Choosing your first home can be a choice that significantly impacts your life for years to come. And while the age-old debate of new versus old properties may suggest that one option is a better choice, there are still many key factors to consider. We’ll explore the pros and cons of each type of property and how it affects your home as your own stay and as a long-term investment.

#1: Location

With newer properties, you have more freedom and flexibility in the exact location of your property within the development.

In a high rise, you would be able to pick and choose from hundreds of units at a time with multiple layouts and numerous customization opportunities at the tip of your fingers. These changes are also a lot more cost-efficient to your wallet for new properties.

However, with subsales, or properties that are slightly ‘older,’ you have the distinct advantage of a mature neighbourhood, which means you have instant access to established amenities such as schools, parks, public transportation, and eateries. This gives you a good idea of how convenient life would be after moving in, setting older properties as a safer option for you.

If you’re looking to rent out a subsale property, you’ll also have an easier time finding and convincing tenants to rent a home that’s within an established neighbourhood. If you have a higher budget, you can even get creative with standing out in the market by renovating your property.

When you engage any of our Super Agents at Ohmyhome, you will be getting someone who specializes in a particular town or area in Malaysia. And if you decide to move forward with the property, they’ll ensure your entire experience is nothing short of a smooth and professional one.

You’ll be able to engage their network of experienced lawyers, previous clients, fellow agents, loan officers, and even contractors to make the transaction process that much smoother and quicker. Our agents will also have in-depth knowledge of the market and are experienced in dealing with buyers. And they’ll be able to tap into their network of past and existing clients and work with co-brokers to get your home sold.

#2: Market Trends and Fluctuations

Another important factor to consider is the investment potential of your property. When there is a significant movement in the economy, it’s often followed by a parallel effect on housing demand.

When interest rates are lower, it might invite home sales and lead to an influx of homeowners within the neighborhood. Or if a bigger MNC or major commercial project establishes itself nearby, this can also cause a mini ‘boom’ of sorts in the demand locally.

In the discussion of market trends, demographics also play an important role as it is a clear indicator of the kind of neighbourhood it will be in the coming years. Areas with a larger group of young and single working professionals may be a sign of a higher potential for appreciation due to their rising purchasing power and desire for amenities as they start their own families.

While areas with a larger proportion of a retiree population may indicate lower demand, it actually poses a good sign for a more stable and consistent market value in the long term as they are less likely to move away from the neighbourhood.

#3: Final Condition and Quality of the Property

With subsale properties, what you see is what you get. You can easily inspect the property and its amenities, as well as check on any maintenance issues ahead of time before making a commitment to purchasing the entire home.

You also have a clear track record of usage and occupancy, which means that you can gauge the quality of the home and its value based on its history.

While you do have the choice to renovate the home and enhance the design, you are still limited compared to newer properties, as they are typically equipped with modern amenities and designs that appeal to contemporary lifestyles. This can add significant value to the property and attract tenants or buyers in the future.

The problem with new properties is that everything is still in the planning stage, and almost every detail is still a ‘proposal’ until the final build. Even then, it’s not uncommon to discover multiple surprises and mismatches between the expected design and what you actually get after the completion of construction.

With a subsale, you may have to do basic upkeep work like wiring, piping and basic repairs, you can see the quality and workmanship right from the get-go and see the actual condition of the property as it is — no delays, no surprises. This makes it a safer choice for first-time homeowners as there are a lot more variables in your control, which can be a favourable option financially.

#4: Upfront Cash Requirement

New launch properties are often viewed as the more attractive contender in this category. With a common standard of a 10% downpayment, new launches offer a range of options with an upfront cash requirement of less than 10%. These projects often come with creative financing options that cater to first-time homebuyers, like no-money-down financing, attractive rebates, rent-and-buy schemes, and deferred payment schemes.

However, despite having warranties or guarantees, buyers are still at risk of encountering structural issues or defects that may arise after the completion of construction. Even after a major repair or renovation, there may be underlying structural or design problems that are simply impossible to fix. For example, water leakage, incorrectly fitted windows or doors, or even missing fixtures and furnishings from what was initially promised in the inventory list.

It’s also worth considering that new properties can take years to be completed, leaving buyers exposed to market fluctuations and infrastructure changes that could impact the property’s value. Proposed projects and initiatives are often contingent on multiple variables that may cause further delays, such as the Covid-19 pandemic, which caused a major disruption to the entire property market, causing delays for under-construction developments country-wide.

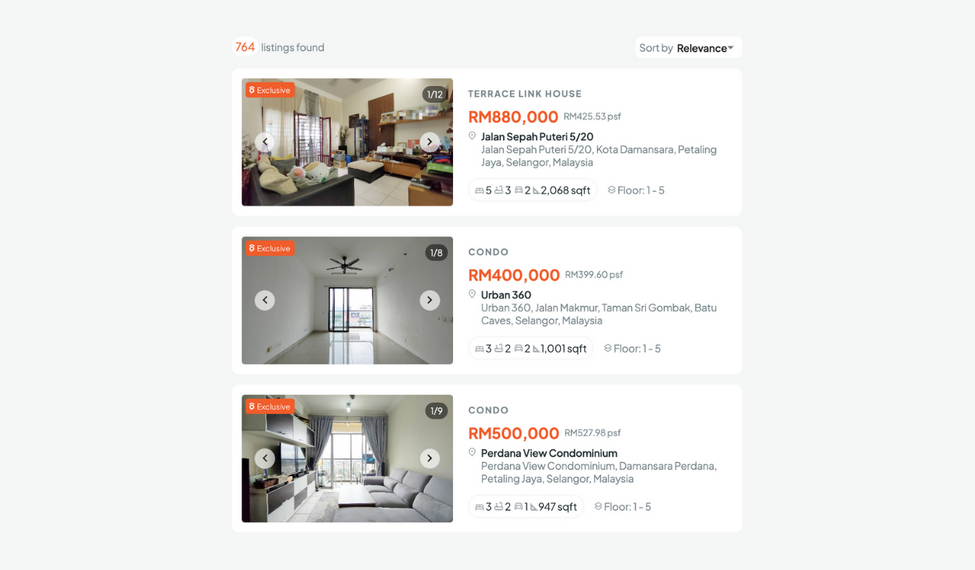

On the other hand, subsale properties typically require a higher upfront cash payment and may come with additional costs such as transfer fees, legal fees, and stamp duties. But despite the higher upfront cash payment, subsale properties offer a set of attractive advantages to first-time homebuyers.

a) Lower prices

One of the primary benefits of subsale properties is the potential for a lower purchase price. This can translate into lower monthly loan payments, which could make it easier for first-time buyers to manage their finances and build equity over time.

b) Lower risk

Another advantage of subsale properties is that you can see exactly what you’re getting. Unlike new properties that may only have floor plans and artist impressions available, subsale properties have already been built and can be inspected before purchase. This eliminates the risk of buying a property that doesn’t meet your expectations, which is a common concern with new launches.

c) What you see is what you get

Moreover, subsale properties are typically located in established neighborhoods, which means that you can assess the local amenities, transport links, and overall livability of the area before making a purchase decision. This can be especially important for first-time home buyers in planning for their future.

d) Immediate Move-In

With a subsale property, you won’t have to wait years for your actual home to be built as you would with a new launch property. So you can move in immediately after selling your current home.

Find the best homes at the lowest prices with Ohmyhome

With Ohmyhome, we’ll be by your side every step of the way.

From choosing a safe, convenient, and desirable area that meets your exact lifestyle expectations, guiding you through the various steps and expenses related to homeownership like mortgage payments and property taxes, to expertly negotiating and dealing with other sellers and agents – Ohmyhome Super Agents will have your back.

Our agents have served more than 8,000 happy customers with over 70 families housed almost every single month. Secure an appointment with any of our Super Agents today by dropping us a message on WhatsApp or via our Live Chat at the bottom, right-hand corner of the screen.