp them to you once we find a match. We’ll also send you relevant content that you can use for your research and inform your home buying decision, so you no longer have to spend hours searching online for the information that you need.

You can also call us at 6886 9009 to secure an appointment with any of our Super Agents or message us in the chatbox at the bottom, right-hand corner of the screen. You can also WhatsApp us at 9727 5270!