The number of million-dollar HDB deals grew from 27 transactions in January to 29 deals in February, reflecting a 7.4% increase. Are HDB prices still on the rise despite the property cooling measures in place?

First, let’s try to understand more about COV and what it’s all about.

What is Cash Over Valuation (COV)?

COV is the amount of money buyers have to pay in cash if the sale price exceeds HDB’s home valuation. For example, if the sale price of the flat is at $600,000 and the HDB valuation is $550,000, the COV will be $50,000.

While COV is not the norm today, not since the policy change in 2014, there have been instances of such cases.

COV mostly happens when the offers are too aggressive or buyers are not informed enough. Hence, we highly encourage engaging a trustworthy property agent who is experienced and knowledgeable in such matters. They can help you with the right pricing strategies and financial planning when buying or selling. BTO flat buyers don’t need to worry about paying the COV as the price is considered the same as the valuation.

Is COV coming back now?

1. HDB flat prices increased for 14 out of 26 HDB towns in February

The average resale prices for HDB flats saw a surge in prices for 14 towns in February. With the highest price increase seen in the town of Clementi, with a 21.6% price change. This can be attributed to the growing number of million dollar deals that are reflected in these areas.

In Dec 2021, the Government announced the latest round of property cooling measures for the private residential and HDB resale markets. Specific to HDB flat buyers, the Loan-to-Value (LTV) limit for housing loans from HDB was reduced from 90% to 85%.

For those taking housing loans from financial institutions, the Total Debt Servicing Ratio (TDSR) was also lowered from 60% to 55%.

2. Buyers with immediate housing needs

The current rise in prices is due to the strong demand for public housing from homeseekers. It is driven by marriage and family formation. Buyers with urgent housing needs will continue to play a pivotal role in driving demand for HDB resale flats.

First-time buyers are the cornerstone of the HDB resale market as they are undeterred by the property cooling measures. So, demand for HDB resale flats will primarily be spurred by them as they are mainly aiming to fulfill their need to “put a roof over their heads” in the shortest time period possible.

The streamlined sale process and the shorter waiting time generally provides an ease of convenience for aspiring buyers. The affordable nature of HDB resale flats for eligible first-timer families, makes it a viable option. Eligible first-timer families are able to access up to $160,000 in housing grants, comprising a CPF Housing Grant, an Enhanced CPF Housing Grant and a Proximity Housing Grant (PHG).

3. Longer waiting time for BTO flats

In the first half of 2022, HDB is expected to offer about 9,000 Build-to-Order (BTO) flats. They are projected to be in mature estates such as Geylang, Kallang/Whampoa, Bukit Merah, Queenstown, Tampines and Toa Payoh.

Although there is a ramp-up in supply of BTO flats, they will still require time to be built. According to the statement released by the Ministry of National Development (MND) as part of a written parliamentary reply in January – the waiting time for the February BTO exercise was expected to be in the range between 3 to 5 years

If the growing threat of the latest Omicron variant worsens globally, travel curbs and restrictions may come into play once again. This could further exacerbate uncertainties in the completion of BTO flats.

With such likelihood of ambiguities, buyers who are risk-averse and couples who are considering getting married and moving in together this year will likely shift their attention towards the resale market.

4. Newer HDB resale flats entering the market

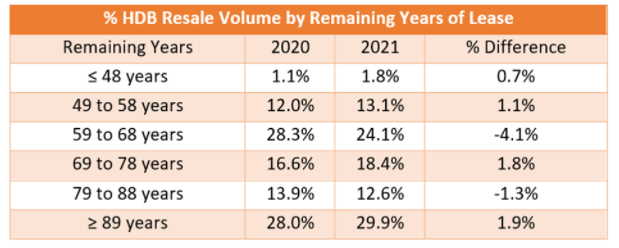

Newer HDB flats with a remaining lease balance of 89 years and above accounted for the highest percentage. It was about 29.9% of the overall HDB resale transactions in 2021. These flats were primarily from non-mature estates such as Punggol, Sengkang, Choa Chu Kang and Yishun. Buyers who are looking to move in without doing major renovations would be attracted to towns with younger HDB flats.

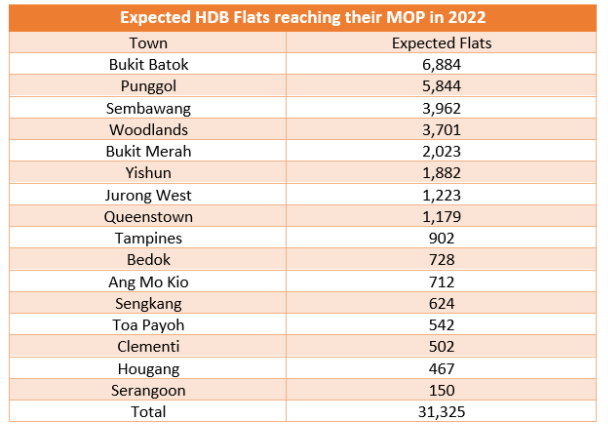

5. Higher number of flats to reach MOP in 2022

An exceptionally higher number of HDB flats will reach its Minimum Occupation Period (MOP) in 2022 – an estimated total of 31,325 flats. This is a 22.7% rise as compared to the 25,530 flats that reached MOP in 2021.

We can expect demand for HDB resale flats to continue to be resilient in 2022 and it might be supply-led as more than 31,000 HDB flats will become eligible for resale. Towns such as Bukit Batok, Punggol, Sembawang, Woodlands and Bukit Merah may possibly see more resale activities in 2022 – as more flats in these areas reach their MOP.

These are the 5 factors that will definitely fuel demand in the HDB resale market.

Generally, COV happens when a resale flat is transacted above its actual HDB valuation, and the difference can only be paid for in cash by the buyer. A wide range of factors influence the price of a flat. This includes location, size, the level of flat, the condition etc.

According to the statement released by the Ministry of National Development (MND) as part of a written parliamentary reply in July 2021 – The proportion of buyers who paid COV increased from around one in five in 2020 to slightly above one in three in the first half of 2021. However, the authorities confirmed that the majority of buyers did not have to pay any COV, and the median COV remained at $0.

With the property cooling measures in place and a rising interest rate environment, it is unlikely that we will see a rise in buyers paying more COV for resale flats.

Essentially, the rising prices were spurred by the increase in demand and a low interest rate environment.

The government will continuously monitor the housing market conditions to ensure that the affordability is maintained for genuine home buyers.

Looking for an HDB or private property?

Here’s how you can speed up your home search

Let Ohmyhome’s smart data-matching technology MATCH you with the right home, according to your specific needs. Submit your preferences to us and our algorithm will filter all our available listings based on those, and we’ll WhatsApp them to you once we find a match. We’ll also send you relevant content that you can use for your research and inform your home buying decision, so you no longer have to spend hours searching online for the information that you need.