One of the concerns most property investors have when purchasing a property is not just which property to buy, but exactly when they should buy it.

Some may wish to purchase as soon as possible to avoid paying rent. Others prefer to take advantage of lucrative deals provided by the property developer.

But for many property investors, they would buy properties if two conditions are met: low housing prices and low interest rates. Today, we will be focusing on the interest rates.

3 Key Questions About Mortgage Rates During the COVID-19 Pandemic

1. When exactly does the interest rate become low?

Different countries have different metrics to gauge national interest rates. The US, for example, uses the Federal Reserve Rate, or Fed rate, as an indicator of where the interest rate movement is headed, a term that you would most probably come across in financial newspapers.

Here in Malaysia, we use the Overnight Policy Rate (OPR) as the indicator of the national interest rates. A decreasing OPR will likely result in lower fixed deposit rates, lower bond yields, and most importantly, lower loan interest rates.

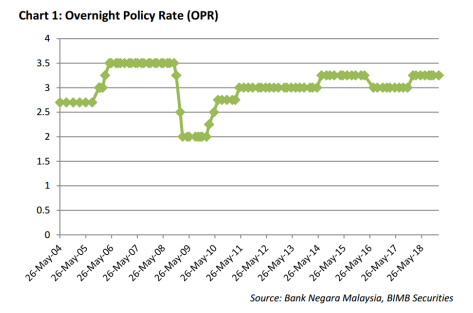

The best way to determine whether the interest rates are relatively low or not is to study the historical movements of the OPR.

As you can see, the Malaysia interest rate has been hovering around 3% to 3.25% for the better part of the decade. But the country witnessed a huge dip in 2009, falling from a high of 3.5% to only 2%, due to the 2008 global financial crisis.

Over a decade ago, governments had to step in to lower the interest rate in an effort to prop up the economy. The act of reducing the interest rates during an economic crisis is part of a popular economic school of thought called the Keynesian Theory.

So now we know that interest rates are low during an economic crisis, how about the situation now due to the COVID-19 crisis?

There have been some rapid developments since the outbreak. The OPR has been cut to 2.75% in February 2020, and 2.50% in Mar 2020, an extremely drastic movement similar to the ones made during the global financial crisis.

On 5 May 2020, the OPR is at 2%, a decrease from the previous OPR of 2.5% announced on 3 May 2020.

2. Should you buy property during a low-interest rate period?

Notice that while the OPR is at 2.50%, your loan interest rates are almost always higher than that at 3.75% or 3.50%. This is because most mortgage loans in Malaysia are semi-flexi or full-flexi loans, where the interest rates will change according to the interest rate movements. It is generally calculated as follows:

Base Rate (BR) + Interest rate = Loan interest rate.

A base rate is fixed, but the interest rate will float according to the existing interest rate. This is good news for property owners, who end up paying reduced interest rates overall. .

What many investors may not realise that, while the BR is fixed, it is determined at the time your loan is approved. For example, securing a loan in 2009 would probably land you a BR of only 3.0%, but doing so in 2016 would probably land you a BR of 3.5%.

Why is this important? Remember that the BR will remain the same throughout the entire loan tenure. Securing a loan during a market downturn would effectively give you a 0.25%-0.50% reduction in interest rates for the following three decades or so.

That difference can be massive. If you were to opt for an RM500,000 loan for 35 years, a 4.20% interest rate would net you RM455,186 worth of interest payments. A 0.50% reduction would translate to RM62,767 worth of savings, or RM180 less in monthly instalments.

3. What if you already have an existing loan?

Interested in securing a housing loan amidst the COVID-19 crisis? You’re ready to take advantage of the situation, but you realise that you are already in the midst of serving an existing loan.

Fret not! You can still secure a lower interest rate if you were to refinance your loan amidst this downturn.

Loan or property refinancing essentially means taking out a new loan to pay off an existing one. Doing so will allow you to obtain better loan terms, such as a lower interest rate.

Not only that, paying off an existing loan with a new loan, when your house value has appreciated, means that you almost always have a cash balance. You can use this windfall to go on vacation, start an emergency fund, or buy more properties to kickstart the process all over again.

Take note that buying a new loan would essentially reset your loan, meaning you would have to pay a higher monthly instalment if your property value is appreciated. Not only that, but you would also have to service the loan for a longer period of time. This should not be an issue if the property is tenanted, where the rent would cover most of the loan instalments anyways.

Being placed in a low-interest-rate environment is very uncommon, and one can only expect to experience this only a few times within their lifetime. So you should definitely take advantage of the situation to take out a mortgage when it is cheap. You’ll be one step closer in achieving a financially independent lifestyle.

Want to learn more about our trusted agent services? Be sure to give our friendly customer care team a call at +60 16-299 1366 for more information. In the meantime, you can download our app from Play Store or App Store now!