It’s been 2 months and we’re slowly but surely seeing the impact of September 2022 cooling measures on homeowners. During our live consumer seminar last night, on 29 November, we heard it straight from the horse’s mouth.

Ohmyhome’s Deputy Sales Director Jason Selvaraj shared some interesting insights about how his own clients are reacting to the 15-month wait-out period.

But before we get into those case studies, let’s do a quick recap on this particular cooling measure.

Key Considerations During the 15-Month Wait-Out Period:

- What is the 15-month wait-out period all about?

- Is your 15-month waiting period over?

- Who’s affected by this cooling measure?

- Why is this new cooling measure in place?

- Are there any ways to work around this cooling measure?

- Will the 15-month wait-out period go away?

- Thinking of selling your private property but unsure how to go about it because of the 15-month wait-out period?

What is the 15-month wait-out period all about?

This new cooling measure basically means that private property owners who are looking to sell their home and buy a HDB flat right after must wait for 15 months before they’re eligible to make a flat purchase.

Is your 15-month waiting period over?

Finally! Time to get cracking on your private property selling journey. Find out your current home valuation and calculate your cash proceeds or speak directly with one of our property agents.

Who’s affected by this cooling measure?

Private Property Owners (PPOs) below 55 years old who are looking to sell their private property and buy a HDB flat will be directly affected by this new measure.

This means that those over the age of 55 and are looking to buy a 4-room or smaller HDB flat, a 2-room flexi will be automatically exempted from the 15-month wait-out period.

Why is this new cooling measure in place?

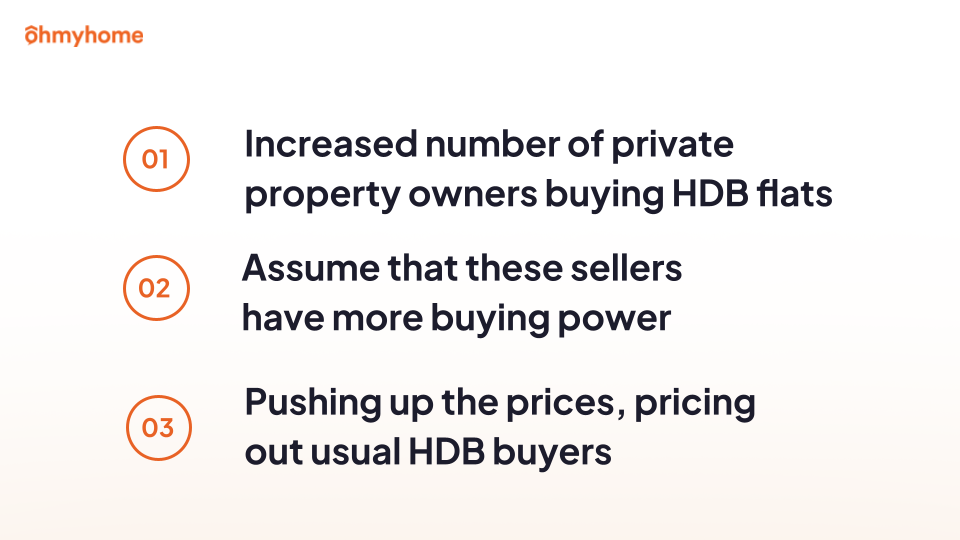

According to Minister of National Development Desmond Lee, the number of PPOs who bought a HDB resale flat doubled in 2021 and the first 3 quarters of 2022 as compared to 2019 and 2020.

This can only mean that as PPOs are selling their homes at higher prices, they have more cash on hand to pay for Cash Over Valuation (COV) compared to first-time HDB buyers or HDB owners looking to move into a bigger flat.

With more financial resources, they’ll be more able to pay higher COV amounts, outbidding those other HDB buyers. As a result, they push up the prices of HDB resale flats within the vicinity and price other buyers out of the market.

Hence, this new cooling measure was put in place to stabilise the market and keep public housing affordable, as it should be.

Are there any ways to work around this cooling measure?

Homeowners who had their private properties in the market right as the new cooling measures took effect had to either pull out of the market or find some other workaround to their situation.

Our Super Agent Jason highlighted the 2 possible courses of action that he presented to his clients and that PPOs can take in order to sell their private property and move to a new home.

Case Study 1: Bite the bullet and start renting

If you’re hellbent on getting a HDB flat after selling your private property, and you’re willing to wait out the 15 months to do so, this is for you. Is it doable? Let’s crunch the numbers — for now, just the basic ones (without all the other costs, such as HDB admin fees, legal fees, etc.)

So last night, Jason shared that one of his clients who owns a 3-bedder condo in District 19 was planning on selling it for about $1.95 million. Now, they had an outstanding loan of about $704,000 and needed to return about $350,000 to their CPF OA, which means they’ll get about $896,000 in cash proceeds. (Numbers are for illustrative purposes only.)

Now, if they take a 2-year lease (because who rents for 15 months?) at about $3,500 per month, which is around $84,000 in total, they’ll have $812,000 left in cash.

Here’s the calculation:

$1.95 million (Selling Price) – $704,000 (Outstanding Loan) – $350,000 (CPF OA Refund) = $896,000 (Cash Proceeds Before Renting) – $84,000 (2-year Rental) = $812,000 [Final Cash Proceeds After Renting)

At this point, the 15-month wait-out period would have passed and they would be eligible to purchase a HDB flat.

Now, let’s say there’s a well-kept and furnished flat in the same district you’re in right now that’s selling for about $650,000. If they decide to go ahead with this flat, keeping in mind they can use both cash and CPF to pay for the flat, they will still have about $512,000 in cash.

As such, we would have to say that renting during the 15-month wait-out period is doable as you’ll still have a bit of cushion in case of a rainy day. However, you will have to consider that you won’t get back the amount you paid in rent for those 2 years — which you did just to be able to buy a HDB flat.

Case Study 2: Buy a smaller condo instead

Another viable option you can consider is buying a smaller condo, maybe a 2-bedder, in the same district instead. (Remember, they currently own a 3-bedder.)

Why is this a good idea?

Well, according to Ohmyhome Research, private properties in D19 appreciated by 6.3% in the past 15 months. That means, Jason’s clients could sell their private property at about $1,295 psf and buy a smaller condo between $1,700 and $1,900 psf. With new launch prices hitting over $2,000 psf, they will also be buying into the potential future growth of the property.

So now here’s the scenario.

Let’s say they go ahead with this strategy and buy the 2-bedder condo in D19 for about $1.6 million, how will their finances look like?

Here’s a quick calculation:

$1.6 million (Purchase Price) = $350,000 (CPF) + $600,000 (Cash) + $700,000 or $4,500/mth (Loan)

Instead of paying about $84,000 for a 2-year rental apartment, they can use that to service their mortgage. Though they have a lesser cash balance of $296,000 (compared to the $512,000 if they rented), they own a property that they can live in for the rest of their retirement and still have a comfortable amount of cash.

Just to let you know, most of the consumers who attended our seminar last night chose this option.

But we did get this next question too.

Will the 15-month wait-out period go away?

While HDB did say that the 15-month wait-out period is a “temporary measure that will be reviewed depending on overall demand and market changes”, we think that there’s very little chance they’ll do away with this cooling measure. As much of a pain as it is to PPOs.

The reason why think this is highly unlikely to happen is because the cooling measures put in place years ago — such as the Seller’s Stamp Duty (SSD), Additional Buyer’s Stamp Duty (ABSD), Loan-to-Value (LTV), Total Debt Servicing Ratoi (TDSR), and Mortgage Servicing Ratio (MSR) — are still in effect today. And we don’t see these going away either.

If you are planning on submitting an appeal to HDB, we talk about some of the exemptions to the 15-month wait-out period in this article.

Thinking of selling your private property but unsure how to go about it because of the 15-month wait-out period?

Our Super Agents are ready to help you figure out the best way you can get your next new home while keeping to your means and hitting all your requirements.

You can book an appointment with our agents by simply filling out the booking form below, dropping us a message on WhatsApp or on the Live Chat at the bottom, right-hand corner of the screen.

And look out for our next article where we’ll talk about what you should look out for in 2023, as a result of these measures.