Is your HDB block’s lease expiring soon? Is it eligible for the Selective En bloc Redevelopment Scheme (SERS)? Let’s explore possible options when the HDB flat’s lease reaches the 0-year mark.

Age is one of the key indicators for SERS, however, not all old HDB flats are eligible for SERS. Singaporeans are urged to be realistic in the pricing when they are paying for old resale HDB flats. When this news was announced, it resulted to the falling of HDB pricing on a monthly basis.

Returning HDB Flats Back to the State at Zero Value

For leasehold properties, the value of the property supposedly should be 0 dollars upon reaching the 0-year mark. Hence, the land including the properties on it should be returned to the state at no value.

Evaluation:

This scenario is unlikely to happen. Even though there is a precedent case where the Geylang private homes are scheduled to return to 2020 upon lease expiry but they form the minority and specifically in the private sector. However, for HDB’s case, more than 80% of Singaporeans are staying in public

housing.

HDB has far been one of the biggest success for our current government. If they choose to reclaim the HDB sites that expired at no compensation, chances are, there may be a huge shift in the political power during the next election as there may be a potential uproar from the Singaporeans. Hence, it would only be logical for the government to offer some form of compensation or alternatives if they were to reclaim.

Expansion of SERS

SERS is a strictly chosen HDB en bloc scheme by the government. Unlike private properties, HDB is public housing and en bloc can only be conducted by the government. However, SERS follow three strict criterias in order to be eligible and they are, flats that are not well utilised; an available site

nearby for the residents affected and the availability of financial resources.

Only 4% of the HDB flats are selected for SERS. At the current rate, there would be HDB flats that are likely to reach the 0-year mark before SERS commenced unless government decided to increase the rate of SERS.

Evaluation:

SERS may be a good way for the residents to savage on the value of their HDB flats. However, it is financially unsustainable for government to do it. SERS is coupled with many benefits, such as priority over BTO and further discounts on BTO prices.

Furthermore, there are large batches of HDB flats that are built from the 1950s to 2000s. Even if the government conducts SERS on all of them, the government is unlikely to be able to fully utilise these sites within a short timeframe. Many of such sites may be left vacated for long period of time. Hence, there may be a need to adjust the compensation package accordingly if the government wishes to leverage of SERS.

The Privatisation of HDB flats

By privatising HDB flats, this empowers the owners to be strata-titled owners with the freedom to make decisions over their home. They can set up sale committee to trigger an HDB en bloc if the age is worrying. Hence, every owner has the rights over the fate of their own home. This may be seen as a relatively straightforward method as the government need not take care of these privatised HDB flats.

Evaluation:

The privatisation of HDB flats may solve the problem of aging leasehold properties but it is not a long-term solution and may have devastating implications. By privatising HDB flats, it also means that the government has limited control over them.

The pricing of such privatised HDB flats would be subject to market conditions and the government could no longer intervene as easily as when they are still public property. One possible outcome is that these resale privatised HDB flats may skyrocket in price and existing owners earn a huge profit margin from the sale. However, a future generation may not be able to afford these housings anymore. If left untreated, pricing of HDB may be highly unaffordable.

This would be against the ideology of HDB in providing affordable housing to Singaporeans. The privatisation of HDB flats may be a feasible solution on the surface, however, they must not enjoy the same benefit that private properties get to enjoy. Tweaks have to be made by imposing certain rules and regulations so as to ensure the pricing of these flats remained affordable and relatively under the control of the government.

Topping Up of Lease

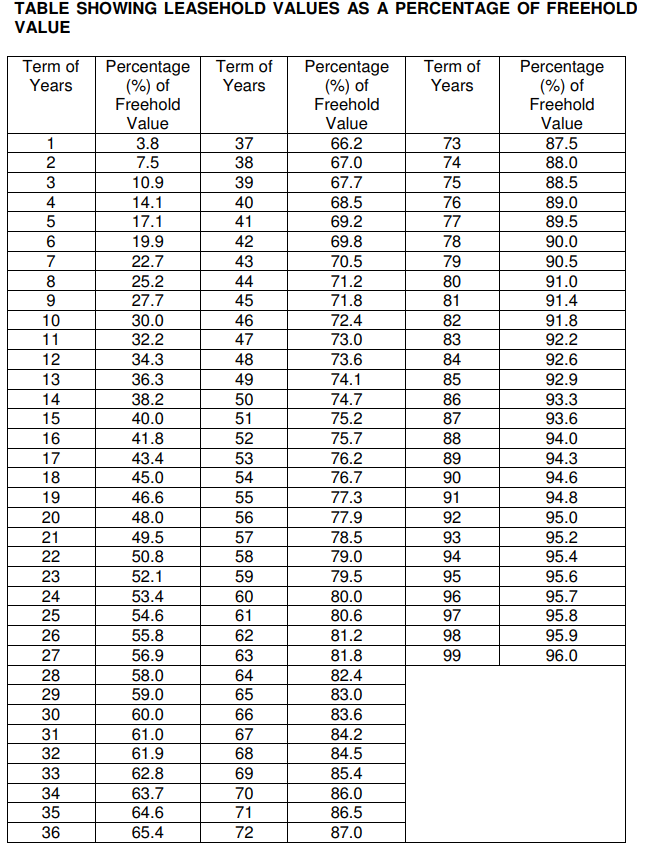

A relatively straightforward method is to top up the lease, this is a very common method used in the private market when the lease of the property is depleting. Property owners are required to submit an application to top up of their lease but are subjected to approval by the government. A payable differential premium is also chargeable based on the table below.

Source: Singapore Land Authority

Evaluation:

This is is one of the more effective ways to address the issue of expiring lease. As HDB flats are hitting the zero year mark in batches, it also means that many may be displaced from their homes. For the flats residing on land which do not have any development plan in the short time, the government can top up their lease accordingly based on the table shown above. The Government may also wish to provide subsidies for the differential premium so that the residents will not find it too hefty.

Different loan packages and grants may also be explored further for residents who experienced financial difficulty. However, for those expiring land sites with development plans, the issue of where to house the existing residents remains a challenge.

There is no existing solution that fits all. Unlike other countries where private housing is the dominant housing type for most of their residents. It remains a difficult task for our government to conclude a solution to the issue of land scarcity, aging flats, ownership rights and affordability together as a whole.

Worried about the expiring lease of your old HDB flat and keen to sell them?

Contact Ohmyhome now for fixed rate agent service at only $2,888 nett for flats below $600k. With a good track record of closing each deal 2X faster than the industry average.

Arrange for a non-obligatory discussion, call 6886 9009 now.

Sources: The Straits Times, HDB, iCompare Loan, Singapore Land Authority, HOA

Contributor: Leow Wei Min