Buying a Build-to-Order (BTO) flat from the Housing and Development Board (HDB) is a major milestone for young Singaporeans, so much so that asking someone to buy a flat with you is understood locally as asking that person’s hand in marriage. To make your BTO buying experience as smooth and easy as possible, follow this step-by-step guide.

Contents

- Your guide to buying a BTO in 2024

- Step 1: Check eligibility to buy BTO

- Step 2: Get started on your financial planning

- Step 3: Look out for the quarterly announcement of flat sales launch & ballot

- Step 4: Book a BTO flat and pay option fee

- Step 5: Sign lease agreement and pay downpayment

- Step 6: Collect keys

- Not fond of waiting? Buy a resale HDB flat instead!

- Not ready to talk to an agent? Find your dream home automatically

- Frequently asked questions about buying a BTO

Your guide to buying a BTO in 2024

Step 1: Check eligibility to buy BTO

The eligibility criteria varies for each BTO flat, so before you do anything else, you must first check if you and/or your co-applicant are eligible to buy one.

Overview of elibility conditions

| Eligible Applicant / Family Nucleus | Must qualify for Public Scheme, Fiancé/Fiancée Scheme, Orphans Scheme, Non-Citizen Spouse Scheme, Single Singapore Citizen Scheme or Joint Singles Scheme |

| Citizenship | At least 1 Singapore Citizen applicant / At least 1 other Singapore Citizen or Singapore Permanent Resident* |

| Age | At least 21 years old |

| Income Ceiling (Average Gross Monthly Household Income) | 2-room flexi flat: $7,000 (99-year lease) or $14,000 (15 to 45-year lease) 3-room flat: $7,000 or $14,000 (varies for each project, to be specified upon sales launch) 4-room flat or bigger: $14,000 / $21,000 (if purchasing with extended or multi-generation family) |

| Property Ownership | All applicants and occupiers listed in the flat application do not own other property overseas or locally, and have not disposed of any within the last 30 months. All applicants and occupiers listed in the flat application cannot invest in private residential property from the date of flat application till after the 5-year Minimum Occupation Period (MOP). You have not bought a new HDB/ DBSS flat or EC, or received a CPF Housing Grant before; or have only bought 1 of those properties/ received 1 CPF Housing Grant thus far. |

*First-timer households comprising only one Singapore Citizen and one or more Singapore Permanent Resident family members will have to pay a $10,000 premium at the point of flat purchase.

You may apply for the additional $10,000 Citizen Top-Up Grant when your spouse gets Singapore Citizenship or when you have a Singapore Citizen child.

Step 2: Get started on your financial planning

1. Eligibility for HDB or bank loan

A crucial part of the financing process is deciding on whether you are taking an HDB loan or a bank loan.

With an HDB loan, BTO flat buyers can use their CPF to cover the full 10% downpayment required while a bank loan requires the 5-10% downpayment to be paid in cash.

Dive Deeper: HDB vs Bank Loan: Which is Better?

If you opt for an HDB loan, you will need to apply for an HDB Loan Eligibility (HLE) letter, which will specify the maximum loan the Board will extend to you.

But if you go for a bank loan, you will need an in-principle approval (IPA).

2. Work out your budget

To ensure you have sufficient funds for your home purchase, you’ll need to ensure you have enough savings in your CPF and cash as there are a number of fees you are required to pay at certain stages of the BTO purchase.

What you need to pay when buying a BTO flat

| Stage | Type of Fees | Amount |

| Submitting Application | Application fee | $10 |

| Booking of a flat | Option fee (forms part of the downpayment) | For 2-room flexi flat: $500 For 3-room flat: $1,000 For 4-room (or bigger) flat: $2,000 |

| Signing Agreement for Lease | Downpayment | HDB loan: 10% of purchase price using full cash or full CPF Bank loan: 20% of purchase price for loan ceiling of 75% = 5% cash + 15% cash/CPF OR 20% of purchase price for loan ceiling of 55% = 10% cash + 10% cash/CPF |

| Signing Agreement for Lease | Legal conveyancing fee | Minimum fee of $20, based on the purchase price of the HDB flat |

| Signing Agreement for Lease | Stamp duties | First $180,000: 1% Next $180,000: 2% Next $640,000: 3% Remaining: 4% |

| Collection of keys | Lease & Mortgage In-Escrow registration fee | For Lease In-Escrow (if HDB acts for you in the flat purchase): $38.30 (fixed amount) For Mortgage In-Escrow (if HDB acts for you in the mortgage): $38.30 (fixed amount) |

| Collection of keys | Survey fee | 1-room: $150 2-room: $150 3-room: $212.50 4-room: $275 5-room: $325 Executive: $375 |

Other requirements during key collection

| Home Protection Scheme (HPS) | In the event of permanent disability or death before the insured person turns 65, the CPF Board will pay the outstanding housing loan amount, based on the amount insured under HPS. The premium is paid annually using your CPF savings or cash. The premium amount depends on factors such as your declared percentage of coverage, loan amount, age, and gender. |

| Fire insurance | On the day of your appointment to collect the keys, please produce a valid Certificate of Insurance on the new flat issued by our appointed insurer, FWD Singapore Pte Ltd (FWD). |

Staggered Downpayment Scheme

If you’re a young couple buying a BTO flat for the first time, you may apply for the Staggered Downpayment Scheme which allows you to pay the downpayment in two instalments:

- 1st payment: when signing the lease agreement

- 2nd payment: during the key collection

Step 3: Look out for the quarterly announcement of flat sales launch & ballot

Check the HDB website regularly for news of upcoming launches, or choose to receive an SMS or email to be alerted about the sales launches. The Board usually announces the project sites 6 months before the launch, so you have enough time to choose your desired location.

After that, you’ll need to pay $10 to ballot for it during the one-week BTO application window. Results will be sent three weeks later.

HDB BTO launches are generally conducted four times a year: in February, May, August and November. However, exigencies may prompt HDB to cancel a launch, like in May 2020 when Singapore imposed strict circuit breaker measures.

Step 4: Book a BTO flat and pay option fee

Depending on your queue position, it can take up to two weeks from the release of the ballot results before you can actually select your BTO flat. If you aren’t successful in securing a unit, you may have to wait longer until you can book a BTO flat or ballot again.

To do so, you will have to go to HDB Hub — don’t forget your IC, income documents and HLE if you’re taking an HDB loan.

Start the purchase process by paying the option fee:

- 2-room flexi flats: $500

- 3-room flexi flat: $1,000

- 4-room or bigger flats: $2,000

You will also apply for your CPF housing grants at this stage. Make sure you download the application forms for Enhanced CPF Housing Grant and bring them along to your flat booking appointment.

Step 5: Sign lease agreement and pay downpayment

You’ll have to sign the lease agreement within four months of booking a BTO flat. Make sure to get your loan arrangements in order within this time.

On the day you sign the lease agreement, you’ll have to fork out the downpayment, as well as stamp duties and legal fees.

Downpayment for HDB loan: 10% of purchase price using cash/CPF

Downpayment for bank loan:

- 20% of purchase price for loan ceiling of 75% = 5% cash + 15% cash/CPF

- 20% of purchase price for loan ceiling of 55% = 10% cash + 10% cash/CPF

Step 6: Collect keys

After a few years, you can finally collect the keys to your new home. Due to the ongoing pandemic, however, buyers may have to wait longer for their BTO flat to be ready on account of construction delays.

Not fond of waiting? Buy a resale HDB flat instead!

Speak to any of our property agents for free! Simply drop us a message on WhatsApp or our Live Chat at the bottom, right-hand of the screen.

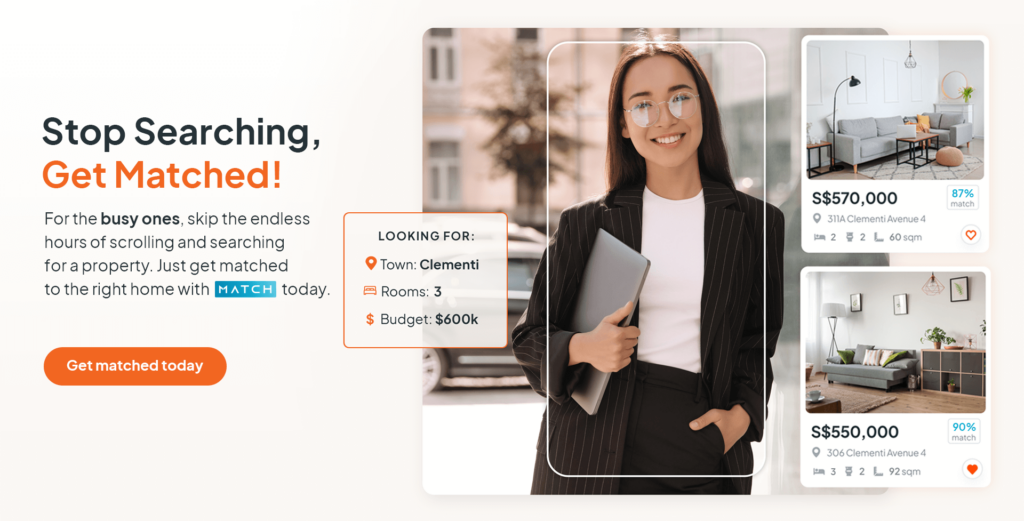

Not ready to talk to an agent? Find your dream home automatically

Or let our smart data-matching technology match you with the right home, according to your specific needs. Submit your preferences to us and our algorithm will filter all our available listings based on those, and we’ll WhatsApp them to you when we find a match.

Frequently asked questions about buying a BTO

Can I buy a BTO flat alone?

Under the Singles Singapore Citizen & Joint Singles Scheme, singles can purchase either new or resale flats. However, for BTO flats, singles can only buy 2-room Flexi units at non-mature estates.

Can you buy a BTO after buying a resale HDB flat?

You will first need to serve the 5-year MOP before you are eligible to apply for a BTO flat. You will also need to pay a resale levy in cash (from $30-50,000, depending on your flat size), upon the sale of your current HDB flat.

Can I buy a BTO flat twice?

Under current regulations, all eligible Singaporeans can acquire two subsidised BTO flats from HDB, with a resale levy paid for the second acquisition.